Resources And Assistance To Avoid Foreclosure

Seek out help to think through foreclosure alternatives, such as by contacting a HUD-approved housing counseling agency. A housing counselor can assess your situation and help you prepare for discussions with your mortgage servicer. To find a HUD-approved housing counseling agency near you, access HUD’s database for Foreclosure Avoidance Counseling or call 888-995-HOPETM .

The California Housing Finance Agency sponsors special programs for homeowners facing foreclosure that may help you retain your home or provide funds to relocate to new housing. Visit CalHFAs Hardship Assistance Page to view options available to you.

Homeowners who have fallen behind on mortgage payments due to COVID-19-related financial hardship may be eligible for relief through CalHFAs California Mortgage Relief Program. This program will pay a total of $1 billion to cover missed mortgage payments during the COVID-19 pandemic. This is a one-time grant that eligible homeowners will not have to repay. To find out if you are eligible and to apply, visit the California Mortgage Relief Program web page.

Reporting Issues With Mortgage Servicers

The Consumer Financial Protection Bureau has made standards for mortgage servicing. You can find these in the Code of Federal Regulations, Title 12, Chapter X. See particularly Regulation X . To contact the CFPB, call 411-2372 or file a complaint.

If your mortgage servicer is a national bank such as Bank of America, Wells Fargo, Citibank, or JP Morgan Chase, then you may want to file a complaint with the Office of the Comptroller of the Currency . The OCC is the federal regulator of national banks. To file a complaint call 1-800-613-6743 or visit the OCC’s website.

If you applied for a loan modification but are having problems working with your servicer, and the mortgaged property is your primary residence, then the Massachusetts Attorney General’s Office may be able to help. Sometimes we are able to help with communication problems, or may be able to help in getting a decision on loan modification options. To see if we may be able to assist you, call us at 727-8400 or file a consumer complaint.

If you have an issue regarding a state chartered bank or credit union, you may want to file a complaint with the Massachusetts Division of Banks . The DOB oversees state-chartered banks and some credit unions. The DOB also oversees Massachusetts laws and regulations about modification and foreclosure processes. To contact the DOB, call 956-1500 or email

Factors To Consider Before Applying For A Loan Modification

Applying for a mortgage loan modification can be a risky move, so youll want to carefully consider its pros and cons before proceeding:

Pros:

- Your monthly payments may be reduced.

- You may face a lower interest rate.

- You can avoid foreclosures if your mortgage loan modification is approved.

Cons:

- A mortgage loan modification application includes a significant amount of paperwork and fees, and may not be the best use of your limited time or resources.

- Your lender may still choose to foreclose, even if you began the mortgage loan modification process.

- You may face a balloon clause, which requires a large payment of thousands of dollars several months into repayment.

- Your mortgage may be extended for 50 or even 60 years.

- You may still lose your home if you cant make payments with your modified mortgage loan.

You May Like: What Is A Single Purpose Reverse Mortgage

Types Of Loan Modification Programs

Some lenders and servicers offer their own loan modification programs, and the changes they make to your terms may be either temporary or permanent.

If your lender or servicer doesnt have a program of its own, ask if you are eligible for any other assistance programs that can help you modify or even refinance your mortgage.

The federal government previously offered the Home Affordable Modification Program, but it expired at the end of 2016. Now, Fannie Mae and Freddie Mac have a foreclosure-prevention program, called the Flex Modification program, which went into effect Oct. 1, 2017. If your mortgage is owned or guaranteed by either Fannie or Freddie, you may be eligible for this program.

The federal Home Affordable Refinance Program, or HARP, helped underwater homeowners refinance into a more affordable mortgage. HARP has also expired. Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance replaced HARP in 2019.

» MORE:Explore Fannie Mae and Freddie Mac refinance options

It Wont Stop The Foreclosure Process

Most importantly, applying for a loan modification does not necessarily mean stopping the foreclosure process. Many borrowers mistakenly think that just because they are applying for a mortgage modification with their lender, that they do not have to worry about the deadlines associated with foreclosure. This is the most dangerous mistake to make for many borrowers, as they may not even be approved, and are still running out of time while actively awaiting the lenders decision.

It may feel like a deliberately malicious thing for the lender to do, but there is actually no requirement for a lender to stop pursuing the foreclosure process even while trying to help you. In the end, they too must safeguard their best interests. This is why it is extremely important to not only stay ahead of your mortgage payments, but to seek help as soon as possible in order to prevent the worst case scenario. Waiting until the last minute is never a good idea.

Read Also: Should I Get A 30 Year Mortgage

When Youre Facing An Imminent Default Judgement

A default judgment is a judgment granted by a judge that allows your lender or servicer to take your home without giving you the option to fight against the foreclosure. Default judgments can happen quickly when you dont answer the initial Complaint or when something happens that may be preventing you from paying your mortgage on time like losing your job, contracting an illness, death of a family member, etc. If you are facing a default judgement but havent received one yet, you still have the opportunity to pursue a loan modification for your mortgage and possibly save your home.

