Can You Explain The Difference Between A Fixed

A fixed-rate mortgage is where your rate and your payment never change.

An adjustable-rate mortgage is when your mortgage rate and your monthly payment can adjust. Typically the rate and payment stay the same for a short period of time and then the rate and payment adjust every year after that.

The benefit of a fixed-rate mortgage is certainty and stability. You always know exactly what your mortgage rate and monthly payment amount are since they never change.

The benefit of an adjustable-rate mortgage is a potential lower mortgage rate and monthly payment.

How To Find The Best Mortgage Rate In California For You

Shopping around for a mortgage is crucial. By comparing at least three offers, borrowers can save thousands of dollars over the life of a loan. Bankrate can help you find the best mortgage deal in todays volatile rate environment.

-

Why trust Bankrate’s mortgage rates

Caret Down

Bankrates goal is to help readers maximize their money and navigate lifes financial journey. We are responsible for providing readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a clear separation between our advertisers and our editorial coverage. Our mission is to offer information to help readers make the best financial decision.

Formula For Calculating A Mortgage Payment

The mortgage payment calculation looks like this: M = P /

The variables are as follows:

-

M = monthly mortgage payment

-

P = the principal amount

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

You May Like: What Are Mortgage Lender Fees

Why Lenders Care About Your Credit Score

Your credit score is one of the most important qualifying factors. It tells lenders how well you handle your finances.

A low credit score shows you pay your bills late and/or overextend your credit. It shows lenders you arent a good risk and may default. If lenders take a risk on you, they increase the interest rate to make up for the risk.

A high credit score shows you pay your bills on time and/or use your credit responsibly. You are a lower risk of default when you have a high credit score and lenders reward you with lower interest rates.

Now the question is, what credit score should get you the best rates?

