Mortgage Protection Insurance Sales Training

Training is a must.

Training continually allows you to critique and refine your pitch, which increases closing percentages. The best agents build training into their weekly routine regardless of how many years they have been in the business.

One of the reasons why I see agents fail is lack of consistent training. Its not because they dont believe in training, its because they choose not to make it a priority. This results in constantly jumping from one sales model to another and never having any real success.

Think about the amount of time baseballs Albert Pujols put into mastering his swing . He constantly works with his batting coach to constantly tweak his stance to avoid or get out of a slump: forward, backward, side to side and choking up or down on the bat.

The constant tweaking, adjusting and learning has allowed him to maintain a high level of performance throughout his career.

In our business, you must dedicate yourself to ongoing training so you can have the confidence to focus on changing your stance when times get tough versus changing your proverbial swing . By doing this, you will keep your policy count and average premiums high!

Below are 10 critical training topics you should continually refine, regardless of your experience level.

Would you agree its worth 60 minutes of weekly training to more than double your salary?

Exclusive Mortgage Protection Leads

Ensure that the protection lead is exclusive. That is because a multi-marketing agency may resell the leads. For instance, once they generate a fresh lead, they will sell it again after 30 days at a lower rate. The reselling can take place several times.

For agents who are new in selling mortgage protection insurance, the leads tend to be ages already at about 6 up to 12 months, which can be problematic. Heres why! Suppose you are the prospect who is now talking to the third or fourth person about your mortgage protection via phone call for sure, you will be irritated. What more if the agent who works with the lead is new and inexperienced. That would smell like a disaster, right.

You may be able to close both mortgage protection leans they may be new or old. But there is no doubt that you will be experiencing more difficulty with an old and working one. As such, it is best to work with fresh leads that no agent has used before and those that cannot be resold so that your success rate will be higher.

Do I Need Mortgage Protection Insurance

You are usually better off with a term policy that provides enough coverage to pay off your mortgage because of the inflexibility of mortgage protection insurance payouts. Choosing term policy provides options for your family to either use the death benefit to pay off the house and use the leftover money or even skip paying the mortgage and use the money as they like.

A mortgage life insurance policy ensures that the borrowers family continues to pay off the mortgage, even if other expenses and requirements arise.

Don’t Miss: How Much Does A Mortgage Broker Make Off A Loan

Life Insurance Vs Mortgage Protection Insurance

Most life insurance policies require a physical examination .

Mortgage protection policies are often non-medical policies that require no physical examination. A homeowner must complete an application and answer simple medical questions to qualify.

Once the application is submitted, the life insurance company underwriters will either approve or decline the policy.

Limra Life Insurance Fact 4

80% of life insurance policyholders state they have no relationship with their agent and 70% of this group acknowledges they need more coverage.

Hello! Buehler?!

We see two broad causes for this:

And, that gold is selling mortgage protection insurance.

Not long ago we published a highly-detailed guide on every aspect a career in mortgage protection, and weve received amazing feedback and response .

So whats my suggestion after all of this?

Get off your tail and go to workand of course read through the selling guide first!

If you want to talk with someone about more ways to help you improve your insurance sales, feel free to email us your questions, we would love to connect.

Independent Agent? Want To Learn About Our Limited Time Direct Mail Leads as Low as $9 Per Lead?

Also Check: What Is The Lowest Mortgage Amount You Can Borrow

How To Choose An Mpi Provider

If you have decided that a mortgage protection insurance policy is something you want to do, you’ll want to do some shopping around. Benefits and payments can vary widely from state to state and from company to company. So you’ll need to do a bit of research before choosing a company to work with. Here are four things to consider:

Pros Of Mortgage Protection Insurance

There are a few benefits to buying mortgage protection insurance.

One big benefit is you may not need to go through an underwriting process to get approved. Underwriting determines eligibility and rates for most term life policies, which means your age and health status, as well as a complete medical exam, determine both if you can get covered and how much youll pay. Some insurers offer mortgage protection insurance without underwriting, so you wont have to worry that you wont get approved, and of course, there is no medical exam.

