Why Transfer Your Mortgage To Another Person

Transferring mortgages between individuals can be complicated, and is not something you see often in the UK. However, if youre considering adding or removing individuals on your mortgage, this is something that can be looked at.

There are many reasons for doing this. For example, you may want to:

- Change from a single to joint mortgage

- Move from a joint to single mortgage

- Remove a borrower

These things should not increase the borrowed amount, but be aware that you may have to pay a fee for the transfer.

Can You Transfer A Mortgage To Another Person

- You might be able to get a mortgage transfer depending on your circumstance and mortgage type.

- The due-on-sale clause lets you transfer a mortgage in specific circumstances.

- If you dont have an assumable mortgage, refinancing may be a possible option to pursue.

- Read about the different types of mortgages on Insider.

Unplanned circumstances happen in life. If youre going through a divorce or unexpected illness, you might not want to continue paying for a mortgage if it isnt reasonable for your situation.

Some lenders permit a mortgage transfer if you have an assumable mortgage, and if your situation falls into one of the exceptions listed in the due-sale clause.

Heres what youll need to check to see if your mortgage is transferable, and what to do if you cant.

Recommended Reading: Typical Student Loan Debt

How To Transfer Mortgage To Another Bank

- Visit to the banks website.

- Need to check all the terms and conditions with the rate of interest and processing fee.

- If you are agreed with the schemes, you need to apply for balance transfer.

- You would need to fill in your required fields involving your name, type of property, tenure of the current loan, and the name of the bank.

- After completion, you can see your loan offer.

- Make payment of all the necessary charges and need to upload your all-required documents.

- You need to complete your application and wait for the approval.

Read Also: When Do You Apply For A Mortgage Loan

How To Transfer Personal Loan

The process to shift to a new Bank takes 5-7 days and its easy if your track on the Personal loan is good and you have a good credit history.

So if you have the option- and even if the process takes 1-2 days of your work we recommend that this should be done as it will save you a lot and at least more than the 2 days of work.

- Every consumer after 2-3 years should review rates and shift to a better lender if required.

- A consumer should also approach his own Bank if he feels the rates are higher as sometime the existing Bank on a fear of loosing good customer matches the new Bank rates with nominal one time fee.

How To Change Mortgage Loan Servicers

Now for the direct answer. The only way to change mortgage servicers is to refinance your loan and move to a lender that services the loans they originate. Keep in mind, just because a company services a loan today doesnt mean theyll continue to do so long term. The industry is always changing.

Dont put yourself through a mortgage refinance if your only reason is to change mortgage servicers. Make sure there are other refinance benefits you can take advantage of, like: a lower interest rate, shorter loan term, access to cash, debt consolidation, or dropping private mortgage insurance .

Tip: If refinancing makes sense for your financial situation, know that you can work with the loan officer who originated your loan. Its your choice when you refinance your mortgage.

Don’t Miss: How To Get A Higher Mortgage With Low Income

How Much Does It Cost To Switch Mortgage Providers

Depending on when you want to switch your mortgage the cost could be quite low. In some cases, lenders will cover some of those costs.

If you switch your mortgage at the end of the term, your current mortgage holder will not charge a penalty but could charge a mortgage transfer fee ranging from $200 to $500 depending on the province you life in.

The legal fees to switch your mortgage are typically covered by the lender you are moving to. There is some admin required to change the mortgage registered on the title to your home, but they don’t discharge the current mortgage. They will leave the current mortgage in place and make sure it points to them instead of the past mortgage lender.

To switch your mortgage with no penalty, you must wait until the end of the term. If you switch your mortgage lender before the end of the term, then there is a penalty. I went through some example calculations in the previous section.

You may feel that it is better to switch during the middle of your term. I like to use this calculator to determine if it’s worth it. I explain how to use this calculator in detail in this article called, “Is it worth it to refinance my mortgage?” please go here is you have any questions.

When switching mortgage lenders at renewal, you might not have a penalty but there may be a couple of costs. You can include these costs when you use this calculator.

Switching lenders mid term will cost more because of the mortgage penalty.

How Transferring Your Equity To Others Works

When looking to transfer your mortgage, whether adding or removing someone, it is best to speak to your lender as the process may vary.

The process is often called Transfer of Equity, but may have various names, and will keep your house ownership the same, but will change the details of the borrowers on the property ownership. The Transfer of Equity process will be different depending on the individuals and their circumstances.

Read Also: Strongly Recommended For First Time Buyers

Also Check: How To Get Approved For A 400k Mortgage

Process To Transfer Your Mortgage

- Get all the essential documents that required to transfer mortgage from current bank.

