Which Payment Schedule Is Right For Me

While it will depend on your specific situation, here are some general guidelines:

- Most people choose to synchronize their mortgage payments with their monthly or bi-weekly paycheck. This will make it easier to budget.

- More frequent mortgage payments will slightly lower your term and lifetime mortgage cost. Accelerated payment frequencies are also available.

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Can I Get A Mortgage If I Have Debt

Having some degree of debt like an auto loan doesnt disqualify you from getting a mortgage. But your DTI certainly will influence how a lender evaluates your loan application. Generally speaking, a lender wont approve you for a mortgage if your DTI is above 43%.

Personally, I advise you to hold off on a mortgage until your DTI is below 40% max. And a 33% DTI is an even better goal before applying for a mortgage. Going into a mortgage with a lower DTI gives you more financial breathing room in the event that unexpected expenses pop up.

Don’t Miss: What Banks Look For When Applying For A Mortgage

Can I Get A Mortgage On 20k A Year Uk

Some mortgage lenders have a minimum income requirement of £20,000 per year for residential property purchases, while others accept applicants who are earning between £15,000 and £10,000 a year. Moreover, there are even a few specialist mortgage lenders in the UK who have no minimum income requirements whatsoever.

How Secure Is Your Income

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

You May Like: Is A Reverse Mortgage Ever A Good Idea

Tips For Buying A Home

In order to help ensure that you can afford your home and maintain it over time, there are some smart measures you can take. First, save up a cash reserve in excess of your down payment and keep it in reserve in case you lose your job or are unable to earn income. Having several months of mortgage payments in emergency savings lets you keep the house while looking for new work.

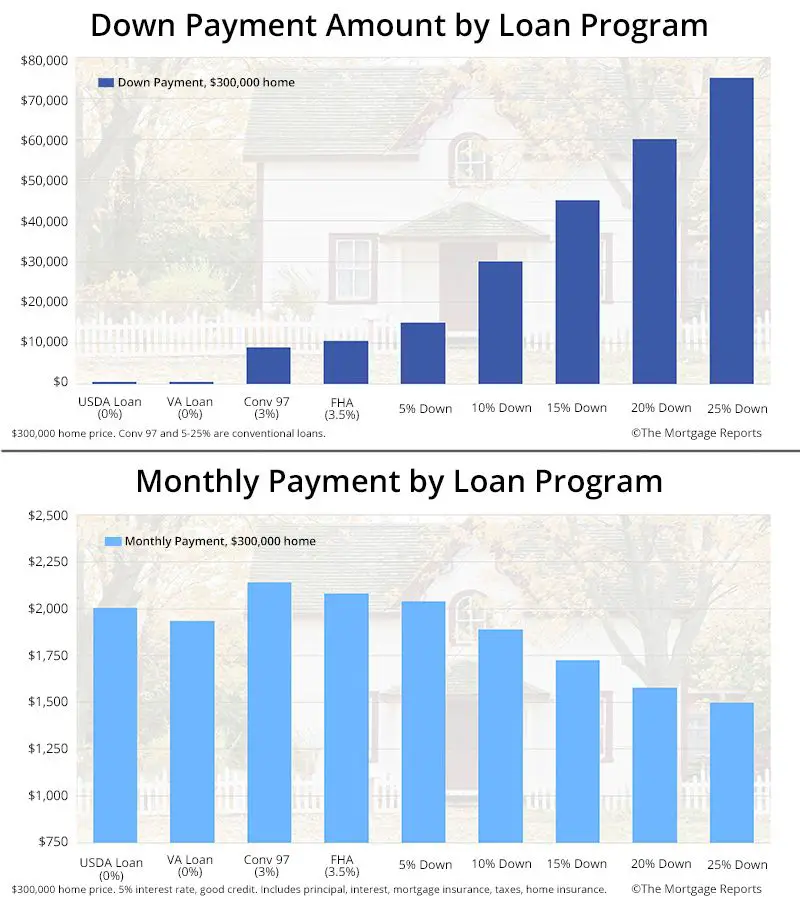

You should also look for ways to save on your mortgage payments. While a 15-year mortgage will cost you less over the loan’s life, a 30-year mortgage will feature lower monthly payments, which may make it easier to afford month-to-month. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

Finally, don’t buy a bigger house than you can afford. Do you really need that extra room or finished basement? Does it need to be in this particular neighborhood? If you are willing to compromise a bit on things like this, you can often score lower home prices.

Can I Get A Mortgage With A 50% Dti

It could be hard to find a mortgage lender that will grant you a home loan with a 50% DTI, but not impossible. Fannie Mae, a government-sponsored mortgage finance entity, will allow a DTI of “over 45%” on a case-by-case basis if the borrower has six months in payments reserves plus other qualifying factors.

Read Also: How To Calculate Your Monthly Mortgage Payment By Hand

Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

What Are Todays Mortgage Rates

Todays rates are still low, which is good news for home buyers. The lower your interest rate, the more real estate you get for your dollar.

Remember, theres no perfect amount to spend on your home loan. The decision is personal it depends on how much you make, how much you currently spend each month, and how large of a housing payment youre comfortable with.

So explore your options, check your rates, and pick the right mortgage amount for you.

