How Much Does Advice For A New Job Mortgage Cost

New job mortgages are quite straight forward once you are dealing with the correct lenders. Approach the wrong lender and youve no chance though.

For new job mortgages I charge a fee of £245. This is the same for mortgages with a job offer letter. For this I will review your full circumstances, get you an agreement in principle with a lender that accepts your situations, and process your mortgage application.

An agreement in principle typically takes me 1-2 days from you sending over your documents.

The fee is payable at the start of my research, after weve had our video appointment and youve sent all your documents to me. If for any reason I cannot get you an agreement in principle its 100% refundable, though this is rare as Im so familiar with the available lenders. If later on a full application is not offered based on your circumstances then the fee would be refunded.

- Flexibility to suit your schedule

- Simplifying big decisions

Mortgages And Pay Rises

If youve recently had a pay rise youre likely to want a mortgage with a repayment plan that reflects your increased income. However, as is the case with a general change in contracts, the likelihood is that you wont have multiple payslips available to demonstrate the consistency of your income to the mortgage provider.

Again though, if you can provide written evidence from your company explaining that your recent pay rise is permanent, then you should be absolutely fine applying for a mortgage with it in mind.

How Bonuses Are Calculated For A Mortgage

When you bring home an annual salary plus a bonus, your lender calculates your income in two parts.

First, your lender divides your annual salary by 12 to determine your monthly income. Then your lender looks at bonus income separately.

If you have received bonus income for at least two years, and the employer indicates the bonus income will continue, lenders can consider it qualifying income.

Underwriters normally divide your last two years of bonus income by 24 months to arrive at a monthly average.

However, as with any income, if lenders see it has been dropping year-over-year, they may choose to discount or even ignore this income.

You May Like: Can I Buy Another House If I Have A Mortgage

How Commission Income Is Calculated

When you earn at least 25 percent of your income from commissions, your base income is the monthly average of your last 24 months of income.

If you have less than 24 months of commissioned income, your lender probably cant use it for qualifying.

There are exceptions. For instance, if you work for the same company, do the same job, and earn the same or better income, a change in your pay structure from salary to fully or partially commissioned might not hurt you.

You have to make the argument, however, and get your employer to confirm this.

Can You Change Jobs While Buying A House

Sometimes a new employment opportunity may come along while you are in the midst of the home buying process.

If you plan to change jobs during the mortgage application process, it is important to tell your lender as early on as possible. Even once your loan has been approved, be cautious about changing employment. Many lenders will do a final check to verify your employment and income havent changed since your final loan approval was issued.

Changing jobs during your mortgage application does not always affect your ability to qualify for a mortgage loan. Some changes, though, can be more impactful than others.

You May Like: How Much Does Mortgage Insurance Cost Per Month

Why Do Mortgage Lenders Care If You Have A New Job

If you were lending someone money, youâd want to be sure they were going to be able to pay it back, right?

Mortgage lenders are exactly the same. They donât want to give anyone a mortgage whoâs not going to be able to pay the loan back. So, when you put in a mortgage application, theyâll spend a long time trying to work out what their chances are of getting their loan repaid. Makes sense, right?

But where does a new job come into this?

Well, if youâve recently changed jobs, a mortgage lender will see you as more risky than someone whoâs been in the same job for ages. Why? It mostly comes down to 3 things:

How A Mortgage Broker Can Help With A Mortgage Application

As a whole of market mortgage broker, we have access to a wide range of lenders, including those that offer specialised mortgage products, so no matter your circumstances, we will be able to find mortgages that are perfect for you.

Our help goes beyond the search for a great mortgage. We also help our customers with their mortgage applications and give them advice on a wide range of different mortgage subjects. We also have a specialist finance team on hand to give advice on life insurance and mortgage protection.

We do this and so much more for FREE, so if youre hoping to get a mortgage with a different job, be assured that we are here to help you during this exciting chapter of your life.

To learn more, get in touch with an online mortgage advisor at YesCanDo Money by using the contact details on our website. With the help of an exclusive mortgage expert, you will be on your way to getting a great mortgage deal in no time at all!

The bottom line here is that its possible to get a mortgage if youve just started a new job, are in a probationary period or have just changed roles with your current employer. But theres a major caveat here some mortgage lenders will decline you outright under these circumstances, and others might feel that youre a risk and hike up their rates.

