Which Loan Is Cheaper Interest Rate Vs Apr

| Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR | Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|---|---|

|

Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR |

Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|

Time into loan |

Dont Settle For A Mortgage With Lender Fees

With most mortgage lenders, closing costs comprise lender fees and third-party fees. But at Better Mortgage, we never charge lender fees, so there are no loan officer commissions, lender origination fees, application fees, or underwriting fees.

The competitive interest rate that you get will be accompanied with an APR that isnt inflated by unnecessary costs, which can equal thousands of dollars over the life of your loan.

Ready to get a Better Mortgage experience? Get your custom rates today.

This blog post is for informational purposes only, and is not intended to provide, and should not be relied upon for tax, legal or accounting advice.

- More

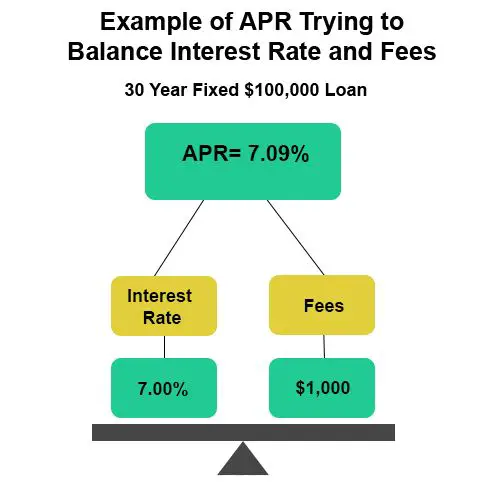

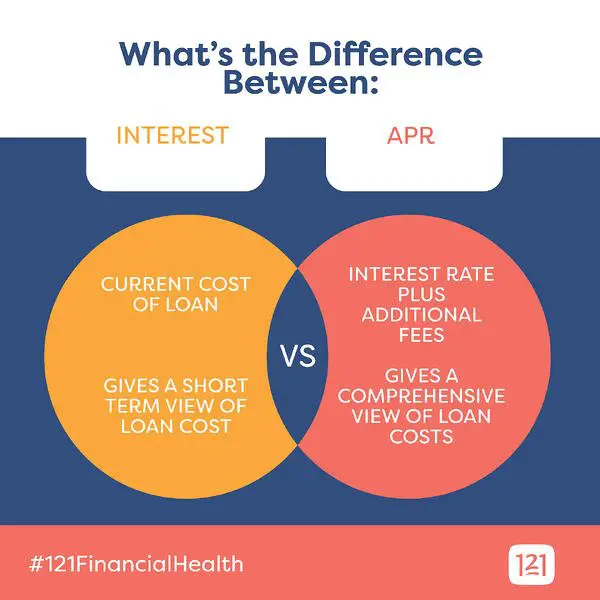

What Is An Annual Percentage Rate

A mortgage annual percentage rate is a number that captures the total cost of borrowing money to buy a home. It represents the interest rate a lender will charge you annually, plus other lender fees and closing costs. APRs are expressed as a percentage and calculated based on the total loan balance.

Unlike what you may be used to with credit cards, a given mortgage loans APR and interest rate wont usually be that close to each other you should expect the interest rate to be lower than the APR because its only capturing the amount youll pay to borrow money. An APR, on the other hand, typically accounts for several costs and fees, including:

- Mortgage interest rate

- Underwriting fees

- Other closing costs

As a result of combining all of these costs and fees into one number, APRs make it easier for consumers to compare loans even if those loans have different rates and fees. The Truth in Lending Act requires lenders to provide a loan estimate within three days of receiving a mortgage application APR information can be found on Page 3 of this document.

Recommended Reading: What Is A Mortgage Bond

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

-

At 3% interest rate = $843 in monthly payments

-

At 4% interest rate = $955 in monthly payments

-

At 6% interest rate = $1,199 in monthly payments

-

At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much youll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Final Thoughts On Mortgage Rates

If youre looking for a lender that will provide you with favorable interest rates and is easy to work with, look no further than Vaster Capital. At Vaster, we prioritize total transparency, fast closings, and personalized assistance within a simple process. We also focus on flexibility and are able to lend to self-employed borrowers and foreign investors. So feel free to reach out to our lending experts today for more information about our process and loan options!

