Searching For Homes Before Getting Pre

When you find the perfect house, theres no time to waste. In many hot markets, youll be up against multiple bids and stiff competition. Sellers are unlikely to consider offers from buyers who dont have a pre-approval letter from a lender. A pre-approval letter shows a seller that the lender has done its due diligence to ensure you have the means and motivation to repay your bills, based on your credit history and score, income and employment history, financial assets, and other key factors.

In a competitive market, sellers wont take you seriously without a pre-approval letter, and you could lose out on a home you really want. This document lists the loan amount for which you qualify, your interest rate and loan program, and your estimated down payment amount. In some cases , lenders might ask you to provide proof of funds for a down payment. The pre-approval letter also includes an expiration date, usually within 90 days.

Dont Delay: Start Your Home Financing Journey Today

If youre considering buying a home, applying early in the process offers big benefits. It allows you to determine a price range in which to search, and real estate agents and sellers will take you more seriously if you have financing lined up.

A full Pre-Approval offers the greatest benefits, but a quick and simple Pre-Qualification is a good way to get started. Get prequalified online now in fewer than 10 minutes with Guidance Residential.

Will Getting Preapproved By Multiple Lenders Hurt My Credit Score

If youre shopping around for a mortgage with different lenders, the multiple credit inquiries they conduct as part of the process are viewed as one inquiryif they all occur within a given period of time, typically within 45 days. This means your will not be negatively impacted, and allows you to get preapproved with multiple lenders in that window.

However, if you try to get multiple preapprovals but the applications dont all fall within that grace period, your credit score will be slightly impacted with each check.

Read Also: What Would My Mortgage Be With Taxes And Insurance

How Will I Know When My Loan Is Approved

With an in-house team of processors, underwriters, and closers, your Academy Loan Officer will be up to date on the status of your loan at all times and will frequently communicate with you throughout the loan process. In addition, you will receive five dynamic videos at specific milestones in the loan process that educate you on what is involved in each particular step: Documentation, Appraisal, Underwriting, Clear to Close, and finally, Congratulationsyouve completed the loan process!

At Academy Mortgage, we create life-changing experiences through lending. CONTACT US today to explore your financing options.

Related Articles

Review Your Financial Situation

Before you apply for preapproval, it’s a good idea to assess your current financial situation.

Pull your credit report: Under normal circumstances, you’re entitled to one free report from each bureau every 12 months, but you can now get a free credit report every week through April 2021. Review your credit history to make sure everything is accurate you can reach out to lenders and the credit bureaus to make corrections if need be.

Calculate your debt-to-income ratio: A key factor in getting prequalified for a mortgage, your DTI ratio represents your total monthly debt payments as a percentage of your monthly income. Most lenders won’t offer a loan that will put your DTI above 43%. So, if you currently have an auto payment of $300, monthly minimum credit card payments of $65 and a monthly income of $5,000, your lender will only approve you for a mortgage with a monthly payment of $1,785.

You May Like: What Does Private Mortgage Insurance Cover

Debts And Mortgage Pre

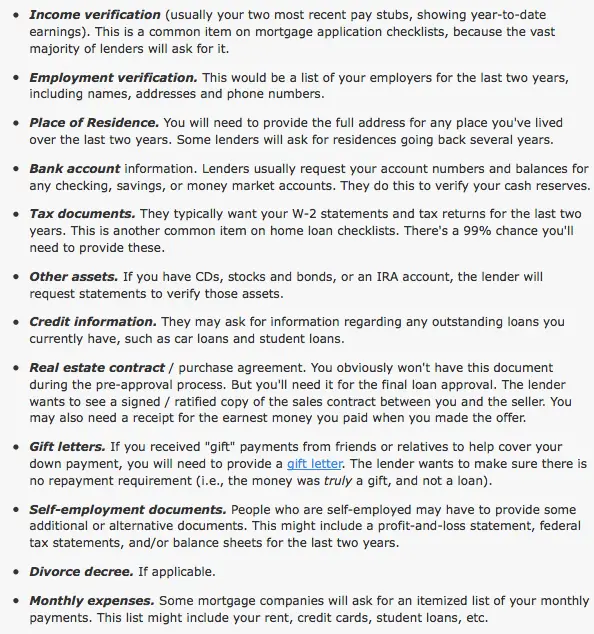

Lenders also examine other documents needed for a mortgage, like your monthly debt payments, to calculate your debt-to-income ratio. List all monthly debt payments, including student loans, auto loans, mortgage and credit cards.