Related reading: Our advisors are often asked whether getting a mortgage when on maternity leave would be an issue.

“*” indicates required fields

Also Check: Is Rocket Mortgage And Quicken Loans The Same

Other Ways To Strengthen Your Loan Application

A new job may not be as significant a factor if the applicant have excellent credit ratings, a large down payment or additional sources of income. However, this depends on the lenders guidelines. While some lenders are willing to accept a new job on a mortgage application, other lenders will immediately deny the loan application.

Mortgage Advice For When Youve Got A New Job

If youve got a new job and need a mortgage, its a really good idea to work with a specialist mortgage broker. Our Mortgage Experts will guide you through the entire journey, from application right through to completion. They know the market, and will make your application look as appealing as possible to lenders. Get started.

You May Like: How Much You Qualify For A Mortgage

Getting A Mortgage After Starting A New Job

There are a lot of questions and concerns about getting a mortgage after beginning a new job. With Winnipeg being one of the faster growing cities in the country, there are a lot of new arrivals coming to town who are getting a fresh start. In addition, the growth of both the commercial and industrial sectors have current and longstanding residents alike taking advantage of new career opportunities and prospects. And yet, many feel as if this exciting time can hinder them when it comes to buying a new home. Here you are with a great new job and yet there is underlying uncertainty about getting a mortgage.

As a Winnipeg broker who has been instrumental in helping first time buyers secure funds to acquire their dream home, I have a lot of insight into this unique scenario, and Im here to tell you that you may not have any cause for concern. In fact, its most likely much easier that you could have ever imagined.

Can You Get A Mortgage With A New Job

Related Articles

Buying a house requires stable income along with all the creditworthiness requirements lenders demand. If you have a new job perhaps relocating to a new city for the job getting a loan for a new home is possible. However, there are some extra hurdles to jump so lenders are confident that the new job has longevity.

