Mortgage Payment Change Calculator

With our calculator, you can compare two scenarios and consider the impact that different mortgage amounts, terms and interest rates may have on your monthly payments.

You can also compare your current rate with a new interest rate â for example, in the case of a change to the Bank of England base rate.

Also Check: What Are Mortgage Underwriters Looking For

How Can I Improve My Chances Of Getting A Mortgage

If you want to get a mortgage, youll need to prove to lenders that youre a reliable borrower, and that you can afford the repayments.

Here are our top tips for improving your chances of acceptance:

- Be realistic about what you can afford. That five-bed house with the swimming pool may have caught your eye, but you wont enjoy it half so much if youre struggling to meet your mortgage payments. Review your finances, get out a calculator, and decide what you can afford â both now and in the future. Remember to take into account the possibility of rising interest rates.

- Try and improve your . Your score isnt set in stone â it changes with your financial behaviour, so you have the power to influence it. There are several steps you may be able to take to improve your score and boost your chances of getting a mortgage.

- Consider using a Help to Buy scheme. If youre struggling to drum up enough for a decent deposit, you might want to check out the governments Help to Buy schemes.

- Consider using a guarantor. A guarantor mortgage means that someone â usually a parent or older relative â promises to make your repayments if you cant. This reduces risk for the lender, so they may be more likely to approve you. Make sure you understand the risks for you and the guarantor first.

Why Calculate Mortgage Affordability

When youre looking to buy a home, its handy to know how much you can afford. Being able to calculate an estimate of how much youre able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Read Also: How Do You Refinance Your Mortgage

Don’t Miss: What Is The Current Interest Rate For A Reverse Mortgage

How Much Would Payments Be On A 70000 Mortgage

By Eusha

how much would payments be on a 70000 mortgage. Asking for “how much would payments be on a 70000 mortgage? Recent update “how much would payments be on a 70000 mortgage”? Let me know your answer to how much would payments be on a 70000 mortgage. It is for you how to below link.

Table Of Content:

What’s the monthly payment of a $70,000 loan? How much does it cost? What are the interest rates? The calculator can be used to calculate the payment for …

Whats The Fastest Way To Pay Off My Mortgage

The fastest way to hammer down your loan principal is with big lump-sum prepayments.

Barring that, opting for accelerated mortgage payments is the next best thing.

How do lump-sum payments affect my mortgage?

About 900,000 borrowers made a total of $23 billion in lump-sum mortgage prepayments in 2019, according to MPC.

A lump-sum mortgage payment is a one thats applied directly towards your mortgage principal. Depending on your lender, you may be allowed to prepay up to 5%, 10%, 15%, 20%, 25% or 30% of the original principal amount of your mortgage each year.

Even if you pay small amounts, the effect is magnified over time, reducing your interest expense every month until the mortgage is paid off.

Lump-sum prepayments also help increase your home equity faster. If necessary, that allows you to use your equity for further borrowing someday, such as adding a HELOC.

The average lump-sum prepayment in 2019 was $19,100, reports MPC.

Read Also: What Is The Best Mortgage Loan Origination Software

Stamp Duty And Set Up Costs Calculator

The purpose of this calculator is to assist you in estimating the upfront costs associated with your loan. It should be used solely for the purpose of providing you with an indication of the upfront costs you may incur, so you can include an estimate for these amounts into your savings plan. Stamp duty and registration costs have been calculated using the rates from the relevant government authority websites and do not take into account any concessions you may be eligible for or any surcharges or additional and duties that may apply given your individual circumstances. We cannot guarantee that these rates are correct, up to date or are the ones which would apply to you. You should confirm the government costs and duties payable with the relevant government authorities.

We have made a number of assumptions when producing the calculations. Our main assumptions are set out below:

Get Matched With The Right Broker For A 70000 Mortgage

Finding a provider who will not only accept your application, but offer you the best rate and terms for your £70k mortgage is tough to do on your own. Thats why speaking with one of the brokers we work with can save you time and, potentially, some money too.

