Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

How To Find The Best 20

Its always a good idea to start with a lender you already have a relationship withsay for a checking account or another loan. But dont stop at just one lender: You should always compare rates and terms with several lenders to find the best loan for you.

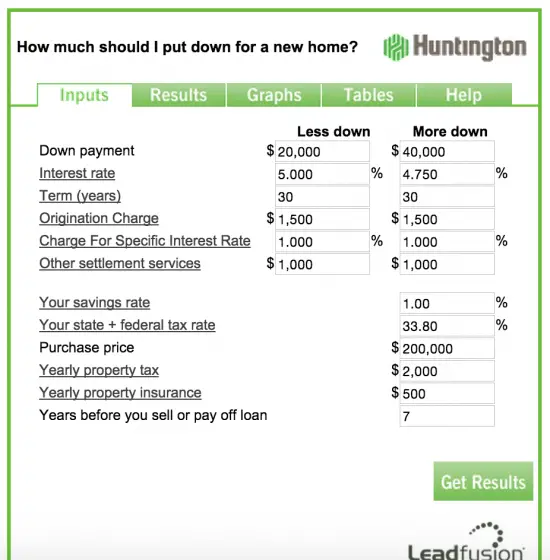

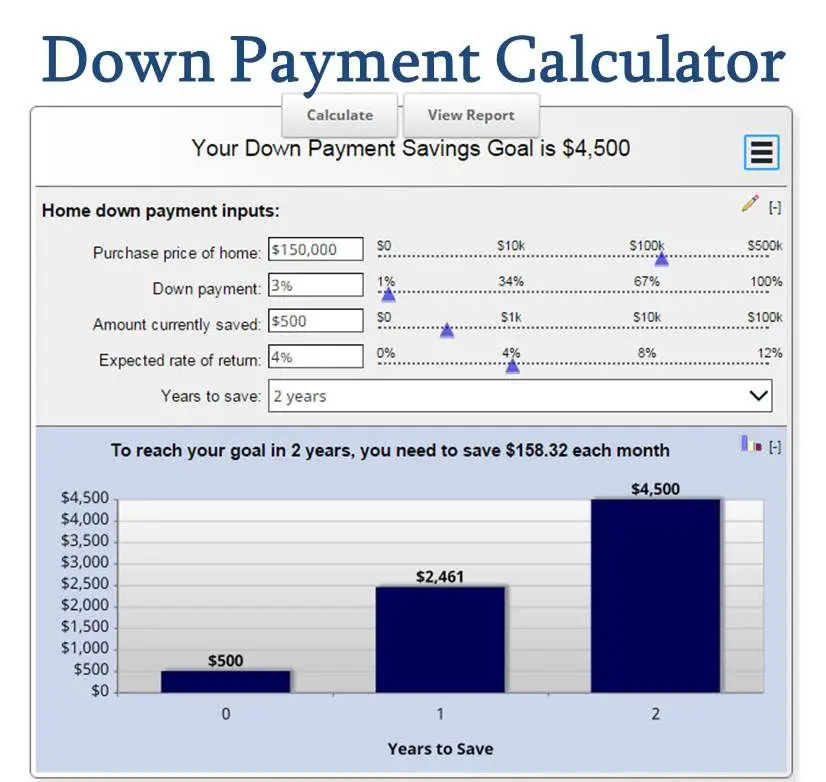

Before you apply, try to get your credit score in the best shape possible and make sure you have all your paperwork ready. Our calculator can help give you a rough estimate of what you can afford and help you think through multiple scenarioslike the length of the loan, whether you prefer to make a bigger or smaller down payment and so on.

You May Like: What To Look For When Refinancing Your Mortgage

How Much Should You Save For A Down Payment

Save up a down payment of at least 20% so you wont have to pay private mortgage insurance . PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage. If youre a first-time home buyer, a smaller down payment of 510% is okay toobut then you will have to pay PMI. No matter what, make sure your monthly payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage. And stay away from VA and FHA loans!

Saving a big down payment takes hard work and patience, but it’s worth it. Here’s why:

- Youll have built-in equity when you move into your home.

Can You Buy A Home With Low Money Down

It is possible to buy a home with little or no money down, however the ability to do so depends on how tight lending standards are, the background of the applicant & the credit quality of the applicant. Some programs are available exclusively to military members, low income communities & first time home buyers.

Don’t Miss: How Much Mortgage Can You Get

Should You Choose A 15 Or 30 Year Mortgage

A 15-year mortgage can have higher payments than a 30-year mortgage, but can save you money in interest. Use our free calculator to estimate your payments and savings!