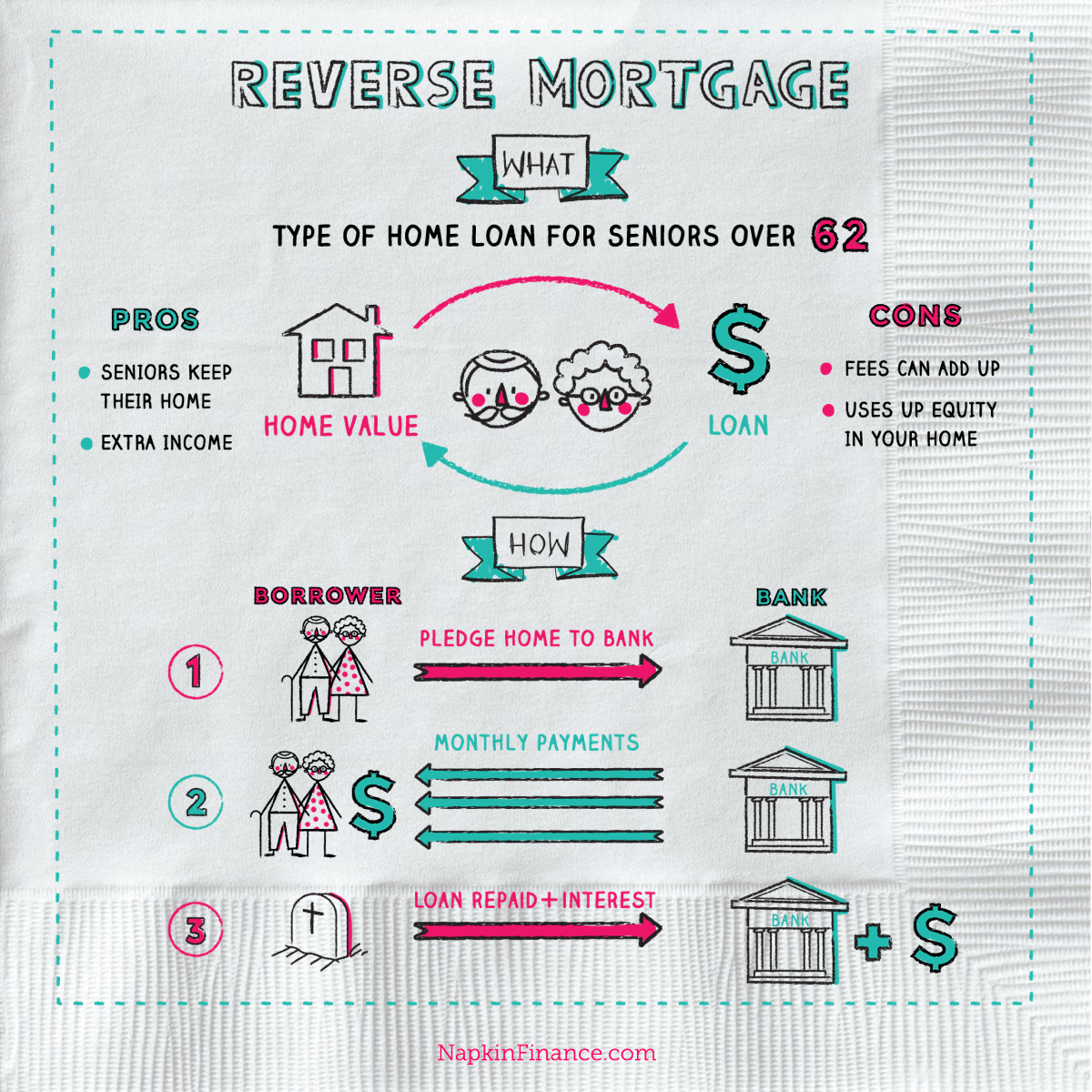

You May Like: How Do Banks Make Money On Reverse Mortgages

Itll Be Hard To Prove Your Income

As part of the application process, lots of lenders will want you to provide them with payslips from the last few months . If you havenât been in your job for that long, thatâs going to be just a little bit tricky.

Donât worry though, some lenders will accept a letter from your employer confirming your salary instead, so all is not lost â weâll get to this later.

Getting A Mortgage When Self

For people that are self-employed, this often means that they need to find a specialist mortgage lender that provides mortgages to self-employed people and will accept evidence other than payslips as proof of income, such as their accounts.

It can be quite difficult for self-employed people to get a mortgage as their income is often harder to prove and does not have payslips to show the monthly salary. Some lenders require several years of accounts as proof of income before they will be prepared to lend to self-employed workers.

If you are considering moving from being employed to starting up your own business, then you should consider the impact of doing so on your future mortgage applications. It is sometimes a good idea to take out a mortgage before you become self-employed to make the mortgage application process more straightforward.

However, if you are already self-employed, there are still many lenders that offer mortgages to self-employed people, but you would need to find a good broker such as Boon Brokers to help you to find the best mortgage lender for your situation.

Don’t Miss: When Can Pmi Be Removed From Mortgage

How To Change Job And Get A Mortgage

It may be the case that time is not a luxury for you and you need to secure your mortgage and change your job at the same time. As many lenders may decline you based on your being on your probationary period, its then advisable to use a mortgage broker to find you a provider that will be suited for you.

You do have to pay for many mortgage brokers, but they should save you time by only matching you with a lender that will offer you a mortgage whilst youre on probation.

So if youre looking for a new job urgently, its important to get signed up to a recruitment agency so that they can help you find a new career path!

What If There Are Gaps In My Employment

Gaps in employment arent uncommon and mortgage lenders usually take into consideration how long they are. A month or two between jobs probably wont be an issue. In contrast, breaks of 6 months or more may require additional information about your circumstances. Lenders may need to establish why you were unemployed and if that affects your future job stability. For example, millions of people faced layoffs due to the pandemic, and many lenders will be understanding of that. Others common considerations may include if a homebuyer left their last job due to events like maternity leave, pursuing higher education, or a short-term disability. The best thing to do is to talk to a Mortgage Professional about your new job and current options.

Read Also: What Salary Is Required For A Mortgage

What Are Todays Rates

Mortgage applicants can achieve homeownership when they can show a steady work history and meet other credit qualifications.

With interest rates still hovering at historic lows, homebuyers can often qualify for larger home loan amounts at lower monthly payments.

Even if you think you cant receive an approval, its worth checking your home mortgage eligibility.

