What Is The Difference Between A Fixed

Not all mortgage rates are created equal. There are different types, and each has their own benefits, including:

A fixed interest rate is one that remains the same throughout the entire time you are paying off the loan. The rate is predetermined, so if you like consistency and want to know exactly what youll be paying, this is the better option for you.

Variable rates fluctuate during the course of the loan based on the current index value. The rate can fluctuate, and go up or down depending on the market. People who want to try to save some money on their loan can opt for a variable rate. If the rate goes down, you’ll make a lower monthly payment for that period.

These rates are charged on an upward curve, meaning you pay less each month at the beginning of the loan and gradually increase your monthly payments as the loan progresses. The actual interest rate doesnt change, but the total amount you pay will decrease because you will be paying off more of the loan as time goes on.

What Is The Difference Between Grants For First Time Home Buyers And First Time Home Buyer Programs

A first home buyer grant is a predefined amount of money that is given by the government or specific organization to a first-time home buyer for the specific purpose of assistance in buying a first home. Grants for first-time home buyers are usually available based on region.

A first home buyer program is an incentive offered by the mortgage lender which outlines special rates, terms, or benefits that are offered exclusively to first-time home buyers. These programs are highly unique to each lender.

What’s The Difference Between Apr And Interest Rate

The difference between a loan’s can depend on the type of financial product.

For installment loans, such as personal, auto, student and mortgage loans, the APR and interest rate may be the same if there are no finance charges. However, if there is a finance charge, such as an origination fee, the APR will be higher than the interest rate because your cost of borrowing is more than the interest charges alone. The difference between the APR and interest rate can also increase if the loans term is shorter, as youll be repaying the entire finance charge more quickly.

On credit cards, the APR and interest rate are the same because a credit card APR never takes the cards fees into account. As a result, you may want to compare not only cards APRs, but also their annual fees, balance transfer fees, foreign transaction fees and any other fees when deciding on a credit card. Keep in mind that you can generally avoid paying interest on your credit card if you pay off the balance in full every month.

Don’t Miss: How To Market Yourself As A Mortgage Loan Officer

How Does Apr Work With Arm Calculations

ARM is an acronym for adjustable-rate mortgage. An ARM has an interest rate that adjusts and changes after a set fixed period. These loans are typically named for the number of years they keep a fixed rate and then for the period of time that passes between each rate change. So, a 5/6 ARM would keep the same initial rate for 5 years and then would adjust every 6 months after.

Since its not possible to predict exactly what will happen with the market and how it will affect your interest rate, APR is not a particularly useful tool for calculating how much it will cost you to borrow over the life of your loan with an ARM.

Here’s How Discount Points Work

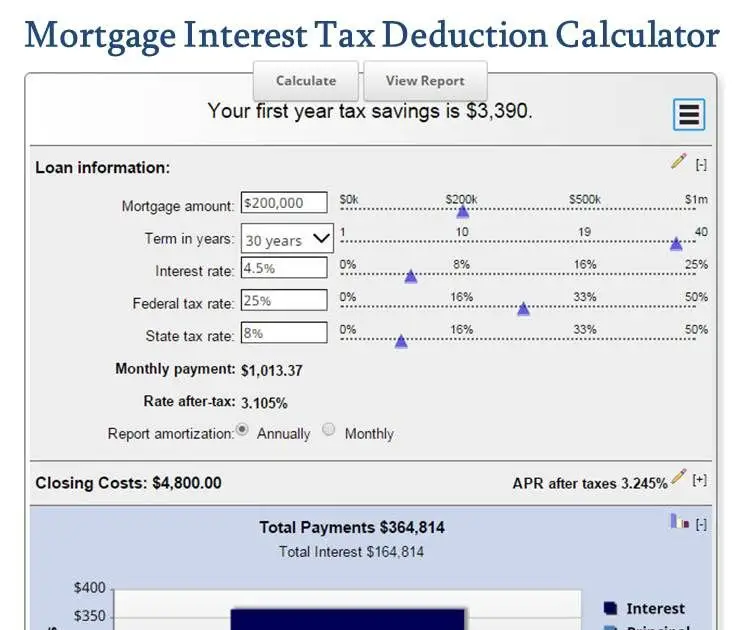

One discount point costs 1% of your loan amount. While one point will typically reduce the interest rate by less than 1%, even a small interest rate reduction can lower your monthly payment and the amount of interest you pay over the life of a fixed-rate loan. Discount points may also be tax deductible .

