What About Pursuing A Short Sale

Homeowners who are behind on payments, out of work, and upside down in their mortgages may be eligible to do a short sale instead of foreclosure. In a short sale, youre essentially asking the bank to let you sell your house for less than you owe on it and requesting that they forgive any loan amount that you still owe beyond the amount gained from the sale of the home.

Of course, you need to talk this all over with your tax account, but in most cases it is far better to do a short sale as far as the debt forgiveness and your credit report, advises Bethany Mendoza. When you short sell a house, its recorded on your credit as paid for less than or settled. Your credit will bounce back a lot faster with a short sale on your report rather than if the property is foreclosed on.

A short sale isnt exactly a cakewalk, though.

Donât Miss: Why You Should Get Pre Approved For A Mortgage

Who Is Foreclosing On These Second Mortgages

The parties foreclosing on zombie second mortgages are a mix of players, with the original lenders seldom still in the picture. The parties threatening foreclosure today are often debt buyers or their collection agents. Debt buyers purchase pools of defaulted loan accounts, then opportunistically select those to foreclose. They can focus on equity-rich properties and those where they can easily pay off the first mortgage to obtain unencumbered title for themselves.

Can A Second Mortgage Holder Force A Property Into Foreclosure

Related Articles

Many property owners have multiple mortgages on their properties, typically first and second mortgage loans. By law, mortgages and other liens on property titles take their positions on those titles according to seniority, which is determined by a lien’s recording date. So, the mortgage that’s recorded first has priority over later mortgages. However, any property lien holder can foreclose a property for money owed, regardless of where they sit in the rankings.

Read Also: Does Usaa Have Mortgage Loans

If Your Mortgage Is Underwater

If the value of your home is less than the amount you owe on your first mortgage, your second mortgage is in essence an unsecured loan. What this means for you is that even if you stop paying your second mortgage, the holder of the second mortgage will probably not foreclose. Why? Because, in the event the junior lender forecloses, all the proceeds of the foreclosure sale will go to repaying the senior lender. The junior lender will have gone through the expense of foreclosing but will get no money out of it.

This doesn’t mean that the junior lender has no other remedy to recover the money it loaned to you. Even though foreclosure is not an option, the junior lender, being an unsecured lender, can sue you personally to recover the money, if allowed by state law. If the junior lender wins the lawsuit and gets a money judgment against you, the junior lender can garnish your wages, freeze your bank accounts, or place liens on other property you may own.

Stopping payment on your mortgage is a drastic step and is one you should take only after considering all other options. Your credit report will take a big hit, but if avoiding foreclosure and hanging on to your home is your top priority, it could be the right option for you.

Second Mortgage & Foreclosure

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Facing foreclosure on your home can feel devastating enough with only a single mortgage. If you have a second mortgage on top of that, your financial situation could feel even more precarious. In this article, you will learn about the differences between a first and second mortgage, what you can expect to happen if your house is foreclosed by the bank while you still owe a balance on a second mortgage, and what to do if you’re facing a lawsuit from a second mortgage holder.

Written byAttorney Serena Siew.

Itâs important to understand the ins and outs of second mortgages because the potential financial consequences of these contracts can be especially hard on already âdistressedâ borrowers. This article discusses second mortgages in detail.

Many people take out second or even third mortgages on their homes. This process is essentially obtaining another loan using real estate as collateral. Second mortgages can even cover the down payment on the first mortgage. Home equity lines of credit are the most common.

Read Also: Should You Get Mortgage Insurance

Dealing With The Worries Of A Second Mortgage

If you were unlucky to buy a house just before the recession and took big loans to fund your purchase, then you may be facing trouble repaying your loans. During the recession, many desperate home owners chose to protect their homes by taking second mortgages with their home equity as collateral to make payments on the first mortgage and manage other necessary expenses. But many of these people are now finding themselves burdened with their second mortgage as house values are still low and it will take quite some time before they reach their pre recession values. If you are in a similar position and are beginning get seriously worried about the fate of your home, then dont lose hope yet.

Second mortgages are loans backed by a part of your home equity. It is true that the second mortgage lender has a lien over your home, and in case you fail to repay the loan, the lender can stake a claim on your property. But the lender cannot foreclose your property or establish any kind of right over the proceeds until the first loan or the primary mortgage is repaid in full.

Considering the massive costs involved in marketing the house, putting it up for sale and executing the sale, the second mortgage lender will only be deriving a fractional benefit by pushing for foreclosure of your home. It is the primary mortgage lender, who benefits the most from foreclosure and more often than not, leaves next to nothing for the second loan to get repaid.

Foreclosure: Second Mortgages Home Equity Loans Investments And Helocs

There’s a lot of confusion when it comes to foreclosure and second mortgage, home equity loans, home equity lines of credit , judgment liens, and other junior mortgages. Some common questions: Can second mortgage lenders foreclose on your home if you stop paying? What happens to second mortgages and HELOCs if your first mortgage lender forecloses? Can the second mortgage lender sue you in court to repay the loan?

