How Discount Points Affect A $400000 30

Number of PointsCost of PointsInterest RateMonthly Principal and Interest PaymentTotal Savings After 30 YearsBreak-Even Point

Zero points$0-4.5%$2,027$0NA

1 point $4,0004.25%$1,968-$17,228-68 months

2 points$8,000-4%$1,910$34,04769 months

3 points$12,0003.75%-$1,852-$50,92569 months

Disclaimer: The purpose of this table is to show how mortgage points function in general. It is not meant for financial advice or to calculate the actual costs of a particular mortgage.

Comparing mortgage costs can also be as simple as looking at the annual percentage rate of a loan. The annual percentage rate is a calculation that takes into account the loans interest rate, discount points, and other lender fees.

Are Mortgage Points Right For Me

There are a few additional considerations if you are looking at discount points. One is that they can be a tax break for you. You will want to speak to your tax preparer to find out whether there are any benefits at tax time if you get mortgage points.

The second big decision is whether it makes sense to buy discount points or to put more money toward your down payment. A larger down payment can also bring down your interest rate and can help you avoid having to pay mortgage insurance which you must pay if your down payment is less than 20%. You will want to compare discount points with a larger down payment to see what makes sense. If you opt for mortgage points, check different lenders to find one with the most advantageous terms.

Money Help Center has unbiased, free calculators to help you make the right choices when its time to get a home loan. Check out our calculators to save on your purchase.

Sign up for our newsletter and get the latest news and updates

Money Help Center

What Is The Breakeven Point

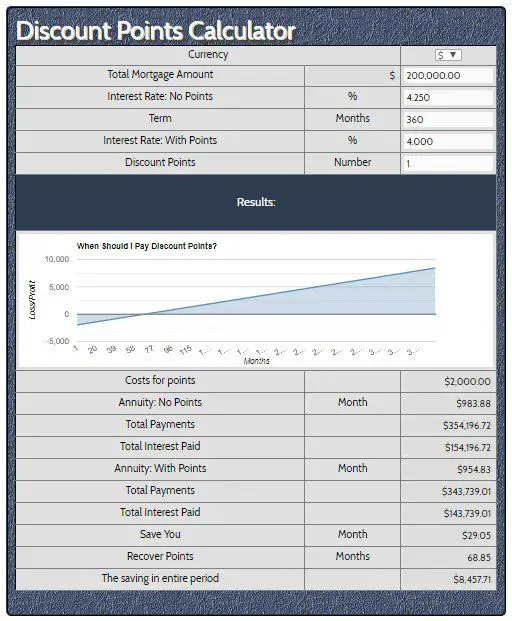

To calculate the breakeven point at which this borrower will recover what was spent on prepaid interest, divide the cost of the mortgage points by the amount the reduced rate saves each month:

$4,000 / $56 = 71 months

This shows that the borrower would have to stay in the home 71 months, or almost six years, to recover the cost of the discount points.

The added cost of mortgage points to lower your interest rate makes sense if you plan to keep the home for a long period of time, says Jackie Boies, a senior director of Partner Relations for Money Management International, a nonprofit debt counseling organization based in Sugar Land, Texas. If not, the likelihood of recouping this cost is slim.

You can use Bankrates mortgage points calculator and amortization calculator to figure out whether buying mortgage points will save you money.

You May Like: How Do I Qualify For A Zero Down Mortgage

Mortgage Discount Points Faqs

Discount points are paid to reduce the amount of interest you pay on the loan.

How Much Do Points Cost?

Every point on the loan is equal to 1 percent of the total loan cost. For example, 1 point on a $200,000 loan would be $2,000. If you paid 4 points, you would pay $8,000.

Can You Buy Partial Points?

Yes. Some lenders showcased in the above mortgage rate table list whole-number points while others may offer loans with no points or fractions of a point like 0.79 points.

How Many Discount Points Can I Buy?

The maximum number of points varies by lender, but it is uncommon for consumers to pay more than 4 discount points.

How Much Does a Point Lower Interest Rates?

The amount you can save on your interest rate by paying for points will vary by lender. However, for each loan point you purchase, you can typically reduce the interest rate on your loan by 1/8 percent or 1/4 percent. 25 basis points or a quarter of a percent is the most common value associated with a discount point.

How Are Points Treated for Tax Purposes?

Discount points are used to buy a lower interest rate throughout the loan. From a tax persepctive they are treated as pre-paid interest. Provided your mortgage document states the number of discount points which were purchased and the number of points you purchased is within the normal range where you live then you may deduct the cost of discount points from your income taxes.

Who Should Buy Points?

Who Should Avoid Points?

Can You Have Negative Points?

Who Pays Closing Costs

Usually both parties will have closing costs to pay. But you can negotiate to have the seller pay a portion of your closing costs. Known as seller concessions, this may be helpful if you think youll have trouble covering all of your closing costs. It could also be useful if the home inspection uncovers issues that are going to cost money to fix. In a buyerâs market , a seller may be willing to negotiate to make the purchase more attractive. In a sellerâs market , itâs less likely a seller will agree to pay part of your closing costs.

