Low Savings Account Balances

If you lose your job or get an unexpected medical bill, will you still be able to afford your mortgage payments? Lenders need to know that you have more than enough money in savings to cover your home loan. Each lender has an individual standard for how much you should have in savings, but most want to see at least a few months worth of payments in your account. Theyll also want to see that you have assets sufficient for the down payment and closing costs without help.

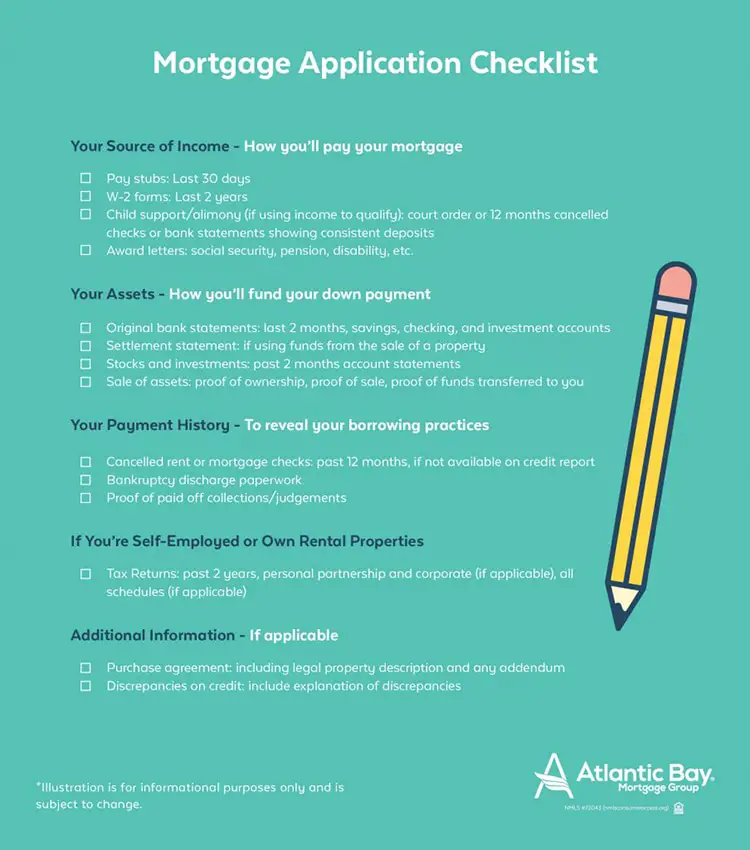

Be Prepared When You Apply For A Mortgage

Dont let this list scare you! Its designed to give you a general sense of the types of things you may need to apply for a mortgage. Chances are you have many of them on hand or easily accessible already! Plus, this list will enable you to gather what you need for the mortgage application process ahead of time, so things can move along smoothly when you are ready to move forward with pursuing a home loan.

Interested in learning more about preparing to apply for a home loan? Contact the experienced mortgage professionals at Maple Tree Funding today! Our team would be happy to answer any questions you may have on the application process.

Give us a call at or complete our easy online contact form to get started!

If Youre Applying For A Mortgage Its A Good Idea To Start Prepping Your Financial Documents

Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation. For example, someone who is self-employed will likely have to provide different forms than someone who is employed by a company.

Although the exact forms might vary, Todd Huettner, owner of Huettner Capital, a residential and commercial real estate lender, says a lender can get a good sense of your likelihood of being approved by checking out your recent pay stubs, bank statements, W-2 forms and tax returns.

Huettner says that with these documents, hes able to make a good assessment of the borrower. These documents allow me to tell what they can and cannot do with a very high level of certainty, he says.

Depending on your unique financial situation, here are seven mortgage documents you might need when applying for a home loan.