Another bigand obviousbenefit is that your family can stay in your home without having to pay a loan if you die. The coverage amount is matched to your mortgage so you can make certain theres enough to repay all you owe. Not having to worry about this financial burden is a major advantage for surviving family members, especially if you were the primary breadwinner.

Also Check: How To Buy A House At Auction With A Mortgage

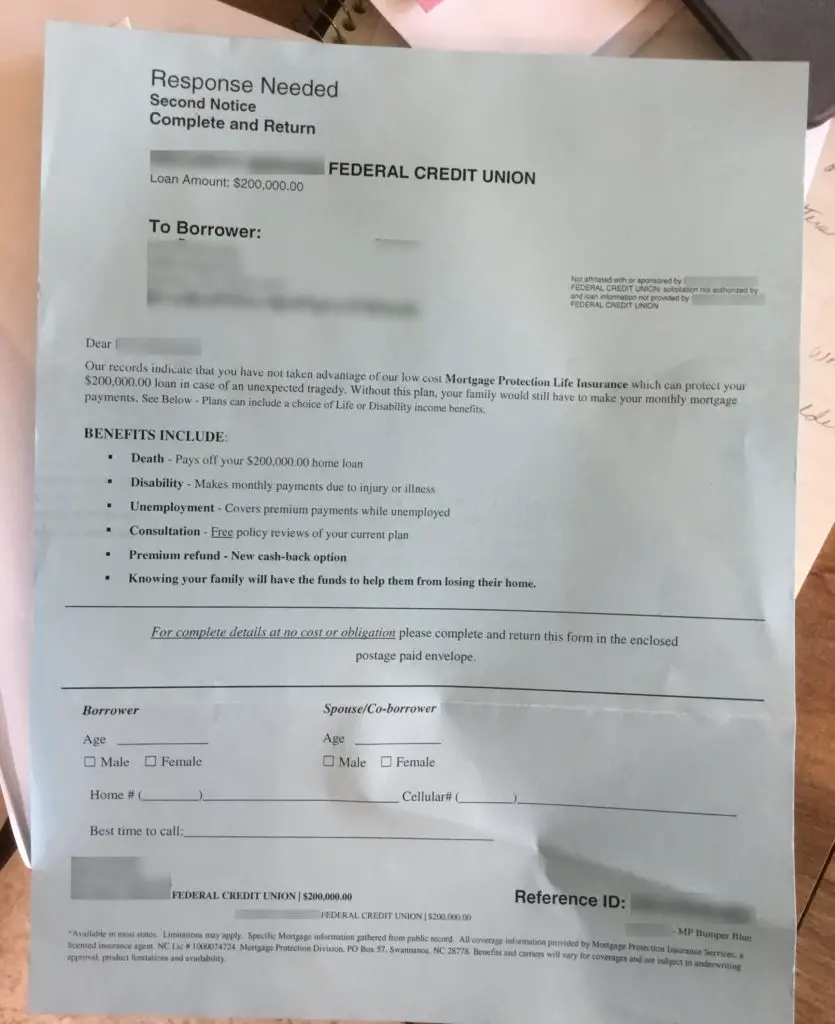

How Direct Mail Works

The process starts when you receive a list of prospects, which consists of new homeowners with home mortgages. These lists are compiled using county and courthouse records.

Youll likely have to buy the list of mortgage holders, but its worth it . It tells insurance agents not just the names and addresses of new homeowners but also their mortgage amounts, purchase dates, and other key data. The more information an agent has, the better the lead quality.

A lead house purchases information to compile lists directly from local courthouses. Insurance professionals can then purchase a compiled list of leads from a lead generation service.

