Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

What Does Having Equity In Your Home Mean

Equity is the value of how much of your house you own. For example, if your mortgage balance is £150,000 and your house is worth £200,000, you have £50,000 equity in the property.

If you sold your house for £200,000, you would use £150,000 of this to pay off your mortgage, and you could keep the remaining £50,000 or use it towards buying a new property.

Your equity is made up of the deposit you paid towards the house purchase and any of your mortgage you have paid off. It should keep going up until your mortgage is paid off you then have 100% equity in your home.

You May Like: How Long Are Mortgage Terms

Canadian Mortgage Regulations Taxes And Fees

Canada-wide mortgage regulations are set by the Ministry of Finance to help protect home buyers and lenders alike. These regulations include guidelines on minimum down payments, maximum amortization periods, as well as mortgage default insurance.

Here are the key regulations you need to be aware of, and that are included in the Ontario mortgage calculator above:

- The minimum down payment in Canada is between 5% and 10%, depending on the purchase price of the home.

- The maximum amortization is 25 years for down payments under 20% and 35 years for higher down payments.

- Mortgage default insurance – also called CMHC insurance – must be purchased for down payments between 5% and 20%. Visit our CMHC insurance page to learn more.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Don’t Miss: Would I Be Eligible For A Mortgage

How Can I Calculate My Monthly Mortgage Payment

The easiest way to calculate your monthly payment is to use a mortgage calculator like ours. But if youd like to do it by hand to check the math, heres the formula for the principal and interest portion of your monthly payment:

M = P/

Where

M = Monthly mortgage payment

P = Principal

i = Your monthly interest rate , so to find the monthly interest rate, divide the APR by 12.)

n = How many payments youll make over the life of the loan

From here, you can find out your total monthly payment by adding in any other fees, including the monthly payment amount for taxes and insurance , HOA or condo fees, and/or PMI.

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

Read Also: How Long Will Mortgage Interest Rates Stay Low

What Is A Mortgage Payment

Your mortgage payment is the amount of money you must pay every month to pay down, and ultimately pay off, your mortgage loan. Your mortgage payment covers both the principal and the interest on the loan. It can also include mortgage default insurance, also sometimes known as CMHC insurance , property taxes and other fees. When you first begin making payments, more of it goes towards covering interest, but over time, more of your payment will eventually go to paying down your mortgage balance.

Ways To Pay Down Your Mortgage Principal Faster

In the excitement of buying a home, many people think more about how much house that they can afford with their monthly budget instead of how long it takes to pay off a 30-year mortgage.

The good news is that a 30-year mortgage does not need to last for the full 30 years. It is possible to pay down a mortgage painlessly in much less time. It does take forethought, dedication, and a concrete plan to see results, but simple changes now can take years off a mortgage.

Here are five ways that you can pay down your mortgage principal faster.

You May Like: How To Become A Mortgage Underwriter With No Experience

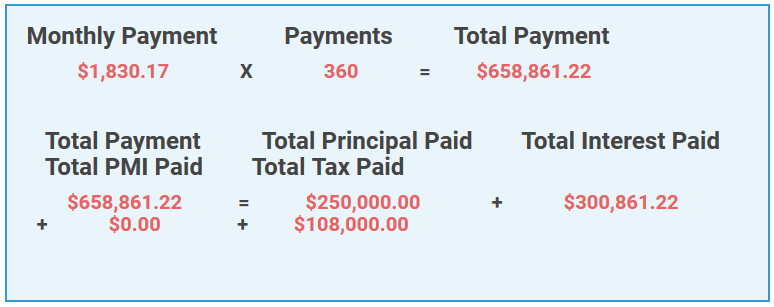

Other Loan Costs To Consider

In addition to paying principal and interest on your loan, you may have to pay other costs or fees. For example, a mortgage payment might include costs such as property taxes, mortgage insurance, homeowners insurance, and homeowners association fees.

The amortization calculator doesnt consider these added costs, so its estimate of your payments may be lower than the amount youll actually owe each month. To get a clearer picture of your loan payments, youll need to take those costs into account.

Mortgage Penalty Calculator 2022

What is the remaining balance on your mortgage?

What is the term-length and type of your current mortgage?

What is your current mortgage interest rate?

If applicable, what was the rate discount you received when you signed your current mortgage agreement?

If you are unaware of any discount, you can skip this step.

When did your current mortgage start?

Who is your current mortgage lender?

What is TD’s current interest rate for a3-year fixed rate mortgage?