We offer a free, no-obligation broker matching service which can connect you with the best broker for your needs. Contact us today on 0808 189 2301 or make an enquiry so we can arrange for a broker to speak with you to optimise your chances of securing a £70k mortgage with the lowest rate possible.

Ask Us A Question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

Also Check: What Is The Monthly Payment On A 75000 Mortgage

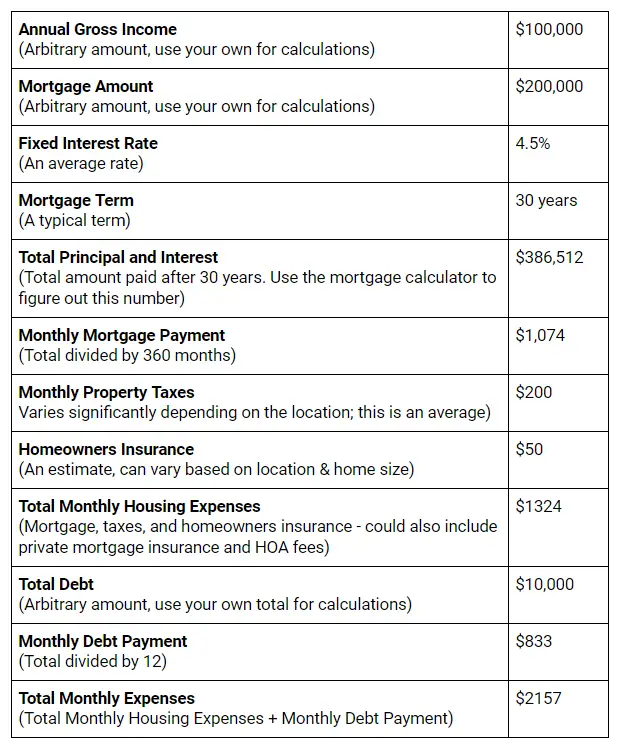

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

How Much Does A 70000 Mortgage Cost Per Month

As a general example, to borrow £70,000 using a standard 25-year repayment mortgage, with a 3% interest rate would be £331 per month. However, it should be noted that the monthly repayments on this level of borrowing are not set. Instead, they can change according to the interest rate and length of the loan term.

Heres why:

- Interest rate The higher the rate set by your provider, the more expensive your mortgage repayments will be.

- Term length The longer the length of your mortgage, the cheaper your monthly repayments will be as youre spreading the cost of your loan. Lengthening your term is one way to make your monthly repayments more affordable. Over the entire term, though, you will end up paying more interest.

Don’t Miss: What Do Mortgage Points Cost

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Read Also: Can You Get A Reverse Mortgage On A Condo

What Is Mortgage Affordability

Mortgage affordability refers to how much youre able to borrow, based on your current income, debt, and living expenses. Its essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term affordability is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but its important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Also Check: What Is Congress Mortgage Stimulus Program

Buy To Let Mortgages:

Some buy to let mortgage lenders have a minimum amount they will lend but you may be able to get a 70000 buy to let mortgage with some specialist buy to let mortgage lenders. A buy to let mortgage broker will be able to assist you in this regard.

You may be eligible for some first time home buyer government schemes which may reduce the total cost of the property or increase your mortgage deposit.

Depending on where you live, you may also be able to take advantage of home buying schemes provided by your local council. Example: In Norwich, the local councils provide the Norwich home options scheme.

The second basis of affordability for a 70000 mortgage will be your salary.

Most mortgage lenders use your annual salary x a multiple to see how much they could lend to you.

If you want a 70000 mortgage you will need your salary when multiplied by a multiple of 3 to be at least 70000.

Most lenders will use multiples of between 3 and 5.

