Try These Strategies To Decrease Your Monthly Home Loan Bill

FOTOGRAFIA INC / Getty Images

Many homeowners would appreciate having a lower mortgage payment. Although refinancing is the most popular way to lower your mortgage payment, its not always the ideal option. The good news is that a few other strategies can help you reduce that regular bill without having to refinance into a whole new loan, including mortgage recasting, eliminating private mortgage insurance , and finding ways to reduce your property taxes and insurance.

Learning more about how to lower a mortgage payment without refinancing can help you choose the best strategy for your situation.

Extend Your Mortgage Term

Stretching out your mortgage payments over a longer term will lower your payment, but youll owe more interest over that longer term.

One way to extend your term is to refinance with a new 30-year loan. Another way is to contact your lender and ask for a loan modification.

To be approved, youll typically need to show you suffered a hardship that impacts your ability to make your payment. Examples include divorce, job loss, illness, disability or the death of a family member.

How To Make An Earnest Money Deposit

Earnest money deposits are placed in an escrow account managed by a third party, and arenât released until closing or one of the parties backs out of the transaction. That third party releases the funds based on the terms agreed upon by the buyer and seller.

That means you donât just make a check out to the seller when you submit your offer. Typically, you make the payment to the escrow company by check or wire transfer. While the deadline can vary, earnest money usually is due within three days of a signed and accepted offer.

Once the seller accepts your offer, you can work with your real estate agent to pay the earnest money deposit.

You May Like: How Do You Calculate Points On A Mortgage

What Is The 20% Business Tax Deduction

The 20% business tax deduction is a provision of the 2017 Tax Cuts and Jobs Act that allows certain businesses to deduct up to 20% of their qualified business income from their taxable income. This deduction applies to businesses that are organized as pass-through entities, such as sole proprietorships, partnerships, and S-corporations. The deduction is based on the businesss net income from taxable activities and is limited by a variety of factors such as the type of business, wages paid to employees, and the number of capital investments.

Comparing A $2000 Monthly Payment Frequency

| Payment Frequency | |

|---|---|

| $500 | $26,000 |

Monthly, semi-monthly, bi-weekly, and weekly all add up to the same amount paid per year, at $24,000 per year. For accelerated payments, youre paying an extra $2,000 per year, equivalent to an extra monthly mortgage payment. This extra mortgage payment will pay down your mortgage principal faster, meaning that youll be able to pay off your mortgage quicker.

This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments. Selecting between them lets you easily compare how it can affect your mortgage payment, and the amortization schedule below the Canada mortgage calculator will also reflect the payment frequency.

Don’t Miss: What Is The Government Refinance Program On Home Mortgage

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price. Then, select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youâll need for closing costs. Additionally, you can use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up and show what your outstanding balance will be over time.

If youâre buying a new home, itâs a good idea to use the calculator to determine what you can afford before you start house-hunting. If youâre renewing or refinancing and know the total amount of the mortgage, use the âRenewal or Refinanceâ tab to estimate mortgage payments without accounting for a down payment.

Find The Best Interest Rate

Do your homework and find the best interest rate and mortgage that fits your needs. Talk to us for help.

If you already have a mortgage, review your interest rate. If interest rates are lower now than when you signed your current agreement, consider refinancingPop-up your mortgage. A lower interest rate could reduce your ongoing payment. Just be aware of any prepayment chargesPop-up. Do the math and consider whether you come out ahead in the end.

Recommended Reading: How Long Until You Can Refinance A Mortgage

Is There A Disadvantage To Paying Off A Mortgage

A: Paying your mortgage off early and closing out an account could impact your credit score. Mortgages are considered “good debt,” and paying it off extremely early could negatively affect your score. But, remember, you can alwaysrefinance to a shorter-termif you are determined to pay it off sooner. In addition, you could possibly get a lower interest rate in the process and be able to pay your loan off sooner.

Related Articles

Cancel Your Mortgage Insurance

Mortgage insurance is a fee that many homeowners pay every month with their mortgage payments. This fee protects your lenders interest if youre unable to repay your loan. Its typically charged if you bought your home with a down payment of less than 20% of the purchase price or refinanced into a new mortgage with less than 20% equity.

Canceling can be challenging, but if youre eligible, it will lower your payment, says Juan Rodriguez, a Zillow mortgage loan officer in Irvine, Calif.

Whether you can remove your mortgage insurance depends on:

- Whether you have a second mortgage or a home equity line of credit.

- Your lenders cancellation policies.

To request cancellation, you may have to pay for an appraisal. That could cost as little as $150 for an automated valuation or as much as $500 or more for a full appraisal.

