Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You have an adjustable-rate mortgage in which your payment stays the same for an initial term and then readjusts annually.

If you have an escrow account to pay for property taxes or homeowners insurance, because those taxes or insurance premiums may increase. Your monthly mortgage payment includes the amount paid into escrow, so the taxes and premiums affect the amount you pay each month.

You may have been assessed fees. Check your mortgage statement or call your lender.

Must reads

How Much Income Do I Need For A 250k Mortgage

You need to make $76,906 a year to afford a 250k mortgage. We base the income you need on a 250k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $6,409.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

How Much Is A $250k Loan

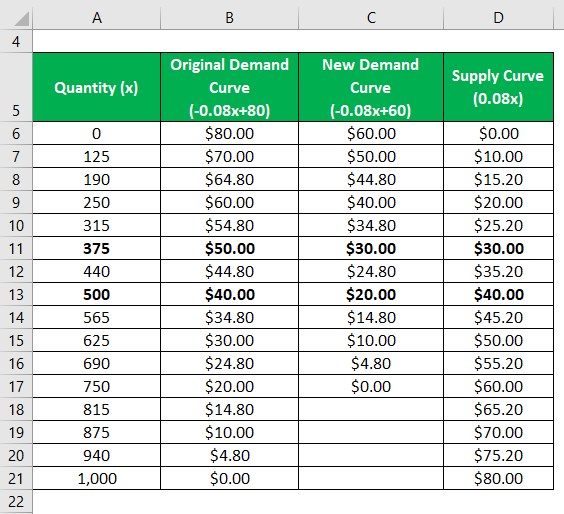

The monthly payments for a $250K loan are $1,474.85 and $280,946.84 in total interest payments on a 30 year term with a 5.85% interest rate. There might be other costs such as taxes and insurance.Following is a table that shows the monthly mortgage payments for $250,000 over 30 years and 15 years with different interest rates.

You May Like: Can I Get A 2nd Mortgage With Bad Credit

How Are Monthly Payments On A$ 250 000 Mortgage Calculated

Amortization means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance. Estimate your monthly loan repayments on a $250,000 mortgage at 4% fixed interest with our amortization schedule over 15 and 30 years. Was this content helpful to you?

Read Also: Recasting Mortgage Chase

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Don’t Miss: Can You Buy A House With A Reverse Mortgage

Total Interest Paid On A $250000 Mortgage

The total amount of interest youll pay on a $250,000 mortgage will vary based on your interest rate and loan term. High interest rates and long terms will result in the most interest over time, while shorter terms and low interest rates will save you on interest.

Example:

However, if you chose a 30-year mortgage at the same rate, your interest costs would jump significantly, and youd pay $179,673 by the end of your loan term.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Don’t Miss: What Is The Rate Of Interest For Mortgage Loan

How Much Is The Monthly Payment For A $250000 Mortgage

The monthly payment is $1,474.85 for a $250,000 mortgage. Above is the repayments on a $250K mortgage with an amortization schedule that shows how much you have to pay each month, and how much interest and principal you are paying.

With the amortization schedule for a $250,000 mortgage, borrowers can easily see that at the beginning of the mortgage loan, the majority of the $1,474.85 monthly payments are for interest payment and little towards paying down the principal.As times go by, the principal and interest payments will get closer for each payment. Eventually, borrowers will be paying more in principal than interest and that’s when they can build equity in their house much quicker.There are other costs in addition to the monthly mortgage payments for your $250K mortgage, such as property tax, home insurance, HOA fees, PMI, utility bills, and home maintenance. First-time home buyers should keep track of these costs as they add up quickly.

Can I Buy A House If I Make 45000 A Year

It’s definitely possible to buy a house on a $50K salary. For many borrowers, low-down-payment loans and down payment assistance programs are putting homeownership within reach. But everyone’s budget is different. Even people who make the same annual salary can have different price ranges when they shop for a new home.

You May Like: How Do I Shop For Mortgage Rates

How To Find An Affordable Home

Would-be buyers in expensive areas may need to think creatively about how to buy a home. For example, if you live in a high-cost area and are planning to buy a home for your family you can try getting an FHA loan or find a seller willing to do a rent to own.

A rent to own is when a tenant rents the house for an extended period of time and then, after all those months are up they can purchase it. Youll still need to make monthly payments on rent as you would owning your own home but how much is different depending on how many years youre renting the property before the home purchase.

Its often less expensive than buying up front, or you can also find a seller willing to give a private mortgage. Or you may have to look for a smaller home in a more affordable area or a condo.

What To Consider Before Applying For A $250000 Mortgage

Before taking out a $250,000 mortgage, youll want to be well aware of the costs it will come with. These costs include interest, your down payment, and sometimes insurance and other fees.

There are also closing costs which typically clock in somewhere between 2% and 5% of the total loan amount.