Include each creditors name and address, and your account number, loan balance and minimum payment amount. Utility bills or records of other regular payments may be used to help you qualify for a mortgage If you have no credit history.

If you own a home and have a mortgage, youll need your most recent statement. Make sure you include the loan number, monthly payment amount, loan balance and the lenders name and address. Include the declaration page of the insurance policy, too. You will also need to provide a copy of your property tax bill. Your taxes are another part of your debt to income ratio.

For Freelancers And Independent Contractors

Self-employed borrowers dont receive W-2 forms or pay stubs from an employer, so theyll need to produce the following pre-approval documents to show theyve earned a steady income for at least the past two years:

- Business and personal tax returns from the past two years

- A copy of current state or business licenses, if applicable

- IRS Form 4506-T, which allows lenders to access your tax records

- A profit-and-loss statement

- Asset account statements, such as retirement or investment accounts

- Any additional income, such as Social Security or disability

You May Like: How To Know How Much Mortgage You Can Qualify For

There Are A Number Of Factors To Consider

A Tea Reader: Living Life One Cup at a Time

Purchasing real estate with a mortgage is often the most extensive personal investment most people make. How much you can afford to borrow depends on several factors, not just what a bank is willing to lend you. You need to evaluate not only your finances but also your preferences and priorities.

Here is everything you need to consider to determine how much you can afford.

Also Check: How Much Can I Loan For Mortgage

Calculate Your Income And Your Monthly Debt Obligations

The first step in preparing to apply for a mortgage is to document your monthly income and debt payments. Youll need to provide at least two weeks of pay stubs to your lender, so it doesnt hurt to start collecting those. If youre self-employed or have variable income, expect the underwriting process to be a bit more involved. You may, for example, have to submit copies of your past one or two tax returns. The lender may then count the average of your last two years income or the lower of the two numbers.

Getting approved for the mortgage you want is all about staying within certain ratios lenders use to determine how much you can afford for a mortgage payment. Large debt payments will limit the size of the mortgage approval you can get. If possible, pay these loans off or, at the very least, avoid taking any new loan payments on.

Also Check: When Does It Make Sense To Refinance Mortgage

How Do I Get A Mortgage Pre

First, find out how much you can spend on a mortgage with our mortgage affordability calculator. Then book an appointment with us for more help. Meet with usOpens a new window in your browser..

Scott on: CIBC Mortgage Advisors

Dont forget, once you find your dream home, you need to complete a full application to be approved for a mortgage2.

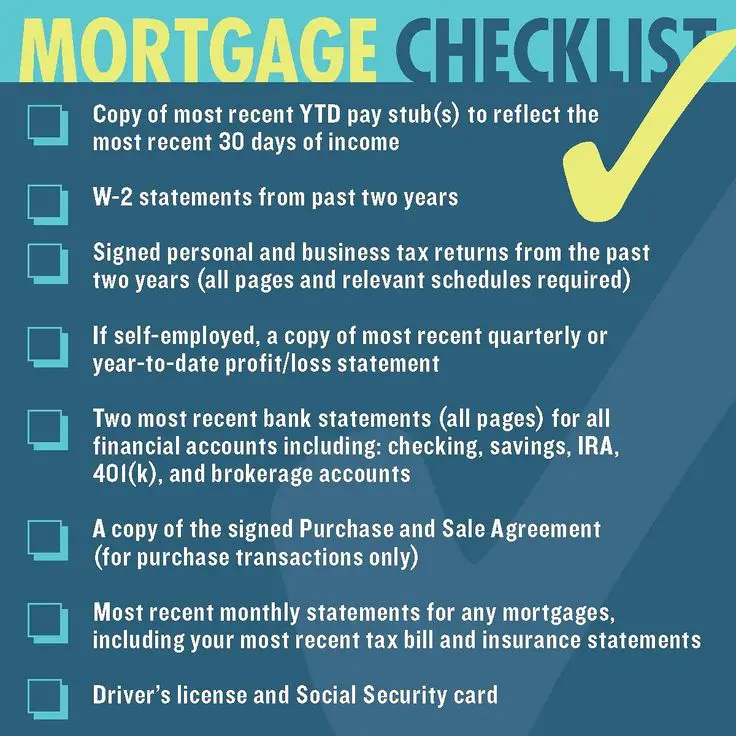

Ensure you have all the documents necessary for the mortgage application process with our required mortgage documents checklist .Opens a new window in your browser.

