Payments Can Become More Predictable

If you have an adjustable-rate loan, you can refinance a fixed-rate mortgage instead. With an adjustable-rate loan, your interest rate changes over time, based on the market. That means it can rise or fall and your monthly payment will do the same.

With a fixed-rate loan, your interest rate stays the same throughout the life of the loan. This makes monthly payments more predictable because your combined principal and interest payment will stay the same. Remember that your escrow payment may fluctuate as property tax and insurance costs rise or fall. This consistency can make budgeting easier.

How To Make The Most Of Refinancing

If youve considered the above pros and cons and determined that refinancing could be the right move for you, then make sure that you’re getting the most bang for your buck. There are ways to reduce the short- and long-term costs of refinancing, such as improving your credit score, negotiating closing costs, and shopping around for the right lender.

Remember, not all lenders are equal. Selecting a lender that doesnt impose unnecessary fees could save you hundreds, if not thousands on closing costs. This means youll start seeing your refinance savings much sooner. At Better Mortgage, we never charge lender fees, like application fees, origination fees, or underwriting fees, and our loan officers never get paid commission.

Get pre-approved in as little as 3 minutes, and see your rates today.

This blog post is for informational purposes only, and is not intended to provide, and should not be relied upon for tax, legal or accounting advice.

- More

When Is It A Bad Idea To Refinance

To sum things up, refinancing isnt always a good idea even if you can get a lower mortgage rate.

Heres a look at when it might not make sense to refinance a mortgage loan.

- You wont keep the mortgage long enough to break even

- You cant get a lower interest rate

- You have issues with your credit score or credit history, and cant qualify

- Youre close to paying off the original mortgage

- Youll pay a lot more in the long run

- You cant afford closing costs

- Youre cashing out your equity for the wrong reasons

Remember that refinancing needs to have a net financial benefit. If a mortgage refinance wont improve your financial situation in some way, then its probably not worth it.