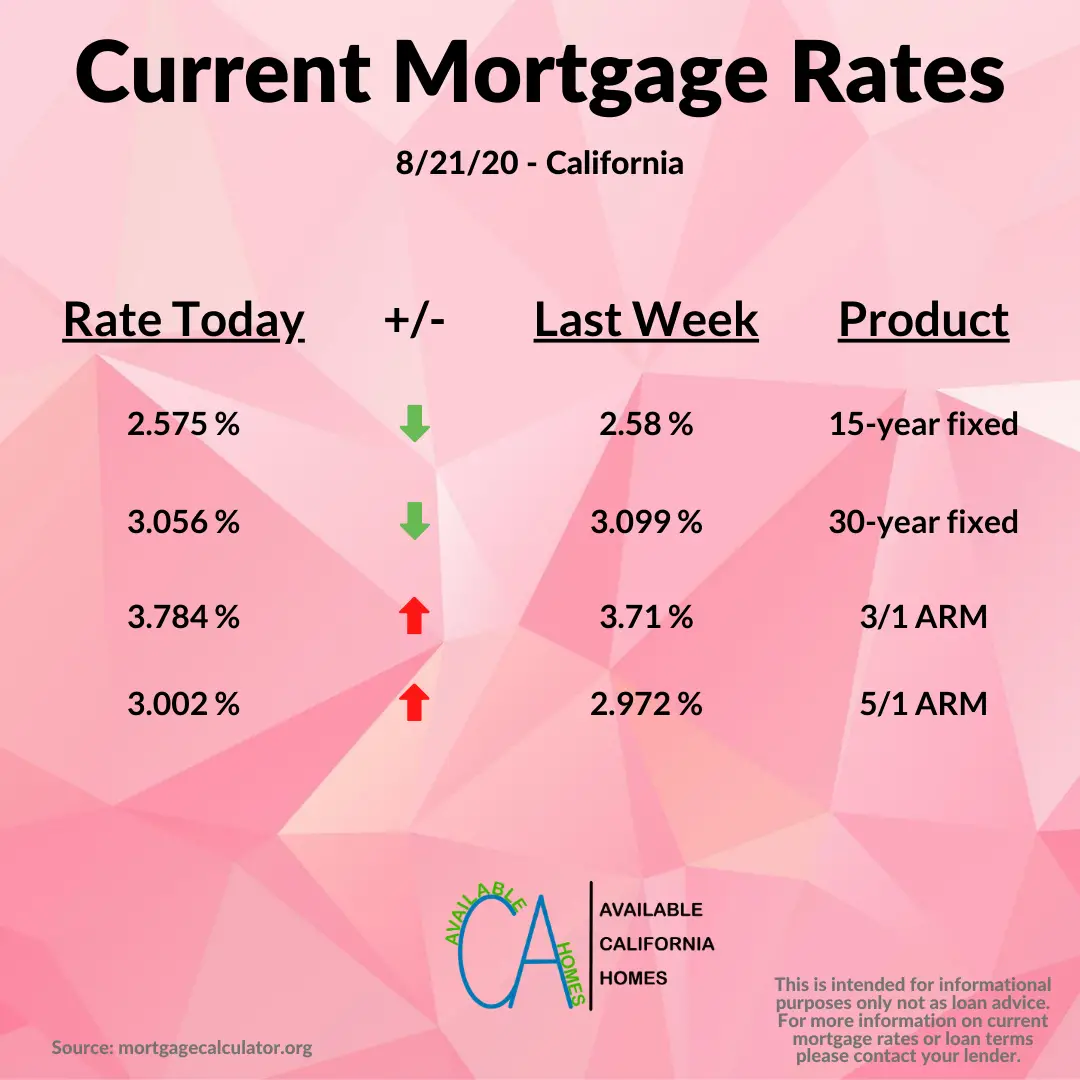

Mortgage Rates In California

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If you’re hoping to buy a home in California, you’ll need to research the best mortgage rates statewide. Shopping around with multiple mortgage lenders will increase your chances of landing a great deal and a lower monthly payment on your loan for what could be many years.

Don’t Miss: How Much Mortgage Payment Can I Afford Calculator

Factors You Can Control

As a homebuyer, you are in the drivers seat to a certain degree. How youve handled money in the past is a big factor in how much house you can afford and what your monthly payment will be. For instance, your credit score is a major factor in determining the loan programs and interest rate available to you. So is the amount of money youre using for a down payment. Another factor you can control is the term length of your mortgage, but note that specific loans may only give limited options. Finally, whether the property will be your primary residence or an investment property will determine your mortgage rate and closing costs.

A Greater Nevada Mortgage consultant can better help you understand all these factors and how they will affect your monthly payment.

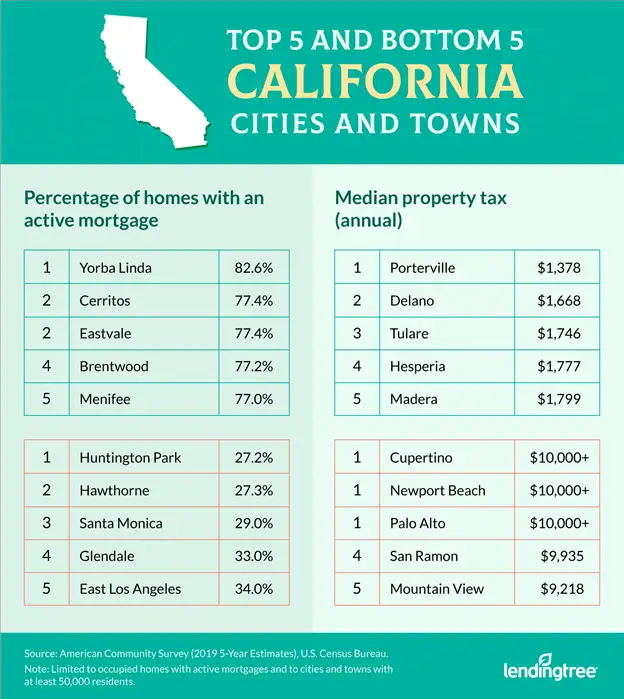

Mortgage Rates For California Cities

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

You May Like: How Much Is A 2 Million Dollar Mortgage A Month

Moneys Average Mortgage Rates For June 27 2022

Mortgage rates are higher for most loan types today. Homebuyers interested in obtaining a 30-year fixed-rate loan will fnd rates averaging around 6.347%, an increase of 0.076 percentage points from last Friday.

- The latest rate on a 30-year fixed-rate mortgage is 6.347%.

- The latest rate on a 15-year fixed-rate mortgage is 5.301%.

- The latest rate on a 5/6 ARM is 5.945%.

- The latest rate on a 7/6 ARM is 6.196%.

- The latest rate on a 10/6 ARM is 6.191%.

Moneys daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each days rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

Recommended Reading: Rocket Mortgage Loan Requirements

Consider The Best Mortgage Type For You

What would your payments look like if you refinanced your original 30-year mortgage to a 15-year mortgage, or if you refinanced a conventional fixed rate mortgage to an Adjustable Rate Mortgage ? Exploring different mortgage types, looking at monthly payments, and considering what ifs how could you swing the new payment if your income fluctuates what would a high-interest rate do to your ARM can help you assess how different mortgage strategies fit into your overall financial picture. Once youve locked in on the type of mortgage that makes the most sense for you, then you can assess interest rates.