All fields are required.

A 15-year mortgage might save you$1225 over 7 yearsThe estimated monthly payment is$

A 30-year mortgage might save you$0 over 7 yearsThe estimated monthly payment is$

How Much House Can I Afford On My Salary

Lets say you earn $70,000 each year. By using the 28 percent rule, your mortgage payments should add up to no more than $19,600 for the year, which equals a monthly payment of $1,633. With that magic number in mind, you can afford a $305,000 home at a 5.35 percent interest rate over 30 years. But youd need to make a down payment of 20 percent.

Also Check: How To Get Your Mortgage Paid For Free

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Different Loans Different Down Payment Requirements

In the U.S., most conventional loans adhere to guidelines and requirements set by Freddie Mac and Fannie Mae, which are two government-sponsored corporations that purchase loans from lenders. Conventional loans normally require a down payment of 20%, but some lenders may go lower, such as 10%, 5%, or 3% at the very least. If the down payment is lower than 20%, borrowers will be asked to purchase Private Mortgage Insurance to protect the mortgage lenders. The PMI is normally paid as a monthly fee added to the mortgage until the balance of the loan falls below 80 or 78% of the home purchase price.

To help low-income buyers in the U.S., the Department of Housing and Urban Development requires all Federal Housing Administration loans to provide insurance to primary residence home-buyers so that they can purchase a home with a down payment as low as 3.5% and for terms as long as 30 years. However, home-buyers must pay an upfront mortgage insurance premium at closing that is worth 1.75% of the loan amount, on top of the down payment. In addition, monthly mortgage insurance payments last for the life of the loan unless refinanced to a conventional loan. For more information about or to do calculations involving FHA loans, please visit the FHA Loan Calculator.

Recommended Reading: What Is A Pre Qualified Mortgage

Homes Not In Designated High

The limits in the first row apply to all areas of Alabama, Arizona, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Texas, Vermont, Wisconsin & most other parts of the continental United States. Some coastal states are homes to metro areas with higher property prices which qualify the county they are in as a HERA designated high-cost areas.

The limits in the third row apply to Alaska, Guam, Virgin Islands, Washington D.C & Hawaii.

| Units |

|---|

How A Mortgage Calculator Can Help

As you set your housing budget, determining your monthly house payment is crucial it will probably be your largest recurring expense. As you shop for a purchase loan or a refinance, Bankrate’s Mortgage Calculator allows you to estimate your mortgage payment. To study various scenarios, just change the details you enter into the calculator. The calculator can help you decide:

Read Also: How Long Does It Take To Get A Home Mortgage

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

How Smartasset’s Mortgage Payment Calculator Works

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

You May Like: What Is Usda Mortgage Insurance

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youâll make monthly paymentsâwhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

What Happens When You Qualify For A Loan

To begin the mortgage process, youll need to meet with a lender and be prepared to provide proof of:

- How much you plan to put down on your home

Its likely your lender will approve you for more money than you should borrow. Just because you qualify for a big loan doesn’t mean you can afford it!

A good lender will clearly explain your mortgage options and answer all your questions so you feel confident in your decision. If they dont, find a new lender. A mortgage is a huge financial commitment, and you should never sign up for something you dont understand!

If youre ready to get prequalified for a mortgage loan, we recommend talking with Churchill Mortgage.

You May Like: How To Get A Pre Qualification For Mortgage

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Also Check: Will A Cosigner Help Me Get A Higher Mortgage

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

You May Like: Can I Refinance My Mortgage With No Closing Costs

What Happens After You Get Preapproved For A Home Mortgage Loan

Getting preapproved for a mortgage is just the beginning. Once the financial pieces are in place, its time to find your perfect home! While its one of the most exciting stages of the process, it can also be the most stressful. Thats why its important to partner with a buyers agent.

A buyers agent can guide you through the process of finding a home, negotiating the contract, and closing on your new place. The best part? Working with a buyers agent doesnt cost you a thing! Thats because, in most cases, the seller pays the agents commission. Through our Endorsed Local Providers program, our team can match you with the top real estate agents we recommend in your area.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Recommended Reading: How Often To Refinance Home Mortgage

How Does A 15

A 15-year fixed-rate mortgage works similarly to other types of mortgages. You apply for the loan by providing proof of income, employment, assets and your credit history. If approved, you put down a certain amount of money, then make payments on the loan each month until it is paid off. The amount you can afford to borrow when you apply for a 15-year fixed mortgage depends on a variety of factors.

When you apply for a 15-year fixed-rate mortgage, you will typically take the following steps: