Home Loan Eligibility Criteria

Home loan eligibility is dependent on many factors such as your salary, current age, credit score, location, total work experience and other monthly financial obligations. Bajaj Finserv brings easy-to-meet eligibility criteria, making the Home Loan more accessible. Below is a chart with details.

|

Eligibility criteria for home loan |

|

|

Age limit of salaried individuals |

23 to 62 |

|

Nationality |

Indian, residing within the country |

Strong applicants can avail Rs. 5 Crore, or higher, based on their eligibility, as a home loan. Know the complete Housing Loan eligibility criteria and documents required for home loan before applying.

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums. In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Know How Much House You Can Afford

Another first-time buying tip is knowing how much house you can afford. While choosing the largest house on the block may be tempting, its important to live within your means by purchasing a house within your budget. To determine your house budget, review your finances, such as your income, down payment, savings, credit score, and debt. From there, you can estimate your monthly expenses to determine reasonable mortgage payments for your financial situation.

Also Check: Can You Write Off Points On A Mortgage

Tips For Buying A Home

In order to help ensure that you can afford your home and maintain it over time, there are some smart measures you can take. First, save up a cash reserve in excess of your down payment and keep it in reserve in case you lose your job or are unable to earn income. Having several months of mortgage payments in emergency savings lets you keep the house while looking for new work.

You should also look for ways to save on your mortgage payments. While a 15-year mortgage will cost you less over the loan’s life, a 30-year mortgage will feature lower monthly payments, which may make it easier to afford month-to-month. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

Finally, don’t buy a bigger house than you can afford. Do you really need that extra room or finished basement? Does it need to be in this particular neighborhood? If you are willing to compromise a bit on things like this, you can often score lower home prices.

Whats Your Interest Rate

Next, your lender will figure out what sort of interest rate you can qualify for, because thatâs one of the most important factors affecting your monthly payment amount.

Your interest rate is determined by a few things, chiefly your credit score. If you have good credit, youâll generally qualify for the lowest interest rates, and that means a bigger potential loan. Some types of mortgages are cheaper than others, too.

In December 2021, the average 30-year U.S. Department of Veterans Affairs loan carried an interest rate of 2.99%, according to mortgage application processing software company Ellie Mae. The average 30-year Federal Housing Administration loan, by contrast, was much more expensive, with an average interest rate of 3.39%.

Read Also: Can You Refinance Mortgage And Add Credit Card Debt

% Down Is Great But Not A Requirement

Theres a general perception that you have to put 20% down to get a mortgage. Thats just not true. There are many mortgage options with low or no down payment requirements.

Depending on the type of loan you choose and the amount of your down payment, you may be required to pay private mortgage insurance . PMI protects the lender against any loss if you fail to pay your mortgage. In some instances, mortgage insurance is required for the life of the loan. Other times, its only required until the loan is paid down to a certain percentage of the original amount. Mortgage insurance is known for its bad rap, but its not always the enemy. The benefit to you is that it allows you put less than 20% down.

Consider your options. Gifts or loans from relatives and programs like an 80/10/10 combination loan can help you avoid PMI. 80/10/10 loans consist of a first mortgage and a second mortgage that total 90% of the purchase price, and a 10% down payment. These loans allow you to put just 10% down while helping you avoid the mortgage insurance payments typically associated with conventional loans with down payments of less than 20%. Our down payment calculator can help you to understand the costs and benefits of different down payment amounts so you can decide what makes the most sense for you.

The Annual Salary Rule

The ideal mortgage size should be no more than three times your annual salary, says Reyes.

So if you make $60,000 per year, you should think twice before taking out a mortgage that’s more than $180,000. However, if you have a partner, and your combined income is $120,000, you can comfortably increase your loan amount to $360,000.

That’s not to say you should always opt for the most expensive mortgage you can qualify for. If you settle on something below your max, you’ll have more wiggle room to put money into a savings account or pay for other costs like home renovations.

Recommended Reading: What Does Taking Out A Second Mortgage Mean

Personal Criteria: Deciding How Much Mortgage You Can Afford

The borrower should consider personal criteria when purchasing a home in addition to the criteria of the bank when determining what kind of mortgage can be afforded. Although someone may be approved for a certain mortgage amount, that certainly does not mean the payments can be covered. The following is personal criteria to take into account along with the criteria of the lenders:

- The ability for the borrower to pay mortgage payments is dependent upon income. Questions to consider are whether or not two incomes are needed to pay bills, how stable the current job is, and how easy it would be to find another job if the current job is lost.