You May Like: What Is The Difference Between A Mortgage Rate And Apr

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

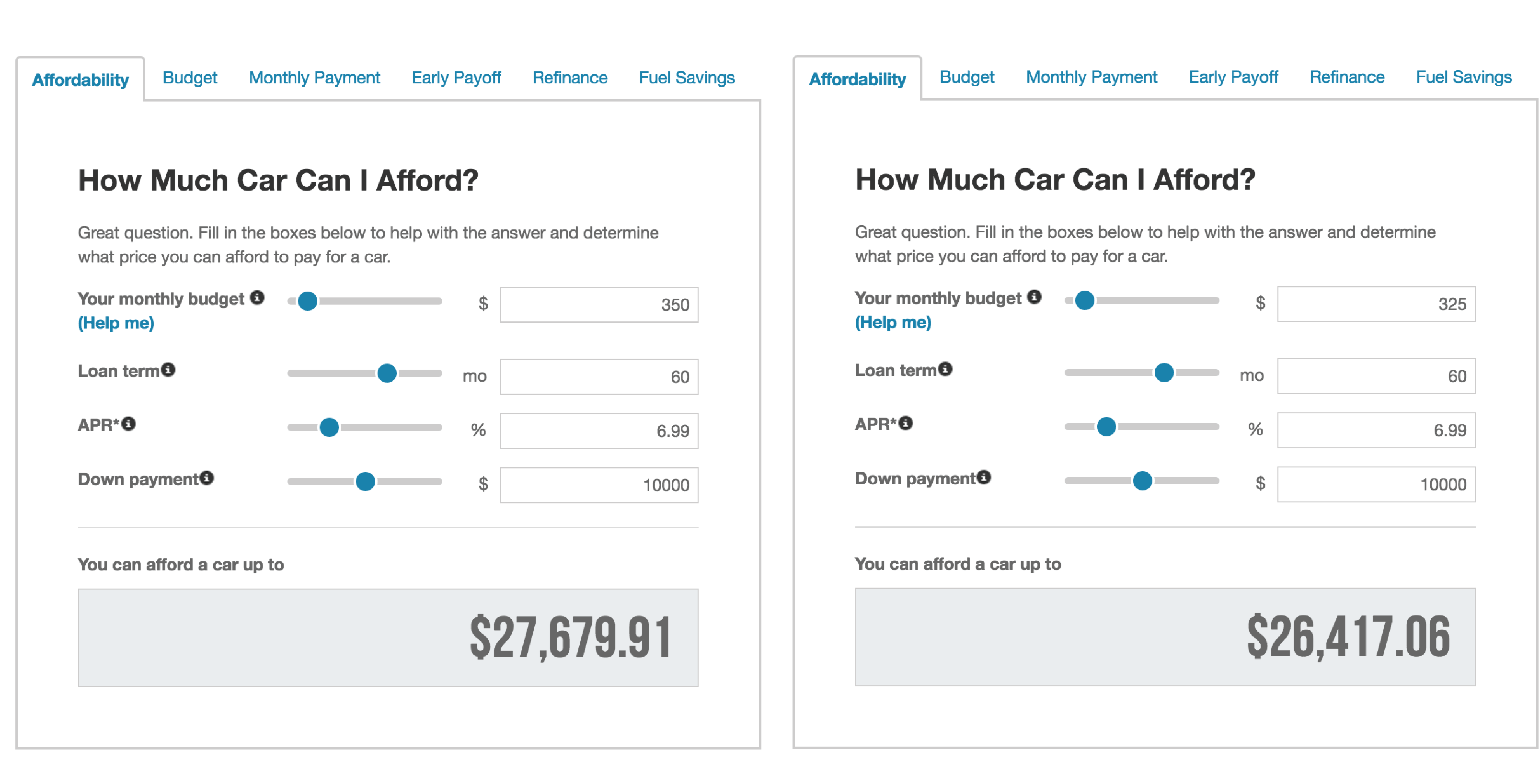

How Does The Amount Of My Down Payment Impact How Much House I Can Afford

The down payment is an essential component of affordability. For example, if we include down payment on that $70,000 annual salary, your home budget shrinks to $275,000 with a down payment of 10 percent . By making a larger down payment, you would reduce the loan-to-value ratio, which makes a difference in how your lender looks at you in terms of risk.

Bankrates mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And dont forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, youll need to pay for private mortgage insurance, or PMI.

Also Check: How Many Years Left On Mortgage

What Is A Mortgage Payoff Statement

Once youâre ready to pay off your mortgage, youâll need to request a mortgage payoff statement from your servicer to make your final payment. The payoff statement is crucial because it will likely include some fees and interest calculations that you may not know about.

The payoff statement is good for a certain period of time, say 30 days, which will be specified in the statement. If you canât make that deadline, itâs not the end of the world. It just means youâll have to repeat the process when you are ready.