Also Check: Can You Refinance An Arm Mortgage

Choose Your Debt Amount

Home > Real Estate > How to Get a Mortgage > Paying off a 30-Year Mortgage Early

Buying a house has never been cheap, but lately, its become more challenging for potential homebuyers to lock in an affordable place to call home.

If you already own a home, paying off your mortgage early can offer benefits like increased cash flow and interest savings. Building equity in your home is enticing, especially for first-time homeowners, however, the rise in housing costs will influence your strategy to pay down your mortgage early.

As of February 2022, housing prices have jumped by nearly 20% from the previous year, and Fannie Mae predicts costs will climb by another 11.2% by December.

For interest rates, as of June 2022, a 30-year fixed-rate mortgage sits at 6.18%, a 3.15% rise from the previous year. A 15-year fixed mortgage sits at 5.38%, a 2.96% rise.

However, getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster, could still be enticing, especially for first-time homeowners. Once that mortgage debt is wiped out, money used there could be moved to retirement savings or college savings for children.

And then there is the tax benefits of owning the home, which should not be ignored. The more careful the process and analysis, the better informed you can be.

Anyone who is uncertain can find help through a nonprofit credit counselor, who could offer advice on your equity, debts and financial plan.

Move To A Less Expensive Home

Sometimes, people wind up with more house than they can afford. If you decide that you cant afford your mortgage and other strategies wont work, consider selling.

Staying in a house you cant afford can lead to heartache, sleepless nights, and to default the worst outcome for your finances. If you sell, you can use the proceeds to buy a less expensive place, or you could invest the money and rent. Remember to factor in a real estate commission if you use an agency to sell your property.

Recommended Reading: How Much Have I Paid Off My Mortgage

How Do Interest Rate Hikes Affect Inflation

When interest rates are higher, they encourage people to save. Since it is a good time for people to save, less borrowing and spending tends to happen. When this happens, companies may increase their prices at a slower pace or even lower prices to get people to spend again. This reduces inflation since the costs of goods arent going up in price as quickly as they would otherwise.

Lower interest rates work in the opposite way. Not only does it cost less to borrow money when interest rates are low, but you also earn less from keeping your money in savings, which means you may end up spending more money. This increase in consumer spending could cause prices to rise as consumers are willing to pay more.

The Bank of Canada actively uses interest rate increases and decreases to control inflation. The BoC tries to keep inflation at 2% a year as most of the population can handle that level of year over year change.

Shop Around For Lower Insurance Rates

If you pay for your homeowners insurance through your mortgage payment, shopping for less costly insurance could lower your payment.

The challenge is to find not only a lower rate, but also an equally reputable insurer and similar coverage.

Raising your deductible will also typically lower your rate. With an increased deductible, your out-of-pocket cost will be higher if you file a claim.

Don’t Miss: When To Refinance Your Mortgage Dave Ramsey

Why Did My Mortgage Payment Go Up

Because many home loans require that taxes and insurance costs be lumped into your mortgage mortgage payment, your payment amount will go up if your property taxes or home insurance premiums increase. Even if you have a fixed-rate loan, property taxes and insurance premiums are not fixed amounts. Therefore, you can expect to pay a slightly different amount each year.

What Determines Mortgage Rates

Mortgage interest charges described in the form of a percentage rate effectively define the amount of fees that are charged by a financial lender for the serving of your loan. Financial firms who extend mortgages to borrowers maintain some control over these mortgage rates, but also need to remain competitive with other lenders. Noting this, fluctuations in mortgage rates set by the Federal Reserve, a government institution, tend to move with the shape of the larger housing and lending market. However, lenders do enjoy some flexibility in the interest rates that they choose to offer, with the best rates typically reserved for buyers with high credit scores, low debt-to-income ratios, a strong history of bill repayment, and a low-risk profile in general.

In other words, the government is a primary driving force in helping set and maintain mortgage rates in the market. Lenders tend to follow the general direction of the market, though they may also extend more favorable mortgage rates to certain home buyers at their discretion. As a rule of thumb, the higher your mortgage interest rate, the more you can expect to pay in mortgage-related fees each month.

Several factors may impact the total interest that you can expect to pay over the life of your loan as well, including the term of the loan , your credit profile, down payment amount, and more.

