Home Equity Loan Definition

A home equity loan is similar to a HELOC, but with a more rigid structureâmore like a conventional mortgage. A home equity loan is a second mortgage, issued separately from a first mortgage, with separate fees and payments.

As with a typical mortgage, youâll receive your full home equity loan funding at closing. The borrower then repays the loan with set monthly principal and interest payments throughout the life of the loan.

Home equity loans offer much less flexibility than HELOCs, but the structure also can be beneficial for people who need a lump sum of money for a specific purpose. These loans also are better for borrowers who prefer more certainty in their financing structureâthey want to know exactly how much theyâll pay each month and when their loan will be fully repaid.

Loan Collateral And Terms

The equity in your home serves as collateral, which is why its called a second mortgage and works similarly to a conventional fixed-rate mortgage. However, there needs to be enough equity in the home, meaning that the first mortgage needs to be paid down by enough to qualify the borrower for a home equity loan.

The loan amount is based on several factors, including the combined loan-to-value ratio. Typically, the loan amount can be 80% to 90% of the propertys appraised value.

Other factors that go into the lenders credit decision include whether the borrower has a good , meaning that they havent been past due on their payments for other credit products, including the first mortgage loan. Lenders may check a borrowers , which is a numerical representation of a borrowers .

Best Heloc Lender For Good Credit In Montana: Us Bank

-

Easily apply for a HELOC via phone, online, or during a branch visit.

–

- 4.20% to 9.35%APR Range

- $15,000 to $750,000Loan Amount Range

- 10-year draw period unspecified repayment periodRepayment Terms

- Not specifiedPre-Approval Time

WHY WE GEEK OUT

U.S. Bank was founded in 1863 and operates in 50 states and Washington, DC. This lender is suitable for homeowners with good credit and offers low APRs starting at 4.20%. Those with a U.S. Bank personal checking account receive the lowest interest rates. To apply, you can visit a branch, call 800-642-3547 or fill out an application online.

Even if U.S. Bank is a top-rated lender in Montana, it might not suit everyones needs. Think of applying for another HELOC lender if your credit score is below 730 or you dont want to pay an annual fee of $90.

PROS & CONS

- Interest rates as low as 3.65%

- High maximum loanable amount

- No information on their website about the repayment period

LENDER DETAILS

- Repayment Terms: 10-year draw period unspecified repayment period

- Minimum Credit Score: 730

Recommended Reading: How To Buy A House Without A Mortgage

When Is A Home Equity Loan Better Than A Home Equity Line Of Credit

A home equity loan is a better option than a home equity line of credit if:

- You know the exact amount that you need for a fixed expense.

- You want to consolidate debt but dont want to access a new credit line and risk creating more debt.

- You live on a fixed income and need a set monthly payment that doesnt fluctuate.

Borrowing Limits With Heloc Loans

Regarding how much you can borrow, the Canadian government regulations stipulate that a HELOC combined with a mortgage cannot exceed 65% Loan to Value unless it is in second position.

If the HELOC is secured on your home in second position, then the amount is raised to 80% LTV. The amount of credit available in your home can go up as you pay down the principal on your mortgage.

Additionally, the LTV percentage can increase if the value of your home increases with the support of a healthy market prompting your home to appreciate in value. Both of these factors can provide additional access to credit.

Read Also: What Is The Grace Period On A Mortgage

So Which One Is Right For You

The answer to this question depends on your individual circumstances. If you are looking for a loan with lower interest rates, a mortgage may be the better option. However, if you need money for a large purchase or to consolidate your debt, a HELOC may be the better choice. Ultimately, it is important to weigh the pros and cons of each option before making a decision.

When To Consider A Home Equity Line Of Credit

If you need extra money intermittently, a variable-rate home equity line of credit might be your best choice. Once the lender approves you for a maximum line amount, you can access the available funds as you need them. Use your Home Equity Line of Credit Visa Access Card anywhere Visa is accepted, write a check, visit a branch or ATM, or log in to Online or Mobile Banking and transfer money to your U.S. Bank savings or checking account. You may have ongoing access to funds for 10 years, called the draw period, following the date you open your line of credit. After the draw period youll have a repayment period of 20 years.