- Obtain a letter of consent from the existing bank with the outstanding amount of loan.

- Provide all these necessary documents to new bank whom you want to transfer the mortgage.

- The new lender would make payment of the balance because of your old lender.

- Later, your old loan account would be closed, which means that all the payments for the loan would have to be paid to the new bank.

- All the documents of property would be handed over to the new bank, after the completion of transferring.

How Do I Obtain A Payoff

In order to request a payoff quote on your mortgage product, please call us at 1-800-822-5626. In addition to your personal information, you will need your account number and payoff requested through date. Through the interactive voice response portal, you may be directed to provide additional information depending upon the unique legal requirements within your property state.

Recommended Reading: Have Mortgage Rates Gone Up Or Down

The Bank Sold My Mortgage Loan To Another Bank Without My Permission Can It Do This

Yes. Federal banking laws and regulations permit banks to sell mortgages or transfer the servicing rights to other institutions. Consumer consent is not required.

However, the bank or new servicer generally must comply with certain procedures notifying you of the transfer.

Last Reviewed: April 2021

Please note: The terms “bank” and “banks” used in these answers generally refer to national banks, federal savings associations, and federal branches or agencies of foreign banking organizations that are regulated by the Office of the Comptroller of the Currency . Find out if the OCC regulates your bank. Information provided on HelpWithMyBank.gov should not be construed as legal advice or a legal opinion of the OCC.

Transferring The Mortgage To The Llc

Once you file the documents to organize your LLC with your state, the company becomes a legal entity that can enter into contracts and borrow money in its name. This means your LLC can also hold title to real estate.

If your mortgage company allows your LLC to assume the mortgage, the first step is to prepare a deed transferring ownership of the property. The lender requires that the LLC sign an assumption of mortgage that creates a legal obligation for the debt between the mortgage company and the LLC. The assumption of the mortgage must be filed with the county real property offices with the deed transferring title to the property.

Recommended Reading: How Much Second Mortgage Can I Afford

Exceptions For When A Lender Cant Enforce A Due

The federal Garn-St. Germain Depository Institutions Act of 1982 generally allows due-on-sale clauses in mortgage contracts.

But the Garn-St. Germain Act bars enforcement of a due-on-sale clause after some kinds of property transfers, including, but not limited to:

- a transfer by devise, descent, or operation of law on the death of a joint tenant or tenant

- a transfer to a relative resulting from the death of a borrower

- a transfer where the spouse or children of the borrower become an owner of the property

- a transfer resulting from a decree of a dissolution of marriage, legal separation agreement, or from an incidental property settlement agreement, by which the spouse of the borrower becomes an owner of the property, and

- a transfer into an inter vivos trust in which the borrower is and remains a beneficiary and which does not relate to a transfer of rights of occupancy in the property. .

So, if you get ownership of real estate as a result of one of these kinds of transactions, the lender cant enforce a due-on-sale clause. You may make the payments on the loan and you can assume the debt if you want to.

Also, after a Garn-exempt transfer, the ability-to-pay rule doesnt apply, and the person assuming the loan shouldnt have to go through an underwriting process or credit screening, except in some instances, like in the case of a Fannie Mae loan, when the original borrower wants a release of liability.

You May Like: Is Homeowners Insurance Included In Fha Loan

When Could I Expect To Speak To A Pnc Mortgage Representative With Questions About My Loan

Hopefully you will find the answers you need here on the FAQ page, but if not please feel free to reach out to our Customer Care team. You are welcome to call at any time, but the ability to view specific account details within our servicing systems will only be available after two business days of your service transfer date.

Recommended Reading: What Is The Interest Rate For Home Mortgage

Understanding Mortgage Loan Transfers And Servicing Transfers

After you take out your mortgage loan, it is likely that the original lender will eventually sell the loan to a new owner, called a “holder” or “investor,” or transfer the servicing of your loan to a new servicer, which means the right to manage the loan is transferred.

What Is a Mortgage Servicer?

Mortgage servicers process loan payments and manage the loan account on behalf of the loan holder. The servicer is the company to which you make your payment. Sometimes, the owner of the loan will also service it, but often the servicer isn’t the loan owner.

Mortgage loans and the rights to service them are frequently bought and sold between banks and investors.

How Do I Transfer My Mortgage To Another Lender

The only way to change mortgage servicers is to refinance your loan and move to a lender that services the loans they originate. Keep in mind, just because a company services a loan today doesnt mean theyll continue to do so long term. The industry is always changing.