Don’t Miss: How To Get A Physician Mortgage

The Bottom Line: Should You Refinance

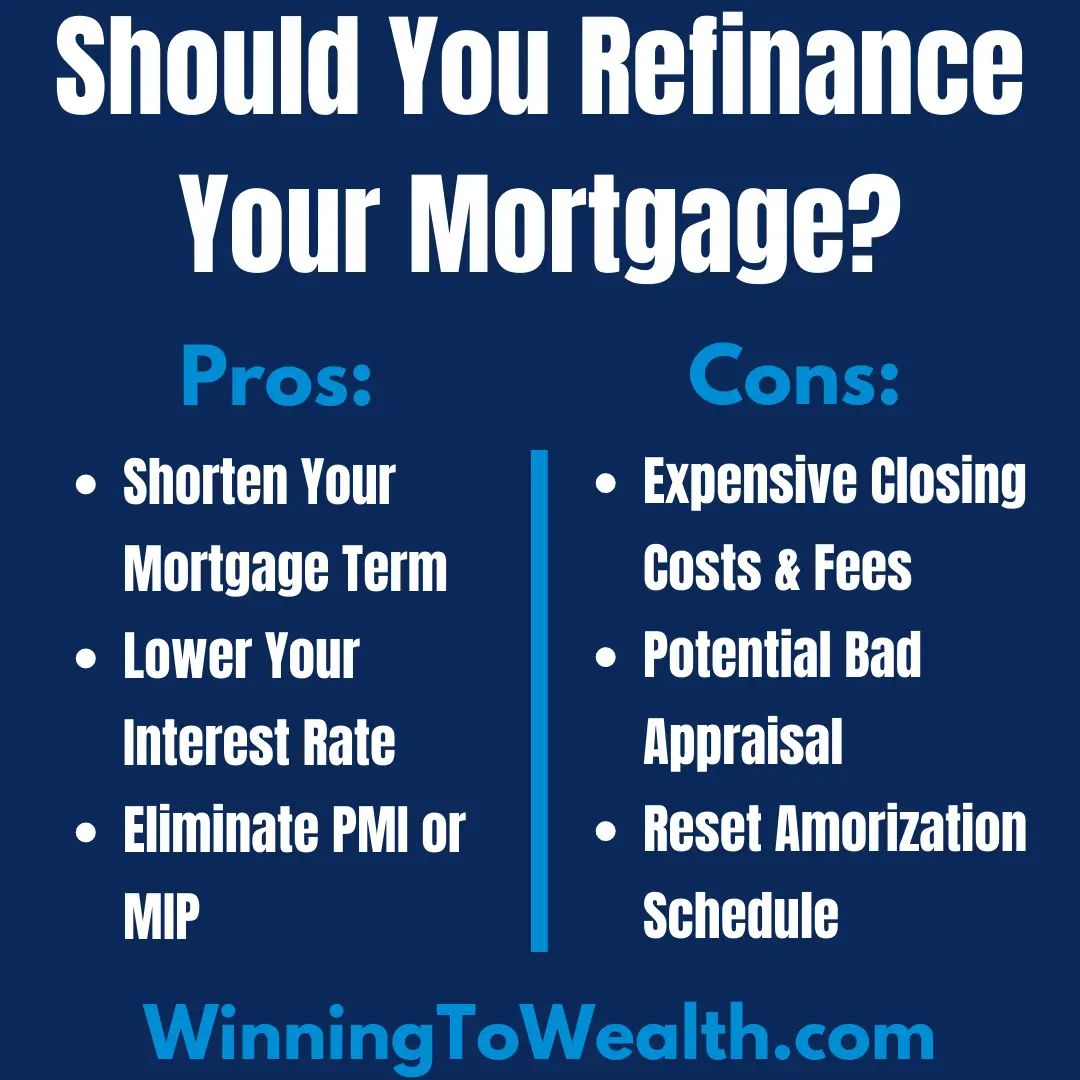

Refinancing can lower your mortgage rate, your monthly payment, and provide cash from your equity. Just make sure you consider the bigger financial picture before applying.

You need to consider the savings as well as the costs of refinancing both short-term and long-term.

- How long will it take to break even?

- How long do you plan to live in the house?

- How long is the new mortgage term?

- Will you pay more or less interest overall?

As long as you crunch the numbers beforehand, refinancing can be a great decision. Many homeowners save thousands, or even tens of thousands, by refinancing into a lower rate.

When Is It Worth It To Refinance

Despite the inherent drawbacks for instance, having to start your loan over refinancing is often worth it. Especially at todays near-record low interest rates, millions of homeowners could save on their housing costs.

Here are scenarios where its often a good idea to refinance.

- Youre able to lower your monthly mortgage payment

- Your new rate is 1% or more below your current rate

- Your credit profile has improved, and you can get a lower-rate loan

- You want to switch from an adjustable-rate mortgage to a fixed-rate mortgage

- You want to switch to a different loan program

- You plan to keep the mortgage long enough to break even with your closing costs

- You can afford closing costs upfront

- You want to eliminate FHA or USDA mortgage insurance

- You want to decrease or increase the loan term

- You want to tap your home equity

- Youre removing a name from the mortgage loan

There are plenty of ways a mortgage refinance can benefit you. Aside from saving you money each month, a refinance could help you consolidate debt, pay for home improvements, pay off your home early, and more.

If youre on the fence, talk to a mortgage advisor or loan officer who can help you explore your loan options and decide whether a refinance is worth it.

You May Like: Why Is There Hazard Insurance On A Mortgage

How Much Does A Va Refinance Cost

If you are refinancing an existing VA loan with a cash-out refinance, expect to pay a 3.6% funding fee, unless you are exempt. The 2.3% cash-out funding fee rate applies to those who are using their VA loan benefit for the first time.

For example, if you purchased your first home with a conventional mortgage and are now refinancing into a VA loan with the VA cash-out refinance, you would only be subject to a 2.3% VA funding fee.

Alternatively, the IRRRL has a funding fee of 0.5% for first time and subsequent use VA loan use. However, expect to pay closing costs like title insurance and real estate fees.

Get A More Desirable Payment Schedule

Refinancing allows you to switch up your loanâs payment schedule, which may be useful if your situation changes.

For example, if youâre feeling financially squeezed with a 15-year loan, you could refinance to a 30-year loan and reduce your monthly payments, giving you more breathing room in your budget.

Additionally, if you have an adjustable-rate mortgage and want a more consistent payment schedule â or if market rates are projected to spike â you could refinance to a fixed-rate loan for a more predictable monthly payment.

Recommended Reading: How Does Reverse Mortgage Work After Death

Should You Refinance Your Home Loan

Whether its a good idea to refinance your mortgage largely depends on your situation and your goals. You might also choose to refinance simply because mortgage rates are low and youre likely to save money over the life of your loan. No matter the circumstances, youll be in a better position to refinance if you have a good credit score and meet other lender requirements.