Recommended Reading: Should I Have A Lawyer Review My Mortgage

Loan Application Information Required

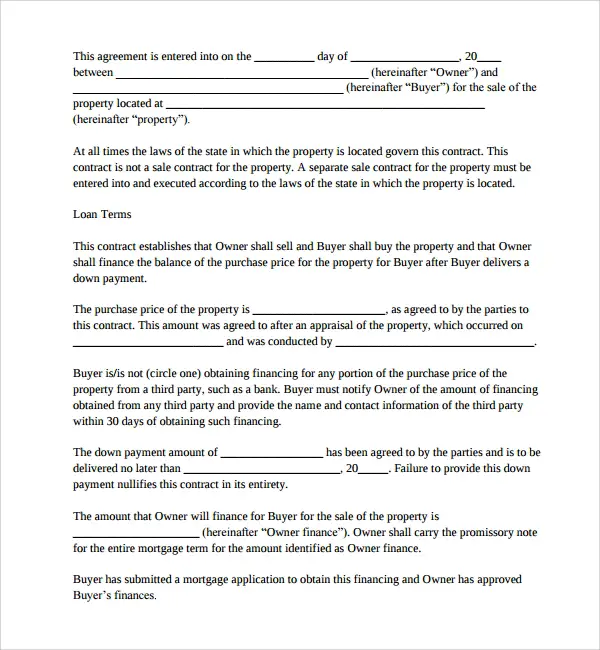

The first thing youll do when applying for a mortgage is complete a federally required mortgage application. Regardless of whether the application is in the paper format linked here, an online form, or done verbally with your loan officer, this linked document contains the application with the information youll need to provide, including:

- Full name, birth date, Social Security number, and phone number

- Residence history for at least two years. If youre a renter, your rent payment is needed. If youre an owner, all mortgage, insurance and tax figures are needed for your primary residence and all other properties owned.

- Employment history for at least two years, including company name, address, phone number, and your title.

- Income history for at least two years. If you receive commissions, bonuses, or are self-employed, you must provide two years of bonus, commission, or self-employed income received. Most lenders average variable and self-employed income over two years.

- Asset account balances including all checking, savings, investment, and retirement accounts.

- Debt payments and balances for credit cards, mortgages, student loans, car loans, alimony, child support, or any other fixed debt obligations.

- Confirmation whether youve had bankruptcies or foreclosures within the past seven years, whether youre party to any lawsuits, or you co-sign on any loans.

- Confirmation if any part of your down payment will be borrowed.

Account Statements For Deposit And Investment Accounts

Certain assets, like bank and retirement accounts, can be used to qualify for a mortgage if you own and have access to the funds. You’ll generally have to provide two months of account statements for assets you’re using to qualify for the mortgage. If you’ve recently made large deposits into your bank account, the lender will ask for additional documents verifying the source of the deposits.

If you don’t receive a statement for securitieslike stocks and bondsyou can provide other evidence that you own the security and verify the current value.

Read Also: Is 15 Or 30 Year Mortgage Better

What Happens If You Dont Qualify For A Va Loan

VA loans are among the most flexible loan programs available today, but theres no guarantee that youll qualify. Even if you submit all of the documents above, you might still get denied. Here are some of the common reasons borrowers get denied for a VA loan even after providing their VA statement of service:

- Low credit scores

The VA doesnt have specific credit score requirements, but lenders do. If your credit score doesnt meet their requirements, you may not get approved.

- High debt-to-income ratios

The VA also doesnt have a maximum debt-to-income ratio requirement. They focus on a borrowers disposable income or money left after you pay your bills each month. But, like credit scores, most lenders have a maximum debt-to-income ratio theyll allow.

- Not meeting the minimum service requirements

If you dont have the minimum service requirements , you wont be eligible for a VA loan no matter how good your qualifying factors are.

- Low income relative to size of requested loan

If your income is low and youre requesting a higher loan amount, lenders may not feel comfortable lending you the money, even with the VAs guarantee to back them up if you default on the loan.

- Unstable employment

After leaving the military, lenders may not feel comfortable lending to you if your statement of service shows instability or you dont have a job. They want borrowers with consistent income.

The Bottom Line: Knowing What You Need For A Mortgage Preapproval Can Help Speed Up The Process

A lender wants to make sure that youll be able to pay back your loan and arent too much of a risk to lend to. In order to do this, they will need to verify your income, assets and debt. To ensure this process goes smoothly, we recommend preparing all of these documents before starting the home buying process. By ensuring that you have all the information required by your lender, you can quickly progress to the next step in your homeownership journey.

If you have more questions about getting mortgage approval, contact a Home Loan Expert today.

Get approved for a mortgage.

Find out how much you can qualify for.

Recommended Reading: When Can I Remove The Pmi From My Mortgage

Automated Underwriting Systems And Documentation Requirements

Most mortgages today are underwritten by software programs. Fannie Mae lenders go through Desktop Underwriter , for example, while Freddie Mac lenders use Loan Prospector . Other lenders have proprietary programs.

