Average Mortgage Interest Rate By Type

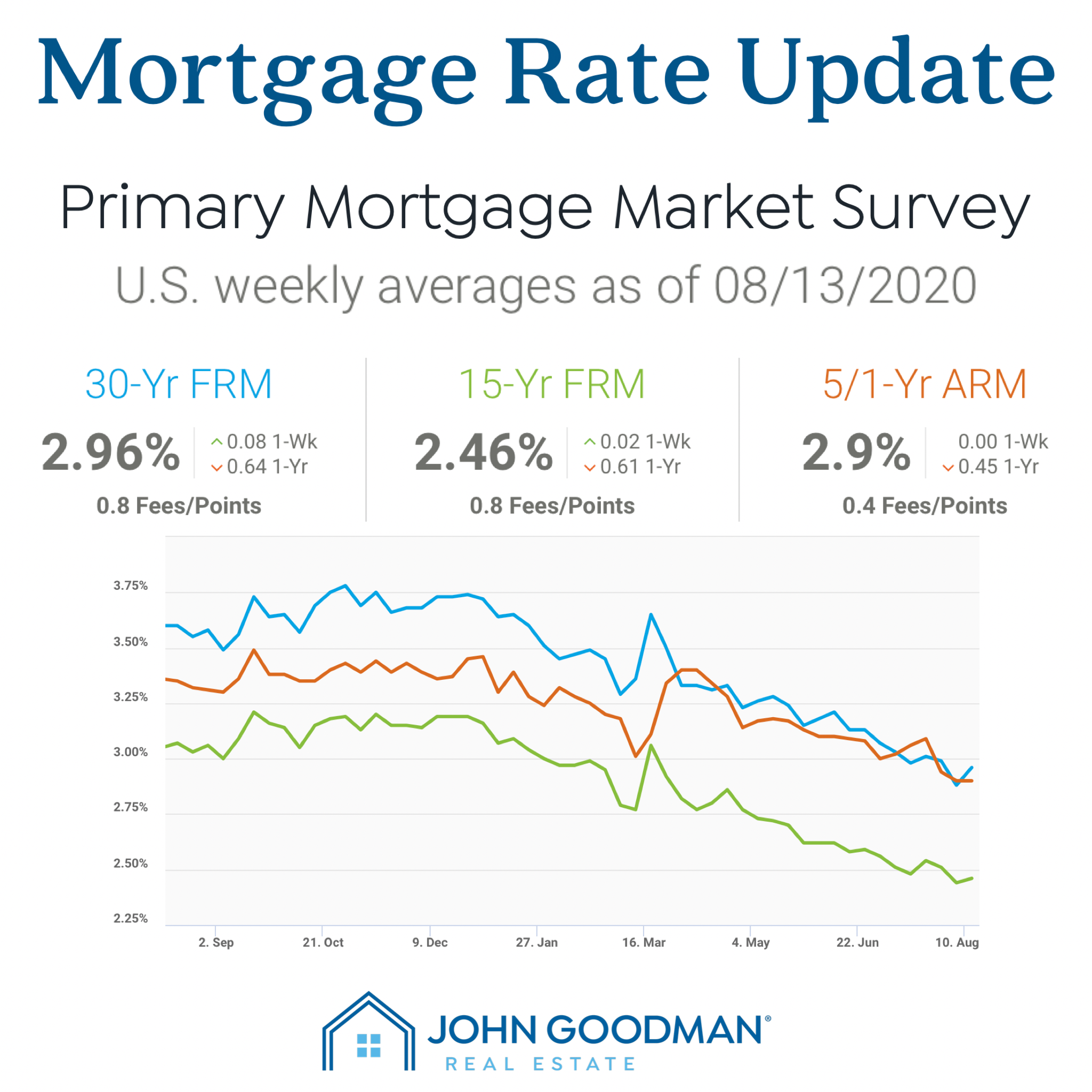

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

| 5.57% |

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

Is There Still Time To Refinance

Americans watch mortgage rates closely, and any time rates pull back even the slightest amount, more people apply for mortgages. With rates still substantially higher than a year ago, however, applications remain stuck near the lowest level in more than two decades, according to MBA data.

While refinancing options can lead to a lower monthly payment, not all of the options yield less interest over the life of the loan. For example, refinancing from a 5% mortgage with 26 years left on it to a 4% rate, but for 30 years, will cause you to pay more than $13,000 in additional interest.

Before you start shopping around for a lender, you can find out how much you could save by using a mortgage refinancing calculator.

Youll also want to consider how long you plan on staying in your home as the closing costs can eat up your savings if you sell shortly after refinancing. The closing costs to refinance run between 2% to 5% of the loan amount, depending on the lender. So you should plan on keeping your home long enough to cover those costs and realize the savings from refinancing at a lower rate.

Keep in mind that the rate you qualify for also depends on other factors such as your credit score, debt-to-income ratio, loan-to-value ratio and proof of steady income.

Read Also: What Is A Reverse Mortgage For Dummies

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

Also Check: How Much Mortgage Can I Afford Zillow

One More Thing To Consider: The Trade

As you shop for a mortgage, youll see that lenders also offer different interest rates on loans with different points.

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs.

- Points, also known as discount points, lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

- Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate. Keep in mind that some lenders may also offer lender credits that are unconnected to the interest rate you payfor example, a temporary offer, or to compensate for a problem.

There are three main choices you can make about points and lender credits:

Learn more about evaluating these options to see if points or credits are the right choice based on your goals and financial situation.

How Does A Mortgage Interest Rate Work

Mortgage interest rates can vacillate, depending on larger economic factors and investment activity. The secondary market also plays a role.

Fannie Mae and Freddie Mac bundle mortgage loans. They sell them to investors who are looking to make a profit. Whatever interest rate those investors are willing to pay for mortgage-backed securities determines what rates lenders can set on their loans.

-

There are dips or insecurities in foreign markets.

-

Inflation slows.

-

Unemployment increases or jobs decrease.

-

The stock market is strong.

-

Foreign markets are strong and stable.

-

Inflation is up.

-

Unemployment is low, and jobs are increasing.

This chart illustrates how 30-year fixed-rate mortgage rates have changed since 2000.

Interest rates aresimply cited and agreed-upon percentages. The amount of interest you will pay each month will decrease as you pay off the principal balance you borrowed and as that number also decreases. Your percentage interest rate applies to that remaining balance.

You May Like: How Much Will 1 Lower My Mortgage Payment

Do I Need A Mortgage Prequalification Or Preapproval

Mortgage lenders can pre-qualify borrowers to help them know how much home they can afford based on a credit report and description of the borrowers financial circumstances. It can help you focus your search for a new home.

A mortgage pre-approval takes a more intricate look at your finances, including your income, assets, credit, and debt, to determine whether you qualify for a mortgage and determine what you can afford. Mortgage pre-approval gives you a realistic look at your borrowing capabilities.

When considering buying a home, it is important to:

- Be preapproved to let sellers and real estate agents know they can trust you as a buyer and that you are serious about purchasing a home.

- Remember that even if you get preapproved for a mortgage, you will still have to apply for a mortgage once you have an offer accepted on the property you wish to buy.

After you are preapproved, avoid making common mistakes like applying for new credit, co-signing a loan, and disturbing your steady income. These changes will alter your preapproved status, potentially resulting in completely new terms for your actual mortgage.

Visit our mortgage preapproval page for more information.

Mortgage Interest Rates Forecast 2022

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserveâs monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

âThe pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year,â says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . âAdditionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.â

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : âMortgage rates are expected to end 2022 at 4.8%âand to decline gradually to 4.6%âby 2024 as spreads narrow.â

- NARâs Yun: âAll in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.â

- Matthew Speakman, senior economist at Zillow: âCompeting dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.â

Read Also: How To Find Remaining Mortgage Balance On A Property

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Read Also: When Do You Apply For A Mortgage Loan

What Is The Difference Between A Mortgage Interest Rate And An Apr

An annual percentage rate reflects the mortgage interest rate plus other charges.

There are many costs associated with taking out a mortgage. These include:

- The interest rate

The interest rate is the cost you will pay each year to borrow the money, expressed as a percentage rate. It does not reflect fees or any other charges you may have to pay for the loan.

An annual percentage rate is a broader measure of the cost of borrowing money than the interest rate. The APR reflects the interest rate, any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate.

If you have applied for a mortgage and received a Loan Estimate from one or more lenders, you can find the interest rate on page 1 under Loan Terms, and the APR on page 3 under Comparisons.

Tip: Take care when comparing loan options to be sure you understand any differences between the terms being offered:

How Do I Get A Mortgage

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-brian-oneill-exp.jpeg)

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Read Also: Can You Have A Second Mortgage With A Va Loan

Reviewing Your Budget With Your New Debt Payments

If interest rates rise and your debt payments increase, you may need to review and adjust your budget.

To prepare yourself, try the following:

- talk to your lenders to find out by how much your payments will increase

- look at how the higher payments will impact your budget and your ability to save for your goals

- if youre out of your comfort zone, see how you can reduce expenses or earn more money to pay off your debt faster

Use the Budget Planner to create or review your budget.

If after reviewing your budget if you expect challenges in making your payments, be proactive and dont wait to seek help. Talk to talk to your financial institution to discuss your options. They may be able to offer temporary accommodations such as making special payment arrangements, mortgage deferrals or allowing you to skip a payment on your loan.

How To Calculate Mortgage Payments

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be tricky to understand what youre paying forand what you can actually afford.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

Heres what youll need in order to calculate your monthly mortgage payment:

- Taxes, insurance and any HOA fees

Don’t Miss: How Much Would A 70000 Mortgage Cost

The Driving Force Behind Mortgage Rates

Mortgage rates are a substantial element of the home buying process. While you likely know what a mortgage rate is if you have begun your home purchase journey, understanding what drives those rates may not be familiar territory.

The average interest rates affixed to home mortgages often fluctuate based on a few different factors. Understanding these can help you better comprehend when your chances increase for a lower interest rate.

Other Mortgage Fees Or Costs

There may be other fees or charges associated with mortgage products such as an application fee or product fee.

- These fees are usually either paid up front or added to the mortgage. Keep in mind, if fees are added to the mortgage this could ultimately cost more due to interest being charged.

- When comparing mortgage deals, it may be a good idea to consider both those with and without product fees. You will be able to compare both APRC and your potential monthly repayments, to make an informed decision about the best option for you.

You May Like: Who Owns Phh Mortgage Services

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.