Sale Agreement Of Existing Property

Existing homeowners can use the proceeds from selling their previous house as the downpayment for their next house. If you are using the sale of your last home for this, then you will need to include a copy of the offer.

However, if you cant sell your home fast enough, then don’t worry – you can use aHELOCor abridge loanto finance your down payment. Just be aware of how these loans affect your debt servicing ratios, as mentioned in category one.

Documents Youll Need: A Complete List

Whether youâre applying for a mortgage or youâre looking to remortgage, there are a few documents lenders will always want to see.

-

Three months of bank statements

Both ourselves and the lender will need to see statements showing your income and outgoings. This will allow us to properly assess your circumstances and make sure we recommend the right mortgage for you.

As most banks now offer online banking, the easiest way to send us your bank statements is to log in to your online banking account and download your statements directly to your computer. Thereâs no need to scan anything this way, and the statements will be automatically saved to PDF format.

-

Three months of payslips

Many people now receive their payslips online which makes it easy to download as a PDF. If you receive paper payslips, youâll need to scan them and send as a PDF. You can scan multiple payslips on one page rather than a page for each.

-

Your ID

Youâll need to provide a scanned copy of either your passport or driving licence.

-

Your address ID

Council tax bills, utility bills, and bank statements are all accepted forms of address ID. They must be dated within the last three months.

The 9 Critical Documents You Will Need To Obtain A Mortgage In Massachusetts

At Brooks & Crowley, we close dozens of mortgage loans every month. In talking with borrowers, a common complaint that we hear is how much documentation had to be supplied to the lender in order to have the loan approved. Some folks who have not applied for a loan for many years, or who are helping their sons and daughters with their first homes, will talk about the good old days of limited documentation and even stated income loans that required little or no documentation from the borrower.

In response to the good old days, of lenders making loans to anyone with a pulse and a job, the mortgage lending landscape has changed considerably. The new Qualified Mortgage rules took effect in January 2014. Gone are the days when lenders would ignore certain underwriting requirements if the deal otherwise seemed promising. Now, your lender must be able to fully document that you can afford your monthly mortgage payments.

The document requirements for mortgage preapproval vary by lender and your individual circumstances, but typically, you’ll need to provide documents that show your monthly income, your assets, and any regular deductions out of your income. The process does not need to be onerous, as long as you gather what you need ahead of time.

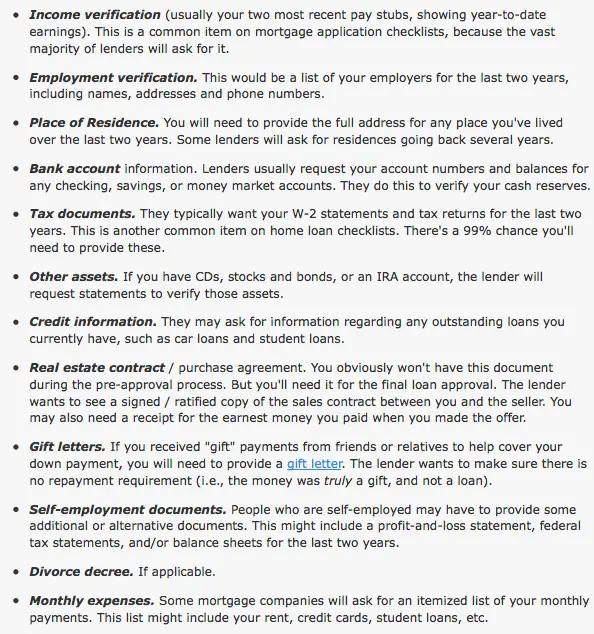

Here are the basic documents you’ll need to provide to your lender for your preapproval:

Once your offer is accepted, here is the additional documentation that the lender will need:

Don’t Miss: How Much Per Month For 100 000 Mortgage

What Documents Will You Need For Your Mortgage Application

Experienced real estate agent Adam Howell, who works with 69% more single-family homes than the average Rochester agent, emphasizes that the most important thing is that you are able to make the monthly mortgage payment. Lenders gauge this by looking at a combination of your income, your debt, and how much credit you already have.

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Recommended Reading: How Much Mortgage Would I Get

Get Your Approval Letter

Once you find the best mortgage solution for your needs, you can see if youre approved online. If you are, well send you a Prequalified Approval Letter that you can use to begin house hunting. If you want an even stronger approval, you may want to consider contacting a Home Loan Expert and applying for a Verified Approval.

Documents Mortgage Lenders Will Probably Ask For

You’ll need to provide your lender with many documents when you apply for a mortgage. Here’s what you need to know about the most common ones.