Note that lenders cant underwrite all mortgage applicants with software. If you have very little information on your credit report, or a lot of inaccuracies, humans must underwrite your application manually. If your application does not receive an approve decision from the software, it may get a refer recommendation, which means a human must underwrite it. Manual underwriting guidelines require a lot more documentation.

The great thing about AUS is that they can cut down significantly on the amount of paperwork loan applicants must furnish to secure mortgage approval. First-time homebuyers or repeat borrowers who have been out of the loop may be surprised at how little documentation they must come up with today.

Some lenders even let you just submit a picture of your paycheck and bank statement via text or email.

Additional Dos And Donts For Your Mortgage Application

- Provide all the requested documents as quickly as possible.

- Return any signed disclosures without delays.

- If you are asked for any additional documentation, provide them as soon as possible to not hold up your loan process.

- Be sure any funds used for your mortgage purchase are in your bank accounts for at least two months before starting the loan process.

- And remember, always ask questions!

DONT:

Since lenders value stability, try not to do the following as this could delay the loan process:

- Transfer money between multiple accounts.

- Switch jobs or quit your job during the loan process.

- Take out any new debt right before or during the loan process. This includes opening new credit cards, co-signing on a new loan, taking out a new car loan, or buying a new appliance on credit.

- Let multiple lenders run hard-credit inquiries, as this could damage your credit score.

- Choose your insurance agent at the last moment.

- Use money not placed in a bank to purchase a home as this is not legal.

If you need help getting a mortgage, refinance, or preapproval, contact us at FFCCU! We have a dedicated team of home loan experts to assist you in navigating the homebuying journey.

Posted In: Home Buying

Recommended Reading: What To Know Before Applying For A Mortgage

Expect Additional Requests Before Closing

As a final thought, it’s important to mention that just because your lender doesn’t request a certain document initially doesn’t mean that they won’t need it at some other point throughout the process.

For example, if your lender goes through your bank statements and sees an unexplained cash deposit, you may need to submit a letter explaining the details. And there are some documents that you’re likely to need when your closing date approaches, such as documentation of an insurance policy on the property.

The bottom line is that there is a lot of documentation your mortgage lender might request, both before your application and while you’re waiting to close. By preparing your documentation ahead of time, you can help ensure that the process will go as quickly and smoothly as possible.

Key Documents In The Homebuying Process

When youre negotiating:

When youre closing:

After closing:

- Escrow Statement: An escrow account is a separate account that a borrower funds and a lender uses to make property tax, homeowners insurance, and mortgage insurance payments on the borrowers behalf. An annual escrow statement details any changes to the account, including any shortages or overages and other account activity.

- Form 1098: Each year, lenders are required to provide borrowers with an IRS Form 1098. If your mortgage is with Wells Fargo, you can access your Form 1098 here. For most homeowners, mortgage interest is tax-deductible, and the 1098 form tells a borrower how much interest was paid last year. This document may also include what a borrower has paid toward points to get the loan and escrow disbursements for property taxes and hazard insurance .

Related articles

Don’t Miss: How Long Does Refinancing A Mortgage Take

Complete These Five Simple Steps To Get To The Closing

Okay. Youve found your dream home and the seller has accepted your offer. Heres what you can expect during the mortgage process, from application to closing.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Personal Information And Mortgage Loan Document Checklist

Personal Information

- Full name and Social Security Number

- Drivers license or state-issued identification card

- Home address for the last two years, including dates

Income verification

- Employment information for the last two years , W-2 statements, and pay stubs from the last two months

- Proof of any other current income source, such as rental property

- If you wish to have it considered as part of your income, child support/alimony: friend-of-the-court printout or 12 months cancelled checks

- Awards letter for Social Security and 1099 for disability income

- Rental Income Copy of lease, if property has been held for less than 12 months 2 years of tax returns with all schedules, if property has been held longer than 12 months

If self-employed

- Signed, completed federal income tax returns for the past two years, including personal, partnership, and corporate returns

- Year-to-date business profit-and-loss statement for current year, if more than three months have passed since the end of the last tax year

- Current business balance sheet

Payment history

- List of all debts presently owed

- Cancelled rent or mortgage payment checks for the past 12 months, if not reflected on credit report

- Child support/alimony*

Recommended Reading: Chase Recast

You May Like: How Does Home Appraisal Affect Mortgage

What Documents Are Needed For Mortgage Preapproval

If youre in the market for a home, you may have heard that you should get a preapproval before you apply for a mortgage. It can help you narrow down your search and let you know how much home you can afford. Not only that, but it can also make you a more appealing buyer to sellers.