Below you can find the answers to these, and other questions regarding foreclosure and second mortgages.

You May Like: How Much Usda Mortgage Can I Qualify For

Does The Cares Act Protect My Home From Foreclosure

In general, federal law prohibits lenders from initiating foreclosure proceedings against you until you are 120 days past due on your mortgage payments. Under the CARES Act, they were originally prohibited from initiating a foreclosure, holding a foreclosure sale, or evicting you from your home at least until the end of May 2020. The Federal Housing Finance Agency extended this deadline to August, but it does not apply in all cases. Lenders and servicers that are covered include:

- FHA insured loans

If A Judgment Has Been Passed On Second Mortgage Foreclosure Now What Happens

The moment your first lender forecloses, every lien that happens to be junior to it automatically gets in line. Though there is not enough equity, then chances are it will not wipe the other liens out. The following is likely to happen:

Once the initial lien is satisfied, the junior liens are likely going to collect from the proceeds.

They will likely file a case against you if they understand that you do not have enough or lump sum money.

You can rid yourself of your junior liens by liquidating all your assets or selling your properties for the debt settlement. You should ensure that you do not use your credit cards as it is likely to damage your score if you fail even to pay your interest only.

The court is likely going to file a judgment against you for the mortgage balance.

The bank will likely collect their payment by levying your accounts, garnishing your wages, or merely passing some of your liens to other properties.

Even if you hold the risk of losing everything in hand, the good news is you can still get out of this mess. All you need to do is file for bankruptcy, and you can get discharged by the court or at least get everything reorganized.

Real estate can definitely be a tricky affair. Buying properties on mortgages should only be done when you are sure that you will pay your debts on time. Otherwise, not only do you risk losing your hard-earned money, even taking a good standing is likely not going to get you anywhere.

You May Like: Can You Lower Mortgage Payments Without Refinancing

Nclc Fair Debt Collections And Mortgage Training Conferences Will Examine Zombie Foreclosures

Consumer attorneys take note: Two forthcoming NCLC conferences will include sessions on zombie second mortgage foreclosures.

NCLC’s Fair Debt Collections Conference will take place April 24-25, 2022, in Orlando Florida. Among other Fair Debt Collection Practices Act issues, a session will focus on using the FDCPA to combat zombie second mortgages, Information on the conference agenda, registration, and attendance options is available here.

NCLC’s Mortgage Training Conference will take place June 23-24, 2022, in St. Louis Missouri. The conference will focus on pandemic-related mortgage foreclosure issues and include a special session focused exclusively on zombie second mortgage foreclosures. Information on the conference agenda, registration, and attendance options is available here.

Avoiding Problems With Second Mortgage Loans

Recent volatility in home prices has shown the risks involved in taking out home equity loans a steep drop in home value can result in owing more on mortgage debt than your home is worth. Taking out a second mortgage or HELOC increases this risk. When considering taking a second mortgage against your home, ask yourself if the risk of adding to mortgage debt is worth the reason for getting another loan against your home. Buying a car? You may be better off financing through your credit union. Check out federal student loan programs before taking a mortgage for paying for college costs. These options provide similar financing rates without using your home as security.

References

Recommended Reading: How Much Can I Loan Mortgage

Priority Liens & Junior Liens: Whats The Difference

There are many types of liens. Liens describe any legal claim to property. Liens can be placed on property for various financial obligations, not just mortgages. Unpaid property taxes and homeowner association dues, for example, may result in liens being placed on a home.

A homeowner who has two or more mortgages has two liens placed on the property. The first is the loan used to buy the home and the second is usually a home equity line of credit . Like credit cards, HELOCs let you:

-

Withdraw money when you need it

-

Access a revolving line of credit

-

Take out money up to a limit

-

Repay during a set time period

So, you can withdraw money up to a maximum as you would with any bank account. During what is usually a 10- to 15-year âdrawâ period, you may only have to pay back part of the balance or the interest. But when this period ends, youâll have to pay back all the balance plus interest.

Types Of Mortgage And Home Equity Loans

Buying a home or refinancing an existing mortgage requires taking out a first mortgage. As your home value increases, you may want to tap your home equity by taking a second mortgage or home equity loan. A home equity line of credit is a form of home equity loan and also functions as a mortgage the amounts drawn against your HELOC are secured by your home. Falling behind on payments for any type of mortgage or home equity loan can lead to foreclosure.

Read Also: How Does A Mortgage Work For First Time Buyers

Second Mortgage Foreclosure Rights

When it comes to mortgages and foreclosures, real estate law is all about timing. The general rule in California real estate law is that first in time equals first in right. By definition, a second mortgage is second in time, and therefore second in right when it comes to foreclosure.