Before buying discount points, consider:

- How much money you can pay upfront – make sure you have enough money to make a down payment, pay closing costs, and still be able to manage other expenses for your new home.

- How long you plan to stay in your new home – the longer you stay in your home, the more you may be able to benefit from buying discount points.

- How much can you pay each month – if you dont have a lot of money to pay upfront and can handle a slightly larger monthly payment, you might be better off not buying points.

You May Like: Can I Get A Mortgage Without Tax Returns

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Tips To Remember When Loan Shopping

Shopping around for a mortgage will help you get the best deal. In fact, nearly half of borrowers who compare multiple loan options will save money on their mortgage, according to a recent LendingTree survey. The lesson here is that, although it may be tempting to settle on one mortgage lender before combing through competitors loan offers, taking the time to comparison shop can potentially save you thousands in interest over the life of your loan.

Keep the following tips front of mind as you compare offers and prepare to get a mortgage:

1. Focus on APR vs. interest rate based on your needsIt makes sense to focus on APRs if you care most about getting the best deal on your monthly payments. On the other hand, if youre more concerned about saving money in the long haul, its logical to give more weight to interest rates.2. Ask about additional fees Although APRs can be a powerful tool as you compare loan offers, they arent foolproof. Lenders are required to include certain costs in their APR calculations, but there are additional fees for example appraisal or inspection fees that may not be represented in the APR.

Tip.

To calculate a break-even point, divide the amount you paid in points by the amount you stand to save each month due to the lower rate. The result will be the number of months you need to remain in the home in order to break even.

Don’t Miss: Does Homeowners Insurance Pay Off Mortgage

Can All Borrowers Rely Safely On The Apr

* Borrowers who expect that they will sell their house or refinance the mortgage within 7 years.* Borrowers looking to raise cash, who are comparing the cost of a cash-out refinancing with the cost of a second mortgage.* Borrowers with little cash who need a high-rate loan with negative points to cover their costs.* Borrowers shopping for a home equity line of credit .

no-cost mortgage

How To Use The Apr Calculator For Adjustable Rate Mortgages

Not sure where to start? Let us help you:

Read Also: What Are The Rates On A 30 Year Fixed Mortgage

Mortgage Interest Rate Vs Apr

Mortgage Interest Rate: When you look at online lending websites ormortgage ads, they will often display a mortgage interest rate. This mortgage rate often fluctuates with theFed Funds rate, but is always a couple percentage points higher. Currently, the Fed Funds rate is 0-0.25% andtoday’s best mortgage ratesare about 2-2.25%. Your quoted mortgage rate is used to calculate your interest expense for each month. To find your monthly mortgage rate, you can simply divide your quoted mortgage rate by 12.

How Is Apr Calculated On A Mortgage

April 23, 2021 By: Mortgage Guru

If youre in search of a home loan or looking to refinance your current home loan, then no doubt youre shopping for the best and lowest interest rate. While a lender or a broker may appear to be offering the lowest rate, the actual rate you should be concerned about is the APR.

If youre going to shop based on interest rates, then the actual comparison you should be done based on the APR