Don’t Miss: How To Calculate Mortgage Debt Ratio

How To Use This Mortgage Payment Calculator

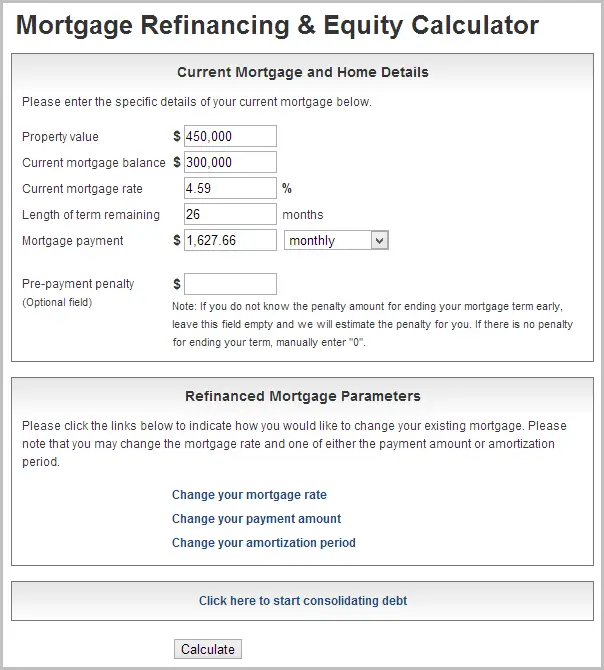

Our mortgage payment calculator computes payments based on your home value, equity, mortgage term and amortization.

To calculate your mortgage payment:

- Select your mortgage type: purchase, refinance or renewal

- Input the province, home value, down payment / mortgage amount and amortization period

- Choose your desired mortgage term and rate type

The calculator will update the calculations each time you change a number.

Tip: If youre renewing or refinancing your mortgage, select the Renewal/Refinance tab to estimate your potential mortgage payments without having to input a down payment.

You can even compare two rates side by side to see which saves you more.

Does Your Down Payment Affect Your Monthly Mortgage Payments

Just as it typically results in a lower interest rate, a larger down payment usually means smaller monthly payments. Since the balance of your loan is less, your monthly payments are smaller.

Lets say you want to purchase a $300,000 home with a down payment of 10% on a 30-year mortgage. The balance of your loan would be $270,000, with payments divided between 360 months. Without considering interest, taxes or insurance, your monthly payment in this example would be about $750.

Now, lets say that you put down 20% instead. This would lower the principal amount on your loan to $240,000. On a 30-year mortgage, your monthly payment would be about $667 .

Though youd pay more upfront, the principal portion of your monthly payments would be about $83 less. That might not seem like much, but its also not the full picture. A 20% down payment could save you hundreds of dollars a month on mortgage insurance, and it could also mean a better interest rate.

For a closer look at how your monthly payment can be affected by the size of your down payment, try a mortgage calculator. Youll enter some basic info to get an estimated monthly payment, and you can adjust down payment amounts to see what works best for you.

Also Check: What’s The Mortgage On 500k

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate is guaranteed to remain unchanged for the length of your mortgage term.

- A variable interest rate can change during your mortgage term. This will not affect your mortgage payment for the duration of the term, but adjusts what percentage of your payment goes to paying off the mortgage principal.