Starting A New Profession And Getting A Mortgage

When you change to a completely new profession this will make most mortgage lenders nervous. Banks and building societies like a track record and starting a new job that is very different from your old one can cause you problems.

The best advice if you have started a new job and are wanting a mortgage is to speak to a mortgage broker. They will be able to speak to the different lenders to find one that will be willing to consider you and your individual situation.

Don’t Miss: How Much Is Mortgage Ins

Things You Need To Know About Getting A Mortgage When You Have Started A New Career Or Job

1. The Numbers Matter Most

Regardless of whether or not you are starting a new job, your credit score and debt history remain to be the most telling feature for lenders. This is great news for those of you in good standing. In Manitoba and the rest of Canada, a credit score above 650 will likely qualify you for a home loan. If you have scores between 800 and 900, you’re in fantastic shape and even starting a new gig will do little to dismay lenders.

2. Type of Job Change Makes a Big Difference

If your new job is within the same company that youve been with for at least two years then this a good sign of stability, whether the move was lateral or vertical .

If your new job is an advancement to a more senior level, but at a new company, youre still looking good to lenders. In this scenario youre a proverbial rising star and thus a good investment.

If your new job denotes a career change, lenders may look a bit closer. If the industries are related, then the transition is often deemed more logical, less risky, and thus youre chances of getting a mortgage remain great .

3. Your Pattern of Job Hopping

Lenders look to historical length of tenure in the same manner that employers do when considering new candidates. If you exhibit a tendency to stay with a company for two to five years this tells lenders that you are not flighty, impulsive, or whimsical. They therefore expect you to remain employed at your new station and will thus be more likely to provide you with a loan.

You Might Get Made Redundant

Donât worry, weâre not trying to scare you! Itâs just that if a company has to make job cuts, often theyâll let go of the newest employees first. You know, âlast one in, first one outâ and all that! This means youâre more likely to be made redundant than someone whoâs been in the same job for years.

Also Check: When Do You Pay Pmi On A Mortgage

Getting A Mortgage With A New Job

Estimated reading time: 4 minutes

Getting a new home or a new job is exciting. But what happens when they happen at the same time? If youre applying for a home loan and have a new employer, lenders will look at a variety of information to determine your eligibility as a borrower. Here are answers to common questions about getting a mortgage with a new job to help you prepare.

Is It Possible To Remortgage With A New Job

It certainly is possible to remortgage with a new job. As you already have a mortgage, its a lot easier for lenders to assess how youve managed your mortgage repayments. Having repaid your mortgage on time will give you heaps of credibility, but having fallen into financial problems will do the opposite. That said, a new job can show lenders that youre regaining control of your finances if this is the case.

The majority of lenders should consider your application and you shouldnt run into any real difficulty. This of course depends on other factors, such as your credit score and the amount of equity you have. Your reason for a remortgage will also be a factor in whether youre approved.

If youre still unsure about getting a mortgage with a new job, you can make an enquiry. A specialist will then call you back to discuss your options.

Also Check: Do Usda Loans Have Mortgage Insurance

Changing Jobs Before Buying A House

Changing jobs before or during the mortgage application process could be a problem for the lenders. This is usually the case if the switch is from a higher-paying job to a lower-paying one. It may also be a problem if you switch from a more stable industry to a job in a less stable industry. If you move from one job to another, and your income stays relatively stable, then it shouldn’t be a problem.

This applies even if the jobs are not in the same field. Lenders look for stability above all else. If you have a history of moving from job to job, lenders may consider you high risk. That said, frequently switching jobs is not bad in itself. If your income and responsibility increase from job to job, it should not affect your mortgage application.

If you have gaps in your employment history, you can still be eligible for a mortgage, provided you can show that your income is sufficient, reliable, and ongoing, and you have a good reason for the gaps. If you get a new job after six months or less, all you need is to get your first paycheck within 30 days of closing your loan. If you have been unemployed for more than six months, you are unlikely to get a loan.

There are plenty of requirements you must meet when applying for a new mortgage or when you plan to refinance your existing loan. Lenders will look at your debt levels, income and credit score. Theyll also look at your employment history. Fortunately, getting a mortgage with a new job is far from an impossible task.