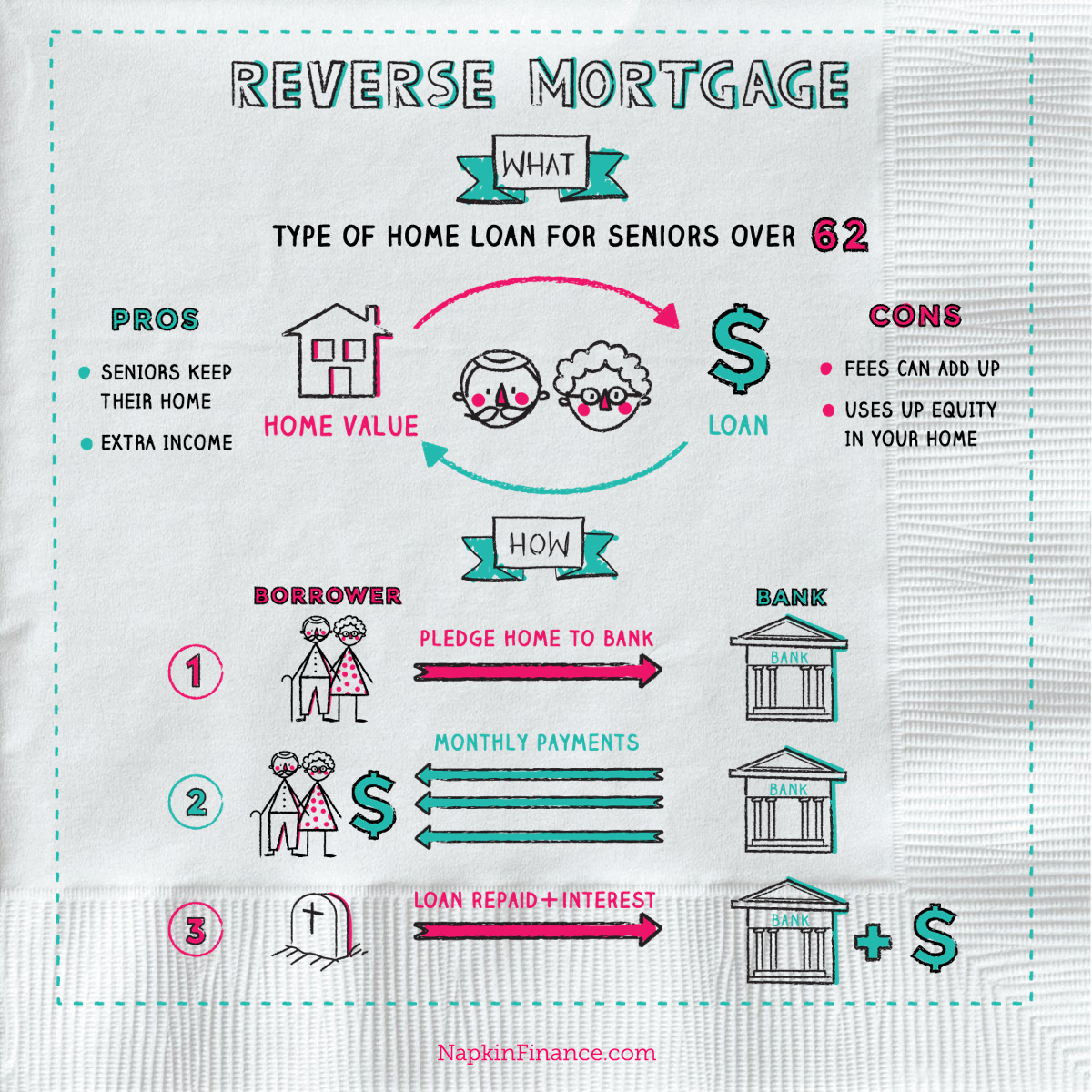

What Is Mortgage Protection

Mortgage protection insurance is a life insurance product designed to pay off the insureds mortgage upon passing.

Studies show that one of the biggest obligations that households carry is the homes mortgage.

In many cases, the mortgage is the biggest financial obligation needing coverage.

And when someone BUYS a new home, she realizes that shes REALLY taken on a TREMENDOUS debt.