How often can you switch home loans?

Everyone has different circumstances. Sometimes it can make sense to refinance after 6 months. Other borrowers might refinance after 10 years. Generally speaking, its a good idea to look into refinancing every couple of years, but you can research and compare interest rates more frequently.

Which is the best bank for home loan?

Best banks to get your home loan in 2021

- State Bank of India

- SBI home loan interest rate.

- Bank of Baroda home loan interest rate.

Read Also: What Information Do You Need To Prequalify For A Mortgage

Find A Mortgage That Fits Your Life

See what mortgage you qualify for

Finding a mortgage lender is a bit like finding the right person to marry. After all, a home loan is probably the largest and longest loan youll ever take out. You could be in a relationship with your lender for up to 30 years.

But what if things change and you slowly fall out of love with your mortgage lender? Can you move your mortgage to another bank, credit union or lender?

The short answer is no. Thats why its important to find the right lender from the beginning of your mortgage search. But the longer answer is a little more nuanced.

I Mailed My Payment To My Old Servicer What Will Happen With My Payment

Your previous servicer will forward your payment to PNC for at least 60 days following the transfer of your loan servicing. This transfer may result in a delay in your payment posting to your account. You will not be assessed a late fee because of this delay. Please do not make an additional payment with PNC unless you have confirmed your previous payment has not cleared and you have placed a stop payment on the payment.

Read Also: Will A Cosigner Help Me Get A Higher Mortgage

How To Protect Yourself When Your Mortgage Is Sold

Although you may have signed on with a certain lender when you bought your house, you may find that after a while, your mortgage statements start coming from a new company. While it can be unnerving to see this new name asking for payment, fear not! The practice of selling mortgages in the secondary mortgage market is very common.

In fact, the majority of mortgages are sold in the secondary market after theyre originated. Regardless of which company owns your loan, a loan is a loan and whats on your mortgage note hasnt changed.

But just so you can rest easy, here are answers to common questions you may have about your mortgage changing hands.

Why would a lender sell my mortgage?

The adage that it takes money to make money holds true, especially for lenders. Lenders need capital to originate new mortgages, and most mortgages have 30-year terms. If a company were to wait for borrowers to pay off their loans, it would need an exorbitant amount of capital to fund new mortgages. So instead of waiting 20 to 30 years for a borrower to pay down a mortgage, most lenders sell the loans they originate to an investor, such as a government-sponsored enterprise .

Is it legal for a lender to sell my loan?

How do I find out if my loan has been sold?

Is the servicing sold too? Are the servicer and lender the same company?

Will my payment change if my loan is sold?

What if I send my payment to the wrong lender?

What if I dont receive any notices, and my servicer has changed?

Mortgage Servicing Transfer Rules

Its very common for mortgages to transfer at some point during the loan term. Unfortunately for you, no law says you can approve the transfer or interview potential servicers first. Instead, you receive a goodbye letter within 15 days of the next due payment. That letter names your new servicer, along with the date the new company will begin accepting payments. Youll also receive a welcome letter that corroborates the transfer and tells you where to send future payments.

Tip: To find out who your servicer is, check your monthly mortgage statement. Or try the MERS® Servicer Identification System.