Read Also: How To Qualify For A Home Mortgage Loan

The Limitations Of An Apr

For starters, lenders arent required to include all of their fees in an APR, meaning theres no standardization across the industry. Consequently, fees included in an advertised APR will vary across lenders and some of your options may even include fees you may not even want or need, like discount points . Therefore, its imperative to understand what fees are included when you shop around. To put it simply, dont automatically assume that the lowest APR is the best deal available.

An APR also doesnt work very well with adjustable-rate mortgages since the APR calculation for these loans is based on somewhat arbitrary assumptions about future interest rate adjustments. Because these assumptions arent certain, a variable-rate APR is also uncertain especially when you take into consideration that its impossible to predict the future direction of interest rates.

There are also some scenarios in which an APR can be lower than your interest rate. The most common examples are when the lender is rebating all of their fees as well as third-party fees such as appraisals and title insurance or due to assumptions the lender makes when calculating their adjustable-rate mortgage products.

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market.

You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

You May Like: Can I Have Multiple Mortgages

Tools To Help: Refinance Breakeven Calculator And Mortgage Points Calculator

Since Clark believes that looking at the APR is bad way to determine your best deal for a mortgage, Team Clark has some tools that can help you with your calculations.

If youre refinancing, we have a breakeven calculator that lets you plug in the terms and fees for your quotes and determine which is better based on how quickly you can recoup the cost of upfront fees via interest savings on your monthly mortgage payment.

If youre trying to decide between a loan quote with points versus one without points, we have a mortgage points calculator that will help you find the amount of time that youll need to recoup the upfront fees you may pay to lower the interest rate.

You May Like: How Much Mortgage Can I Afford On 200k Salary

What Is A Good Apr

APR stands for annual percentage rate. The APR on a loan or other debt gives you a more complete picture of how the debt will accumulate than you would get from the interest rate alone. A good APR depends on your credit score and on the type of debt youre borrowing. If you want professional advice related to APR and matters of credit and debt, consider working with a financial advisor.

Don’t Miss: How To Determine Mortgage Pre Approval Amount

The Various Fees That Raises The Apr

Below are some of the common fees that affect APRs:

- Discount points: Lenders allow buyers to purchase points in return for a lower interest rate. The cost of a point is equal to 1% of the mortgage amount and typically lowers the interest rate on the loan by an eighth of a percentage point. For example, a buyer approved for a $1,000,000 loan could buy three points, at $10,000 each, to lower the interest rate from 4.5 to 4.125.

- Loan origination fees: Loan origination fees typically average about 1% of the loan amount. This cost can be especially significant for larger loans.

- Loan processing: This fee, which some lenders will negotiate, pays for the cost of processing a mortgage application.

- Underwriting: These fees cover an underwriters review of a loan application, including the borrowers income, credit history, assets and liabilities and property appraisal, to determine whether the lender should approve the loan application and what terms should be applied to the loan.

- Appraisal review: Some lenders pay an outside reviewer to make sure an appraisal meets underwriting standards and that the appraiser has submitted an accurate report of the homes value.

- Document drawing: Lenders often charge a fee for creating mortgage documents for a loan.

Closing costs that arent commonly in an APR calculation are notary fees, credit report costs, title insurance and escrow services, home appraisal, home inspection, attorney fees, document preparation and recording fees.

Summary Apr Vs Note Rate

The difference between APR and Note Rate is dependent on which costs are taken into consideration in its calculation. Due to the inclusion of total cost, use of APR is more beneficial than Note Rate. It also allows effective comparison of rates than the Note Rate. On the other hand, Note Rate is the usual rate used to demonstrate the annual interest on borrowings by many financial institutions.

References

Image Courtesy

Read Also: How Much Net Income Should Go To Mortgage

Also Check: Can I Refinance My Parents Mortgage

Where Are Mortgage Rates Headed This Year

Rates for home loans have soared this year, rising from 3.22% in early January to 6.39% this week for the most popular 30-year, fixed-rate mortgage. What happens next is anyones guess: a Forbes Advisor survey of experts predicts the year-end average anywhere from 5% to nearly 7%. If you are seeking a mortgage right now, consult multiple lenders and lock in a rate as soon as a competitive offer comes along.

How To Use Apr To Comparison Shop

The higher the APR, the more fees are required to get the loan. To comparison shop, ask the mortgage lender to quote you a certain rate. See if the loans APR is higher or lower than on other quotes.

For instance:

Loan #1: 3.0% rate, 3.12% APR Loan #2: 3.0% rate, 3.05% APR

You can see instantly that Loan #2 has fewer closing costs, as long as both these loans are the same type.