How Can I Get A Loan Modification

Ask your lender if they offer a loan modification. Some lenders and servicers offer their own loan modification programs, not just loan modification programs related to a government agency.

If your lender or servicer doesnt have a program of its own, ask if you would qualify for another assistance program or a refinance.

You May Like: What Is A Prepayment Penalty On A Mortgage

What Is A Loan Modification

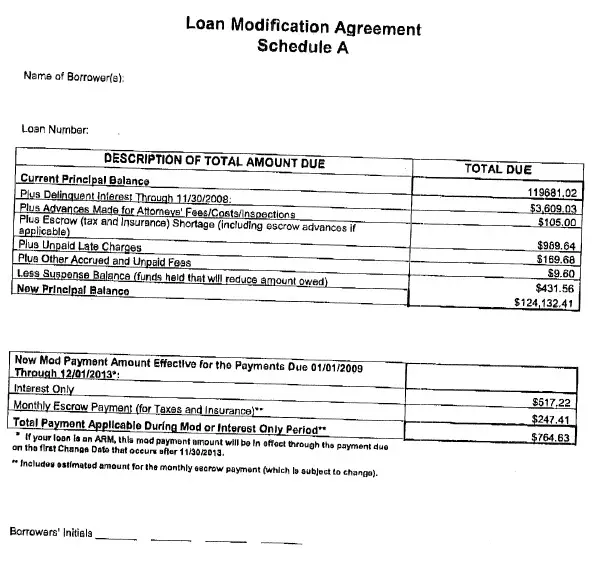

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesnt pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

Its also important to know that modification programs may negatively impact your credit score. If you’re current on your mortgage, it would be better to review your options and see if you can apply to refinance.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include:

- Loan term changes:If youre having trouble making your monthly payments, you may be able to modify your loan and extend your term. This gives you more time to repay your loan and reduces the amount you must pay every month.

- Interest rate reduction: If interest rates are lower now than when you locked into your mortgage loan, you might be able to modify your loan and get a lower rate. This usually lowers your monthly payment.

- Loan structure changes: You may be able to modify your loan from an adjustable interest structure to a fixed-rate loan. This can be beneficial if you now live on a fixed income and you need a more predictable monthly payment.

Free Resources For Potential Applicants

There are free resources available for potential applicants.

- Homeowners can call the Homeowner’s HOPE Hotline at 1-888-995-HOPE for information about the Making Home Affordable Program and to speak with a HUD approved housing counselor. Assistance is available in English and Spanish, and other languages by appointment.

- HUD.org helps applicants find a local counselor. HUD.gov

- MakingHomeAffordable.gov computes estimated payments and has other resources. Making Home Affordable

- Fannie Mae and Freddie Mac allow applicants see if their loan is owned by one of them and thus potentially eligible for the program Fannie Mae Loan Look UpFreddie Mac Loan Look Up

Recommended Reading: What Is The Mortgage Rate For Bank Of America

What Is A Mortgage Modification

A mortgage modification changes the terms of your original mortgage agreement. Your lender will work with you to try and find a way to lower your monthly payment by adjusting the terms of your current mortgage. The goal is to help you get back on track.

Lenders have several options when it comes to a mortgage loan modification. They’ll work with you to find the best solution for your situation. You may want to talk to your lender about a mortgage modification if you:

- Are in danger of falling behind on your mortgage payments

- Have already missed a payment

- Aren’t eligible to refinance your property

- Are facing long-term financial hardships that could make it difficult to repay your loan

Necessary Paperwork: The Documents

To request a mortgage loan modification, youre required to submit a letter that explains your specific situation to the lender. Go ahead, open a fresh document and dont hold back! Lenders want specific details.

The mortgage lender will use the information along with your loan modification application to determine your eligibility.

Your mortgage lender may also ask you to prove your financial status by providing some or all the following documentation:

- Income/expenses worksheet

- Lender deems you unable to afford modified payments

- Property has been condemned

If youve been denied, dont worry. You can appeal and plead your case.

Theres reason for hope: In many cases, mortgage lenders benefit from modifying a homeowners mortgage payments. It helps them avoid having to deal with a messy foreclosure process.

Recommended Reading: What Do I Need To Get A Mortgage

Forbearance Vs Mortgage Loan Modification

Forbearance happens when your lender agrees to pause your mortgage payments for a limited number of months.

Pros:

- Forbearance can help you avoid foreclosure

- Pauses or reduces mortgage payments

- Gives you time to get back on your feet

Cons:

- Adds missed payments to the end of the loan

- May lower credit score

Gather Information About Your Financial Situation

Youll need to give your lender or servicer everything from tax returns to pay stubs to demonstrate youre experiencing financial hardship and are unable to make your monthly mortgage payments. Youll also need to provide a letter explaining your situation. This letter should be clear, accurate, complete and business-like. Keep emotions out of it.

Read Also: What Is The Typical Closing Costs For A Mortgage

When To Pursue Mortgage Loan Modification

Mortgage modification is usually reserved for borrowers who do not qualify for a refinance and have exhausted other possible mortgage relief options.