Also Check: How Many Years Of W2 For Mortgage

How Are Mortgage Rates Determined

Mortgage rates are set by the lender. The lender will consider a number of factors in determining a borrowers mortgage rate, such as the borrowers credit history, down payment amount or the homes value. Inflation, job growth and other economic factors outside the borrowers control that can increase risk also play a part in how the lender sets their rates. There is no exact formula, which is why mortgage rates typically vary from lender to lender.

Mortgage Rates Drop For Fifth Week In A Row

CNN, CNN BUSINESS

Mortgage rates fell once again this week, dipping for the fifth straight week.

The 30-year fixed-rate mortgage averaged 6.31% in the week ending December 15, down from 6.33% the week before, according to Freddie Mac. A year ago, the 30-year fixed rate was 3.12%.

Mortgage rates have risen throughout most of 2022, spurred by the Federal Reserves unprecedented campaign of harsh interest rate hikes to tame soaring inflation. But mortgage rates have tumbled in the last severalweeks, following data that showed inflation may have finally reached its peak.

Inflation, as measured by the Consumer Price Index, cooled considerably in November and was at its lowest level in nearly a year, according to the Bureau of Labor Statistics closely watched index, released on Tuesday.

However, the Fed announced on Wednesday that it will continue to raise interest rates albeit by a smaller amount than it has been, while acknowledging that inflation is easing. The rate hike was already factored in to where mortgage rates are, but signaled more good news on inflation.

Mortgage rates continued their downward trajectory this week, as softer inflation data and a modest shift in the Federal Reserves monetary policy reverberated through the economy, said Sam Khater, Freddie Macs chief economist.

You May Like: What Are Prepaid Items On A Mortgage

Can You Explain How I Should Compare Online Mortgage Rates

When comparing online mortgage rates between different websites its important to know that each website has rates listed that are based on different home loan scenarios. And some websites have dozens of lenders listed which means each one of those home loan lenders has its own loan scenario.

Its important to keep these four facts in mind when you compare online mortgage rates.

- The rates listed are not quotes.

- These websites are not always providing rates for your specific loan scenario.

- Mortgage rates are not set in stone, they can and often do change daily/weekly.

- The below websites make money when you click on a lenders rate listing.

Online mortgage rates in California are basically a rough snapshot of todays mortgage rates for a very specific loan scenario. Our website clearly displays an assumption link so that its easy to learn what loan scenario our rates are based on.

What Does It Mean To Lock In A Mortgage Rate?

It simply means that if the market moves up or down your locked-in mortgage rate will not change. If its not locked in then your rate can adjust with the market.

When You Apply Are Your Required To Lock In Your Mortgage Rate?

No, at least not with us.

Some mortgage companies do require you to lock in your rate at the time of application and others wont let you lock in your rate until closing .

Either way, you have options. And in some cases, you have the option of doing a float down.

When Will Mortgage Rates Go Up

Mortgage rates have surged since the start of 2022, which reflects investors views that the economy is too hot and that the Federal Reserve will take any necessary steps to cool it down and rein in inflation.

Rates for U.S. Treasury bonds, which mortgage rates follow, have hit some rough patches this year: in late February, when Russia invaded Ukraine, and over the summer when investors grew concerned about a weakening economy. During those periods, bond yields fell, and mortgage rates followed.

Most mortgage-market experts think rates are in for a period of choppiness over the next several months but that rates are likely to settle where they are nowwith the 30-year fixed-rate mortgage about 6%for the rest of the year.

You May Like: How To Remove A Co Borrower From A Mortgage

Mortgage Applications Tick Up

For people looking to buy a home, and homeowners wanting to sell, the retreat in mortgage rates over the past several weeks has been welcome.

With more homes available for sale, and more of them sporting price cuts, some buyers are running the math and finding that the slide in rates is offering better options within their budgets, said Ratiu.

After a month of declines, mortgage applications ticked up last week as buyers looked to take advantage of several weeks of slightly lower rates, according to the Mortgage Bankers Association.

Overall, applications increased, driven by increases in purchase and refinance activity, said Joel Kan, MBAs vice president and deputy chief economist. However, with rates more than three percentage points higher than a year ago, both purchase and refinance applications are still well behind last years pace.

The MBA expects the recent downward trend in mortgage rates to continue, said Bob Broeksmit, president and CEO of the MBA. These lower rates, he said, along with moderating home prices, should encourage more homebuyers to return to the market in early 2023.