How Lawsuits For Money Judgments Work

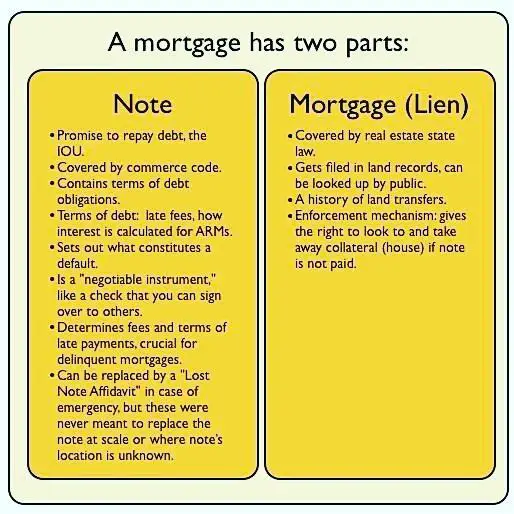

After a first-mortgage lender forecloses, you might think that your second mortgage will go away, too. However, while the foreclosure will wipe out the second-mortgage lenders lien, the debt remains. Again, home loans usually have two main agreements: a promissory note and a mortgage. While the mortgage gives the right to foreclose if you dont pay the debt, the promissory note allows the lender to sue you personally if you dont pay back the loan.

Read Also: Is It Better To Use A Mortgage Broker

Default Sets The Wheels In Motion

Second mortgage lenders can take action against you once your loan is in default. As soon as you fail to meet the terms of your loan agreement, you’ll trigger a default. Partial, late, or skipped payments are common examples of failing to pay as agreed. At first, your lender may give you some time to sort things out. But if the lateness continues, the lender will pursue one of the following options.

1. Foreclosure. The second mortgage lender cannot foreclose without paying off the first mortgage lender. Therefore, this course of action only makes sense when you have sizeable home equity. In that scenario, the second mortgage lender could sell the property and raise enough cash to pay off both home loans. More commonly, the equity value is too low to support a foreclosure. In that case, your second mortgage holder would try to initiate a forbearance plan or make a settlement offer.

2. Forbearance plan. This is a temporary, negotiated reduction in your monthly payments. If you’re facing a temporary hardship, for example, you might negotiate a six-month payment suspension. Generally, your interest will accrue during this time and the lender may require you to make larger, catch-up payments after your six-month stay.

What Happens To Underwater Homes

If your home is underwater , your second mortgage is effectively unsecured. So, if the second-mortgage holder foreclosed, the foreclosure sale proceeds wouldn’t be sufficient to pay anything to that lender.

In most cases, if you’re underwater and fall behind on payments for your second mortgage, the holder of the second mortgage probably won’t start a foreclosure. That’s because all the money from the foreclosure sale would go to the senior lender. But the second-mortgage lender could, if allowed by state law, sue you personally for repayment of the loan.

Recommended Reading: How To Pay Off Mortgage In 10 Years Calculator

Should I Get A Second Mortgage If I Have Bad Credit

Although second mortgages are often difficult to qualify for with bad credit, its not impossible. Obtaining a second mortgage with a low credit score likely means that youll be paying higher interest rates or using a co-signer on your loan.

You can also consider looking into alternative financing options to help pay for your home improvements or debt consolidation. Both personal loans and cash-out refinances are good options to use if you have trouble qualifying for a second mortgage.

Why Did These Second Mortgages Become Dormant

Many homeowners struggled to keep up on their first mortgages through the Great Recession, often with the help of loan modifications. In the early years of the Recession, home values dropped precipitously. With so many properties deep underwater, holders of first mortgages faced reduced recoveries if they foreclosed. Second mortgagees, on the other hand, were almost certain to obtain nothing if they decided to foreclose. Not surprisingly, as many homeowners were unable to make payments on second mortgages, the owners of these loans wrote them off.

These write-offs were accounting devices used to reflect that the loans had ceased to be income-producing assets. The accounting adjustment did not necessarily mean that the borrowers were no longer under legal obligations to repay the debts. In most cases, unless some of the legal principles discussed in this article applied, the loan owners retained the option to change their minds and demand payment again. Borrowers did not understand this. Many thought that when their first mortgages were modified, second mortgages were covered as well. Years passed, sometimes well over a decade, and borrowers heard nothing from anyone about the second mortgages.

Read Also: Can I Refinance My 2nd Mortgage

What Happens If I Dont Pay My Second Mortgage

If, for whatever reason, you are unable to repay a home equity loan, the lender may choose to foreclose on the house that you used as collateral. The actions usually depend on the value of your home, whether there are any other liens against it, and how much money you still owe.

When a borrower defaults on their first mortgage, the loan used to buy the home, lenders are highly likely to begin foreclosure proceedings to get their money back. Whether this same approach is adopted on a second mortgage depends on the propertys value and how much equity the borrower has in it.

This is because the first mortgage lien, by virtue of being recorded in county land records earlier, is given higher priority. Thus, if you fail to repay your home equity loan and the secured house is sold to satisfy the debt, the proceeds will be used first to extinguish whatever is left to pay on the initial mortgage. The second mortgage lender can only begin to collect what it is owed once the more senior lien has been honored and paid off.

The more home equity you have, the more likely your lender will choose to foreclose.