What Are Todays Refinance Rates

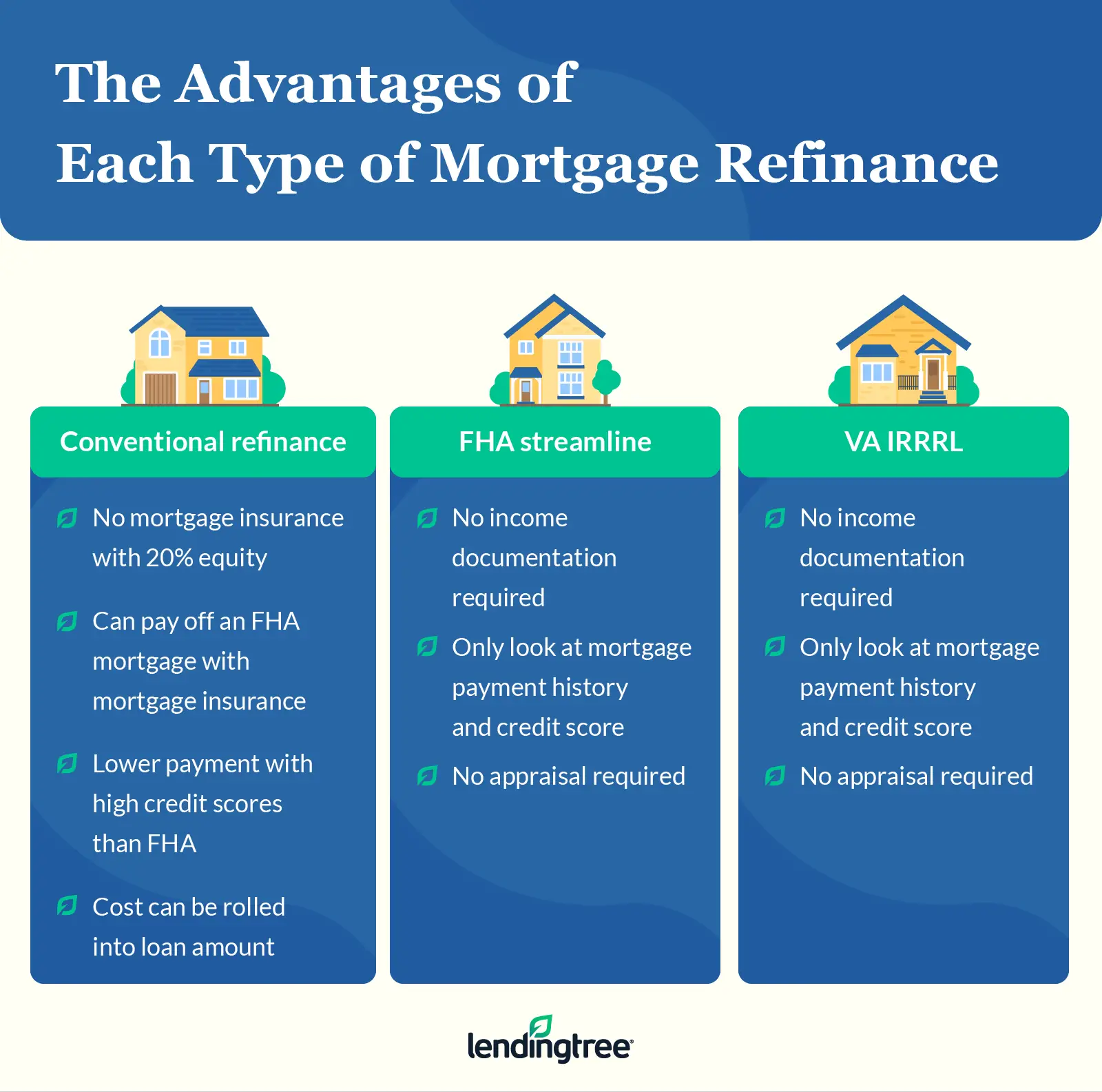

Nationwide, average refinance rates are higher than the low rates available back in 2020 and 2021. But some homeowners may still benefit from a mortgage refinance. I advise that you talk to a qualified mortgage planner or loan officer who can provide you with a mortgage plan that best meets your needs, Laffey recommends.

Even if youre not sure whether a refinance will work for you, its worth talking to a mortgage lender about your options.

Don’t Miss: How Do I Get A Mortgage Statement

You Might Qualify For Special Programs

Dealers may offer special financing programs with low rates or other incentives. In some cases, these programs require you to make a larger down payment.

When dealers advertise special incentives, theyre required to disclose the terms, so read the fine print carefully and ask questions to make sure you understand the down payment requirements.