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Don’t Miss: How Much Is The Average American Mortgage Payment

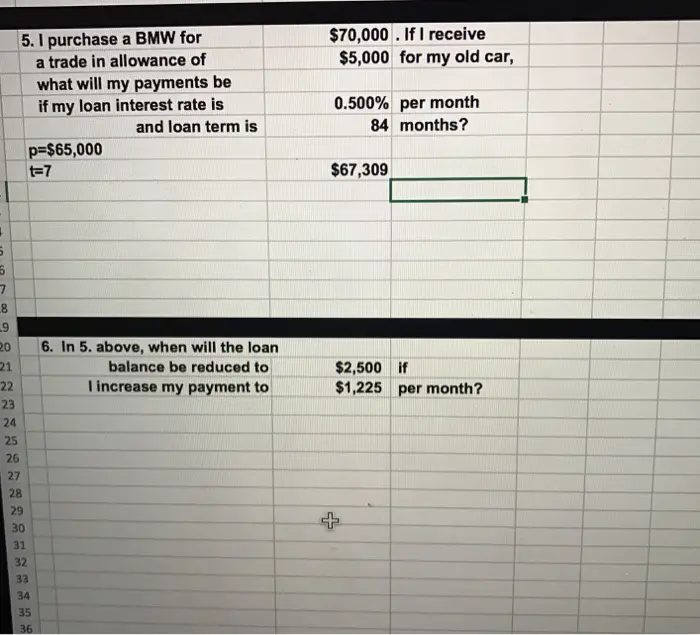

What To Do With Your Trade

Although its convenient to trade in your old vehicle to the dealer at the time of purchasing another, its not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice from the Arizona Attorney General to the FTC. Dont underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, its extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put afor sale sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

You May Like: Is Freedom Mortgage A Bank

How To Calculate Your Mortgage Repayments

Gauging the approximate cost of your monthly repayments using our mortgage calculator is easy. First, simply input in the total amount that you think youll need to borrow and detail how many years you would like the loan over normally for new mortgages for first-time buyers this will be around 25 years, however more lenders are now happy to offer mortgages over periods of up to 40 years.

Next, you need to specify the interest rate in order to calculate your monthly mortgage repayments. If you have no idea of the mortgage interest rate, you can always take a look at our mortgage comparison charts to get an idea of the deals currently available for your needs and circumstances.

Finally, our mortgage repayments calculator will need to know what type of loan repayment you need: capital and interest or interest only. Dont panic if you arent sure. Simply put, capital and interest repayments mean that each month you pay off a proportion of the sum borrowed plus interest, while interest only means that you are just paying off the monthly interest on your loan without ever repaying the sum youve borrowed. To find out more about the different types of mortgage repayment options and those that may be suitable for you check out our handy guide: Repayment and interest-only mortgages explained.

How Much Can I Borrow

This mortgage calculator will give you an estimate of your maximum borrowing capacity. The calculator allows you to add in other financial commitments to test the affordability of any potential borrowing. This calculator uses a range of factors to estimate your mortgage borrowing limit. These figures are not set in stone as all lenders use a range of factors in estimating your borrowing capacity. Our consultants will provide you details and additional information about how borrowing limits vary between lenders. Use our How Much Can I Borrow Calculator

You May Like: How Much Mortgage Can You Get With 100k Salary

How Much Mortgage Can I Afford If I Make 70000

ifearnshouldmortgage

. Consequently, how much mortgage can I get on 70k salary?

For the couple making $80,000 per year, the Rule of 28 limits their monthly mortgage payments to $1,866. Ideally, you have a down payment of at least 10 percent, and up to 20 percent, of your future homes purchase price.

Additionally, how much house can I afford if I make 80000 a year? So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

Likewise, what mortgage can I afford on 60k salary?

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. Thats a $120,000 to $150,000 mortgage at $60,000. You also have to be able to afford the monthly mortgage payments, however.

How much do you need to make to afford a 400k house?

To afford a $400,000 house, for example, you need about $55,600 in cash if you put 10% down. With a 4.25% 30-year mortgage, your monthly income should be at least $8178 and your monthly payments on existing debt should not exceed $981.