- The borrower must ask if they are willing to make changes in lifestyle in order to afford the home. If tightening the budget will not impact lifestyle, then having a higher back-end ratio might be the way to go. If there are little things within the budget that are too important to eliminate, it might be better to take a more conservative approach.

- The back-end ration contains most of the current debts, but there may be debts that come about in the future that are not considered in the back-end ration. Doing things such as buying a new car or boat, or a child who will attend college are things to consider.

- Then there is the borrowers personality. Some people are more comfortable making a specific payment amount than others.

Why Should You Get Pre

There are many reasons why you should get pre-approved. The most important reason is that you will get an accurate idea of how much home you can afford. This can help to target your home search and ensure you only look at houses that are truly in your price range. A pre-approval letter also helps you prove to real estate agents and sellers that youre a credible buyer and able to act fast when you find the home you want to buy. Some sellers might even require buyers to submit a pre-approval letter with their offers, though having a pre-approval letter does not guarantee that your offer will be accepted by a seller. A pre-approval letter can make you stand out in a competitive real estate market. If you make an offer on a house without a pre-approval, your offer may not be taken as seriously as an offer from another person with a pre-approval.

You May Like: What’s The Monthly Mortgage Payment

When Do Consumers Choose An Arm

Adjustable-rate mortgages , on the other hand, have interest rates that change depending on market conditions. ARMs usually start with a low introductory rate or teaser period, after which the rate changes annually for the remaining term.

ARMs come in 30-year terms that can be taken as a straight adjustable-rate mortgage with rates that change annually right after the first year. However, borrowers usually take them as a hybrid ARM, which come in 3/1, 5/1, 7/1, and 10/1 terms. For example, if you get a 5/1 ARM, your rate remains fixed for the first 5 years of the loan. After the 5-year introductory period, your rate adjusts every year for the rest of the payment term.

When does taking an ARM make sense? ARMs are usually chosen by consumers who plan to sell their house in a few years or refinance their loan. If you need to move every couple of years because of your career, this type of loan might work for you. ARMs usually have a low introductory rate which allows you to make affordable monthly payments, at least during the teaser period. Before this period ends, you can sell your home, allowing you to avoid higher monthly payments once market rates start to increase.

There Are A Number Of Factors To Consider

A Tea Reader: Living Life One Cup at a Time

Purchasing real estate with a mortgage is often the most extensive personal investment most people make. How much you can afford to borrow depends on several factors, not just what a bank is willing to lend you. You need to evaluate not only your finances but also your preferences and priorities.

Here is everything you need to consider to determine how much you can afford.

Also Check: How Much Can I Loan For Mortgage

Determine Your Down Payment

It helps to know how much you can provide as down payment before you start looking for a home. The size of your down payment may have an impact on the amount you get pre-approved for. Plus, down payments of less than 20% of the purchase price of a home require mortgage default insurance, whereas down payments that are 20% or above may not.

How Much Do I Need To Make For A $750000 House

A $750,000 house, with a 5% interest rate for 30 years and $35,000 down will require an annual income of $183,694.

We’re not including additional liabilities in estimating the income you need for a $750,000 home. Use our required income calculator above to personalize your unique financial situation.

Recommended Reading: What Does Credit Approved Mean For A Mortgage

Negotiate With The Seller

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs.

This can make all the difference when you want to buy a new home and stop renting.Seller contributions can cover closing costs, buy your interest rate down to a more affordable level, or make a onetime payment to cover your mortgage insurance.

How Is Prequalification Determined

Looking at income is just one of the components that is used to determine your buying power. Your monthly debt gets used as true measure against your monthly gross income when it comes to financial institutions. Most lenders feel comfortable with applicants who have less than a 36% debt-to-income ratio or a DTI. PropertyNests Prequalification Mortgage calculator also factors in the DTI to approximate your buying power.

Also Check: How Do You Remove Pmi From Your Mortgage

Mortgage Approval With Fha

FHAs guidelines are much less restrictive. They allow loan approval with a FICO score as low as 580 and just 3.5 percent down, and a score down to 500 with 10 percent down.

However, there is a difference between allowing a low credit score and actual bad credit. If your score is low because you have little credit history, too many accounts, or bad history thats at least a year old, FHA may give you a shot. But if youre missing payments all the time or have a ton of collections, youre too risky. You have to prove that you can manage debt, and that means paying your bills on time for at least 12 months.

