Recommended Mortgage Templates Provided By Wps Office

Tips: You can click the following pictures to use these templates quickly.

The templates provided by WPS Office go far beyond mortgage calculator charts, and you are welcome to visit WPS Templates to use more elegant and professional templates. Click the following links to view more templates quickly:

Use Conditional Formatting To Make It Pretty

Recall that we set up this spreadsheet so that it could handle a maximum of 30 years of monthly payments. What would happen if the loan term was less than that ? Well, you would end up with a bunch of rows with zeros in them after the loan is paid off. Ugly.

We can fix this with the Conditional Formatting functionality that is built in to recent versions of Excel. Basically, we’d like to make those “empty” cells disappear. If would also be nice if we could underline the last payment as well.

First, select cells A10:E369 since we are going to apply the formatting to all of them at once. Now, go to Format » Conditional Formatting from the menus. That will launch the following dialog box.

Notice that I have set two conditional formats. The first is the most important. It sets the text color to white for any cells after the last payment has been made. This effectively hides them, but the formulas are still there. We can determine if a cell is after the last payment by comparing the payment number with the total number of payments .

I am using the “Formula Is” option, so select that from the drop-down list and then enter the formula: =$A10> and type it exactly. The $A10 is a relative reference so that in the next row it will change to $A11, then $A12, and so on. Now, press the Format button and set the font color to white.

Convert The Annual Interest Rate In Month

This is the hardest part of the calculation. In fact there is 2 situations

- The interests are calculated at the end of the period

- The interests are running over the period

If the interest are calculated at the end of the period, the conversion is really easy

=annual interest rate/12

If the interests are calculated over the period the formula is more complex.

=^-1

Don’t Miss: How Long Does A Mortgage Approval Last

Tip: Return Payments As Positive Numbers

Because a loan is paid out of your bank account, Excel functions return the payment, interest and principal as negative numbers. By default, these values are highlighted in red and enclosed in parentheses as you can see in the image above.

If you prefer to have all the results as positive numbers, put a minus sign before the PMT, IPMT and PPMT functions.

For the Balance formulas, use subtraction instead of addition like shown in the screenshot below:

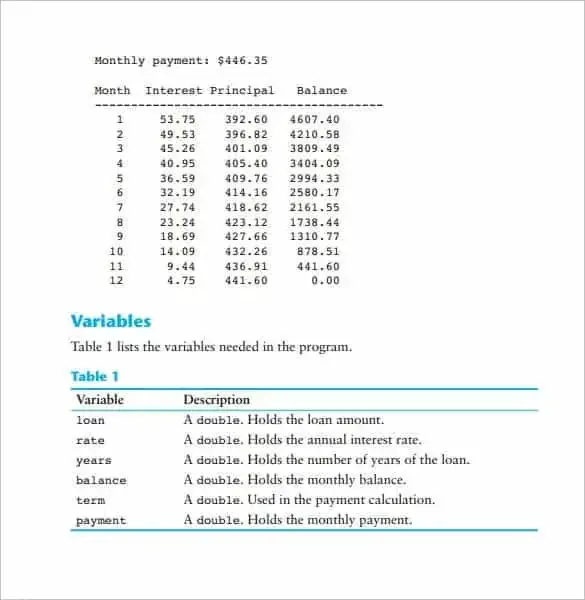

How To Calculate Monthly Payments For A Loan In Excel

We can calculate the monthly payments for the loan/mortgage using built-in functions like PMT and other functions like IPMT and PPMT.

PMT function is used to calculate the monthly payments made towards the repayment of a loan or mortgage.

=PMT

The PMT function requires 3 elements to calculate the monthly payments:

- RATE: Rate of interest of the loan. If the rate is 4% per annum monthly, it will be 4/12, which is .33% percent per month.

- NPER: the number of periods for loan repayment. For example for 5 years, we have 60 monthly periods.

- PV: Present value of the loan. It is the amount borrowed.

However, some other optional elements can be used for some specific calculations, if needed.

- FV: The future value of the investment after all the periodic payments are made. It is usually 0.

- TYPE: 0 or 1 is used to ascertain whether the payment is to be made at the beginning or end of the month.

Recommended Reading: How To Take Over Mortgage Payments

More Free Mortgage Spreadsheets

- Home Expense Calculator – This worksheet helps you estimate the overall monthly cost of owning a home, besides just the mortgage interest and principal.

- Amortization Chart – Explains how to create a chart showing balance vs. interest and principal, with an example spreadsheet.

- Balloon Payment Loan Calculator – For when you are getting close to paying off your mortgage and you want to make a lump sum to finish up.