Get Your Approval Letter

Once you find the best mortgage solution for your needs, you can see if youre approved online. If you are, well send you a Prequalified Approval Letter that you can use to begin house hunting. If you want an even stronger approval, you may want to consider contacting a Home Loan Expert and applying for a Verified Approval.

Don’t Miss: How To Qualify For A Va Loan Mortgage

A Historic Opportunity To Potentially Save Thousands On Your Mortgage

Chances are, interest rates wont stay put at multi-decade lows for much longer. Thats why taking action today is crucial, whether youre wanting to refinance and cut your mortgage payment or youre ready to pull the trigger on a new home purchase.

The Ascents in-house mortgages expert recommends this company to find a low rate and in fact he used them himself to refi . and see your rate. While it doesnt influence our opinions of products, we do receive compensation from partners whose offers appear here. Were on your side, always. See The Ascents full advertiser disclosure here.

Read Also: What Do I Need To Become A Mortgage Broker

Five Things You Need To Be Pre

A mortgage pre-approval means that youre able to back up an offer with financing, which puts you ahead of the game.

If you submit a bid before meeting with our loan experts, a seller might reject your offereven if its a reasonable onebecause you dont have a financing option in place. And as a result, you could miss out on the perfect property.

This might seem a bit unfair, but put yourself in their shoes.

If you had to thumb through multiple offers and choose between a pre-approved buyer and a non-pre-approved buyer, which one would you pick? In most cases, youd go with the buyer whos already met with a lender.

With that being said, dont let your dream home slip through your fingers. Getting pre-approved for a mortgage with Blue Spot Home Loans is a quick and simple process. Heres what we need from you to get started.

1. Proof of Identify

We must verify your identity and make sure you are who you say you are.

Be prepared to provide a photo ID, such as a copy of your drivers license, passport, military ID, or other state-approved identification.

Since your Social Security number also confirms your identity, well need this information, too.

Once you provide us with an authorization, well use this number to pull your credit report, as well as request transcripts of your tax returns from the Internal Revenue Service.

2. Proof of income

Your income plays a major role in the pre-approval process because its used to estimate how much youre able to borrow.

Bottom Line

Recommended Reading: Which Credit Report Do Mortgage Companies Use

The Buyers Employer Or Job Title Changed

Changing jobs even for higher pay can ruin your pre-approved mortgage.

If you plan to make any of the following changes in your job or career, ask your mortgage lender before making the change:

- Becoming a partner in a company

- Starting a new business

- Switching from a salaried position to a salary + bonus position

- Changing industries

- Accepting payment in cryptocurrency

Its okay to make changes in your career. Be sure to speak with your lender to avoid unintended consequences.

Correct Credit Score Errors Pronto

If your credit file infos wrong, you have a right to do something about it either having the error corrected or, at the very least, having your say.

Your first step should be to check if the error is on your credit file held with other agencies, then talking to the lender. If this doesnt work, the free Financial Ombudsman could step in and order corrections.

Heres our step-by-step help:

Check your file with other agencies. See if your file with them has the same error. If you get it corrected with one agency the information should be sent to the others, but its better to contact them yourself to ensure your file with all three TransUnion, Equifax and Experian have the right details.

Contact the lender. Most will have a system in place to deal with customer disputes, and if youve proof, it should be resolved quickly. Write to it, say you think the error is unfair and ask it to wipe it from your file.

If its a default and youre prepared to settle with your lender, either in part or in full, you could also try negotiating with it. As part of negotiations, you could make a condition of settlement that the default is wiped off your credit file. Companies can do this for disputed defaults.

Read Also: What Is Current 30 Year Fixed Rate Home Mortgages

Employment And Income History

When you apply for a mortgage, lenders go to great lengths to ensure that you earn a solid income and have stable employment. Thats why lenders request two years worth of W-2 tax forms and contact information for your employer. Essentially, lenders want to ensure that you can handle the added financial burden of a new mortgage.