Here is the breakdown of FICO scores for approved FHA borrowers from Ellie Mae:

You can see that the program is much more forgiving, with the majority of approvals going to applicants with FICO scores of 600 or better.

Is It Free Or Do I Have To Pay An Application Fee

This will depend on the lender. Sometimes, they will waive the application fee as an enticement to bring in more borrowers . In other cases the application fee will be rolled into your closing costs, which you must pay when you close on the loan. You should ask about this before you submit your application.

If there is a fee, find out if its refundable. Some mortgage lenders will charge a non-refundable fee for their pre-approval services. They collect this fee when you submit your application paperwork. On average, application fees cost between $300 and $400. Non-refundable means you dont get the money back, if you end up walking away. Other lenders offer free mortgage pre-approval in order to gain your trust .

Related articles:

Read Also: What Will My Mortgage Cost

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

Tips For Buying Your First Home In 2022

One of the most significant purchases you will make in your lifetime is a home. In todays competitive market, home prices are on the rise as inflation starts to creep up and more and more people are looking to switch from renting to buying. As a first-time buyer in 2022, you might not know what goes into buying your first home. In this article, well provide our top tips for first-time buyers, such as how to save, find the best mortgage rates, and pick the right realtor.

Also Check: What Is A Bad Mortgage Rate

Who Is This Calculator For

The Maximum Mortgage Calculator is most useful if you:

- Want to know exactly how much you can safely borrow from your mortgage lender

- Are assessing your financial stability ahead of purchasing a property

- Would like to compare the impact of different interest rates on the amount you can feasibly borrow.

Why Should You Get A Pre

A mortgage pre-approval is not compulsory. However, getting pre-approved makes the home-buying process more efficient and provides an opportunity for you to compare loan options and solidify your budget.

It is important to be clear on your budget and the monthly repayments you can comfortably afford. This saves you time as you can eliminate homes that are out of your budget. It also prevents you from committing to a home that will stress your finances for years to come.

On top of this, pre-approval shows sellers and real estate agents that you are a serious buyer and can afford a home. Sellers want to know that a buyer can follow through with the financing. So being pre-approved gives you a much higher chance of having your offer accepted and securing your dream home.

