How Much Income Is Needed For 500k Mortgage

Given what we know above, lets see how much you need to make to buy a $500K home.

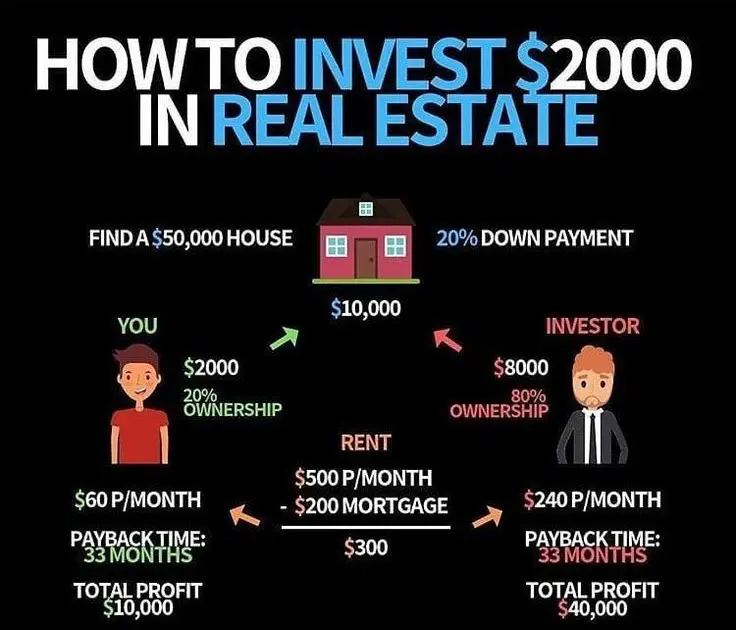

In this example, lets suppose you are putting the minimum down payment of 5% or $25,000. Because you have less than 20% down youll need to pay CMHC insurance. In this case the CMHC insurance adds an extra $19,000 to your mortgage for a total mortgage of $494,000.

Inevitably, you will have to pass the stress test when applying for a mortgage with any major lender. So first, lets see how much income is needed to qualify for a $500K mortgage under the stress test.

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums. In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit score and your employment history. From all of this, theyll determine how much theyre willing to lend to you.

However, the amount you may qualify to borrow isnt necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They dont take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

Also Check: Can I Refinance My Parents Mortgage

How Much Of A Home Loan Can I Get With A 720 Credit Score

With fixed-rate conventional loans: If you have a credit score of 720 or higher and a down payment of 25% or more, you don’t need any cash reserves and your DTI ratio can be as high as 45% but if your credit score is 620 to 639 and you have a down payment of 5% to 25%, you would need to have at least two months of …

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

Recommended Reading: How To Determine Mortgage Approval Amount

Bringing It All Together

As you can see, there are a number of factors that determine how large of a mortgage you can get. If you get access to your FICO score and crunch some numbers, you can get a rough idea of your borrowing capacity. You can also seek assistance from your bank or a mortgage broker.

All of this, however, still leaves one important question.

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in total interest over time, it can free up monthly cash to keep your DTI low.