Recommended Reading: What Is A Great Mortgage Rate

How To Use This Apr Calculator

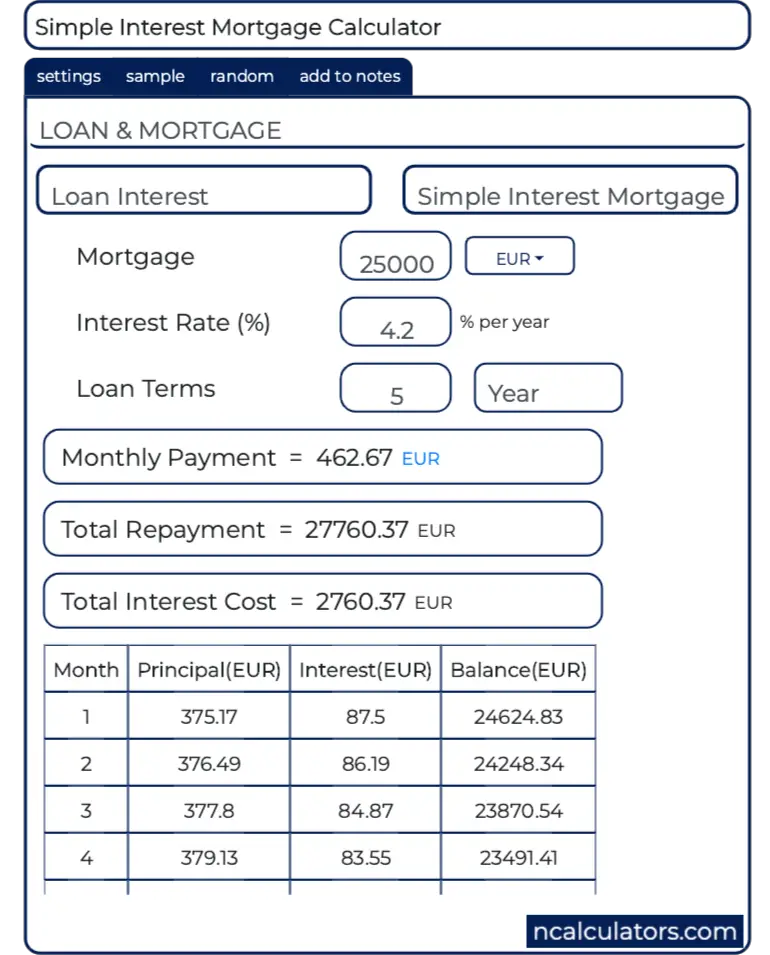

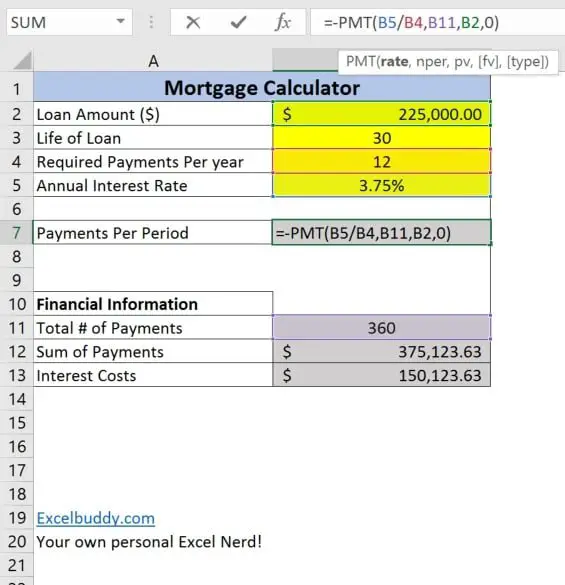

To find out what the APR amount will be on your mortgage, simply input the following items:

- Loan amount: The total amount of money you are borrowing to buy the home

- Interest rate: The interest rate the lender has offered you on the loan

- Loan term: The total number of years for the mortgage

- Discount points: This is any points you purchased to lower the interest rate on your mortgage.

- Origination and other fees: This is where you can include additional costs like the percentage the lender charges for originating your mortgage or if theres mortgage insurance costs included.

Once you have inputted all the loan terms and costs, the calculator will determine your APR estimate so you can see how much it will cost you to borrow funds on an annualized basis.

Using Apr To Compare Mortgage Offers

Using APR lets you easily compare mortgage loan offers between different lenders that have the same mortgage term, but it’s not always the best way to compare mortgages. That’s because closing costs and lender fees are all rolled into APR based on the mortgage’s term length. If you don’t plan on sticking with the entire mortgage term, such as if you plan on selling the home or paying off the mortgage early, then the APR won’t be accurate.

Lenders that have low mortgage rates but high closing costs will have a lower APR compared to lenders that offer higher mortgage rates with low closing costs. That’s because interest generally takes up the bulk of a mortgage’s APR. However, if you plan on selling your home or paying off your mortgage early, it might be a better idea to choose the lender with lower closing costs but a higher APR.

For example, let’s take a look at a mortgage with a$500,000 principal for a 30-year term. Lender A is offering a fixed mortgage rate of 3% and charges $25,000 in fees, while Lender B is offering a fixed mortgage rate of 3.5% but charges only $5,000 in fees. Which mortgage would be better?

|

Lender A |

|---|

You May Like: What Is A Government Backed Mortgage

Improving Your Credit Can Get You Lower Rates

Lenders may offer you a different APR on your loan depending on your creditworthiness and the repayment term you choose. Those applicants with higher credit scores and lower debt-to-income ratios may qualify for lower interest rates and finance charges, leading to a lower APR.

To improve your credit and avoid late payment fees, make all your debt payments on time. Paying down your credit card balances can also help your credit by lowering your .