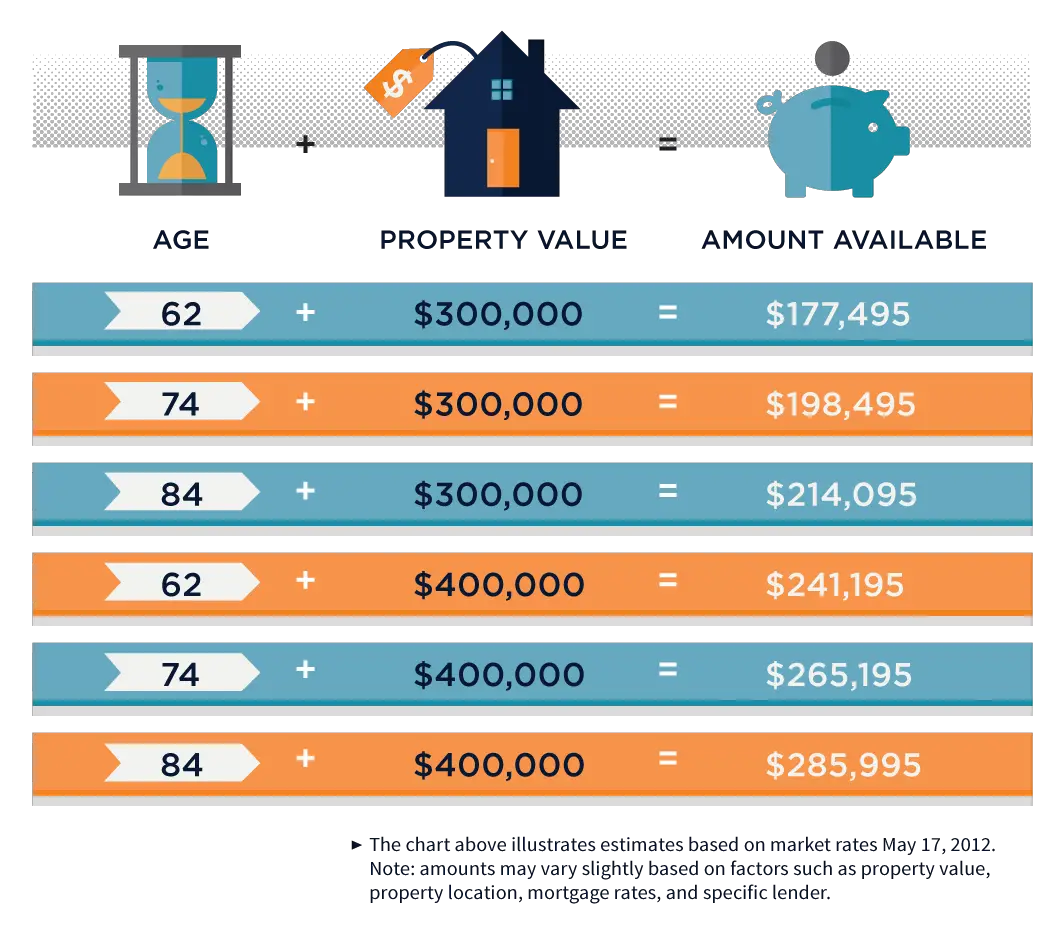

You May Like: Can You Do A Reverse Mortgage On A Condo

Also Check: What Do They Look At For Mortgage Approval

How Much Income Do I Need To Buy A $400k Home

This answer isnt just about your income. Your interest rate and your plans for a down payment play an important role. For example, if youre planning to secure an FHA loan and put down 3.5 percent on a $400,000 home, youll need to earn just over $102,000 per year for a 30-year mortgage with a 5 percent interest rate.

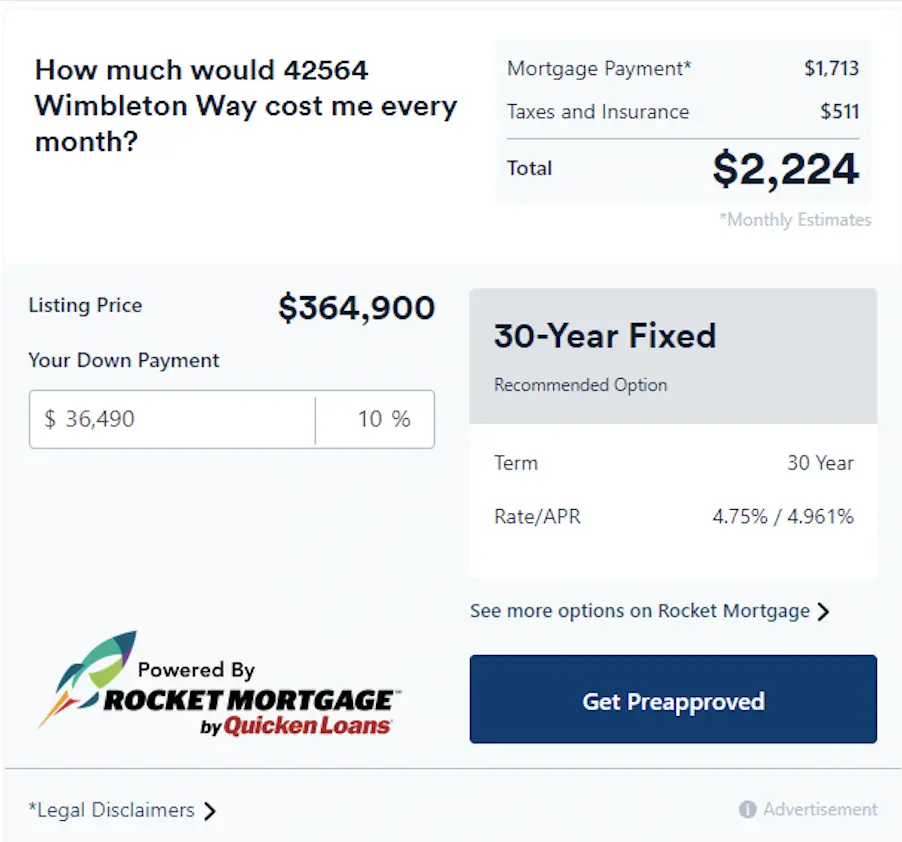

If youre sitting on the money you need for a 20 percent down payment, your income needs look a lot different. For example, if you can put down $80,000 and lock in a 4.75 percent interest rate on a 30-year mortgage, you only need to earn $78,000 per year.