You May Like: 10 Year Treasury Vs Mortgage Rates

Also Check: What Is A Single Purpose Reverse Mortgage

How Much Can I Borrow

Lenders have altered their mortgage application process due to the new rules surrounding the mortgage lending market. Lenders main focus is now on the affordability of the mortgage, and they will often request the following in support of an application:

- Details of your employment

- Your monthly outgoings

If you need a £250,000 mortgage, find our mortgage table above that shows the best mortgage deals available.

Where To Get A $250000 Mortgage

If you qualify, you can get a $250,000 mortgage from any mortgage lender, bank, or credit union. Rates and terms vary by company, though, so youll need to shop around to get the best deal.

Traditionally, this would mean reaching out to each lender individually to get a quote, which can be time-consuming and tedious.

With Credible, shopping around for your loan is much more streamlined. It only takes a few minutes to get pre-approved, and you can get quotes from several mortgage lenders at once.

Once youve compared your quotes, you can decide which lender to proceed with. Youll then need to complete their full application and provide the required financial documentation.

Dont Miss: Chase Recast Calculator

You May Like: How To Shop For Mortgage Refinance

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Do Your Own Research For A $250k Mortgage

Our final piece of advice is simple: do your own research. Were confident that weve put together a solid guide here for a 250k mortgage, but its not the be-all and end-all. We dont tackle your specific financial or personal situation , nor can we provide advice for every single location on the planet. And ultimately, a lot of what weve said is subjective and a matter of opinion.

We recommend taking the resources and advice weve pointed you to and then doing some more leg work. That final call to buy a home is ultimately yours to make.

Today’s Mortgage Rates – Updated Daily

- Credible: Credible makes getting a mortgage easy. It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter through this link.

Recommended Reading: What Is The Best Mortgage Loan Company

Costs Included In Your Monthly Mortgage Payment

Here are two formulas to visualize the costs that are included in your monthly mortgage payment:

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also homeowners insurance, property taxes, and, in some cases, private mortgage insurance and homeowners association fees. Heres a breakdown of these costs.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How High Credit Score For Mortgage

How Long Do You Want The Mortgage Term To Be

Most mortgages are fully repaid over 25 years, but you can opt for a longer or a shorter mortgage term. Your mortgage term could be as long as 35 years, or as short as five years .

Longer mortgage terms generally mean lower monthly repayments, as you have longer to pay off the loan. Against that, the total amount you repay will be greater for the same reason.

Heres an example:

A £250,000 25-year mortgage with a 2 per cent fixed-rate deal would mean an initial monthly payment of £1,060. However, the same mortgage on a 15-year term would mean an initial monthly payment of £1,609.

However, assuming you could keep 2 per cent interest , with the 25-year mortgage you would repay £318,000 in total but with the 15-year mortgage you would repay only £289,620 in total.

Read Also: How To Find Total Interest Paid On A Mortgage

What Is The Total Interest On A 250000 Mortgage

On a 30-year mortgage with a 4% fixed interest rate, youll pay £179,673.77 in interest over the life of your loan. Thats about two-thirds of what you borrowed in interest.

If you instead opt for a 15-year mortgage, youll pay £82,859.57 in interest over the life of your loan or about 46% of the interest youd pay on a 30-year mortgage.

-

See how much youâd pay in total interest based on the interest rate.

Interest

You May Like: How Much Do I Have Left On My Mortgage Calculator

You May Like: Who Should I Get Mortgage Pre Approval From

How Is The Monthly Payment Calculated For A 350k Mortgage

This calculates the monthly payment of a $350k mortgage based on the amount of the loan, interest rate, and the loan length. It assumes a fixed rate mortgage, rather than variable, balloon, or ARM. Subtract your down payment to find the loan amount. Many lenders estimate the most expensive home that a person can afford as 28% of ones income.

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnât pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnât mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youâll have on-hand after you make the down payment. Itâs best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youâre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youâll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youâre comfortable withâjust because a bank pre-approves you for a mortgage doesnât mean you should maximize your borrowing power.

Don’t Miss: What Is A Modified Mortgage

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youâll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

You May Like: Can Reverse Mortgage Interest Be Deducted

If You Have A Low Credit Score How To Improve

First of all, start by checking for errors on your credit report before applying for loans or mortgages. You can get one free copy from each of the three bureaus once every 12 months so you can face any looming obstacles head on.

But there are also steps you can take to establish credit history and improve your credit score, like how long it takes for lenders to report payment or how much of their balance is available on short-term loans. You may want to review the list of common myths about mortgages, too.

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgageâstated another way, itâs the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youâll pay each monthâthe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youâll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still donât know which term to choose, itâs also worth considering whether youâd be able to break evenâor, perhaps, saveâon the interest by choosing a lower monthly payment and investing the difference.

Also Check: How To Apply For A Home Mortgage

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.