Aside from that, you should cancel any automatic payments on your mortgage, get a refund on your escrow, and let your insurance company and tax collector know youâll be paying them directly .

You might see a bump in your after paying off your mortgage .

How Can I Get Assistance Buying A Home

There are quite a few opportunities to get financial assistance with buying a home. If its your first time or if you havent owned a home in the last three years start by exploring the first-time homebuyer loans and programs that cater to your state or city. There are also grant programs, many of which are tailored to help low- and moderate-income borrowers with money that does not have to be paid back. Additionally, you might be able to get assistance based on your line of work. For example, teachers and emergency service workers, like police officers and firefighters, can qualify for the Good Neighbor Next Door program, which lets qualifying individuals buy HUD-approved properties for 50 percent off their purchase price.

Recommended Reading: How Much Will A Mortgage Lender Lend Me

What Is The Difference Between An Open

The major difference is the penalties associated with aclosed-term mortgage. With an open-term mortgage you can pay off the entire mortgage amount whenever you want. You still have to pay your principal and interest amounts every month but you can make additional payments without having to pay a prepayment penalty . These benefits are great but most people usually opt-in for a closed-term mortgage agreement for a couple reasons. First, an open-term mortgage usually has a higher set interest rate. And since most individuals don’t plan on paying off their mortgage early, they decide to go for the lower closed-term rate.

That being said, a closed-term mortgage is one that you take out for a specified amount of time. In Canada, the standard term is about 5 years. As mentioned, the main difference with a closed-term mortgage is you don’t have the freedom to payoff your principal when you want. Some closed-term agreements allow you to pay off 10%-20% of principal once a year but outside of that, you will have to pay your lender a penalty fee for doing so.

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

You May Like: Where To Compare Mortgage Rates

Should I Pay Off My Loan Early

Whether you should pay off your loan early depends on your individual circumstances. Paying off your loan early can save you a lot of money in interest. In general, the longer your loan term, the more in interest youll pay. Suppose you get a $200,000 home loan with an interest rate of 4%. If you pay this off over 30 years, your payments, including interest, add up to $343,739. But if you got a 20-year mortgage, youd pay $290,871 over the life of the loan. Thats a difference of $52,868.

To pay off your loan early, consider making additional payments, such as biweekly payments instead of monthly, or payments that are larger than your required monthly payment. Ask your lender to apply the additional amount to your principal.

But before you do this, consider whether making extra principal payments fits within your budget or if itll stretch you thin. You might also want to consider using any extra money to build up an emergency fund or pay down higher interest rate debt first.

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

Also Check: Can You Quit Claim Deed A House With A Mortgage

Ontario Mortgage Regulations Taxes And Fees

Most taxes and fees are set at the provincial, or even municipal level. In Ontario, purchasers are responsible for obtaining Ontario mortgage rates, paying the provincial sales tax for CMHC insurance, and covering Ontario land transfer taxes.

For those purchasing in Toronto, a second set of municipal land transfer taxes apply in addition to the state tax, as well as an overseas speculation levy for properties in the Golden Horseshoe.

What Does Breaking My Mortgage Mean

If you decide to end your mortgage before the prescribed term is up, then you are “breaking” your mortgage contract. For example, if you are 3 years into your 5-year fixed rate mortgage, and you find out that a lender is offering a significantly lower interest rate, then it is possible to break your mortgage early to sign a new mortgage with the discounted lender. But be aware, deciding to break your mortgage before the mortgage term ends is usually associated with penalties.

Also Check: How To Get The Pmi Off My Mortgage

What Documents Should I Keep After Paying Off My Mortgage

Itâs a good idea to read up on the various documents you can expect to receive after paying off your mortgage. In general, you can expect to receive:

- Canceled promissory note , which your servicer may or may not provide

- Deed of trust or mortgage deed

- Certificate of satisfaction

- Final mortgage statement

- Loan payoff letter

Youâll definitely want to hang on to your deed, the certificate of satisfaction and the final mortgage statement.

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Recommended Reading: How To Roll Credit Card Debt Into A Mortgage

How Do Mortgage Points Work With Arm Loans

Mortgage points on an adjustable-rate mortgage work like points for a fixed-rate mortgage, but most ARMs adjust at five years or seven years, so its even more important to know the breakeven point before buying points.

Factor in the likelihood that youll eventually refinance that adjustable rate because you may not have the loan long enough to benefit from the lower rate you secured by paying points, says McBride.

Because the points only apply to the fixed period of an ARM, most adjustable-rate borrowers do not use them, according to U.S. Bank.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

You May Like: What Is The Current Interest Rate For A Reverse Mortgage