Understanding Mortgage Interest Rates

When you take out a mortgage to buy a home, you are borrowing money backed by the home’s price. Naturally, the lender won’t allow you to borrow money for free. To make money, the lender charges interest that accrues over the life of the loan. The amount that you borrowed in the first place is known as the principal on the mortgage.

On a fixed-rate mortgage, this interest rate will remain the same for the term of the loan, whether that’s 20 years, 30 years or longer. For an adjustable rate mortgage, the rate will change based on prevailing interest rates at various intervals.

Either way, you should be able to find your current interest rate in your mortgage paperwork or through your bank’s online lending site. You can also check to see if your mortgage statement specifies how much of the current month’s payment is attributed to interest. If it doesn’t, you can make that calculation yourself.

Take Homeowners Insurance Into Consideration

Even if you think you can avoid it, homeowners insurance should be taken into consideration. Most people have to pay for this item, and the lender will automatically add the cost to the payment you make each month.

There are many different types of insurance in the world. For homeowners, there are eight options to choose from for your place. Its critical to consult a professional to determine which will help you the most in case of a disaster.

Varying price points depend on the type of insurance you get, and a high deductible means you owe a lower monthly premium than other choices.

Recommended Reading: How To Calculate Mortgage Debt Ratio

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Also Check: How To Get A Contractor Mortgage

How Do I Figure Out How Much Interest I Will Pay On A Loan

Consider the number of payments you will make in that year to compute your interest rate. If you have a 6 percent interest rate and make monthly payments, you would divide 0.06 by 12 to get 0.005. By multiplying that number by your remaining loan balance, you can calculate how much interest youll pay in that month.

How Do I Calculate A Monthly House Payment For A 30

Related Articles

Calculating a 30-year fixed-rate mortgage is a straightforward task. In order to find out what your monthly payments might be, you can use a mortgage formula or a calculator. This will give you a good estimation of whether you can afford the mortgage. Home loans are amortized over 30 years with monthly payments that are the same each month. As you begin to pay your mortgage, you will actually pay more in interest. Over time, as the loan decreases, more of your money goes toward the principal.

Also Check: What Would My Mortgage Payment Be On $90000

The Best Home Loan Option For You

Any good calculator will help determine what might be a good loan product for you based on what you might qualify for. Youll usually see several options.

Its worth noting that you must qualify, so dont take what the mortgage calculator says as gospel. A Home Loan Expert will better be able to tell you what you qualify for when they take a more detailed look at your financial history. However, it does give you a starting point in terms of things to think about.

If You Should Rent Vs Own A Home

There are many advantages to owning a home versus renting. Among them is the fact that you gain equity with each payment, as opposed to giving your money to a landlord. As an owner, you also gain the ability to paint your living room any color you desire.

However, theres a mathematical piece to this as well. You have to know how much you need for a down payment, and whether owning a home will be cheaper or require you to pay more when looking at the monthly cost of homeownership.

In many cases, its better to get a mortgage, because the rate can be fixed for the life of the loan. There are very few controls that can stop landlords from raising your rent every year if they want to. You can lock in your interest rate sooner rather than later by starting the approval process early. This will ensure you’re prepared to lock in as soon as your loan officer gives you the go-ahead. With rates projected to rise, getting a lock in early could help you save money on your mortgage.

Read Also: Is A Heloc Considered A 2nd Mortgage

Calculate The Number Of Payments

The most common terms for a fixed-rate mortgage are 30 years and 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

Figuring Out Your Unpaid Principal Loan Balance

If you want to know your unpaid principal loan balance that is remaining after you make your first mortgage payment, you can use our amortization calculator. But if you’d like to understand how to figure it out on your own, read on.

First, take your principal loan balance of $100,000 and multiply it by your 6% annual interest rate. The annual interest amount is $6,000. Divide the annual interest figure by 12 months to arrive at the monthly interest due. That number is $500.

Since your December 1 amortized payment is $599.55, to figure the principal portion of that payment, you would subtract the monthly interest number from the principal and interest payment . The result is $99.55, which is the principal portion of your payment.

Now, subtract the $99.55 principal portion paid from the unpaid principal balance of $100,000. That number is $99,900.45, which is the remaining unpaid principal balance as of December 1. If you are paying off a loan, you must add daily interest to the unpaid balance until the day the lender receives the payoff amount.