A debt that would be disastrous if the breadwinner died and the surviving family couldnt pay!

This is why selling mortgage protection insurance is so powerful.

Read Also: How To Get Out Of Mortgage Without Ruining Credit

Dont Put Your Home At Risk

- Choose your Mortgage Protection accidental death insurance coverage from $50,000 to $350,000.

- Acceptance is guaranteed, regardless of health if you are between the ages of 18 and 69.

- No health questions or medical exams.

- The affordable monthly premiums will never increase for any reason.

- Rates as low as $5.50 per month.

Join The Mortgage Protection Telesales Course Waitlist

Many agents feel like selling over the phone can be intimidating and with the investment in lead costs they feel like they cannot afford to take the risk of selling over the phone. The Mortgage Protection Telesales Mastery course is designed to help eliminate the fear of selling over the phone, help you become more confident and make more money.

In this course you will learn what you need to get started, how to call your prospects, how to schedule appointments, what to say during a presentation, how to present available options, and how to close the sale. This mortgage protection phone sales process allows you to present solutions to more people, close more sales, and get your life back, all from the comfort and convenience of your home or office.

Read Also: What Is A Good Tip For Mortgage

Good Leads Vs Bad Leads

Im going to ruffle some feathers here, but its something you need to hear.

There is no such thing as a bad lead.

Yes I said it, yes some of you are shaking your head at me. But, its true.

Working leads takes patience and consistency.

I wish I could take credit for this, but its a great phrase I heard once from Don Runge.

There are 365 days in a year, 24 hours in a day, 60 minutes in an hour, 60 seconds in a minutefor you to catch your prospect at the right 30 seconds to set an appointment or let you in the door to give a presentation.

Leads are all about timing and I would be doing you a disservice if I didnt emphasize that point.

Now, certain lead types can be easier to set than others.

Below is a breakdown of the common types of mortgage protection leads. But always remember that catching a prospect is all about the right timing, keep that in mind whenever youre working any type of mortgage protection lead.

The First Guy In Wins

Effective mortgage protection agents understand that the FRESHNESS and the SPEED of receiving the direct mail lead is CRITICAL to their success.

You will experience measurably higher levels of success with the RIGHT lead generation system in mortgage protection sales.

About David Duford

Read Also: Can You Add Closing Costs Into Your Mortgage

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

|

Jeff is a well-known speaker and expert in life insurance and financial planning. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading finance websites.He is a licensed life insurance agent and has helped over 3000 people secure life insurance. He is licensed in all 50 states & DC.Jeff has spoken at top insurance conferen… |

Written byJeff RootLicensed Life Insurance Agent |

|

Benjamin Carr was a licensed insurance agent in Georgia and has two years’ experience in life, health, property and casualty coverage. He has worked with State Farm and other risk management firms. He is also a strategic writer and editor with a background in branding, marketing, and quality assurance. He has been in military newsrooms literally on the frontline of journalism. |

Former Licensed Life Insurance Agent |

What Should I Do If I Want To Protect My Home

You can start by filling out the mortgage protection free quote form on this page to get an idea of what your mortgage protection policy may cost.

Your information will remain confidential, and you will bypass the hassles of receiving phone calls for the next several years if you had mailed in that mortgage protection letter.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

|

Jeff is a well-known speaker and expert in life insurance and financial planning. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading finance websites.He is a licensed life insurance agent and has helped over 3000 people secure life insurance. He is licensed in all 50 states & DC.Jeff has spoken at top insurance conferen… |

Also Check: How Much Does A Mortgage Payment Increase For Every 100000

Are You Selling Mortgage Insurance Or Final Expense

When it comes to final expense sales, the people are easier to deal with and easier to sell to. The senior market has always been this way and thats why some states have very strict laws regarding senior citizens. Sadly enough, our seniors tend to be an easy prey for unethical insurance agents and sales people. If youre selling mortgage protection insurance, youre dealing with a much more sophisticated crowd. These are mainly professionals who have their act together enough to have a mortgage. These folks are a lot harder to sell to as they can tell if youre new and unsure of yourself, or if youre a seasoned life insurance agent. Theyre great at getting rid of sales people, even if they filled out the mortgage protection leads cards. You must be a talented closer, to be successful at selling mortgage insurance.