Read Also: How To Estimate My Mortgage Payment

What Are The Benefits Of Mortgage Points

The main benefit of buying mortgage points is reducing your loans interest rate and thus the amount youll pay over the life of the loan. Generally, each point lowers your interest rate by 0.25%, although the exact amount can vary.

Lowering your mortgage interest rate can decrease your monthly payments, making it easier to manage your budget. Additionally, the cost of the points could be an itemizable tax deduction because youre prepaying mortgage interest. If you meet IRS requirements, you could take the entire deduction during the year you paid the points. Otherwise, you may be able to claim the deduction over the lifetime of your loan.

What Are Points On A Mortgage

Mortgage discount points allow you to essentially buy a lower interest rate when it comes to home loans. Heres how it works:

A 0.25% discount might not look like a lot on paper, but over the course of a 30-year mortgage, points can mean serious savings.

On a $300,000 loan, for example with a 20% down payment and no mortgage insurance the difference between a 3.50% rate and a 3.25% rate would be about $33 per month and nearly $12,000 over the life of the loan.

Heres how two home loans would look with and without points:

| Total interest paid over loan term | $147,975 | |

| Total payments over loan term | $387,975 | $376,018 |

| Note: All numbers here are for demonstrative purposes only and do not represent an advertisement for available terms. |

Read Also: How Much Are The Payments On A 200k Mortgage

Talking About Discount Points

Discount points are essentially prepaying a certain amount of your interest. In order to give a borrower a lower interest rate, the lender will charge you discount points. This is considered buying down your interest rate since you are making a payment upfront in order to obtain a lower rate throughout the life of your loan.

Each percentage of your loan is the same as one discount point. If you select to roll the VA funding fee into your mortgage, the total amount, mortgage plus funding fee, is used to determine the amount of each discount point. As an example, if the total amount of your loan is $300,000, then one discount point is $3,000.

There is an assortment of interest rates and closing costs available when looking around for a mortgage. Below is a snapshot of what a VA Mortgage borrower with great credit would qualify for as of early 2015.

| Interest Rate | |

| 2.000% | 3.000% |

As you can see, with the lower interest rates, you will have to pay more in origination fees and discount points. So, how can you determine if paying more upfront will lead to paying less over the life of your loan? There is a simple calculation to figure out how much time it will take for the lowered monthly payments to justify paying for discount points up front. Here it is:

÷X = Number of months it will take before discount points offset lower payments

Heres how the calculation would work out in the example below:

1,706.371,679.97 = 26.40

Lets Look At An Example Of Discount Points In Action:

Par rate: 5% Desired interest rate: 4.5% Total cost: 2 discount points

Say you qualify for an interest rate of 5% with no costs other than a loan origination fee of 1% . But you want to secure an even lower mortgage rate, perhaps 4.5%. In order to do so, youre told youll need to come up with more money at closing to pay mortgage discount points.

The mortgage broker or bank will do the math and determine that you need to pay X amount of discount points to lower your interest rate by a half of a percentage point.

In our example, it would take two discount points to lower your rate by the desired 0.5%. Again, this can vary, but well use those numbers to illustrate the potential cost.

The cost of two mortgage discount points on a $200,000 loan amount is $4,000 to obtain the desired mortgage rate, as seen on the GFE pictured above.

That $4,000 would lower your monthly mortgage payment from $1,073.64 to $1,013.37, a savings of roughly $60 a month. So in exchange for lower mortgage payments each month, youd pay more at closing. Thats the tradeoff.

A lower rate would also help you pay down your mortgage balance faster, something that also needs to be considered alongside the monthly savings.

If you decided that a rate of 5% was good enough, you would avoid paying the discount points and reduce closing costs substantially. In our example, youd have $4,000 in your pocket, instead of wrapped up in your mortgage.

Read Also: What Does Icd Stand For In Mortgage

How To Pay For Mortgage Points

A borrower who pays discount points is likely to have to meet these costs out of pocket. However, many scenarios exist, particularly in buyers real estate markets, in which a seller offers to pay up to a certain dollar amount of the closing costs. If other closing costs, such as the loan origination fee and the title insurance charge, do not meet this threshold, then the buyer can often add discount points and effectively lower their interest rate for free.

Reducing your mortgage interest rate with discount points does not always require paying out of pocketparticularly in a refinance situation, in which the lender can roll discount points, as well as other closing costs, into the new loan balance. This prevents the borrower from coughing up more money at the closing table of course, it also reduces their equity position in their home.

Because the Internal Revenue Service considers discount points to be prepaid mortgage interest, they generally are tax deductible over the life of the loan. If they and the home purchase meet certain conditions, then they can be fully deductible for the year when they were paid.