You know now that your unpaid principal balance after your December payment will be $99,900.45. To figure your remaining balance after your January 1 payment, you will compute it using the new unpaid balance:

Also Check: Can You Get A Mortgage With A New Job

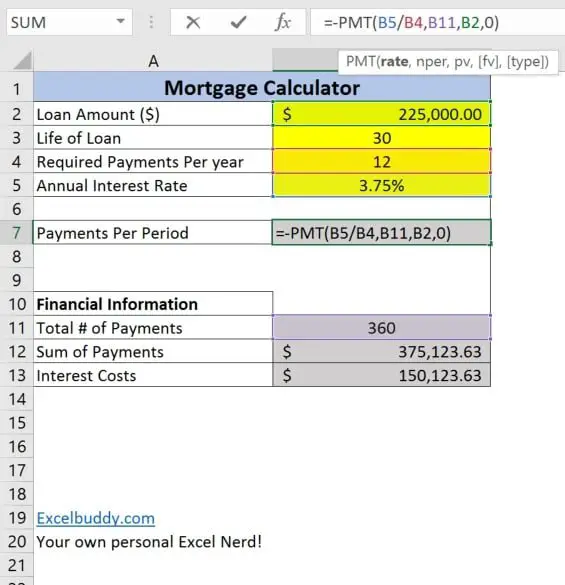

The Formula For Monthly Mortgage Payment In Excel

Consider that, we want to start a business. For that, we need to take a loan. Now we would like to calculate the monthly mortgage payment. For example, we received a $150,000 term loan in cell C7 to start the business. The annualized rate of interest in cell C8 is 6%, the loan duration in cell C9 is 2 years and the loan must be repaid monthly, according to the terms of the sanction. Now, calculate the monthly mortgage payment using the information provided.

The PMT function in excel can be used to compute expected mortgage payments using a formula. Now, lets have a look at the steps below.

STEPS:

- Firstly, select the cell where we want to calculate the monthly payment. So, we select cell C13.

- Next, we need to write down the formula. As we are using the PMT function, the formula is:

=PMT

Read More:How to Use Formula for Mortgage Principal and Interest in Excel

Principal And Interest Vs Interest

Theres another factor that can affect your monthly mortgage payment: whether youre making principal and interest or interest-only payments. Principal and interest payments are the most common way to pay off a home loan, and they basically mean that one portion of your monthly payment goes towards paying off the amount you borrow and another portion goes to paying off the interest you owe.

However, some loans are designed to allow you to make interest-only payments for a certain period, for example if youre building a new home or if youre a property investor with an investment mortgage. This allows you to reduce your monthly payment amount.

Susies mortgage payments

Susie is borrowing $700,000 to buy a house and she wants to save as much money on interest as she possibly can. She decides to calculate just how much difference a 0.25% APR difference in interest rates could make to the total cost of a loan.

If she can find a loan with an interest rate of 4% APR on a 30-year loan term, her monthly principal and interest payments will be $3,341.91. The total interest she will end up paying over the life of the loan is $503,086.54.

But if Susie finds a loan with a marginally lower interest rate of 3.75% APR, her monthly payments will be $3,241.81 and the total interest over the life of the loan will be $467,051.29 thats a total interest saving of $36,035.25.

You May Like: How Much Does A Mortgage Payment Increase For Every 100000

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Using Excel Formulas To Figure Out Payments And Savings

Managing personal finances can be a challenge, especially when trying to plan your payments and savings. Excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long it will take for you to reach your goals. Use the following functions:

-

PMT calculates the payment for a loan based on constant payments and a constant interest rate.

-

NPER calculates the number of payment periods for an investment based on regular, constant payments and a constant interest rate.

-

PV returns the present value of an investment. The present value is the total amount that a series of future payments is worth now.

-

FV returns the future value of an investment based on periodic, constant payments and a constant interest rate.

Figure out the monthly payments to pay off a credit card debt

Assume that the balance due is $5,400 at a 17% annual interest rate. Nothing else will be purchased on the card while the debt is being paid off.

Using the function PMT

=PMT

the result is a monthly payment of $266.99 to pay the debt off in two years.

-

The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year.

-

The NPER argument of 2*12 is the total number of payment periods for the loan.

-

The PV or present value argument is 5400.

Figure out monthly mortgage payments

Using the function PMT

Using the function PMT

=PMT

Read Also: A Better Mortgage Company Reviews

What Factors Affect The Amount Of Interest You Pay

The following factors will affect the amount of your interest payments:

- The mortgage interest rate. This is the rate at which the bank charges you interest on the loan. Even a small difference in the interest rate can add up to thousands over the life of the loan.

- The federal funds rate. The interest rate on your loan is loosely tied to the federal funds rate set by the Federal Reserve, which dictates the rate at which banks lend money to each other overnight. If you have a variable interest rate, paying attention to the federal funds rate can help you predict what your interest rate will do.

- The amount you borrow. The more you borrow from your bank, the more interest youll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000.

- The outstanding loan amount. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

- The loan term. The time you take to pay off your loan will affect the amount of interest you pay paying your loan off over a shorter period of time will minimize your interest.

Whats The Difference Between Interest Rate And Apr

The interest rate is the amount that the lender actually charges you as a percent of your loan amount. By contrast, the annual percentage rate is a way of expressing the total cost of borrowing. Therefore, APR incorporates expenses such as loan origination fees and mortgage insurance. Some loans offer a relatively low interest rate but have a higher APR because of other fees.

