When Discount Points Are Worth It

Katherine Alves, executive vice president of Homeowners First Mortgage, says you want to ensure that purchasing discount points will result in a financial advantage.

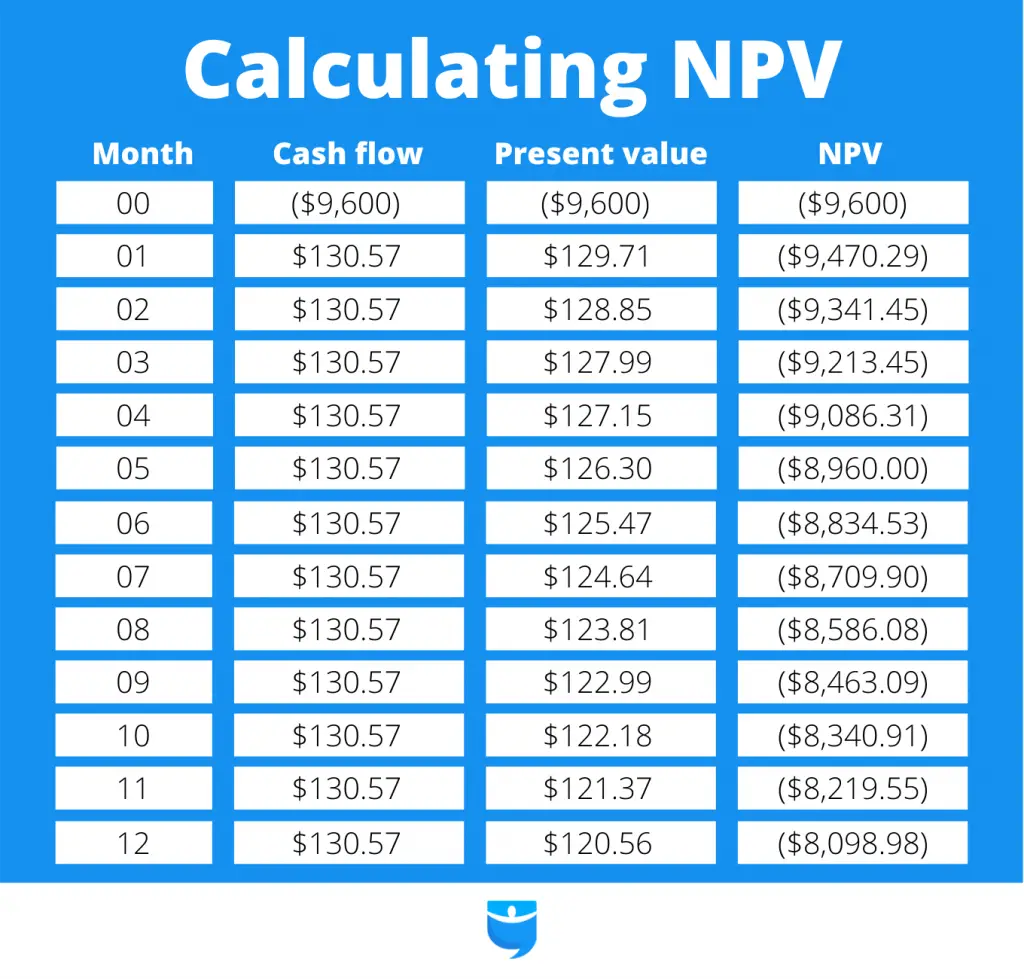

To do so, you need to calculate the cost versus savings over time. This is done by comparing rates with no points to a loan with points and reviewing the overall annual savings in the monthly payment, recommends Alves.

Then, you need to decide if you are going to remain in your home or the current mortgage loan long enough to recoup the costs of your discount points, she explains. This is known as the break-even point.

Take a look at an example.

Assume a borrower named Steve purchases a home and takes out a 30-year mortgage for $400,000. Hes offered a 3.25% fixed interest rate.

- If Steve purchased one discount point a $4,000 upfront cost he would save about $108 on each monthly payment

- It would take Steve 37 months to reach his breakeven point and recoup the $4,000 he paid upfront

If Steve held onto the loan over its full 30-year term, he would save around $35,000 overall in interest by purchasing that single discount point, Killinger says.