If youre applying for a mortgage, lenders will need information about your income, debt, employment, assets and more, which could take a lot of document-gathering on your part. Some of the documents will always be required a government-issued ID, for example while others, like HOA certifications, will vary by situation.

Many documents will be easy for you to find and submit others could be more challenging and take longer. And documents will be aging while youre in the loan process, so you may need to go back and get current versions before your loan closes.

You may also receive documents, such as waivers and disclosures, from the lender. Be sure to keep these for future reference.

Don’t Miss: How Big A Mortgage Can I Get

Retirement Or Investment Account Statements

If you are retired, you need to show proof of any retirement income. According to Wise, the best way to do so is with an award letter. An award letter is one that either the Social Security Administration gives you or that can be provided by the retirement fund that youre using. The letter shows how much youre getting paid every month.

As far as personal retirement accounts, stocks, and other investments youve made that you want to have considered in your income you will have to show the lender your investment accounts. This may include showing copies of your stock certificates and records, investment or securities accounts for the last three years .

Common Homebuyer Mistakes Between Application And Closing

Your loan is not complete after pre-approval, and its not even complete after you submit all your documentation, and get a full approval. Your loan really isnt complete until the lender verifies everything is as it should be and determines your loan is clear to close.

While some factors that can affect your qualification for your mortgage and the purchase of a home are out of your control , there are several moves you can make between application and closing that could prevent you from getting a mortgage.

Lenders review your credit, income, and assets soon after you submit your application and if all goes well, theyll issue an approval for your loan. But that approval is not set in stone until they clear you to set a closing date.

Before they do so, they may request signatures on certain documents, make additional documentation requests, etc. and because all these things can take time, they will also want to make sure none of the information you submitted in your application has changed between when you applied and when your loan is ready to close.

If any of the information they relied on to approve your loan changes dramatically while your loan is being processed, they may have no choice but to deny your loan, even if it is right before the purchase is supposed to close.

Here are some of the things you shouldnt do while youre waiting to close on your new home:

Header Image Source:

Also Check: What Is The Mortgage On A 3 Million Dollar Home

Category Two: Proof Of Income

This category is designed to prove mortgage lenders your monthly salary and your ability to meetdebt servicing ratios. In particular, lenders willcalculate your monthly mortgage paymentsto ensure they don’t exceed 39% of your gross income. Additionally, your income has a direct effect on yourmaximum mortgage affordability.

What Documents Are Needed For Mortgage Preapproval

If youre in the market for a home, you may have heard that you should get a preapproval before you apply for a mortgage. It can help you narrow down your search and let you know how much home you can afford. Not only that, but it can also make you a more appealing buyer to sellers.

Before you can apply for a preapproval letter, though, you need to get your affairs in order. Here are the documents needed for mortgage preapproval.

You May Like: Do I Need To Get Prequalified For A Mortgage

Minimum Mortgage Application Documents For Wage Earners

If you’re a full-time W-2 employee who does not earn commission or bonus income, you may need just a few documents – enough to prove that you have predictable and sufficient income and funds to close. In this case, you supply these things:

It’s not uncommon to be asked for the most recent two pay stubs, or bank statements covering a three month period. If you are an ordinary W-2 wage earner with a couple of years on the job, you may just need a bank statement and a pay stub. And you might be able to text it to your lender. Probably a lot easier than you imaged.

Im Ready To Apply For A Mortgage What Documents Will I Need

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

Much like applying for a job, youll have to jump through some hoops when you apply for a mortgage but the good news is youll be able to buy a house when all is said and done!

The Consumer Financial Protection Bureau reported that approximately one in nine loan applications to buy a new house were denied in 2018. As for those who received approval, according to the Mortgage Bankers Association , the last quarter of 2019 saw a seasonally adjusted delinquency rate of 3.77% for mortgage loans on one- to four-unit residential properties.

The purpose of the mortgage application and underwriting process is for lenders to ensure that you are someone who can afford to pay the money back over the life of the loan. They generally make this determination by looking at your mortgage application information, proof of income, assets and debts, credit verification, and a variety of other documents.

Theres credit, capacity, capital, and collateral.

To simplify things, here are the documents you will likely need for a mortgage application.

Don’t Miss: How To Buy A Reverse Mortgage Foreclosure

What Documents Will I Need For A Mortgage

Documentation is crucial to getting a mortgage loan. If youre applying for your first mortgage, you might feel overwhelmed by the amount of paperwork youre asked to provide. But if you know what lenders expect, you can prepare early and submit your information in a timely manner. The sooner we receive the necessary paperwork, the sooner you can get pre-approved for a mortgage and start shopping for a home.

