A Va Loan Is Assumable

Your VA loan can also be assumed by someone else. That means that another buyer could take over your existing mortgage , basically a transfer of loan terms from current owner to a new buyer. The only contingency is that the new buyer must also be VA loan eligible.If the new buyer doesnt have VA entitlement, your entitlement will remain attached to the loan even after assumption. However, this means that the current owner is basically putting their entitlement on the line, so beware and make sure your entitlement will be fully restored after assumption.Overall, a VA loan is an amazing option for service men and women to achieve homeownership. If youd like to know if youre eligible for this program, an Atlantic Bay Mortgage Group mortgage banker can help guide you through the process.

Va Funding Fee Vs Mortgage Insurance

With a VA loan, you dont pay for mortgage insurance. This is one of the most significant benefits of this mortgage program, one that can easily save borrowers tens of thousands of dollars over the life of their loan.

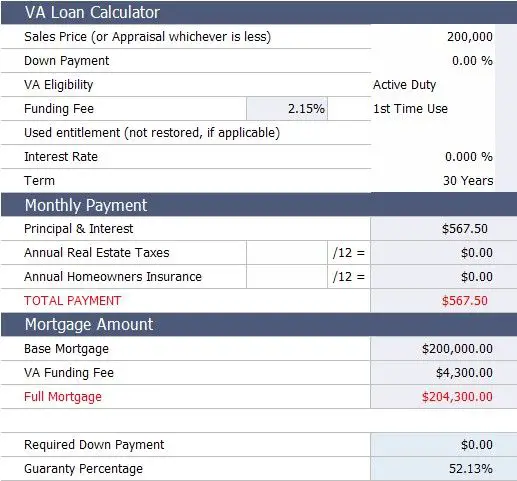

However, with a VA mortgage, you will pay a one-time VA funding fee. The VA funding is a small percentage of the total loan amount, which you can either pay at closing or roll into your mortgage loan balance and pay off over time.

In a sense, the VA funding fee buys you out of paying mortgage insurance. But it pays for more than just that. These fees allow the VA mortgage program to be self-sustaining, and to continue to offer a multitude of benefits to VA borrowers, including zero down payments and competitive mortgage rates.

The first time you buy a home with a VA loan, the VA funding fee is 2.3% of the loan amount. For any subsequent purchases, its 3.6%.

The good news is the fee goes down if you make a down payment. With a 5% down payment, the VA funding fee is just 1.65%. With 10% down, it drops to 1.4%. Those lower rates apply to both your first-time use and subsequent ones.

| Down payment amount |

| 1.4% |

How Do You Assume A Va Loan

There are 2 ways that you can currently assume a VA loan.

When the new buyer is a veteran that qualifies who substitutes his/her VA eligibility for eligibility of a seller. The new buyer of the home qualified through the VA standards for mortgage payments. This is usually the safer method for a seller since it allows these loans to be assumed with the reassurance that the buyer becomes responsible for this loan, while the seller will no longer hold responsibility when it comes to the loan.

The lender or/and the VA must first approve loan assumptions. The loans that are serviced by lenders that have automatic authority may process an assumption without the need to send them to the VA Regional Loan Center. For the lenders that do not have automatic authority, these loans must first be sent to a VA Regional Loan Center for approval. These processes can take up to several weeks. Once a VA loan is assumed, it is the responsibility of the servicer to ensure the homeowner that has assumed the property matches up to both the lender and VA requirements.

Also Check: How Many Tax Returns For Mortgage

The Va Loan Guaranty Program

The VA Loan Guaranty Program is a government-backed loan guarantee that allows veterans, active service members, and surviving dependents to purchase homes with no money down. The program makes it easier for qualified borrowers to finance their dream homesits that simple. This program has been in the lives of military members and their families since 1944, making homeownership accessible and more affordable.

Despite the change in lenders regulations and underwriting standards, the benefits of the VA Guaranty Program arent going to change. So if you have an interest in homeownershipnot to mention if you already own a homeyou must understand the process and whats in there for you. Whether youre in the process of purchasing your first home or refinancing an existing mortgage, be sure to do as much research as possible to avoid future surprises.

In addition, qualifying for a VA loan does not require you to put any money down or pay private mortgage insurance . These are two of many reasons why VA loans are attractive financing tools for first-time homebuyers, especially those who have served in war zones. All you need to do is go with your gut and pick the best financing option, bearing in mind that VA loans were created to honor and reward you for your sacrifices. So, gravitate to the mortgage companies, loan officers, and realtors who honestly embrace that spirit.