If you need to borrow money now and dont have time to improve your credit first, you can still compare lenders offers to figure out which loan has the lowest APR. Often, you can start by getting prequalified or preapproved for a loan to see your estimated APRs and terms.

All else being equal, the lowest APR may be best. However, keep the big picture in mind before taking out a loan. For example, lenders may offer you a lower rate on shorter-term loans, which can lead to a lower APR but higher monthly payments. If thats not affordable, the longer-term loan with a higher APR may be best.

Limitations Of The Apr

While the APR serves as an excellent indicator for loan comparisons, the listed fee structure presumes that the loan will run its course. For any borrower planning to pay their loan off more quickly, the APR will tend to underestimate the impact of the upfront costs.

For example, upfront fees appear significantly cheaper spread out over a 30-year mortgage compared with a more accelerated 10-year repayment plan. In the U.S., borrowers usually pay off 30-year mortgages early due to reasons such as home sales, refinancing, and pre-payments. Therefore, when comparing loans with the same APR, the loan with lower upfront fees is more favorable to borrowers intending to pay off a mortgage early.

Also Check: What’s The Mortgage Interest Rate Now

How To Calculate Annual Percentage Rate

Conceptually, APR represents the estimated cost of the yearly fees associated with a specific type of borrowing.

The stated interest rate on a loan is not usually enough on its own to make the right borrowing decision â for instance:

- Consumer and Commercial Loans

How To Calculate The Apr On A Loan

There are two ways to calculate APR: the actuarial method and the U.S. rule method. Both are acceptable according to federal regulations and, for most peoples purposes, the differences between the methods are negligible both methods will return the same results .

Youll need to use a mortgage APR calculator to determine your rate, because the calculations involve several complex variables that a basic calculator cant handle. Here are the APRs calculated for our above example loans:

| Loan A | |

|---|---|

| 5.79% | 5.84% |

We used an online mortgage APR calculator to input the loan costs and fees. As you can see, the APR on Loan A is lower, making it indeed the better deal.

Takeaway:

Read Also: What Is Needed For A Mortgage Loan

Buying Your First Home

First time home buyers may not have as much experience as seasoned property flippers, but you do have some important advantages working in your favor. As a first time home buyer, you can qualify for lower down payments and more favorable interest rates. You also might qualify to save money on your taxes.

Thanks to these rules for first time home buyers, anyone with a decent credit score should be able to get through the home buying process with a fair mortgage that suits your needs and that wont drain your bank account on day one. When comparing lenders, dont forget to look at factors like APR, loan terms, and closing costs. Always ask what your lender can do for you as a first time buyer.

How To Calculate The Apr Of A Loan

The key question to ask when comparing loans is, how much will this cost me? Learning how to calculate the APR of a loan will allow you to compare apples to apples when searching for the best deal available. The problem is millions of borrowers dont even know what an APR is.

So, how do you calculate the annual percentage rate of a loan? Is it the same method for all loans?

Lets start with some background.

Also Check: How To Sell A House Before Mortgage Is Paid Off

How Long Will The Process Take

Generally, the mortgage application process should take about 30 days. This could end up being longer or shorter. Some online lenders might be able to complete the process in as little as a week. In other cases, especially during peak periods for applications, this process can stretch out a bit longer. Applying for first home buyer grants might also elongate the process. Much will also depend upon how prepared you are with the information the lender requires.

What Factors Influence Interest Rate And Apr

What do lenders and credit card companies look at when determining the interest rate and APR youll pay on loans and credit cards? Well, theres a lot.

First, your lender or card provider will look at your three-digit FICO® Score and your three credit reports maintained by the national credit bureaus of Experian, Equifax® and TransUnion®. In general, if your credit score is low and your credit reports contain missed or late payments, you can expect to pay a higher interest rate and APR. If your score is strong and your reports are clean with no collections, your interest rate and APR will be lower.

Lenders will also check your debt-to-income ratio, which measures how much your monthly debts consume of your gross monthly income. Lenders worry that if your debt is too large compared to your monthly income, youll struggle to pay back your loan on time. In general, according to the Consumer Financial Protection Bureau , lenders want your total monthly debt including your new estimated loan payment to equal no more than 43% of your gross monthly income. If your DTI is higher than this, your lender might boost your interest rate, which would increase your APR.

Don’t Miss: What Documents Will I Need To Apply For A Mortgage