Refinancing isnt for everyone. For instance, you might not want to refinance if rates are high or you plan to move soon. Or it might not be a good time to refinance if you are experiencing financial hardship or having trouble affording your monthly mortgage payments. Maybe you recently bought your house, and its just too soon to refinance your mortgage.

Before deciding on whether to refinance, speak with your lender or one of our Home Loan Experts.

Pros Of Refinancing Your Home

There are many reasons why a mortgage refinance could be on your mind, especially when interest rates are increasing and you’d like to lock in a low fixed rate before they rise further. While rates are going up this year, you may still be able to save money if your current rate is high. But the advantages of refinancing go beyond the potential savings. Consider these pros:

You May Like: Can You Finance A Pool Into Your Mortgage

To Switch From An Arm To A Fixed

For some homeowners, this can be an excellent move, particularly if you intend to stay in the home for years to come. But homeowners who are simply afraid of the bad reputation of an adjustable-rate mortgage should carefully look at their terms before making a move to refinance.

If you have an ARM, make sure you know the index to which it is tied how often the loan adjusts and what the caps are on loan adjustments for the first cap, annual cap, and lifetime cap. It may be that a fixed-rate loan is better for you, but do the math before committing to spending money on a refinance.

Refinancing Can Help You Ditch Pmi

When its right for you:

- If you put less than 20% down when you purchased your home

- If you refinanced previously but still required private mortgage insurance

The challenge of coming up with a 20% down payment is difficult for many homebuyersespecially first-timers. In fact, according to a recent survey by the National Association of Realtors, more than three-quarters of first-time homebuyers end up putting less than 20% down.

While the option of a lower down payment may have helped you afford your home, it also likely meant an added cost: private mortgage insurance . Most lenders require the additional monthly cost of PMI to offset the risk of approving homebuyers who have less cash or equity up front.

If youve paid off enough of your current mortgage, or if your home has increased in value, then you may have enough home equity to get rid of PMI with a new loan.

Don’t Miss: Is Mortgage Insurance Required For Va Loans

How To Refinance Your Mortgage In 2023

If you think thereâs a chance you will refinance in 2023, there are several ways that you can prepare for a successful refinance.

For one, follow the Federal Reserveâs actions and watch what it does to the federal funds rate. While the Fed does not set mortgage rates, its hawkish or dovish monetary actions have a meaningful influence. This is because the bond market, which directly impacts mortgage rates, responds to Fed rate movements. In 2022, the Fed made six rate hikes through November, a key factor that drove up mortgage rates later in the year.

âItâs impossible to predict whatâs going to happen in the market, but following and understanding what the government is doing can help you make a more informed decision,â says Ward Morrison, president and CEO at Motto Franchising, the Denver-based company behind Motto Mortgage.

Here are some other steps you can take now so that you donât find yourself scrambling when youâre ready to refinance.

How Much Of A Down Payment Can You Afford

The typical down payment required for an FHA loan is just 3.5%. With jumbo loans, though, it is typically required that borrowers make a down payment of at least 10% of the home’s value. Some lenders might actually require you to make a down payment of as much as 20%.

So let’s say you’re purchasing an $800,000 house and your lender requires a 10% down payment that means your down payment alone wsill be $80,000. This doesn’t even account for your closing costs, inspections, or other fees you might incur during the process. So you can see how taking on a jumbo loan can quickly get even more expensive than taking on other loans that allow for lower down payments.

To ensure you’re spending as little money upfront as possible, be sure to find out your lender’s minimum down payment amount ahead of time. Ally Bank requires a minimum of 10%. SoFi also requires a 10% minimum down payment but on top of that, this lender won’t charge Private Mortgage Insurance , which can help you save some money on your payments each month.

-

Apply online for personalized rates fixed-rate and adjustable-rate mortgages included

-

Types of loans

Conventional loans, HomeReady loan and Jumbo loans

Also Check: How Much Does Mortgage Go Up Per 10000

Lock In A Better Interest Rate

A lower rate can reduce your lifetime interest costs by thousands of dollars. Consider refinancing when mortgage rates begin to dip. Most experts agree that you should consider refinancing if you can lock in a rate thats 0.75 percentage points lower than your current rate.

You may also be able to lock in a better rate if your credit score is higher than when you took out your original mortgage.