Learn From Top Leaders

Selling mortgage protection insurance allows you to offer peace of mind to your clients. Top leaders from our industry will dive into the traits of the most successful agents. Well cover everything from setting the appointment to product knowledge and even the pros and cons of the different types of leads we offer.

You May Like: Is A Mortgage Pre Approval A Soft Inquiry

Key Points To Remember

Whether youre a new agent or a seasoned seller looking for new ideas, we hope youve learned something from this article. The key takeaway is that direct mail still wins out over all other lead generation tactics. It requires paying for leads, but think of that fee as an investment.

It takes some money to make money, but dont worry. The more experience you gain, the higher your lead conversion rates will climb.

Get a Free Quote for Mortgage Protection Insurance

About Us

MortgageProtectionReviews.com is the top source of reviews and quotes for mortgage protection insurance. We provide in depth analysis of mortgage protection insurance options across the nation.

Menu

Peace Of Mind When Things Go Wrong

As a house is most often the most expensive investment buyers make, this type of insurance helps protect your family against the loss of that property. According to Experian, the average homeowner in the United States has a mortgage balance of around $201,811. That number is nearly 10% higher than in 2007 and could climb even more as housing prices rise in some cities.

Further, the average household carries a balance of $9,333 in consumer debt and 41% of all households have at least some type of credit card debt, according to a report by Value Penguin. Perhaps most startling is households with the lowest income average the highest amount of credit card debt, nearing $10,308.

Mortgage protection insurance could ensure that surviving family members continued to have a place to live while grieving and adjusting to a lower income.

Don’t Miss: How Do I Get Mortgage Insurance

Cons Of Mortgage Protection Insurance

For most people, the cons of mortgage protection insurance significantly outweigh the pros.

First and foremost, mortgage protection insurance is often inferior to a term life insurance policy. It can be more expensive for the coverage you get, and the death benefit continually decreases in value.

With a term life policy, you can buy a set amount of coverageoften far more than just the amount needed to pay off your mortgageand can choose how long you want the policy to stay in effect. Your family can be designated as the beneficiary of term insurance, not your mortgage lender, and your beneficiary can do anything they want with the money, including paying off your house.

Its also important to remember that a mortgage isnt the only cost of keeping a home. Theres also property taxes and insurance that are in addition to monthly payments, which can cost many thousands of dollars. If your family cant afford to pay these costs, theyd have to sell the home even if the mortgage was paid in full. With a term life policy, you can get a larger death benefit so theres money to both pay the mortgage and cover these other expenses.

Plus, with mortgage protection insurance, the payoff on the policy isnt guaranteed. If you pay off the mortgage before you die, you have nothing to show for paying your premiums for all those years.

Acceptance Rates And Insurance Premiums

Secondly, MPI policies have guaranteed acceptance. When you buy a term life insurance policy, the cost you pay each month depends on factors like your health and occupation. You get to skip the underwriting process with an MPI policy, as most policies typically don’t require policyholders to submit a medical exam. This can be very beneficial if youre sick or work in a dangerous or high-risk job. However, it also means that the average MPI premium is higher than a life insurance policy for the same balance. For adults in good health who work in low-risk jobs, this can mean paying more money for less coverage.