Youll also be asked to provide salary information, so a lender has evidence that you earn enough money to afford a mortgage payment and related monthly housing expenses. Youll also have to provide 60 days of bank statements to show that you have enough cash in hand for a down payment and closing costs.

How Long Does Preapproval Last

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

Also Check: How To Include Renovation Costs In Mortgage

Can You Get A Mortgage With Bad Credit

You can still get a mortgage even if you have bad credit, although youre likely to pay a much higher interest rate to compensate for the increased risk to the lender.

Government-backed loans, like FHA loans, specifically cater to borrowers with lower credit scores. But even if youre not certain that youll qualify, its worth offering some extra security to your lender.

For example, you might give a larger down payment or set aside extra cash reserves to show the lender you have the money to repay the mortgage loan. Or you might give proof that youve consistently paid your rent on time for an extended period.

Check Out Our Top Picks for 2022:Best Mortgage Loans for Bad Credit

You could also try writing a letter to explain your credit situation. This can be done, especially if its due to an extenuating circumstance like emergency medical bills. Be upfront in asking your lender what you can do to qualify for a loan, even if you might not meet the usual underwriting standards right away.

If youve had a bankruptcy or foreclosure in your past, there are a few rules that you simply cant get around. The exact specifics depend on your loan type.

However, in general, you have to wait for a predetermined seasoning period after the bankruptcy or foreclosure has been discharged before you can get approved for a home loan.

For bankruptcies, the seasoning period is typically between two and four years. For foreclosures, youll need to wait between three and seven years.

What Is Mortgage Modification

When someone gets behind on their mortgage or discovers that they can no longer make the payments, a mortgage modification is the best option to pursue. Through a mortgage modification, you are asking the lending company to change the terms of your mortgage so that payments become more manageable. You do away with the initial terms of your agreement and instead create a plan that better fits your current financial situation.

Don’t Miss: Are Closing Costs Added To Mortgage

If Youre Applying For A Mortgage Its A Good Idea To Start Prepping Your Financial Documents

Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation. For example, someone who is self-employed will likely have to provide different forms than someone who is employed by a company.

Although the exact forms might vary, Todd Huettner, owner of Huettner Capital, a residential and commercial real estate lender, says a lender can get a good sense of your likelihood of being approved by checking out your recent pay stubs, bank statements, W-2 forms and tax returns.

Huettner says that with these documents, hes able to make a good assessment of the borrower. These documents allow me to tell what they can and cannot do with a very high level of certainty, he says.

Depending on your unique financial situation, here are seven mortgage documents you might need when applying for a home loan.

More Options For First

You can also explore newer mortgage programs available for homebuyers with low to moderate-income. The Freddie Mac Home Possible mortgage, for example, allows you to purchase a home with a down payment of just 3%. Fannie Mae also offers a 3% down payment option with the HomeReady loan, as long as you have a credit score of at least 620.

Don’t Miss: Can You Wrap Closing Costs Into Mortgage

How Does Financing A Car Work

Whether youre financing or leasing a car through your own bank, or through the dealership or OEM, auto financing works like other types of loans. Youll agree to the purchase price plus other fees, including the down payment, interest rate. Youll also receive a payment schedule, which tells you your monthly payment and how long itll take you to pay back the loan. Here are some key terms to be aware of:

What Else Do You Need To Get Approved

In addition to your credit scores, your mortgage lender looks at a few other factors to approve your home loan. Theyll review your employment situation to make sure you have a steady income to make your monthly mortgage payments.

Youll most likely need to submit pay stubs, bank statements, W-2s, and sometimes even a verification of employment form. If youre serious about purchasing a home, start setting these documents aside in a safe place so you have them ready to give to your lender when the time comes.

Not only does the lender look at your debt-to-income ratio and other financials, but theyll also check out the actual home youre purchasing. Some types of home loans require the house to be in a certain condition, which can take rehabilitation projects off the table.

Before making an offer, check with your lender on what types of properties you can consider. That allows you to avoid making an offer you cant follow through on. The propertys appraisal also needs to come in at or above the amount of the loan because a lender cannot loan more than the appraisal value.

Also Check: How To Calculate House Mortgage Payment