Dont Miss: How Long It Takes For Sba To Approve Loan

Other Benefits Of The Program

Weve covered two of the biggest benefits offered by VA loans. Washington home buyers who use this program can finance up to 100% of the purchase price without having to pay for mortgage insurance. Thats a unique combination of benefits you just wont find with most other loan programs.

But the benefits dont end there. VA loans are also one of the easiest mortgage products to qualify for, when it comes to credit scores and other borrower criteria. Thats because of the unique nature of this program.

The federal government guarantees VA loans, giving mortgage lenders a layer of protection in cases of borrower default . Because of this, the minimum qualification criteria for VA loans in Washington State tend to be more relaxed when compared to conventional or regular mortgage loans.

Additionally, borrowers who use this program can do so more than once. If you use a VA loan to buy a house, and later sell the home and pay off the debt, you could restore your program eligibility and use it on a future purchase.

In future articles, we will explore some of the other benefits offered by the VA home loan program. Today, we wanted to focus on the mortgage insurance subject in particular. The bottom line here is that this is one of the only financing options that allows you to put little or no money down without mortgage insurance being added on.

Recommended Reading: How To Become A Mortgage Loan Officer In Michigan

Conventional Mortgages Down Payments And Pmi

Borrowers who use a VA loan to buy a home in California can enjoy benefits not available with most other mortgage programs.

With a non-government conventional home loan, for example, buyers who put down less than 20% on a purchase usually have to pay for private mortgage insurance . As weve already discussed, this could potentially add hundreds of dollars onto the monthly mortgage payment.

But PMI does have its advantages. It allows home buyers to purchase a house with less money down and therefore sooner rather than later. But its still an added expense on top of the mortgage principal and interest. Thats why some borrowers put down at least 20% on a home purchase. They do it to avoid PMI.

But again, the private mortgage insurance requirement only applies to conventional loans that are not guaranteed by the government. VA loans do receive a government guarantee, and this allows borrowers to avoid the PMI that would normally be triggered by a small down payment.

Va Home Loan Requirements

Meeting the requirements for a home loan shift when using your VA benefits.

VA home loans are insured by the U.S. Department of Veterans Affairs. They offer 100% financing and no mortgage insurance, making them a great option for members of the U.S. Armed Forces who serve to protect our security. The Department of Veterans Affairs doesnt issue the loans. Rather, borrowers acquire a loan by applying for a mortgage with a VA-approved lender.

GETTING A VA LOAN

Recommended Reading: What Are Mortgage Lender Fees

What If I Want To Purchase A Condo With A Va Loan

The Department of Veterans Affairs has a condo database of approved developments. If your dream condo is not on the VAs list, your lender can ask the VA to approve this development. Keep in mind that the VAs process for adding a new condo development to their approved list can take months and is not guaranteed to be approved once the process is over.

% Loan To Equity Value

You dont need any equity to refinance your VA loan into a lower rate or take cash out in most cases. In fact, with a VA Streamline loan, you can refinance up to 120% of your homes value for changing your term or lowering your rate. This means you can refinance even if you owe more on your home than its worth.

You May Like: Does Usaa Have Mortgage Loans

Does A Va Loan Require Private Mortgage Insurance

Whether you are looking to buy, build, or refinance, a VA loan is tough to beat. A popular feature of this program is the ability to buy a home with no money down. Another amazing VA loan advantage includes the subject of VA loan PMI.

PMI means private mortgage insurance. This is commonly charged on home loans exceeding 80% of the purchase price or appraised value and comes in four formats. VA loans have the most payment-friendly option, which we explain.

Your Home Must Qualify For Va Loan

This is one of the harder aspects of VA loan restrictions to explain. Before you can purchase your home using VA loans, your property must qualify. The VA will send a specially appointed VA appraiser to assess the house. Here is a good breakdown of the VA property requirements but in general, your home must be a conventional home in good working condition.

You May Like: How Long Is A Mortgage Rate Good For

Debt To Income Requirements

Your debt-to-income ratio is another important factor when it comes to VA loans. Again, the exact DTI for loan approval will depend on your lender and personal situation but, generally speaking, you can expect up to 45% to be the maximum acceptable DTI for a VA loan.

Can you qualify for a VA loan if you do not meet the debt to income requirements?

Every situation is unique and to offer the best answer, contact your mortgage banker. In some cases, your debt-to-income ratio can be adjusted by including any residual income you may have.

How Va Loans Work

The Department of Veterans Affairs backs VA loans by committing to pay up to 25% of the original loan amount if the borrower defaults on their home loan. Lenders often refer to this commitment as the VA guarantee.

The VA guarantee acts as an insurance policy, allowing lenders to offer veterans and service members home financing with additional benefits that borrowers may not be able to get through a conventional mortgage.