Here, the assumption is that Steve will stay put in his home and not refinance or sell until more than three years have passed. In this case, paying for a discount would be well worth it.

How A Good Credit Score Can Lower Your Interest Rate

Buying mortgage loan points isn’t the only way to get a low interest rate. Your credit will have a direct impact on the rate you’ll get. In theory, the higher your credit scores, the less likely you’ll default. So, low scores can affect your ability to get a loan, or the lender might decide to charge you a higher interest rate. If your aren’t good, it might make sense to pay points for a lower rate after considering all other factors. Or you could take steps to improve your credit before applying for a mortgage loan.

What Are Mortgage Points And How Do They Work

Mortgage points are the fees a borrower pays a mortgage lender in order to trim the interest rate on the loan. This is sometimes called buying down the rate. Each point the borrower buys costs 1 percent of the mortgage amount. So, one point on a $300,000 mortgage would cost $3,000.

Each point typically lowers the rate by 0.25 percent, so one point would lower a mortgage rate of 4 percent to 3.75 percent for the life of the loan. How much each point lowers the rate varies among lenders, however. The rate-reducing power of mortgage points also depends on the type of mortgage loan and the overall interest rate environment.

Borrowers can buy more than one point, and even fractions of a point. A half-point on a $300,000 mortgage, for example, would cost $1,500 and lower the mortgage rate by about 0.125 percent.

The points are paid at closing and listed on the loan estimate document, which borrowers receive after they apply for a mortgage, and the closing disclosure, which borrowers receive before the closing of the loan.

Don’t Miss: When Can Pmi Be Removed From Mortgage

Mortgage Points: What Are They

Mortgage points are a one-time cost paid to the lender in exchange for a lower interest rate on a home loan. Because the homebuyer is required to pay more money upfront, points raise the closing expenses. At the same time, however, they lower the monthly mortgage payment and lower the total amount of interest paid throughout the loans term.

Why It’s A Better Time Than Ever To Buy Mortgage Points

by Christy Bieber |Updated July 19, 2021 – First published on Sept. 3, 2020

Image source: Getty Images

Considering buying mortgage points? Here’s why it could be a smart financial move right now.

One of the biggest decisions you’ll make when applying for a mortgage is whether to buy points. Mortgage points, or “discount points,” are fees you pay to lower the interest rate on your loan. They’re considered a type of prepaid interest and can be tax deductible if you itemize.

Each mortgage point costs 1% of the value of your home loan, and reduces your interest rate by 0.25%. That means if you’re borrowing $300,000 at a rate of 3.00%, you could buy a point for $3,000 and reduce your rate to 2.75%.

As you can see, mortgage points are a big up-front expense, but now may be a better time than ever to buy them. Here’s why.

Recommended Reading: What Is A Reverse Mortgage Canada

Should You Buy Points

If you can afford them, then the decision whether to pay points comes down to whether you will keep the mortgage past the “break-even point.”

The concept of the break-even point is simple: When the accumulated monthly savings equal the upfront fee, you’ve hit the break-even point. After that, you come out ahead. But if you sell the home or refinance the mortgage before hitting break-even, you lose money on the discount points you paid.

The break-even point varies, depending on loan size, interest rate and term. It’s usually more than just a few years. Once you guess how long you’ll live in the home, you can calculate when youll break even.

» MORE:‘Should I buy points?’ calculator

How Much Money Can You Save Buying Mortgage Points

Whether or not you save money by buying down your interest rate depends on your break-even point. This is the number of years, months, or mortgage payments it will take before buying mortgage points is worth it.

For example, if you pay several thousand dollars to buy down your rate, but you sell or refinance your home before your specific break-even point, then you will see no savings from a lower rate.

Suppose it costs two points to reduce the interest rate on a $400,000 fixed-rate loan with a 30-year term from 4.5% to 4.0%. Your monthly mortgage payment for principal and interest would drop by $117 with the lower rate .

- After five years at 4.0%, youll have paid $76,370 in interest payments, plus $8,000 in mortgage points, for a total of $84,370. Youll have reduced your principal balance by $38,210

- With the 4.5% loan, youll have paid $86,236 in interest. Youll have reduced your principal balance by just $35,368

In this case, then, it will cost you $1,888 less over five years if you pay the discount points. But thats not all. Youll have reduced your balance by an extra $2,842. So your total savings in five years is $4,730. Moreover, buying points will have saved you $10,000 in interest payments.