Before you can apply for a preapproval letter, though, you need to get your affairs in order. Here are the documents needed for mortgage preapproval.

What Are The Documents Needed For Gold Loan In Sbi

The following are the documents which are necessary for processing your loan.

- Application Form for Gold Loans.

- Two copies of photographs of the borrower

- Proof of Identity such as PAN card, Aadhar card.

- Proof of Address such as voter ID, ration card.

What is the current rate of gold? Bullion / Gold Price Today

| Metal |

|---|

| 4,114 |

Which Pakistani bank gives loan against gold?

BOP Sonay pe Sohaga is a running / cash / demand finance facility against pledged gold bullion / gold ornaments for consumers to meet cash requirements.

How much loan can I get if my salary is 25000? 25,000, you can avail as much as Rs.18.64 lakh as a loan to purchase a home worth Rs. 40 lakh

Read Also: Can Two Unmarried Borrowers Be On The Same Mortgage

Income And Asset Documents

When applying for a mortgage, your lender may need proof of income. The lender will review your income documents to ensure you have the financial means to pay off your new mortgage, in addition to any other living expenses and long-term debts.

When you apply for a home loan, be prepared to provide copies of the following documents:

Documents Needed For Mortgage Preapproval

Documents needed for a mortgage preapproval may include various financial statements, tax returns, and more so that your lender knows the limits of your budget. It also indicates to them your reliability as a borrower.

Here are some of the documents you should prepare if you want a mortgage preapproval:

Don’t Miss: How To Shop For A Mortgage

Documents Youll Need To Apply For A Mortgage

- Social Security numbers, or individual taxpayer identification numbers for all borrowers.

- Home addresses for at least the past two years.

- Your most recent paystubs covering at least 30 days of income

- Your most recent W-2s , or if self-employed, 1099s or K1s

- Your most recent Federal Tax Returns , including all pages and all schedules. Note: if you are self-employed, you may need to provide both your personal and business tax returns.

- Two to three-months of statements for each of your accounts: Checking, savings, IRA, 401K, credit cards, etc.

- Information on other consumer debt accounts such as car loans or leases and student loans

- Social Security award letter or pension award letter, if applicable

- Year-to-date profit and loss statements and/or balance sheets, if self-employed

- Gift letter if you are using money from parents or relatives to help cover down payment or closing costs

- Landlords name, address & phone number, if you rent

- May also need to show rent/utility payments to document payment history if needed

Depending on the type of home loan you are applying for, and your individual circumstances, you may also need:

Required Mortgage Application Information

Once youre ready to buy a property and choose a lender, youll need to submit a mortgage application. This document will provide the information your lender needs to evaluate your financial situation, determine whether or not to approve you for financing and what terms to offer, if approved.

The 1003 mortgage application form, or the Uniform Residential Loan Application, is the most common mortgage application and requires following information.

Recommended Reading: Reverse Mortgage On Mobile Home

Read Also: Do You Pay Interest On A Mortgage

Top 5 Documents To Give Your Mortgage Lender

Buying a house is an exciting time, but applying for a mortgage can be stressful. When you apply for a loan, there are several documents your lender will request from you. A great way to decrease your stress when applying for a mortgage is to ensure that you have all the documents you may need on hand before you start the application process. Below are the top 5 documents that your mortgage lender will need so you can be ready when the time comes.

W-2 Forms and Tax ReturnsPart of your mortgage application is stating your income, so youll need to provide your most recent W-2 forms and tax returns to prove it. Each year, your employer should send you a new W-2 form to file with your taxes, and after you file, you should keep a copy of your tax return. These documents detail your financial history, which will help your lender determine how much mortgage you can afford. If you dont have these already on hand, start collecting them as soon as possible.

Where to Find Them: W-2s should be available through your employer, while your tax returns may be at home, available through your CPA, tax service or the Internal Revenue Service.

Where to Find Them: Pay stubs are available through your employer or payroll service.

Where to Find Them: Your bank statements can be requested through your bank, or you can pull them yourself through your online banking provider.

Where to Find Them: Access your account information through your bank to provide proof of reserves to your lender.