The-CNN-Wire

Home Equity Loans And Helocs In California

The rates of Home Equity Loans and Home Equity Lines of Credit in California are usually higher than general home purchase or refinance rates. However, they can help you achieve more financial flexibility.

This is possible because you can use your home equity to sort other financial needs that you may have. For instance, you can convert any current debt you have into a constant monthly loan payment. This is called debt consolidation and the payment involved comes at a lower interest rate. Other expenses such as medical bills, college tuition, and home renovations can be covered too.

To find the best Home Equity and HELOC rates in California for you, you can enter your details in the rate quote form on this page and see rates from up to three lenders.

Read Also: Is Pnc Bank A Good Mortgage Lender

Current Mortgage Rate Trends

The average mortgage rate for a 30-year fixed is 6.74%, more than double its 3.22% level at the start of the year.

The average cost of a 15-year, fixed-rate mortgage has also surged to 6.07%, compared to 2.43% in early January.

In the current environment, ARMs might be more affordable than those with fixed rates. The average 5/1 ARM was 5.45% at the end of October.

How Will The Boc Rate Affect Home Prices

Laird is expecting home prices to remain flat throughout 2023, as they have already declined by 10% to 20% from their peak, and no further declines are likely at this point.

However, demand will be galvanized by two specific demographics.

New Canadians and first-time homebuyers will drive demand for more housing, Laird said. The federal government is targeting 465,000 newcomers in 2023. Fifty-one per cent of Canadian millennials say they plan to purchase a home within the next five years.

New regulations will also contribute to this reinvigorated demand.

At some point in 2023, the Tax-Free First Home Savings Account will be launched, Laird predicted. This is a very strong no-tax vehicle that will help first-time homebuyers who are trying to save for a down payment.

A likely reduction of 25% in CMHC mortgage insurance rates could also boost affordability in 2023.

Increasing the insured mortgage cut-off from $1 million to $1.25 million would help first-time homebuyers enter the housing market because it significantly reduces their minimum down payment required, Laird said.

Read Also: What Is Mip Mortgage Insurance Premium

Consumer Protection And Mortgage Rates

Its important to know that the mortgage industry does offer a wide variety of resources that are aimed at protecting the consumer. The three main organizations are the Consumer Financial Protection Bureau , the California Department of Real Estate and the Nationwide Mortgage Licensing System .

Why is this important to mortgage rates?

When you receive a mortgage rate quote you want to know that the quote comes from a trustworthy mortgage company and that the quote is legitimate. By utilizing the resources that the CFPB, the California DRE, and the NMLS offer youll be in a better position to know which companies are trustworthy and that in turn will provide you a better opportunity to obtain legitimate mortgage rate quotes.

Read Also: 10 Year Treasury Yield Mortgage Rates

Applying For A Better Rate Mortgage / Refinancing In California

Mortgage refinancing is a good option for lowering mortgage costs. The borrower can get the several benefits of refinancing if he knows the right time of refinancing. The main reason and advantages of refinancing are to lower the interest rate and reduce your monthly payment. When the mortgage market is going down, the average interest rate of the market reduces, and that is the best time for refinancing.

Like the mortgage rate, the refinance rate in California also goes up and down depending on the market cycle. If the real estate market rises, the refinance interest rate also increases.

You May Like: Do You Still Own Your Home With A Reverse Mortgage

When Is The Best Time To Refinance To Get A Lower Rate

Refinance rates fluctuate, so the best time to refinance is when they reach their very lowest. Of course, it’s impossible to know in advance when rates are at their lowest.

The good news is that at the moment refinance rates are still really low, so if you’ve got a mortgage that you’ve had for a while, you should definitely consider refinancing. It’s possible that your current rate is higher than you could get currently. You can easily view our refinance rates by using our iPhone Mortgage Rates App.

What Is A Mortgage Rate Lock

A mortgage rate lock is a guarantee that the rate youre offered in your mortgage application acceptance is the one you will eventually pay, assuming you close within a normal period of time and make no changes to your application.

In a period of rising or volatile interest rateslike the current oneit may be wise to lock in a rate that seems affordable for you.

You May Like: What Documents Does A Mortgage Lender Need

Refinancing Your Mortgage In California

Rates are at historic lows right now, so it could be worth it to switch your current mortgage for one with a lower rate especially if the new rate would be significantly lower.

You don’t necessarily need to refinance with the same lender you used for your initial mortgage. A different company may offer you a better deal this time around. Shop around for a lender who will offer the lowest rate based on your credit score and debt-to-income ratio, and the one that charges relatively low fees.