Read Also: How Much Is Tax And Insurance On A Mortgage

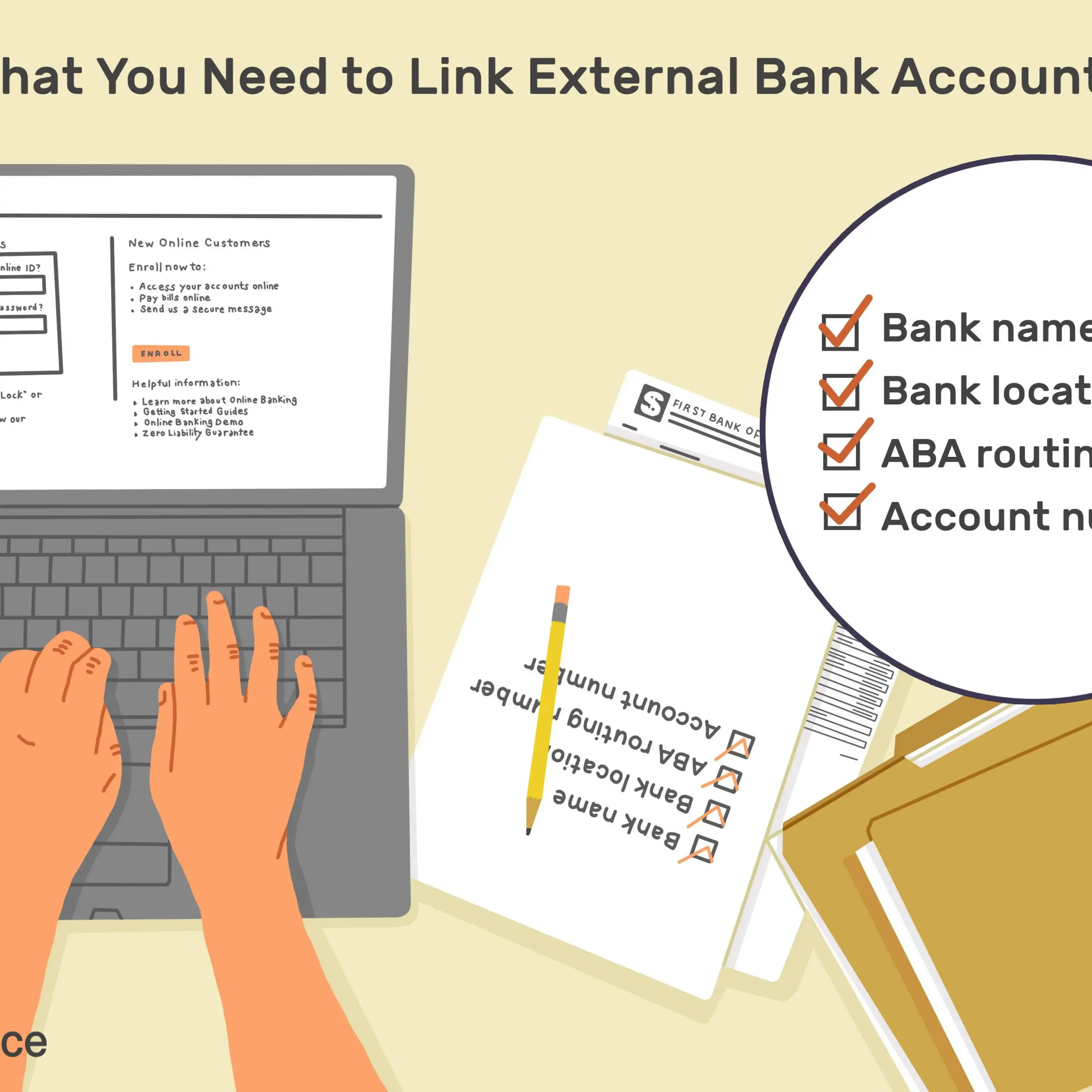

What Is The Process To Change Lenders

Before changing lenders, you must get your mortgage preapproved by your new lender. This step is relatively quick and is usually completed before the offer is made. If you already have a mortgage, you will have gone through a preapproval at least once before. You will need to repeat this process if you decide to change lenders.

When looking for a new mortgage lender, be transparent about the reasons for the change with your real estate agent and the home seller. Sellers may become suspicious of your ability to get a mortgage if they dont hear about the change from you directly. Additionally, provide a new preapproval letter to your real estate agent, if one is involved, in your change of lenders.

The home seller might become alarmed if youre switching from a conventional to an FHA loan because of the FHAs stricter appraisal process. Ultimately, be transparent about your intentions to the sellers and communicate early and often.

Is It Worth Porting Your Mortgage

It really comes down to simple math when deciding if you should port your mortgage.

Lets say the remaining balance on your mortgage is $400,000, and youre paying a fixed rate of 2%. The new home you purchase is $500,000, and current interest rates are at 3%. That means you need an additional $100,000. If you were to port your mortgage and blend and extend, your interest rate would fall between 2% and 3% on a new term. Thats better than current rates, so you come out ahead.

Your other option is to break your mortgage and pay the penalty fee, which can be substantial with a fixed-rate mortgage, especially if there is considerable time left on the term. You could then go with a different lender, who might have a lower interest rate compared to what you were offered with a blend-and-extend mortgage.

One other alternative is to let your buyer assume your mortgage. This only works if both parties are interested, and your lender approves it. For the buyer, the potential benefit is access to a lower interest rate. As the seller, youd be off the hook for the mortgage and wouldnt need to pay any penalty fees because youre not breaking the contract.

Porting your mortgage can definitely work to your advantage, but sometimes getting a new one makes more financial sense. Speaking to a mortgage broker about your options is a wise idea since these professionals can shop around on your behalf.

Recommended Reading: What Is Rocket Mortgage Interest Rate