Also Check: Does Paying Off Mortgage Increase Credit Score

Summary Of Key Points

We covered a lot of information in this article, because we believe in being thorough. Lets wrap up with a brief summary of the key points you should take away from this:

- California VA loans typically do not require mortgage insurance or PMI.

- Thats just one of the benefits this unique program offers to home buyers.

- VA loans also allow borrowers to purchase a home with no money down.

- Conventional loans with low down payments usually require mortgage insurance.

- To compensate, the VA does require borrowers to pay a funding fee.

- The funding fee is a one-time payment that costs less than mortgage insurance over time.

Have questions? Bridgepoint Funding specializes in California VA loans. Located within the San Francisco Bay Area, we serve the entire state of California. Please contact us if you have any questions relating to this program.

What Is Va Mortgage Insurance

So, theres really no such thing as VA mortgage insurance. One of the benefits of VA loans is that they do not require monthly mortgage insurance payments .

Mortgage insurance is insurance payments made on a mortgage if you put less than 20% down. Its helpful in the sense that mortgage insurance lowers the risk to the lender of making a loan to you, so you can qualify for a loan that you might not otherwise be able to get. But, it also increases the cost of your loan, so you might have higher monthly payments, higher closing costs, or both.

But for mortgage insurance for VA Loans? There isnt any!

Also Check: What Is A Reverse Mortgage Canada

Perks And Quirks Borrowers Should Know About Va Loans

What Is A Va Funding Fee

The VA funding fee is a one-time fee paid to the Department of Veterans Affairs, and it supports the VA home loan program. Veterans who put down less than 5% on their home purchase will pay 2.3% of the loan amount when buying a home for the first time, and theyll pay a funding fee of 3.6% on subsequent loans. VA borrowers can pay less on the funding fee by putting down more money on the home.

This governmental fee changes periodically based on legislative action by Congress.

Read Also: What Mortgage Companies Use Experian

Does My Home Qualify For A Va Loan

Your VA appraiser will have final say in whether your home qualifies for a VA loan. To ensure the best chances for your property to be approved by the VAs Minimum Property Requirements , make sure your home covers the following:

Property condition:

- Mechanical systems are operating safely and are deemed to have reasonable future utility.

- Adequate heating supply that is in good working order.

- Roofing must be in good condition with no major leaks.

- Property must be free of any structural threats such as termites, rot, or fungus.

- Generally speaking, it is best to avoid homes listed as is as these homes tend to have one or more of the above listed issues.

Conventional property:

Your property must be a conventional family home. VA appraisers tend to dislike unique properties due to the complications they can create when trying to find recent comparable homes. In addition, your lender may have additional restrictions to certain unique homes including but not limited to: ranches, converted churches, and homes with geodesic domes.

How Does Va Loan Pmi Work

So, VA loans do not charge a monthly PMI. But, VA loans do charge most borrowers an up-front VA funding fee . Luckily for VA borrowers, the VA funding fee is financed on top of the loan in most cases. Notice it says most borrowers are charged VA loan PMI. The reason is that disabled military veterans are exempt from the VA funding fee.

Do keep in mind, there is a recent change in financing the VA funding fee. A VA cash-out refinance requires the full loan amount including the VA funding fee be within the appraised value. On a purchase or streamline refinance, the fee may exceed the VA appraised value! Even though VA allows the fee to be financed, a borrower may pay it from their own funds at closing. Another strategy is that a seller may pay the fee through seller paid VA concessions.

Recommended Reading: What’s A Normal Mortgage Interest Rate

A Va Appraisal Is Required

One contingency of a VA loan is that you must get a VA appraisal. The VA appraisal is an evaluation of your proposed property value. An independent VA-certified appraiser inspects the condition of the home, compares surrounding sales, and makes a value assessment. The appraisal can be anywhere from $300 to $500.But dont mistake this for the home inspection these are two different things. Mainly, the appraisals purpose is to determine if your home is fair market value. This helps you, the VA, and your lender ensure youre not overpaying for your property.

The VA appraisal typically takes around 14 days, but dont be surprised if it takes longer.

Also, timelines vary by state based on specific state guidelines.

Basic Homeowners Insurance Coverage

Your homeowners insurance will compensate you for damage to or destruction of your home and personal belongings caused by an event covered under your policy. In some cases, you will also be covered if you injure another person or damage property. Homeowners insurance has three primary functions:

- Make repairs to your house, yard, and other structures.

- Replace or repair your personal belongings.

- Ensure youre protected if youre legally liable for the injury or damage of someone else.

In general, homeowners insurance policies cover six types of risks.

| Coverage type |

You May Like: How Do I Go About Getting A Mortgage

Also Check: What Is The Mortgage Rate For Bank Of America