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Recommended Reading: How To Get A Mortgage After Chapter 7

Do You Accept Photos Of Documents

We can accept high quality photos so long as the photos meet the following standards:

-

No additional items should be visible in the image background

-

The image must not be covered in part or whole

-

Any text must be clearly visible and legible

-

A flash or shadow shouldnât be visible

-

The document must be laid flat

-

We cannot accept any screenshots of documents on your phone

How To Prepare For Your Application

Before applying for a mortgage, contact the three main credit reference agencies and look at your credit reports. Make sure there is no incorrect information about you. You can do this online either through a paid subscription service or one of the free online services currently available.

You can check you credit score with one of the three main credit ratings agencies:

You May Like: What Are The Chances Of Getting A Mortgage

Spending Expenses And Debts

On top of your income, your lender will also want to understand your financial liabilities. After all your bills are paid, how much is left over each month to put toward a new mortgage payment? You’ll be asked to list out all of your debts, as well as expenses like child support and alimony you may provide.

Financial And Income Documents

The most common financial and income documents youll need when applying for a mortgage include:

- Most recent pay stubs covering the past 30 days

- W-2 forms for the past two calendar years

- The two most recent statements for all checking, savings, CD, money market, and/or securities-brokerage accounts

- Most recent statements for all retirement accounts s or 403s)

- Your most recent statement of stock options, employee stock option purchase plans, and similar if youre using them as part of the down payment or for closing costs

- Federal tax returns for the past two calendar years

- All federal K-1s, partnership returns , and corporate or S Corp returns for the past two calendar years

You May Like: Can Your Mortgage Go Up

Rental Information And Landlord References

Lenders want to be assured youll make your monthly mortgage payments on time. If youre a renter, youll likely be required to show that youve made on-time rent payments in the past.

You may also be required to include the names and contact information of the landlords youve had previously. This will help the lender verify that youve upheld your financial responsibilities as a tenant. How far back youll need to show payments or landlord information may depend on your lender.

Documents To Prepare Before Applying For A Mortgage

by Christy Bieber | Updated July 19, 2021 – First published on May 4, 2021

Getting ready in advance can make the application process a lot easier.

Applying for a mortgage can be a time-consuming process. That’s because mortgage lenders want to carefully evaluate all of your financial credentials before they decide to approve you for a home loan.

You can make life easier for yourself — and hopefully expedite the process of loan approval — by having your financial documents ready so there’s no delay when lenders ask for them.

In particular, here are five documents worth having ready to go as soon as you submit your mortgage application.

Don’t Miss: What Is A Teaser Rate Mortgage

Applying For A Mortgage Can Seem Like An Overwhelming Process But We Are Here To Help Walk You Through The First Stage Of The Process By Providing The Top 10 Documents You Will Need To Apply For A Mortgage

1. Proof of income/permanent employment

You will be asked for proof of permanent employment so you can show proof of steady income. To show evidence of this you may be asked to show payslips. If you are paid monthly then you must provide payslips from the last 3 months or if you are paid weekly then the last thirteen weeks will be required. If you are including a bonus as part of your pay even though it is not guaranteed, there will still need to be evidence of this.

If your payslips are sent to you electronically/online you can download these as a PDF. Or if they are in paper form then you will need to scan these and send them as a PDF. If neither of these is an option then having your P60 form is another way to prove your monthly income.

2. Self-employed

If you are self-employed it is a slightly different process. You will need to provide 2 to 3 years SA203s and 2 to 3 years of bank account statements. You will need to provide the last two years HMRC tax year overviews showing that your full tax liability has been paid. You have the option to replace the most recent years records with financial accounts produced and signed by a qualified accountant.

If you have a limited company, you will need to provide the last two years accounts produced and signed by a qualified accountant. The most recent year must be dated no more than 18 months before your mortgage application submission date.

- If youve been furloughed, well need a letter from your employer detailing:

Find A Property And Make An Offer

Now comes the best part finding the home thats right for you. To help you with your search, try connecting with a real estate agent in your area when you start viewing properties, especially if youre buying your first home. A real estate agent can help you narrow your search and show you properties that fit both your budget and needs.

Once you find the right home, your real estate agent will also help you submit an offer, and potentially begin negotiating with the seller. Once the seller accepts your offer, its time to move to the final stages of the home buying process.

You May Like: Can You Get A Second Mortgage With An Fha Loan