Learn More: When to Refinance a Mortgage: Is Now a Good Time?

Locking In A Lower Interest Rate

Securing a low mortgage interest rate is one of the most common reasons to refinance, especially if rates are lower now than when you first took out your mortgage. Lowering your interest rate can help you save money on interest payments over the life of the loan.

Factors to consider before taking advantage of a low mortgage interest rate include

- How long youve had your existing mortgage

- The difference between your current and would-be-new mortgage rate

- How much you might spend closing on your new loan

Before choosing to refinance to a lower rate, talk with your lender about how much money youll actually save over time.

Don’t Miss: Can You Pay More On Your Mortgage

Take Advantage Of New Loan Features

Refinancing means you can ask your lender to make features like redraw facilities and offset accounts available to you. An offset account acts like a transaction account which is attached to your home loan. Money deposited in it is offset against the balance of your loan when interest is calculated.

For example, if you have $50,000 in your offset and a $450,000 loan, interest will only be charged on $400,000 of the loan. A redraw facility allows you to make extra repayments on your loan and redraw these if needed, at the discretion of the lender.

An offset account is a great way to reduce interest on the loan, while a redraw facility can be advantageous in an emergency or if you need to make a large purchase. Your lender may increase your interest rate to accommodate adding these facilities, so make sure the savings add up compared to the expense you may incur.

Apply For A Home Equity Loan

A home equity loan lets you borrow up to 85% of your home equity as a lump-sum payment. You repay your principal and interest with fixed monthly payments, similar to a fixed-rate mortgage. Depending on your loan terms, your repayment period can be as long as 30 years.

Here are some of the advantages of home equity loans:

- Can use funds for different purposes: You can use your funds for a variety of expenses, including home repairs, medical bills, and debt consolidation.

- Potential tax deductions: In many cases, your interest payments are tax-deductible for home repairs and capital improvements for your primary residence.

- Fixed interest rate: Lenders offer fixed interest rates so you have the same monthly payment for the life of the loan.

Some of the disadvantages of home equity loans include:

- Lump sum payment: You receive your entire loan amount upfront and cannot request future withdrawals. If you dont need to spend the entire amount immediately, consider a HELOC, which allows you to make distributions as needed.

- Higher monthly payments: Your monthly payments can be higher than a HELOC as you start repaying the principal right away. Youre also accruing more interest than with a HELOC as your starting balance will most likely be higher.

- Secured debt: Home equity loans are secured debt, meaning your home is collateral. If you default on the loan, your lender has the right to foreclose on your home.

Don’t Miss: How Long To Pay Off 70000 Mortgage

Top 5 Reasons To Refinance And The Pros And Cons Of Each

Read, 3 minutes

With low interest rates, you might be thinking about refinancing your home. Doing so may lower your monthly mortgage payments and/or save on interest over the life of your loan. However, refinancing isnt just about the interest ratethere are costs and risks to keep in mind, too. Heres an in-depth look at the reasons to refinance, and the pros and cons youll want to consider.

Switch To A Fixed Rate

If your original loan is an adjustable-rate mortgage and your initial fixed term is about to expire, you may want to refinance to a fixed-rate mortgage. Locking in a fixed rate can protect you from rising interest rates in the future. And having the same principal and interest payment every month is easier to plan and budget for. Remember, you still have the option of refinancing for fewer than 30 years .

Recommended Reading: When Do You Start Paying Mortgage After Closing

You Move Towards A Longer

While refinancing into a home debt with a lower debt, the fee can set aside your cash every month. It can make certain to take a gander at the general expense of the advance. On the off chance that you have 5 years left to pay on your present credit and you, at that point, loosen up the installments into another 20 years advance, what will happen? You will wind up paying more in revenue by and large to get the cash. You will be left with 10 additional long periods of installments.

Paying For Closing Costs

Refinancing is similar to taking out a mortgage for the first time in that youre still expected to pay closing costs. These fees can be anywhere from 3% 6% of your new loan amount. For a $200,000 mortgage, for instance, you can expect to pay $6,000 $12,000 in closing costs.

Fees covered in closing costs include the application fee, loan origination fee, home appraisal fees, homeowners insurance and lender fees. Evaluate whether the costs associated with closing on your new loan are worth the savings that come with a refinance.

Also Check: How Does Private Mortgage Insurance Work

Enjoy More Predictable Payments

If you currently have an adjustable-rate mortgage , refinancing to a fixed interest rate will provide more stability in your monthly principal and interest payments. With a fixed-rate loan, youll pay the same amount every month for the entire loan term. This makes your mortgage payment easier to budget for and provides you with some peace of mind.

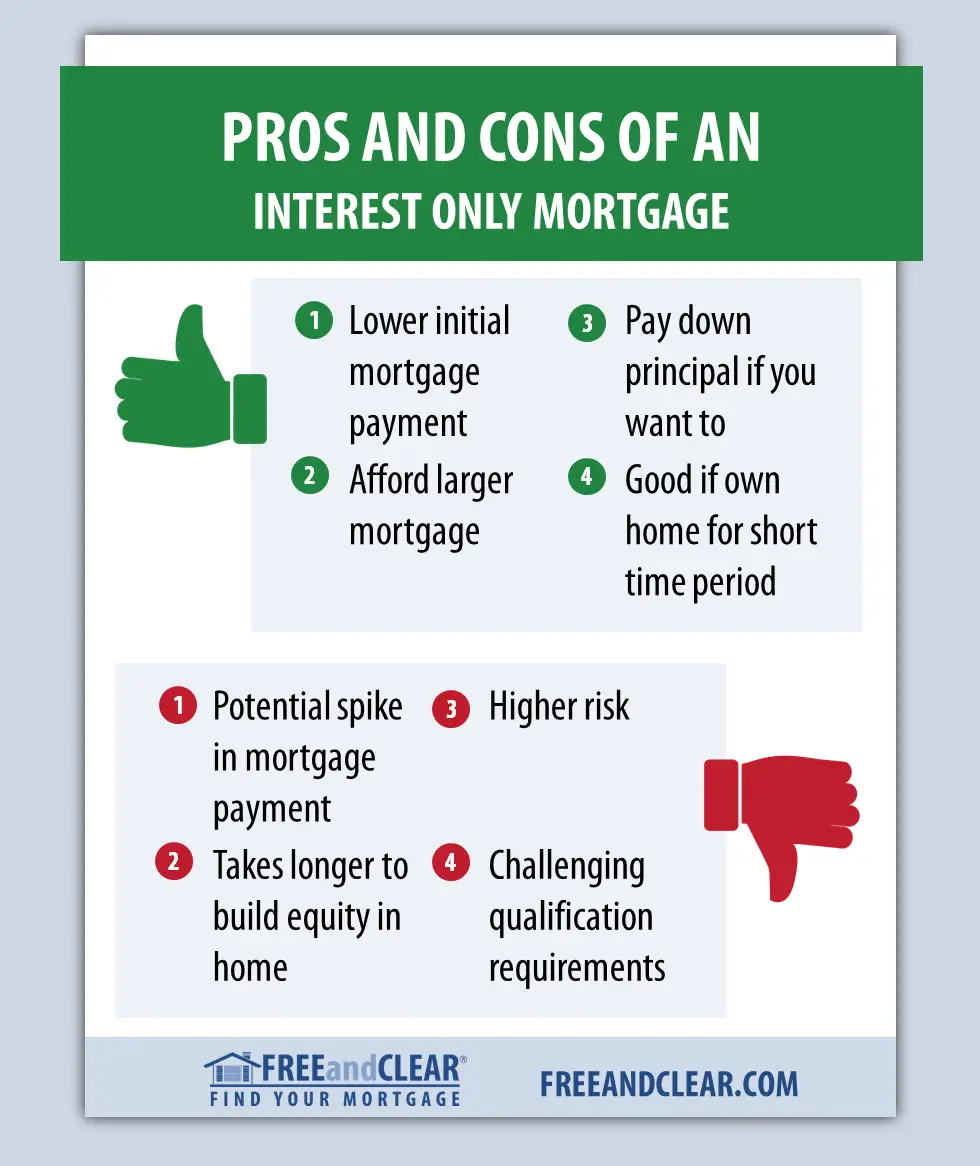

Pros And Cons Of Refinancing A Mortgage

Homeowners with a mortgage may have the option to refinance into a new home loan to shorten their term, lower their mortgage rate or use their equity to meet other financial needs but there are drawbacks theyll need to consider before taking advantage of this loan option. Why? Because it could end up costing them more money or be more work than its worth.

If youre considering getting a new loan, weigh these pros and cons to decide whether you should refinance.

Read Also: How To Eliminate Mortgage Insurance