Read Also: Can You Combine 2 Mortgages Into One

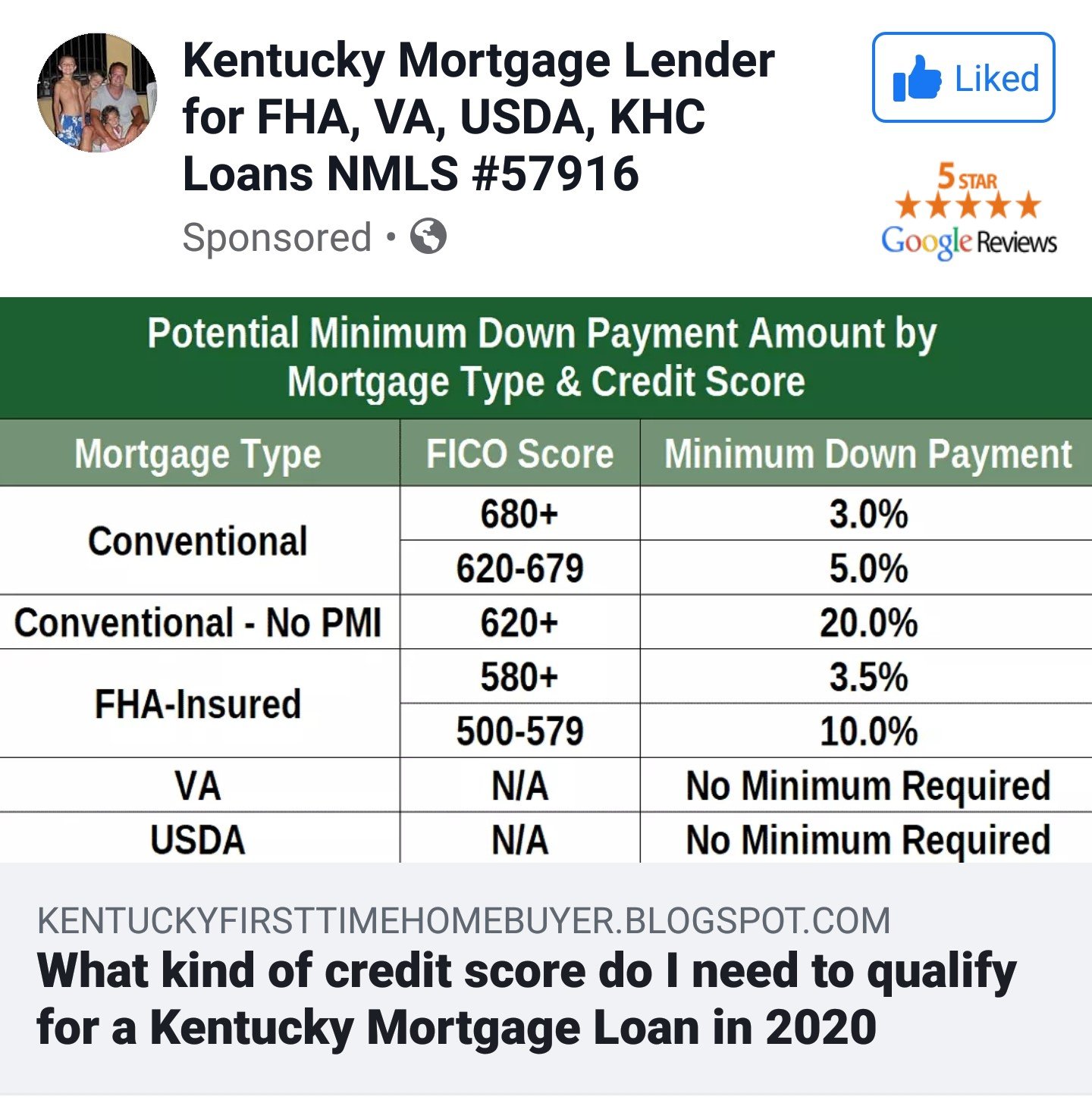

Internet Mortgage Protection Insurance Leads

Direct mail is by far the best source of mortgage protection insurance leads, but its not the only one. You can also use online lead generation tactics.

Think of examples like Facebook ads. Facebook allows advertisers to target new homeowners. If you want to, you can take ads that perform well via direct mail, adapt them to online use, then pay for ads on Facebook to generate even more leads.

Some lead houses offer online lead generation help alongside direct mail lists. Were one of those houses. Our agents can access Facebook-generated leads as well as lists from the county.