- Amortization Calculator – A web-based loan calculator

How Do You Manually Calculate A Mortgage Payment

You can calculate a monthly mortgage payment by hand,but its easier to use an online calculator.Youll need to know your principal mortgage amount,annual or monthly interest rate,and loan term.Consider homeowners insurance,property taxes,and private mortgage insurance as well.Click here to compare offers from refinance lenders »

Also Check: What Does A Mortgage Include

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before Encrypt Cells with password Create Mailing List and send emails…

- Super Formula Bar Reading Layout Paste to Filtered Range…

- Merge Cells/Rows/Columns without losing Data Split Cells Content Combine Duplicate Rows/Columns… Prevent Duplicate Cells Compare Ranges…

- Select Duplicate or Unique Rows Select Blank Rows Super Find and Fuzzy Find in Many Workbooks Random Select…

- Exact Copy Multiple Cells without changing formula reference Auto Create References to Multiple Sheets Insert Bullets, Check Boxes and more…

- Extract Text, Add Text, Remove by Position, Remove Space Create and Print Paging Subtotals Convert Between Cells Content and Comments…

- Super Filter Advanced Sort by month/week/day, frequency and more Special Filter by bold, italic…

- Combine Workbooks and WorkSheets Merge Tables based on key columns Split Data into Multiple Sheets Batch Convert xls, xlsx and PDF…

- More than 300 powerful features. Supports Office / Excel 2007-2021 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

What Is The Formula To Calculate Mortgage Payment

Identify the sanctioned loan amount,which is denoted by P.Now figure out the rate of interest being charged annually and then divide the rate of interest by 12 to get the effective interest rate,which is denoted by r.Now determine the tenure of the loan amount in terms of a number of periods/months and is denoted by n.More items

Don’t Miss: When To Refinance Home Mortgage

Explanation Of The Pmt Function

PMT calculates the PayMenT for a loan for a constant interest rate.

The arguments of the function are:

- Rate The interest rate on the loan.

- Nper The total number of payment periods for the loan.

- Pv The Present Value, the value of the mortgage or loan.

- Fv The future value. It’s optional and the value = 0 most of the time.

- Type Whether the payment calculation is done at the beginning of the period or at the end

How Do You Calculate Payoff Amount

Part 1 Part 1 of 2: Knowing the Essentials Download ArticleUnderstand why your mortgage payoff amount does not equal your current balance. Gather the information needed for your calculations. In order to determine the payoff amount,either using a calculation program or on your own,you need to know a handful Consider online calculators if youd rather not exercise your math muscles. More items

Read Also: How Soon Will I Pay Off My Mortgage Calculator

Calculate The Principal Payment Of A Mortgage

PPMT works a bit differently. Since the amount of principal paid changes based on the payment number, the function takes an additional argument . This is the number of the monthly payment. For example, if we calculate the principal payment for the first month of the second year, we will use 13 as the argument.

Ive used the following formula in cell F3 to calculate the principal payment for the first month:

=-PPMT

The arguments used in the formula are:

- I have omitted fv and type.

Note: the minus sign at the beginning of the formula is needed to return a positive number.

As you can see, the sum of principal and interest payments is the same as the amount obtained using the PMT function.

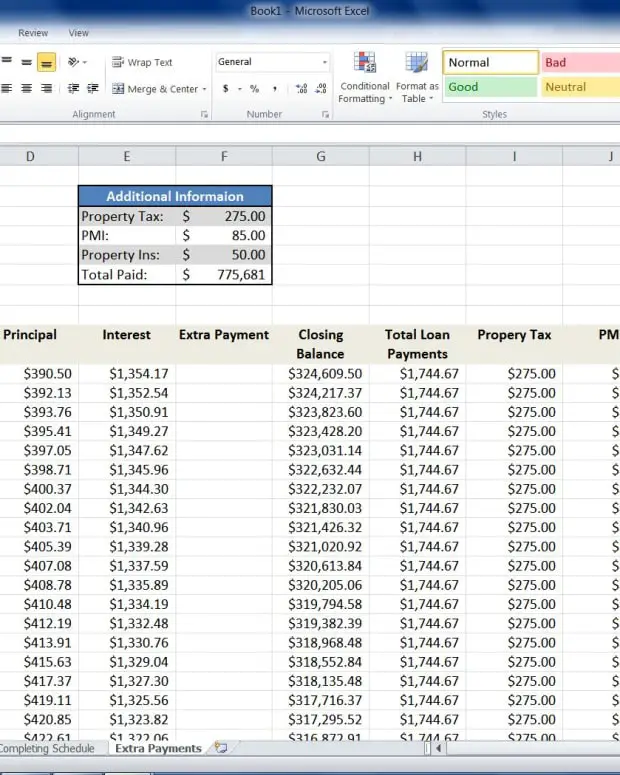

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

If you are looking for the procedure of creating your own mortgage calculator with taxes and insurance in Excel, then this article is useful for you.Here, you will get the automatic calculator for calculating mortgage payments and besides this, you will know the procedure also.