With a loan modification, you work with your existing bank or lender on modifying the terms of your existing mortgage, explains David Merritt, a consumer finance litigation attorney with Bernkopf Goodman, LLP.

If youve defaulted on your existing mortgage, chances are your credit has been negatively impacted to the point where a new lender would be wary to give you a new loan.

Typically a refinance is not possible in this situation, adds Merritt.

That means theres no real contest between loan modification versus mortgage refinancing. The right loan option for you will depend on the status of your existing loan, your personal finances, and what your current lender agrees to.

Tips To Avoid Loan Modification Scams

Unfortunately, there are people who aim to wrongly profit off consumers facing difficult times by creating mortgage modification program scams.

Modification scams typically relay false promises of saving you from foreclosure, and instead, take your money. Scammers may charge high, upfront fees to receive assistance or ask you to sign over the title to your home, just to name a few examples, according to the Consumer Financial Protection Bureau .

Do your due diligence when seeking mortgage assistance and verify youre receiving legitimate loan modification help. The Federal Trade Commission recommends the following six tips to avoid a modification scam:

File a complaint with the CFPB online or by phone at 855-411-2372 if you believe you might be the victim of a mortgage modification scam.

You May Like: How To Assume A Va Mortgage

My Loan Modification Was Denied Now What

If your loan modification application has been denied, you can appeal the decision working with a lawyer, if you feel the decision was made in error. If your only other choices are filing for bankruptcy or facing foreclosure, this is where AMI can help.

We can make you a cash offer on your home and cover all closing costs. Selling the house to a cash buyer would allow you to sell your home quickly, so you can use the sale proceeds to work on repairing your finances and/or buy a new home, while avoiding the hassles, fees, and skip the time it can take to sell your home on the market.

Fill out this form to receive a no-obligation cash offer, regardless of what condition its in or what situation you are currently facing. If you accept our offer, we can close in 10 days or less.

Is There Anything Specific I Need To Know About Loan Modifications In Texas

While each state, including Texas, has its own foreclosure laws and homeowner protections in place, there are federal mortgage servicing rules which went into effect on January 10, 2014.

These rules were designed to protect borrowers when it comes to foreclosures, and in 2017, they were amended to better protect homeowners by:

- Ensuring servicers provide a borrower with assistance if the borrower is having difficulty making mortgage payments

- Protecting borrowers from wrongful actions by servicers

During the housing crisis that began around 2008, the number of homeowners in financial distress increased exponentially. Servicers couldnt keep up with the increased demands for information and assistance, and as a result, servicing errors were abundant.

Now, there must be continuity with the borrowers point of contact at the servicing company, and that contact must be available to the borrower during any loss mitigation process, including applying for a loan modification.

Recommended Reading: Can A 70 Year Old Get A 30 Year Mortgage

How Do Loan Modifications Work

Loan modifications are available to borrowers who are facing extreme financial hardship. Many lenders would rather work with you on a compromise than go through with a foreclosure.

To get started, youll need to gather information and documents about your loan and your current financial situation:

- Mortgage statements

- Other types of debt, such as credit cards, student loans, or car loans

- Other bills, such as utility bills, alimony, child support, and other recurring payments

- Your income, including recent pay stubs and tax returns

Next, determine the current value of your home. You can look for an estimate of the current market value on a real estate valuation website, or contact a real estate agent or appraiser. Agents and appraisers may charge you a fee for the service.

After youve collected the paperwork and determined your homes value, contact your lender. This is the company you pay every month. Take notes during your call, including when you called, whom you spoke to, and the details discussed.

When you call, mention that youre interested in a loan modification. Talk about your financial hardship and your preparation for completing the process. Ask what details they need to determine eligibility. If you qualify, your lender will provide you with the necessary documents for you to fill out.

If youre considering a loan modification, keep in mind that the process from start to finish could take several months.

What Is The Process For Applying For A Loan Modification

Its best to start with a phone call or email to your lender and let them know about your current financial situation and explain why its difficult for you to make your mortgage payments right now.

Youll need to fill out an application and provide detailed information on your finances. Be prepared to submit the following:

- Income: All the money you take in through earnings and other sources.

- Expenses: How much you spend each month on your car, utilities, groceries, etc.

- Documents: Proof of your financial situation, which can include pay stubs, bank statements, tax returns, outstanding debts, etc.

- Letter of Hardship: Explain the circumstances which are affecting your ability to make your current mortgage payments, and how you are trying to rectify this situation.

- IRS Form 4506-T: This form allows the lender to access your tax information from the IRS if you cant or dont supply it yourself.

The application process alone can take several hours or even days, as youll have to fill out many forms, gather information, and submit everything in the format required by your lender. Your application can be delayed or rejected if something your lender requires is missing or outdated.

You May Like: When Is Private Mortgage Insurance Required

Mortgage Loan Modification: A Last Resort

If youve missed one or more mortgage payments and you feel like youre out of options, a mortgage loan modification may end up being your best bet.

But before you jump into modifying your mortgage, give yourself a chance to check out all your options so that you can decide which one is right for you.