Read Also: What Is The Recommended Mortgage To Income Ratio

Save For A 20% Down Payment

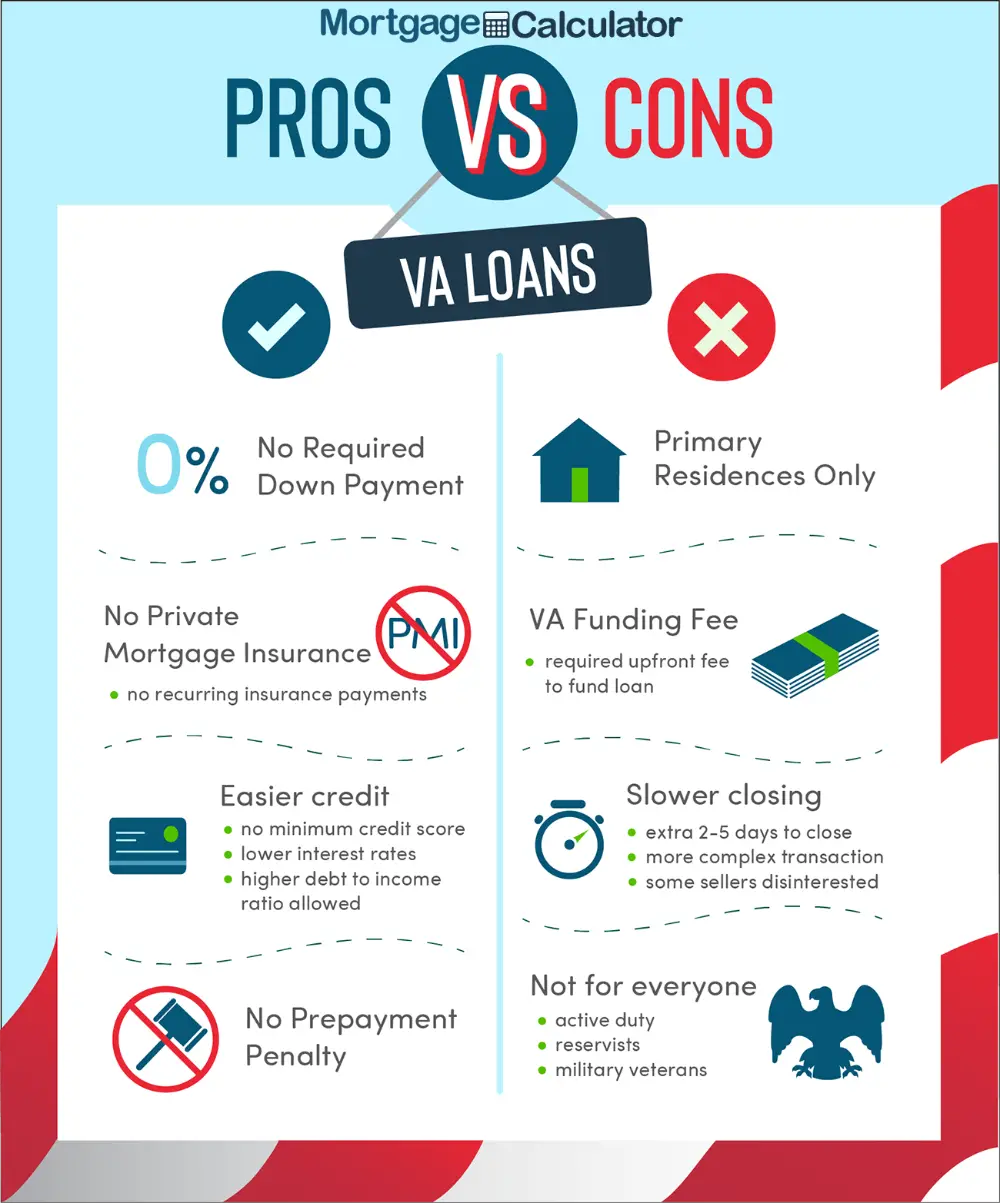

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you qualify for a VA loan and pay the funding fee upfront .

My Income Changed Radically How Can I Calculate This Change

The maximum mortgage payment you qualify for will change if your income changes. You can figure out your maximum monthly payment by adding up your gross monthly income and multiplying it by the maximum housing DTI of the loan program you’re interested in. The result will be the maximum mortgage payment you can get.

Read Also: Can I Skip A Mortgage Payment With Pennymac

What Percentage Of Income Do I Need For A Mortgage

A conservative approach is the 28% rule, which suggests you shouldn’t spend more than 28% of your gross monthly income on your monthly mortgage payment.

Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage. Outside of credit score, lenders typically look at your debt-to-income ratio, which compares your monthly debts, including the prospective mortgage payment, to your expenses. With lenders looking at income and expenses, our mortgage calculator provides a great option when determining what you can potentially afford.

Get Matched With The Ideal Broker For Your Income

No matter what your circumstances are, if youre looking to make the most of your income in order to achieve the size of the loan you need to buy your dream home, our free broker matching service will pair you with an expert who has the exact experience necessary.

Theres no obligation whatsoever, and your initial consultation will always be free, so you have nothing to lose. Simply contact our team on 0808 189 2301 or make an enquiry, to find out how taking advice from the right broker can help you to achieve your home ownership goals.

Ask a quick question

We can help!We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all values of MortgagesAsk us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

You May Like: Can You Get A Larger Mortgage For Renovations

How Much House Can I Buy With My Current Salary

The amount of house you can buy depends not only on your current annual salary, but other factors such as your level of debt, your credit score and history, and the amount of down payment youre prepared to make.

Use our income requirement calculator to get an estimate of how much salary and combined personal income youll need to buy a home with a mortgage loan.

Mortgage Payment Percentage Example

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $300

In this example, your total monthly debt obligation is $1,250. With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Considering that you already spend $500 a month on rent, if you add that to the $900, you can estimate a maximum monthly mortgage payment of $1,400. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

You May Like: What Is A Teaser Rate Mortgage

Do You Have Enough Income

To afford a home, you must have enough income to cover your mortgage payments as well as your usual expenses and other debt obligations. This is a big deal because it reveals how predictable your finances are, which is crucial in making monthly payments. You have increased chances of securing approval if you have a stable long-term job with high income, which is why lenders verify your employment status.

Apart from evaluating your income, you may also submit any additional proof of income. Note that extra income is only accepted by lenders if it can get funds from those sources for at least three years. Heres a list of eligible sources of additional income:

- Payment from part-time work

- Stocks, bonds, and mutual funds

- Certificates of Deposit

What If Youre Self

The requirements for qualifying for a mortgage are even stricter when youre self-employed. Unlike W-2 employees, most lenders will require that a self-employed individual have at least two years of income in their business.

It doesnt have to be difficult as long as you have all the documents required, said Jeff Shipwash, real estate investor and owner of Shipwash Properties. The most common situation is a single-member or partnership LLC or people with a DBA as a sole proprietor. You have to provide two years of tax returns. Tax returns can be unique depending on your situation, but typically the best thing to do to supplement those is to provide audited financial statements from a CPA.

In addition to your tax returns, lenders may ask to see profit and loss statements or bank statements for the current year to ensure your income situation hasnt changed.

Its important to note that when lenders look at your tax returns when youre self-employed, theyre really looking at the adjusted gross income on your Schedule C. Your AGI is all of your business income minus any expenses and deductions. While you might feel your gross income is sufficient to qualify for a mortgage, its really your AGI that matters.

Read Also: How Much Mortgage Would I Get

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How Long Do I Need To Show Income For A Mortgage

The standard qualification rules for a conventional mortgage, the more popular mortgage type, generally require at least two years of employment history. There are, however, circumstances where a lender would work with a borrower outside of this standard. Other loan types, such as FHA or VA loans, the requirements will differ by lender.

Don’t Miss: What Is Needed For A Mortgage Loan

Additional Homeownership Costs To Consider

There may be additional costs that go along with owning and maintaining a home that you have not considered when calculating your monthly expenses, especially if you are a first-time home buyer. When trying to determine how much you can afford to spend on a mortgage, it is important to consider all of the expenses you may have, even if they dont apply yet. Some easily forgotten expenses that can accompany owning a home include:

- Lawn maintenance

- Home maintenance savings fund

What Is A Stable Income And How Does It Affect Your Mortgage

A stable income: understanding your mortgage income requirements

So, youre thinking about buying a property and you want to take out a mortgage. When you apply for a mortgage, youll need to prove that you can afford the monthly mortgage payments and that you intend to pay the money back.