Also Check: What Is The Current Fixed Rate Apr For Mortgages

Amortization Schedule For A Variable Number Of Periods

In the above example, we built a loan amortization schedule for the predefined number of payment periods. This quick one-time solution works well for a specific loan or mortgage.

If you are looking to create a reusable amortization schedule with a variable number of periods, you will have to take a more comprehensive approach described below.

What Is The Pmt Function In Excel

The PMT function calculates monthly loan payments based on constant payments and a constant interest rate. It requires three data points:

-

Rate: Interest rate of the loan

-

Nper : The number of loan payments

-

Pv : The principal or current value of the sum of future payments

While optional, there are two additional data points you can use for more specific calculations:

-

Fv : The balance you want to achieve after the last payment is made. If omitted, this value is assumed to be 0, meaning that the loan is paid off

-

Type: Use ‘0’ or ‘1’ to specify whether the payment is timed to occur at the beginning or end of the period

You May Like: How To Be Mortgage Underwriter

Mortgage Down Payment Calculator

With nestos mortgage down payment calculator, we make it easy to figure out the minimum down payment in Ontario, BC, Alberta, Quebec or wherever youre planning on making your home in Canada. Just as our mortgage calculator helps you calculate your mortgage payment when you know your amortization period and mortgage term our mortgage down payment calculator helps you figure out your down payment.

How much is a house down payment? Can you buy a house without a down payment in Canada? These are some of the top questions that people ask when learning to seek out down payment calculators in Ontario, Quebec, BC and Alberta or anywhere else they call home in Canada.

Below you will find our answers to many questions about down payment. We have also added a portion on prepayment options being able to use these to your advantage can make it easier to reduce your total interest over the life of your mortgage if you do not have the money at the time of purchase.

How Do You Calculate Mortgage Payment

Principal: The amount of money you borrowed for a loan. Interest: The cost of borrowing money from a lender. Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Mortgage insurance: An additional cost of taking out a mortgage,if your down payment is less than 20% of the home purchase price. More items

Recommended Reading: What Is Escrow Means Mortgage

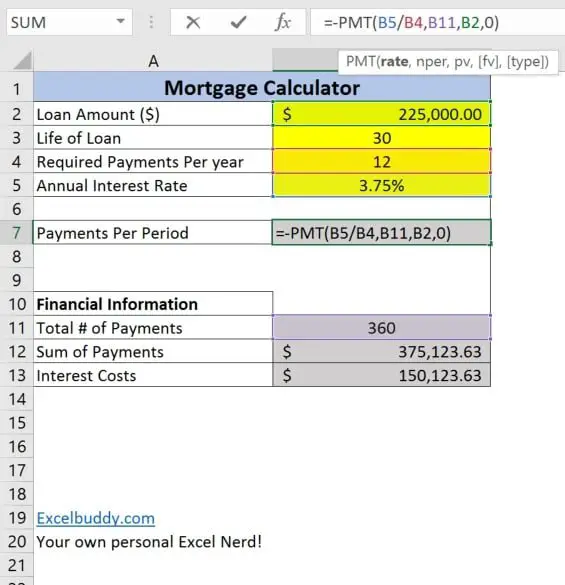

What Is The Formula For Calculating Monthly Mortgage Payments

PMT is a built-in function that calculates an annuitys monthly or annual payment based on constant payments and a constant interest rate. An annuity is defined as a series of equal cash flows that occur at fixed intervals . A mortgage is an example of an annuity.

The Excel formula to calculate mortgage payments can be written as:

=-PMT

Note: If omitted, the future value and type arguments are set to 0 by default.

Using the annual interest rate, the principal, and the loan term, we determine the sum to be paid monthly. The formula, as shown above, is written in the following order:

The minus sign before the PMT function is needed since the formula returns a negative number. For the interest rate, we use the monthly rate , then we calculate the number of periods . Finally, we insert the principal borrowed .