Read Also: How To Find The Cheapest Mortgage Rates

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

What House Can I Afford On 30k A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Also Check: What Does Points Mean Mortgage

First: What Is A Mortgage Payment

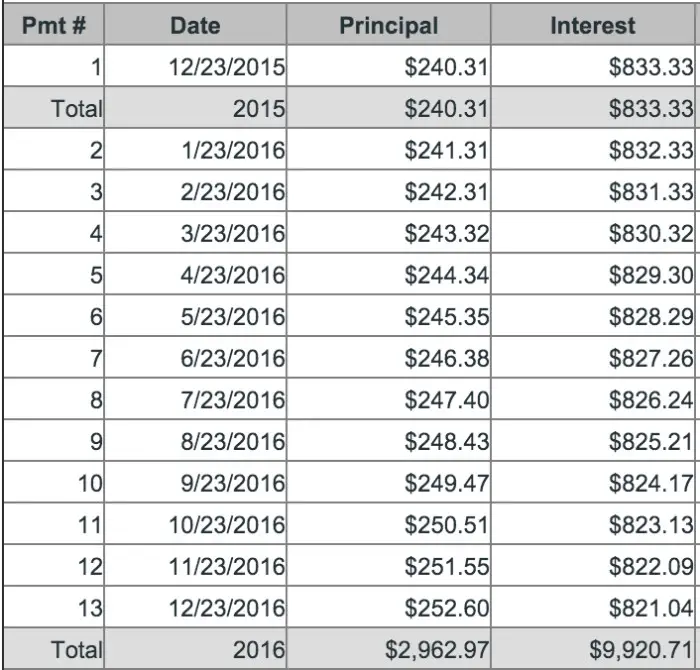

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

How Much House Does Dave Ramsey Say I Can Afford

For decades, Dave Ramsey has told radio listeners to follow the 25% rule when buying a houseremember, that means never buying a house with a monthly payment thats more than 25% of your monthly take-home pay on a 15-year fixed-rate conventional mortgage.

At Ramsey Solutions, we also teach people they cant afford to buy a house until they:

- Are completely debt-free

- Have an emergency fund of 36 months of expenses

- Have a down payment of 20% or more

Why is all this important? Because when life happens, an unexpected expense or a job loss could crush someone financially if theyre also trying to get out of debt and pay a mortgage. We dont want that to happen to you.

Also Check: How To Remove Co Signer Off Mortgage

What Portion Of Your Income Should Go To Your Mortgage

Many lenders and mortgage experts adhere to the 28% limit meaning your monthly mortgage repayments should not exceed 28% of your gross monthly income or the amount you earn before taxes are deducted.

This percentage also puts you below the mortgage stress threshold of 30%.

According to some experts, if you are spending more than 30% of your pre-tax monthly income on mortgage payments, then you may be at risk of mortgage stress.

To illustrate, the average weekly income of full-time working adults in Australia is $1,714, according to last Mays seasonally adjusted figures from the Australian Bureau of Statistics .

To get the median monthly income, we need to multiply this number by four the number of weeks in a month then multiply the product by .28 to get the 28% limit and .3 to find the mortgage stress threshold.

$1,714 x 4 x 0.28 = $6,856 x 0.28 = $1,919.68

$1,714 x 4 x 0.28 = $6,856 x 0.3 = $2,056.80

Given these, an average working Australian should ideally allocate about $1,920 to their monthly mortgage repayment and not pay more than $2,057 to avoid falling into mortgage stress.

However, it is worth noting that each persons financial situation is different and there are some who can allot more than 30% of their income to their monthly mortgage and still live comfortably.

Mortgage Payment Percentage Example

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $300

In this example, your total monthly debt obligation is $1,250. With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Considering that you already spend $500 a month on rent, if you add that to the $900, you can estimate a maximum monthly mortgage payment of $1,400. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Also Check: How Much Is Mortgage Insurance Monthly

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate is guaranteed to remain unchanged for the length of your mortgage term.

- A variable interest rate can change during your mortgage term. This will not affect your mortgage payment for the duration of the term, but adjusts what percentage of your payment goes to paying off the mortgage principal.

What Is The 80/20 Rule In Savings

Quite simply, the 80 20 rule for saving money states that 80% of our outcomes are the direct result of only 20% of our actions. It’s something that can be seen and used in a wide range of industries and settings. Approximately 20% of a company’s customers account for approximately 80% of the company’s profits.

Don’t Miss: Why Do Mortgage Lenders Need Bank Statements

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

You May Like: Are Mortgage Rates Predicted To Go Up Or Down

How Does The Interest Rate Affect The Cost Of My Mortgage

Your regular mortgage payments include both principal payments and interest payments. Having a higher interest rate will increase the amount of interest that you will pay on your mortgage. This increases your regular mortgage payments, and makes your mortgage more expensive by increasing its total cost. On the other hand, having a lower mortgage interest rate will reduce your cost of borrowing, which can save you thousands of dollars. While interest rates play a large role in determining the cost of your mortgage, there are other factors too. This includes the size of your mortgage, how long it will take to pay your mortgage off, and if you require CMHC insurance. This all affectshow much mortgage you can afford.

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Also Check: What Is The Meaning Of Mortgage

How Lenders Decide How Much You Can Afford

Lenders use a few different factors to see how much home you can afford. They use your debt-to-income ratio, or DTI, to make sure you can comfortably pay your mortgage as well as your other debt. This includes credit cards, car loans, student loan payments and more.

You can calculate your DTI ratio by adding up all your debt payments and dividing it by your gross monthly income. Say your monthly income is $7,000, your car payment is $400, your student loans are $200, your credit card payment is $500 and your current home payment is $1,700. All that together is $2,800. So, your DTI ratio is 40% since $2,800 is 40% of $7,000.

In general, a good DTI to aim for is between 36% and 43%. Some lenders will go higher, but the lower your DTI, the more likely you are to be pre-approved for a mortgage. Different lenders have different DTI requirements, though, so compare multiple mortgage lenders to find one that works for you.

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

Read Also: What Is Needed For Mortgage Application