When Not To Buy Mortgage Points

Mortgage points dont make sense for every homeowner. Here are some reasons not to buy them:

- You dont plan to stay in your home for long. If youre a wandering soul who loves to move from place to place every few years, you wont get much benefit from discount Points are a long-term strategy to pay less interest over time. It takes a few years for the money you save on interest to surpass the amount you spend to buy the points. If you know youll want to move at any point in the near future, points may not be worth the cost.

- You plan to pay extra on your mortgage payments. Mortgage points will only benefit you if you pay on your home loan for a long time. If you have the means to pay off your loan quickly, you might not end up saving much money.

- You dont have the money to buy points. Its not worth emptying your savings account to save on interest down the line. Instead, you could save on interest in the long run by putting extra money toward your principal when you have the cash.

- Your down payment would suffer. Its usually better to apply extra cash to your down payment than to points. A larger down payment could mean a lower interest rate, cheaper mortgage insurance or lower payments. Mortgage discount points dont come with all of these benefits.

Also Check: What Is Refinancing Your Mortgage

The Longer You Keep Your Home Loan The Better If You Pay Points

- If you do happen to pay discount points

- Youll be rewarded more the longer you keep the loan

- Since each monthly payment will be lower as a result

- The reverse is also true so try to determine your tenure ahead of time

As a rule of thumb, mortgage discounts points make more sense for those who plan to stick with their mortgage for the long-haul, as the interest saved over the years can be exponential.

On the other hand, if you plan to move or refinance again in the near future, paying mortgage discount points could be a complete waste of money.

While mortgages generally have terms of 15 or 30 years, most homeowners dont see them through to maturation. Not even close.

Instead, they sell or refinance long before that time. So there are definitely a lot of borrowers out there leaving money on the table when paying points.

Also be sure to consider your asset situation before making the decision to pay any extra at loan closing.

If you dont have a lot of money saved up, you wont want to blow what little you do have lowering your mortgage rate by some incidental amount. Itll just make you more house poor.

You always have the option to pay more toward the principal balance each month if you want to save on interest, even if you didnt elect to pay points at closing.

Doing so could accomplish the same basic objective while giving you more flexibility.

About Mortgage Discount Points

Discount points are a common feature of mortgages, but they can be confusing for many borrowers. Just how do they work?

Discount points are a type of pre-paid interest. So by paying part of your interest up front, you can get a lower rate. And what you save in interest over the long haul can be a lot more than what you paid for the points up front. The question is, will you save enough to make it worth the initial cost?

The key is to calculate the break-even point how long it will take for your interest savings from a lower mortgage rate to exceed what you paid for your discount points. If you can recoup your costs in five years or so, that’s often a good deal.

A big consideration is how long you expect to have the mortgage. If you sell the home or refinance the mortgage before reaching your break-even point, you’ll have lost money. Or if you do so only a year or two after reaching it, your savings might not be enough to make it worthwhile.

Discount points work best for someone who expects to stay in their home and not refinance for a long time. Over 20-30 years, the savings can be substantial in the tens of thousands of dollars. However, if it takes a long time to reach your break-even point, say 10-15 years, you have to ask yourself whether the small savings you’ll realize each month are worth the trouble, even if you expect to stay in the home longer than that.

Also Check: Can I Get A Mortgage At Age 70

When Should You Not Buy Mortgage Points

Here are some reasons why buying mortgage points may not be a great decision:

- You dont intend to stay in the home for long. If youre in the military or love to move from place to place, buying mortgage points may not be beneficial.

- You plan to make additional payments on the loan. If youre financially capable with the means of making extra payments on your mortgage, buying mortgage points might seem like a waste of money.

- You dont have the finance to buy mortgage points. Mortgage points can be expensive. It is not financially wise to splurge your savings to save on interest down the line. Instead of spending your savings on mortgage points, you could channel it to paying down your mortgage principal.

- It will impact your down payment. Most mortgage experts will advise that you channel your saving towards your down payment. Bigger down payment will mean lower monthly mortgage payments, lower interest rates, and even no mortgage insurance costs.

Also Check: How To Write An Appeal Letter For Mortgage Assistance

How To Calculate Discount Points In Real Estate

Mortgage lenders use discount points to make small adjustments in the projected return from loans and to give borrowers different rate and payment options. In lender jargon, one point is 1 percent of the loan amount. The dollar value of points can be quickly calculated. Some additional math will give you comparison figures to help you decide whether it makes sense to pay more points for a lower rate or go with less points and accept a higher mortgage interest rate.

Obtain current discount point amounts with associated home loan rates from a mortgage lender. A lender sets the points it will charge for a range of interest rates. For example, a loan at 5 percent may be listed at zero points, a 4.75 percent mortgage costs one point and a 4.5 percent loan requires the payment of 2.5 points.

Multiply your projected loan amount times the points for a specific interest rate. The result will be the dollar amount added to the loan closing costs for the selected interest rate. Using the example rates and a $250,000 loan, the one point for a 4.75 percent rate would equal $2,500 and the 2.5 points at 4.5 percent equals $6,250.

Tips

References

Also Check: What Is A Closing Cost On A Mortgage