How To Use The Pmt Function To Calculate Loan Payments In Excel

Let’s say you are shopping for a mortgage and want to know what your prospective monthly payment would be. To calculate, all you need are the three data points mentioned above:

-

Interest rate: 5.0%

-

Length of loan: 30 years

-

The amount borrowed: $250,000

Start by typing Monthly payment in a cell underneath your loan details. To use the PMT function, select the cell to the right of Monthly payment and type in ‘=PMT(‘ without the quotation marks. You will then be asked to enter the aforementioned data points:

Don’t Miss: What Is Flex Modification Mortgage

How To Create A Loan Amortization Schedule In Excel

To build a loan or mortgage amortization schedule in Excel, we will need to use the following functions:

- PMT function – calculates the total amount of a periodic payment. This amount stays constant for the entire duration of the loan.

- PPMT function – gets the principal part of each payment that goes toward the loan principal, i.e. the amount you borrowed. This amount increases for subsequent payments.

- IPMT function – finds the interest part of each payment that goes toward interest. This amount decreases with each payment.

Now, let’s go through the process step-by-step.

How To Create A Bond Amortization Table In Excel

Method 1 Method 1 of 2: Creating an Amortization Schedule ManuallyOpen a new spreadsheet in Microsoft Excel.Create labels in column A. Create labels for your data in the first column to keep things organized.Enter the information pertaining to your loan in column B. Calculate your payment in cell B4. Create column headers in row 7. Populate the Period column. Fill out the other entries in cells B8 through H8. More items

You May Like: What Is The Average Mortgage Payment In Georgia

Executing The Pmt Function

The formula now reads:

Once you’ve entered all of the data points, you can press enter to execute the function. This will tell you your monthly payment amount:

As you can see above, the monthly principal and interest payment for this mortgage comes out to $1,342.05. This is shown as a negative figure because it represents monthly money being spent.

If this calculator isnt the right fit for you, you can try to determine how rates, terms, and loan amounts impact your payment.

How Do I Calculate A Home Loan In Excel

Method 2 Method 2 of 2: Making a Payment Schedule Create your Payment Schedule template to the right of your Mortgage Calculator template. Add the original loan amount to the payment schedule. This will go in the first empty cell at the top of the “Loan” column.Set up the first three cells in your “Date” and “Payment ” columns. More items

Read Also: What Does Prequalification For A Mortgage Mean

Things To Remember About Excel Mortgage Calculator

- The Excel shows the monthly payment for the mortgage as a negative figure. This is because this is the money being spent. However, if you want, you can make it positive also by adding sign before the loan amount.

- One of the common errors that we often make when using the PMT function is that we dont close the parenthesis, and hence we get the error message.

- Be careful in adjusting the interest rate as per monthly basis and loan time period from years to no. of months .

How Do You Estimate A Mortgage Loan

Save this loan estimate to compare to your closing disclosure. These words are italicized in the upper right-hand corner of the first page of your loan estimate. Date issued. You must receive a loan estimate within three business days of completing a loan application. Loan term. Product. Loan type. Loan terms. Costs at closing.

Also Check: What Would Payments Be On A 70000 Mortgage

How To Calculate Monthly Mortgage Payment In Excel

For most of modern people, to calculate monthly mortgage payment has become a common job. In this article, I introduce the trick to calculating monthly mortgage payment in Excel for you.

Calculate monthly mortgage payment with formula

To calculate monthly mortgage payment, you need to list some information and data as below screenshot shown:

Then in the cell next to Payment per month , B5 for instance, enter this formula =PMT, press Enter key, the monthly mortgage payments has been displayed. See screenshot:

Tip:

1. In the formula, B2 is the annual interest rate, B4 is the number of payments per year, B5 is the total payments months, B1 is the loan amount, and you can change them as you need.

2. If you want to calculate the total loancost, you can use this formula =B6*B5, B6 is the payment per month, B5 is the total number of payments months, you can change as you need. See screenshot:

Make The Amortization Schedule Fancy

Just for fun and some functionality, I fancied it up a bit by using some IF statements, conditional formatting, and creating a chart that shows the remaining balance over time. Even though these things are mostly for looks, they also improve the functionality of the spreadsheet. I’ll go through each of these one by one.

Recommended Reading: Is Mortgage Interest On A Second Home Deductible

The Down Payment Can Make Your Monthly Payments Higher Or Lower

The higher your down payment the less amount of mortgage youll need. So if you have $100,000 saved earmarked for your down payment but only need a mortgage of $500,000 then you could put the minimum down payment of 5%, or the whole amount.

$500,000 x 0.05 = $25,000

Mortgage needed $500,000 $25,000 = $475,000

Mortgage needed $500,000 $100,000 = $400,000

Not a math whiz? When using a down payment calculator, you can see the increase or decrease in monthly payments automatically.