You can figure out your potential savings and break-even point by using a mortgage calculator.

Recommended Reading: Can You Have A Second Mortgage With A Va Loan

Is It Better To Pay Points Or Increase Your Down Payment

Buying discount points and putting down a larger down payment can both lower your monthly mortgage payments. The benefit to paying more towards a down payment is that your money goes toward the principal, increasing your equity in the home and decreasing the amount you are borrowing. When buying mortgage discount points, your money is going toward the interest, which means youll own less of the home and be borrowing more.

The reason why some people choose to buy discount points vs putting down a larger down payment is because the upfront cost is usually less. You typically need to put down at least 10% before you start to notice a big difference in your monthly savings. A 20% down payment will allow you to remove the additional cost of mortgage insurance which can help you save even more over your loan term. Talk to a mortgage expert to calculate the best option for you based on your loan details, available cash, monthly budget and how long you plan to stay in the home.

So What’s The Catch For The Free Version

You may be saying, “Wait a minute, if I can get all of those apps for free, why pay for Microsoft 365 in the first place?” Well, the functionality of the free apps is limited: They only run in your web browser and you can only use them while you’re actively connected to the internet. They also have fewer features than the full Microsoft 365 versions.

There are still a number of benefits, however, including the ability to share links to your work and collaborate in real time, similar to what G Suite tools allow. If you’re looking for basic versions of each of these apps, the free version should work well for you.

You May Like: How To Sell A Mobile Home With A Mortgage

Make Sure To Comparison Shop Carefully Among Lenders

Knowing exactly what are mortgage points means you can decide whether it makes sense to buy points. You can also make certain you’re comparing apples-to-apples when you take out a mortgage loan.

When you shop around the best mortgage lenders, let’s say one lender offers you a loan at 3.00% with no points and the other offers you a 3.00% loan but charges you one point to get that rate. Obviously the first loan is a much better deal. With the second lender, you’d be paying 1% of the entire cost of your mortgage just to get the same rate the first lender is giving you for free.

Do The Math On Buying Mortgage Points

Whether you consider buying mortgage points to reduce your rate or applying negative points to get cash up front, make sure to do the math to understand the long-term impact your choice will have on your mortgage costs.

Your mortgage is probably going to be your largest debt with the biggest monthly payment, so you owe it to yourself to get the best deal possible.

Don’t Miss: How Do Commercial Mortgages Work

Despite Headwinds Creative Buyers And Sellers May Find Opportunities This Year

So how is someone who hopes to buy a house expected to navigate 2023? Will conditions improve or are consumers better off continuing to rent?

No one has a crystal ball but real estate professionals spend a lot of time studying market trends and looking at history. If anyone has insight into that question they probably do.

Shmuel Shayowitz, president and chief lending officer at Approved Funding, thinks anyone contemplating a home purchase this year needs to access personalized guidance and advice.

There is no question that the housing market is transitioning away from a seller’s market, but it is not the housing market crash that the media has many believing it is, Shayowitz told ConsumerAffairs. Some areas are still seeing strong home prices with limited inventory causing unique market conditions that differ from the national headline stats.

In that case, home prices may stay elevated, or even go up slightly, providing no increase in affordability.

What Are Points And Lender Credits And How Do They Work

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years. Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount, whether or not you receive a lower interest rate. Some lenders may also offer lender credits that are unconnected to the interest rate you pay for example, as a temporary offer, or to compensate for a problem.

The information below refers to points and lender credits that are connected to your interest rate. If youre considering paying points or receiving lender credits, always ask lenders to clarify what the impact on your interest rate will be.

Points

Points let you make a tradeoff between your upfront costs and your monthly payment. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

Lender credits

See an example

When comparing offers from different lenders, ask for the same amount of points or credits from each lender.

Don’t Miss: How To Find A Good Mortgage

Mortgage Discount Points Faq

Is purchasing points on an adjustable-rate mortgage a good idea?

Paying for mortgage discount points on an adjustable-rate mortgage only provides a discount during the ARMs initial fixed-rate period. With a 0.25 percent discount rate, it generally takes around 4-6 years of homeownership to break even with these loan terms. Therefore, your opening fixed-rate period should be longer than 4-6 years to see real savings.