But what about when the rate is different? Example:

Loan #1: 3.0% rate, 3.05% APR Loan #2: 2.75% rate, 3.10% APR

Loan #2 is actually more expensive overall. It likely has large upfront costs. But if having the lowest possible monthly payment is your priority, you may still consider this loan.

Read Also: Can You Get A Second Mortgage On A Va Loan

Why Are Interest Rates Higher On Investment Or Rental Properties

Your interest rate will generally be higher on an investment property than on an owner-occupied home because the loan is riskier for the lender.

Youre more likely to default on a loan for a home thats not your primary residence. Thats a good reason to use our investment property mortgage rate tool to compare prevailing interest rates that you qualify for.

In addition to paying higher investment property interest rates, its likely youll have to make a higher down payment.

Conventional mortgages generally require at least 15% down on a one-unit investment property and 25% down on a two- to four-unit investment property.

Loan terms are usually shorter than the typical 30-year residential mortgage. After all, its a business transaction, rather than a home purchase.

How Do I Find The Best Loan Available When Im Shopping For A Home Mortgage Loan

Shopping around for a mortgage loan will help you get the best deal. Start with an internet search, or contact banks, credit unions, and other lenders and brokers in your area.

The internet is a good place to start your search. By doing a broad online search for mortgage rates in your area, you will get a good sense of the market.

Next, contact banks, credit unions, or other lenders and mortgage brokers in your area. Ask each lender or broker you call for:

- A list of current interest rates for their available mortgage loans and whether the rates being quoted are the lowest for that day or week.

- What fees the lender normally charges for each loan product.

- Each loans annual percentage rate . The APR tells you the yearly cost of the loan based on the interest rate as well as points, broker fees, and certain other charges that you may be required to pay, including certain closing costs.

- Whether the rates given for various products are fixed or adjustable, and what points or fees go along with different rates. Sometimes you can get a better rate if you pay points or additional fees. But make sure that you actually get a lower interest rate in exchange for the extra points you pay.

With all of the options out there, it is important to shop around and take the time to understand the terms of the different loans offered to you. Its a good idea to request loan estimates from at least three different lenders and compare them to choose the best loan for you.

You May Like: Can You Borrow More Than You Need For A Mortgage

Compare Loans Using Apr

When youre shopping for the best deal on a loan, compare APRs rather than interest rates. Fees may vary widely from lender to lender, so using the all-inclusive APR should provide you with a more meaningful comparison. Borrowers sometimes believe that the loan with the lowest interest rate is their best choice, only to discover later that the fees charged on that loan outweigh any cost savings in interest.

- Will the lender be charging you simple interest or compound interest ?

- Is the interest rate fixed or variable ?

- What fees and other costs will be included?

- What is the loans repayment term?

Important Reminders About The Mortgage Process

You May Like: How To Cut A 15 Year Mortgage In Half

Going Deeper Into The Apr Vs Interest Rates Discussion

While its important to understand the difference between the interest rate and APR of a loan, neither give you a complete picture of your repayment costs.

Perhaps most crucial concepts to understand are your total repayment cost and finance charge. The finance charge is the amount that youll end up paying back on top of your loan principal. Your total repayment cost is principal plus the finance charge.

Because total repayment cost is affected by both the interest rate and the length of repayment, this is where focusing too much on APR can lead you astray. This is particularly the case with student loans, which typically offer many repayment options, ranging from deferring payments until after youve graduated, to making full, partial or interest-only payments while still in school.

Remember that a longer repayment term lowers the APR if the interest rate stays the same, but will increase the total amount repaid. Also, keep in mind that private lenders usually charge higher interest rates for longer-term loans the shorter the loan term, the lower the interest rate.

Ideally, youd be able to compare loans using a chart like the one below, that shows not only interest rate and APR, but repayment term, origination fees, monthly payment, and finance charge.

Cost to repay a $10,000 student loan at different rates, APRs, and repayment plans

| Interest rate |

|---|

Not All Closing Costs Are Included In Your Apr

Its important to note all closing costs are included in the calculation of your APR. Lots of the most variable closing costs are included: origination fees, discount points, and mortgage insurance upfront premiums.

But some are excluded such as title costs, appraisal fees, local taxes, credit report fees, attorney and notary fees.

But, given that all lenders should calculate annual percentage rates in the same way, that still leaves APRs useful and comparable.

You May Like: Who Has The Best Reverse Mortgage Rates