Monthly minimum payments are variable and based on the amount of the line balance and the variable interest rate. As you pay the money back, the funds are available again on your HELOC. This provides you with a renewable source of funding during the 10-year draw period. This is a good option if you anticipate the need to make periodic payments for tuition or remodeling.

Although a home equity line of credit provides ongoing access to available funds, which may be tempting for some people, there are some critical things to consider.

- You have to pledge your home as collateral

- If you dont make payments, your property can go through foreclosure

- Your credit score is on the line if you arent diligent with your payments

Read Also: Rocket Mortgage Qualifications

You May Like: How Much Is A 30000 Mortgage Per Month

Home Equity Line Of Credit

A HELOC is a revolving credit line. It allows the borrower to take out money against the credit line up to a preset limit, make payments, and then take out money again.

With a home equity loan, the borrower receives the loan proceeds all at once, while a HELOC allows a borrower to tap into the line as needed. The line of credit remains open until its term ends. Because the amount borrowed can change , the borrowers minimum payments can also change, depending on the credit lines usage.

Whats A Home Equity Loan

Home equity loans let you turn your home equity into a one-time lump sum payment. You then repay the loan via fixed monthly payments over an extended period of time usually 10 to 30 years.

Many homeowners use home equity loans to cover the costs of repairs, renovations, or other expenses around the house. Others use them for bills or paying off debts.

You May Like: What Are The Chances Of Getting A Mortgage

Possible Tax Advantages Of A Cash

According to CNBC, cash-out refinance loans may be tax-deductible for eligible borrowers:

Homeowners may also be able to deduct the interest on the first $750,000 of the new mortgage if the cash-out funds are used to make capital improvements .

Now, we arent tax advisers. So you must take your own advice from a professional before relying on that information.

But it may be that you are able to deduct for money spent on home improvements. So check it out if thats why you want to borrow. Because it could be a decisive factor in your personal home equity loan vs. mortgage analysis.

Home Equity: What It Is And How To Earn It

Your home equity is the portion of your home that you ownyou can calculate this by measuring the value of your home minus the amount of money you still owe on your mortgage. For example, if your home is worth $250,000 and your current loan balance is $150,000, then you have $100,000 in home equity:

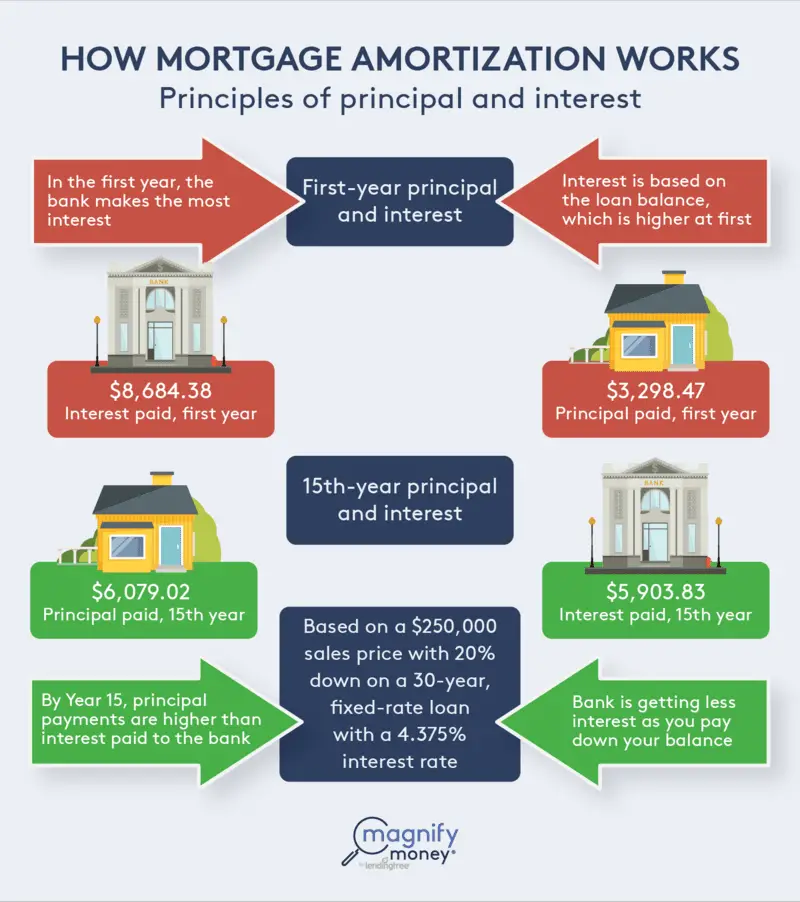

There are a number of ways your home equity can grow. The first and most obvious way to grow your home equity is by making your monthly mortgage payments. Every time you make a mortgage payment and reduce the outstanding principal balance of your loan, you essentially buy back a portion of your homes value from your mortgage lender.

Your equity can also increase if the appraised value of your home goes up. The easiest way to make this happen is through home improvements and renovations, but it can also occur naturally over time housing appreciation and housing market fluctuations. Whatever the reason, when the value of your home increases, the difference between that value and your mortgage loan balance also gets bigger, and the difference is your earned home equity.

You May Like: How To Process A Mortgage Loan

How You Can Use The Funds

Neither cash-out refinances nor home equity loans dictate how you can use the funds. Its totally up to you.

However, you typically want to use the money for something with a good return on investment. Thats because youre paying interest on the cash and its secured by your home.

Popular uses for home equity include home renovations and debt consolidation .

Second Mortgage Vs Home Equity Loan

When youre talking about second mortgages vs. home equity loans, youre really talking about the same thing. A home equity loan is a second mortgage on a home thats secured by the underlying property. So theres no which is better? question to answer as theyre referencing the same thing.

The better question to ask is Should I get a home equity loan? There are some pros and cons associated with having a second mortgage on your home.

On the pro side, the main benefit of a second mortgage is being able to access your homes equity. A home equity loan offers flexibility, in that you can use the money for just about anything. So you could overhaul your kitchen, for example, if you want to make some upgrades that will improve your homes value. Or you could use the money to consolidate and pay off high-interest credit card debt.

Home equity loan interest rates are often much lower than credit card interest rates or even personal loan rates for borrowers who have good credit scores. Opting for the shortest loan term possible can help you pay off a home equity loan faster, though keep in mind this will mean a larger monthly payment.

Don’t Miss: What’s The Best Mortgage Loan To Get

How Heloc Interest Rates Work

HELOC rates work a little differently than standard mortgage rates.

Most cash-out refinances involve a new, 30-year fixed-rate mortgage. Similarly, nearly all home equity loans have fixed interest rates. By contrast, HELOCs are usually variable-rate loans, meaning your interest rate can rise and fall over time with the market.

HELOCs are usually variable-rate loans, meaning your interest rate can rise and fall over time with the market.

Another major difference is that, during the HELOC draw period, interest is charged only on your loan balance . By contrast, mortgage interest rates are always charged on the full loan amount. That means HELOC payments are typically much lower than mortgage payments.

Some lenders do offer fixed-rate HELOCs or allow you to fix the rate on a particular outstanding balance part way through the loan. You may also be able to convert your HELOC into a home equity loan. However, lenders typically charge a higher rate on these types of HELOCs because they are shouldering more of the risk.

How To Apply For A Heloc

Most HELOC lenders provide online applications to make the process more convenient. You only have to submit various pieces of information, including personal data and contact details. Then, you wait for the approval.

Determine how much you need

Keep in mind that a HELOC isn’t for everyone. For homeowners who can budget properly and know the precise amount they need to borrow, MoneyGeek advises a home equity line of credit. HELOCs are also great for big purchases like investments, debt reduction and education.

Assess your financial standing

You need to qualify before applying for any type of loan. For HELOC, this means that you must be able to fulfill the credit score requirement, earn within the income threshold, have enough home equity and more. If youre planning to apply for a HELOC loan, try to avoid hurting your creditworthiness by applying for other credit lines.

Shop around and compare lenders

Researching lenders and comparing their rates could be beneficial. This will help you in locating the best option for your needs. You may avoid paying additional fees and take advantage of cheap rates before the loan begins if you choose the correct HELOC lender.

Apply

Most HELOC applications may be completed online and are typically less complicated than mortgage applications. Simply gather your application documents and answer the questions honestly. Verification documents, such as bank statements and asset information, must also be provided.

Use funds wisely

You May Like: How Do You Know How Much Mortgage You Can Afford

Home Equity Line Of Credit Rates For 2022

The table below provides an overview of lender equity rates, repayment terms and other essential details as of May 2022. Please note that rates and information continually change. MoneyGeek will regularly update this table with the most current information.

-

and then 20 years for repayment

None

Show more

How Do You Pay Back A Home Equity Line Of Credit

A HELOC has two phases: the draw period and the repayment period.

During the draw period, you can borrow from the credit line by check, transfer or a credit card linked to the account. Monthly minimum payments often are interest-only during the draw period, but you can pay principal if you wish. The length of the draw period varies its often 10 years.

During the repayment period, you can no longer borrow against the credit line. Instead, you pay it back in monthly installments that include principal and interest. With the addition of principal, the monthly payments can rise sharply compared with the draw period. The length of the repayment period varies its often 20 years.

At the end of the loan, you could owe a large lump sum or balloon payment that covers any principal not paid during the life of the loan. Before you close on a HELOC, consider negotiating a term extension or refinance option so that youre covered if you cant afford the lump sum payment.

Dont Miss: Reverse Mortgage Manufactured Home

Read Also: How To Eliminate Mortgage Insurance Premium

How A Home Equity Like Of Credit Works

Home equity lines of credit are another type of second mortgage that let you borrow cash from your home equity without changing the terms on your first mortgage.

In some ways, HELOCs are more like credit cards than home equity loans. Because you get a credit line you can borrow against, repay, and borrow again. And you pay interest only on your outstanding balance.

And HELOCs differ from HELs in another way.

Home equity loans are installment loans, like a mortgage or auto loan. You borrow a lump sum and pay it back in equal installments over the loans fixed term, usually at a fixed interest rate. So theyre predictable and easy to budget for.

But, with HELOCs, you typically get a loan in two parts.

- During your draw period you pay only interest, usually at a variable interest rate, on your current balance

- Then comes the repayment period, which can often last for half the draw period. During that time, you cant borrow any more but have to zero your debt before that period ends, while keeping up interest payments

HELOCs can be great for people whose incomes fluctuate a lot, such as contractors, freelancers, and those in seasonal jobs. But theyre dangerous for those who are bad money managers. If you tend to max out your credit cards, you may well do the same with a HELOC.

When To Use A Heloc

You should note that a home equity line of credit is actually a type of second mortgage. However, we often think of it as something different.

This misconception is due to the characteristics of a HELOC. As mentioned above, instead of receiving a lump sum, you end up with an approved credit amount.

You can access the money as you need it, much as you would access a line of credit on a credit card. Some HELOCs even come with linked debit cards so that it is easy to access your line of credit.

Most HELOCs feature variable interest rates, so your rate and your payment can change, and go higher.

HELOCs can be useful, however. One of the most common uses for the home equity line of credit is the home improvement loan. This is because it allows you the flexibility to borrow as much or as little as you need.

If you end up needing more money, you can get it from your line of credit without having to re-apply for another mortgage loan.

Using a HELOC makes sense when you arent sure exactly what you will need, or if you want a low initial rate and you can pay off the loan quickly.

Read Also: How To Determine Mortgage Approval Amount

What Are Some Alternatives To Helocs

You can leverage the equity in your home with home equity loans, which differ from lines of credit in that they are taken out for a set amount and paid back on a regular basis with a fixed interest rate.

You may also consider a cash-out refinance, which involves refinancing your current mortgage into a smaller one, and pocketing the difference as cash.

What Is A Home Equity Loan

Unlike a HELOC, which allows you to draw out money as you need it, a second mortgage pays you one lump sum. You then make fixed-rate payments on that sum each month until its paid off. It essentially is the same as your first mortgage, only instead of using the loan proceeds to purchase a house, you get an influx of cash.

Recommended Reading: How To See If You Qualify For A Mortgage