Are mortgage origination points the same as mortgage discount points?

Discount points and origination points are different. Origination points refer to the origination fees a borrower pays to their mortgage lender for processing and underwriting a home loan. Discount points are upfront fees home buyers pay at closing to reduce their mortgage interest rate.

How much does a mortgage point cost?

One point typically costs 1 percent of your loan amount, or $1,000 for every $100,000 borrowed. As an example, if your mortgage loan is $400,000, then one discount point would be $4,000. Additionally, many mortgage lenders will allow home buyers to purchase fractional points. On a $4000,000 home loan, a half point would cost $2,000.

How Mortgage Discount Points Help You Save Money

Buying mortgage discount points increases your upfront costs in exchange for a discounted interest rate for the full term of your loan. When your savings from points cover the cost of the points, you break even, and from that date youll start saving money on interest payments. So to make mortgage points worth it, you need to keep your mortgage long enough to break even.

Also Check: Should I Have A Mortgage

How Buying Down Interest Rates Works

Buying down your mortgage interest rate involves purchasing discount points . Youll pay an upfront fee to the lender at closing in exchange for a lower rate over the life of the loan. Most types of mortgage loans allow buyers to purchase discount points, including conventional, FHA, VA, and USDA loans.

The rate reduction per point depends on the lender and the type of loan. However, as a rule of thumb, a mortgage point costs 1% of your loan amount and lowers your rate by about 0.25%.

Lets look at an example, using a $400,000 mortgage amount:

- Original quote: $400,000 mortgage at 6.25%

- One discount point costs $4,000

- One point lowers the rate by 0.25%

- Over 30 years at 6.25%, youd pay $486,600 in total interest

- Over 30 years at 6%, youd pay only $463,300 in total interest

- Extra upfront cost of buying points: $4,000

- Savings from buying points: $23,300

The actual savings and interest rate reduction will vary depending on your loan and lender. Ask your loan officer to show you a few different quotes, with and without points, so you can understand how the potential cost and savings stack up.

How Much Will You Save When Buying Mortgage Points

Depending on your circumstance, buying mortgage points can save you significant money over the course of your loan. Heres an example:

Number of months to reach your break-even point

Payments beyond your break-even point are where you really start saving. For example, if it takes 68 months to hit your break-even point, you would have a little more than 24 years left on a 30-year mortgage.

Don’t Miss: How To Pay Mortgage Online

Mortgage Discount Points Vs Apr

Buying discount points on your mortgage is effectively a way of prepaying some of your interest, and looking at the annual percentage rate can help you compare loans with different rate and point combinations. The APR incorporates not just the interest rate, but also the points you pay and any fees the lender will charge. Check out a quick explanation from Greg McBride, CFA, Bankrate chief financial analyst:

Which Is Better Banks Vs Online Mortgage Lenders

Negative mortgage points, also known as lender credits, are the reversal of points, where you minimize your closing costs by increasing your loans interest rate. Using the previous example, if you obtain a $4,000 lender credit or a negative 1 point on a $400,000 mortgage, youll get 1% of the loan amount to assist cover closing expenses.

In comparison to a loan with no lender credits, youll also be charged a greater interest rate. This implies youll pay more interest overall and a greater monthly mortgage payment.

Also Check: How Many Rental Property Mortgages Can I Have

When Discount Points Are Not Worth It

Now, take the same scenario as above. But imagine Steve decides he needs to sell that home two years after buying a $4,000 discount point.

After 24 months of being in that loan, Steve would have recouped less than $2,600 of his initial $4,000 investment. With such short-term plans for his property, Steve is better off not increasing the costs of his loan with discount points and is better suited to take the higher original interest rate, says Killinger.

Bardos reminds us that one of the most important considerations for choosing a loan with points is the length of time you plan to remain in the home until refinancing or selling.

The longer the horizon, the more advantageous it is to prepay interest through points, Bardos says.

Consider, as well, that the cash required for points could often be better spent on paying off high-interest credit card or student loan debt, building an emergency fund, or investing in stocks, bonds, or other investment vehicles that can yield a higher rate of return.

This is especially true in our current low interest rate environment, when rates even without points are at historically low levels, Bardos says.