Youll need to meet the income requirements for the loan and part of that may include showing that your income is stable and regular.

Its a good idea to check out how much you can afford to borrow using a mortgage calculator before you speak to lenders, but remember, its only a guide and not a firm mortgage offer.

Read Also: Can You Write Off Points On A Mortgage

Proof Of Income For A Mortgage Loan

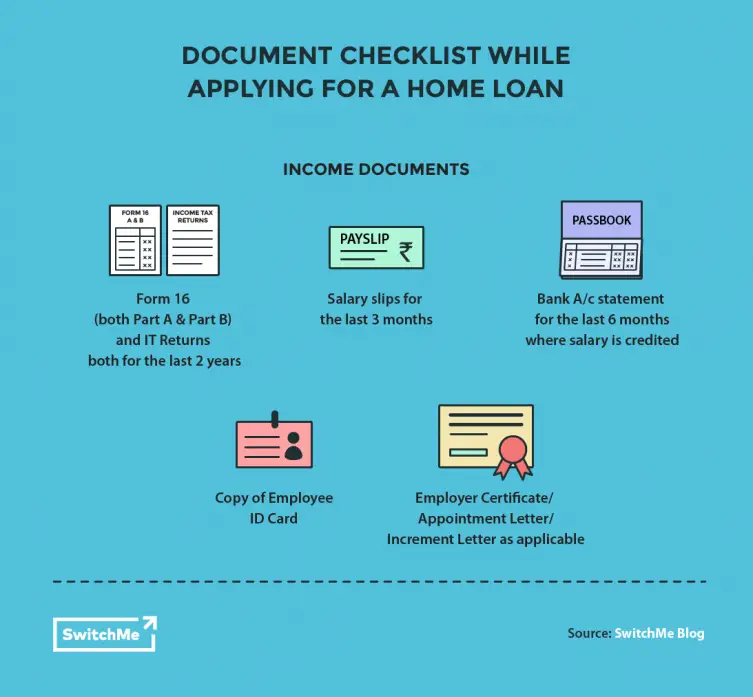

When you apply for your mortgage, your lender will require several documents to prove that your income is as youve stated. For W-2 employees working in a traditional employment situation, this step is fairly simple. Youll have to provide your latest pay stubs, as well as two years of tax returns and W-2 forms.

Though you must provide two years of tax returns, lenders dont actually require that you be at the same job for two full years. Instead, theyll require two years of consistent income, preferably within the same field.

Things become a bit more complicated if you work in a job where your income is reliant on bonuses or commissions. According to Cohn, youll generally need at least two years of bonus or commission income for a lender to consider it, though it could be as little as one year if its offset by other factors.

If your variable income from the most recent year was higher than the previous year, theyd take an average of the two numbers. If the most recent years income was lower, theyd only use the lower number.

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Recommended Reading: Does It Matter What Mortgage Lender You Use

Approval Aside What Percentage Of Your Income Should You Put Toward Your Mortgage

The focus of this article so far has been on the requirements to gain the approval of a lender for your home purchase. Its also important, however, for you to make your own decisions about the percentage of your income you should dedicate to a mortgage. Although each situation is different, its typically not recommended that you put more than 28% of your income toward your mortgage, no matter how stunning the dream home.

The median home price in the U.S. is $284,600. With a 20% down payment, you can expect to pay roughly $1,200 a month for your mortgage on a home at that price. That means that in order to follow the 28% rule, you should be making $4,285 each month.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How Much Faster Can I Pay Off My Mortgage Calculator

Loan Term And Adjustable Vs Fixed Rate Mortgage

Loans with short terms usually have lower interest rates than loans that are paid off over a longer period of time.

An adjustable-rate mortgage might have a lower rate than a fixed-rate mortgage at first. But over time, the rate on an adjustable-rate mortgage could go up by a lot, while the rate on a fixed-rate mortgage would remain the same.