Also Check: Rocket Mortgage Qualifications

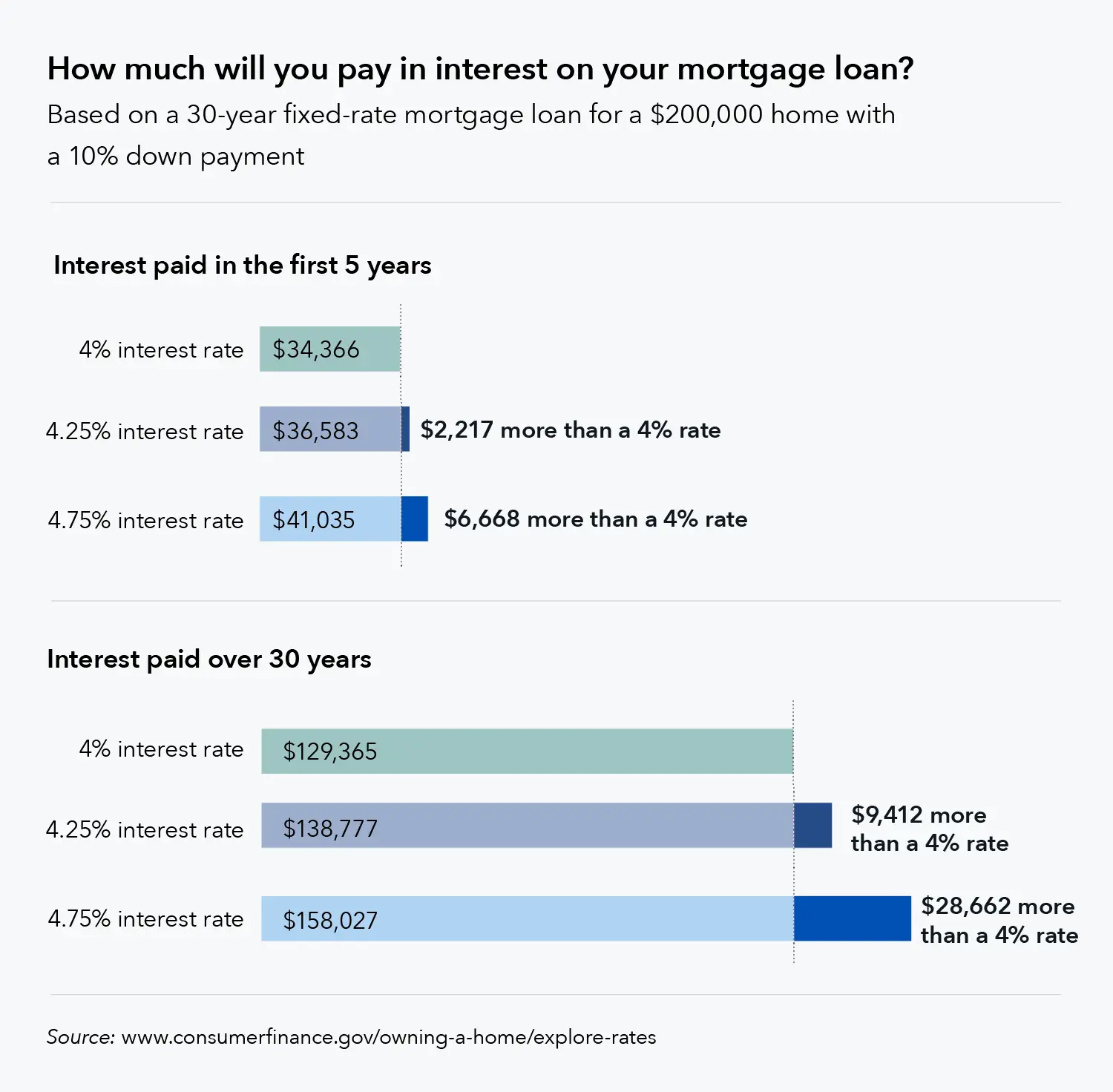

Refinance With A Lower Interest Rate

A lower interest rate can mean big savings. For example, on a $200,000 30-year-fixed loan, reducing the interest rate 1% can mean a monthly savings of almost $120.

If youre looking to lower your mortgage payment, keep an eye on the market. Look for rates that are lower than your current interest rate. When mortgage rates drop, contact your lender to lock your rate.

Another way to get a lower rate is to buy down your rate with points. Mortgage discount points are upfront prepaid interest paid as a part of your closing costs to get a lower rate. Each point is 1% of the loan amount. For example, on a $200,000 loan, one point would cost you $2,000 at closing. One mortgage point generally results in an interest rate reduction of .25% to .5%.

Whether discount points make sense for you is generally a matter of how long you plan to stay in the home. If you only see yourself in the home for a few more years, its probably less expensive to pay a slightly higher interest rate. However, reducing your rate by half a percent could save you thousands over the course of a 30-year loan.

Keep in mind that mortgage refinances are different from a mortgage recast, which is a lump-sum payment you pay toward your remaining principal. Both, however, may give you an opportunity to cut down on your mortgage bill.

Get approved to refinance.

You May Like: How Much Does A Mortgage Go Up For Every $1000

What Happens To My Variable Mortgage When There Are Interest Rate Increases

If you have a variable rate mortgage, when the prime interest rate increases this means that your mortgage payment may be higher which could impact your cash flow and budget.

Your advisor can clearly outline your options and work with you to decide on the best path forward. Contact your advisor to help choose the right mortgage option for you. This article is provided for information purposes only. It is not to be relied upon as investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this article, including information relating to interest rates, market conditions, tax rules and other investment factors are subject to change without notice, and The Bank of Nova Scotia is not responsible to update this information. All third party sources are believed to be accurate and reliable as of the date of publication and The Bank of Nova Scotia does not guarantee its accuracy or reliability. Readers should consult their own professional advisor for specific investment and/or tax advice tailored to their needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

1 All mortgage applications are subject to meeting Scotiabanks standard credit criteria, residential mortgage standards and maximum permitted loan amounts.