You May Like: How To Choose A Mortgage Refinance Lender

How Much Interest Will I Pay For A 15

Image by: https://thetruthaboutmortgage.com

The average interest rate on a 15-year mortgage as of May 20 was 6.6%, while the average interest rate on a 30-year mortgage was 7.22%. The interest rate on a 15-year mortgage is fixed for the entire duration of the loan, meaning that you will pay the same amount every month.

Calculating Repaymentmortgage Monthly Payments

If you have arepayment mortgage and would like to work out how much capital you must repayeach month, the calculation is as one might expect more intricate. We haveto add some capital amortisation to each monthly sum, while still payinginterest on the amount of the outstanding loan.

Using arepayment mortgage calculator is probably the quickest way to gain an idea ofmonthly mortgage payment levels. This example of an onlinemortgage calculator will tell you how much the monthly repayments will be for agiven loan amount, term and interest rate.

Don’t Miss: Is Mortgage Interest On A Second Home Deductible

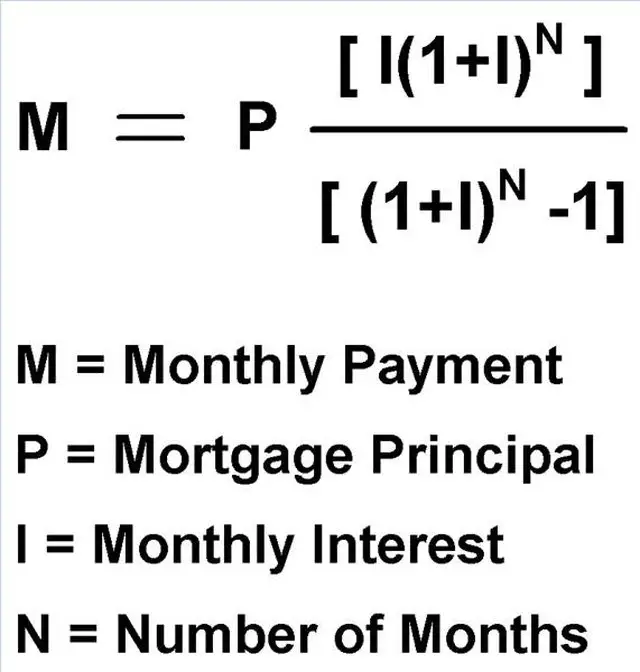

Examples Of Mortgage Formula

Lets take an example to understand the calculation of Mortgage in a better manner.

Mortgage Formula Example #1

Let us take the example of XYZ Ltd that has availed a $2,000,000 term loan to set up a technology-based company. As per the terms of sanction, the annualized rate of interest is 8%, the tenure of the loan is of 5 years, and the loan has to repay on a monthly basis. Calculate the fixed monthly payment based on the given information.

Solution:

Fixed Monthly Payment is calculated using the formula given below.

Fixed Monthly Payment = P * /

- Fixed Monthly Payment = $2,000,000 * * 12*5 /

- Fixed Monthly Payment = $40,553

Therefore, the Fixed Monthly Payment for XYZ Ltd is $40,553.

Mortgage Formula Example #2

Let us take another example where the company has borrowed a loan of $1,000,000 that has to be repaid over the next 4 years. The annualized rate of interest is 6%, and the payment has to be made monthly. Based on the given information, calculate the following:

#1 Outstanding Loan Balance at the end of 2 years

Outstanding Loan Balance is calculated using the formula given below.

Outstanding Loan Balance = P * /

- Outstanding Loan Balance = $1,000,000 * /

- Outstanding Loan Balance = $529,890

#2 Principal Repayment made in the 24th month

Outstanding Loan Balance is calculated using the formula given below.

Outstanding Loan Balance =P * /

Get A Handle On What A Loan Costs You Each Month

If you own a home, you probably know that a portion of what you pay the lender each month goes toward the original loan amount while some gets applied to the interest. But figuring out how banks actually divvy those up can seem confusing.

You may also wonder why your payment stays remarkably consistent, even though your outstanding balance keeps going down. If you understand the basic concept of how lenders calculate your payment, however, the process is simpler than you might think.

Also Check: What Is A Va Mortgage Rate

How To Calculate Amortization

In order to make an amortization schedule, you’ll need to know the principal loan amount, the monthly payment amount, the loan term and the interest rate on the loan. Ouramortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance.

-

Step 1:Convert the annual interest rate to a monthly rate by dividing it by 12.

Annual interest rate/12=monthly interest rate

-

Step 2:Multiply the loan amount by the monthly rate to get the interest payment.

Loan amount*monthly rate=interest payment

-

Step 3:Subtract the monthly mortgage payment from the interest to determine the principal payment.

Monthly mortgage payment-interest payment=principal payment

-

Step 4:Subtract the principal from the loan amount to get the outstanding loan balance.

Loan amount-principal payment=outstanding loan balance

The above steps calculate monthly amortization for the first month out of the 360 months in a typical 30-year loan. For the remaining months, repeat steps two through four using the previous outstanding loan balance as the new loan amount for the next month in the schedule.

| Payment |

|---|

| $199,657 – $344 = $199,313 |