How To Get A $200000 Mortgage

Getting a mortgage isnt as hard as you think. As long as you prepare and break the process down into small, manageable steps, its really quite simple. And were here to help you break those steps down.

If youre ready to get started, you can use Credible to request an instant streamlined pre-approval today.

Credible makes getting a pre-approval letter easy

- Streamlined pre-approval: It only takes 3 minutes to see if you qualify for a streamlined pre-approval letter, without affecting your credit.

- Figure out your homebuying budget: No more second-guessing how much you can afford well tell you the amount youre prequalified for instantly.

- Compare your mortgage options: You can check out rates from multiple lenders to make sure youre getting a great deal on that $200,000 mortgage.

Here are the steps to follow to get a mortgage:

Find a great agent today

Keep Reading:

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can You Afford A 10000000 Mortgage

Is the big question, can your finances cover the cost of a £100,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering yes then its worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £100,000.00

Do you need to calculate how much deposit you will need for a £100,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UKs leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesnt charge you fees, so you get the best mortgage deals without the hassle.

Recommended Reading: How Many Times Can I Apply For A Mortgage

Read Also: Are Mortgage Origination Fees Negotiable

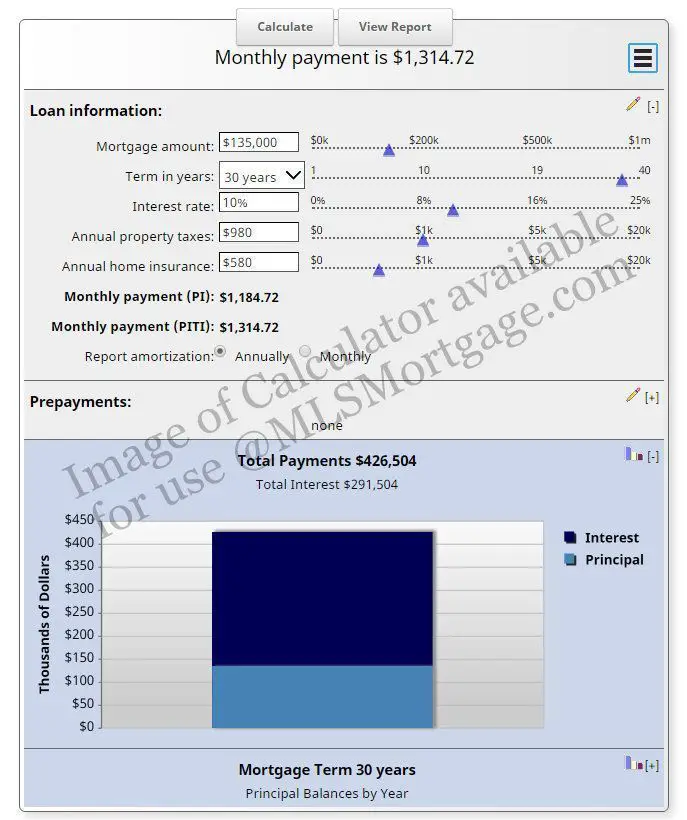

How Much Interest Will You Pay On A $200000 Mortgage

A longer mortgage term and higher interest rate results in more interest over the life of the loan. Conversely, the shorter your mortgage term and lower your rate, the less youll pay in interest.

For a 30-year, $200,000 mortgage at 3.5%, youll pay about $123,000 in interest over the loan term. If the interest rate rises to 5%, your total interest would reach more than $186,000 over those three decades.

Shorter loan terms require you to pay much less in interest, though your monthly payments are higher. Say you have a 15-year, $200,000 mortgage at 3.5% . Youd pay just $57,358 in total interest. At a 5% interest rate, youd pay $84,686 in interest over the life of the loan. Youll also pay off your mortgage much earlier than you would with a 30-year loan.

At the beginning of your loan term, the majority of your monthly payment goes toward paying this interest. Only a small amount goes toward principal. As time passes, the ratio flips. By the time youre close to paying off your loan, most of your payment goes toward principal, with a small amount allocated to interest.

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgageâstated another way, itâs the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youâll pay each monthâthe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youâll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still donât know which term to choose, itâs also worth considering whether youâd be able to break evenâor, perhaps, saveâon the interest by choosing a lower monthly payment and investing the difference.

Also Check: What Is Loan To Value Mortgage

How Much Does A 200000 Mortgage Cost Per Month

There is no one set amount a mortgage of this size costs but as a broad example, for a standard capital and repayment mortgage, over 25 years, using an interest rate of 3% the repayments would be £948 per month.

Remember, at this stage, you can only guess which rates and term length will be available to you. Its best to speak to a broker if youre looking for a more specific answer based on your individual circumstances.

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but our mortgage payment calculator makes it much easier. Ratehub.caâs mortgage payment calculator gives you everything you need to test different scenarios to help you decide what mortgage is right for you. Read on for more information on how the calculator works.

Read Also: What Credit Score Do You Need For A Mortgage Loan

Mortgage Calculator: Fees And Definitions

The above mortgage calculator details costs associated with loans or with home buying in general. But many buyers dont know why each cost exists. Below are descriptions of each cost.

Principal and interest. This is the amount that goes toward paying off the loan balance plus the interest due each month. This remains constant for the life of your fixed-rate loan.

Private mortgage insurance . Based on recent PMI rates from mortgage insurance provider MGIC, this is a fee you pay on top of your mortgage payment to insure the lender against loss. PMI is required any time you put less than 20% down on a conventional loan. Is PMI worth it? See our analysis here.

Property tax. The county or municipality in which the home is located charges a certain amount per year in taxes. This cost is split into 12 installments and collected each month with your mortgage payment. Your lender collects this fee because the county can seize a home if property taxes are not paid. The calculator estimates property taxes based on averages from tax-rates.org.

Homeowners insurance. Lenders require you to insure your home from fire and other damages. This fee is collected with your mortgage payment, and the lender sends the payment to your insurance company each year.

Loan term. The number of years it takes to pay off the loan . Mortgage loans most often come in 30- or 15-year options.

Interest rate. The mortgage rate your lender charges. Shop at least three lenders to find the best rate.

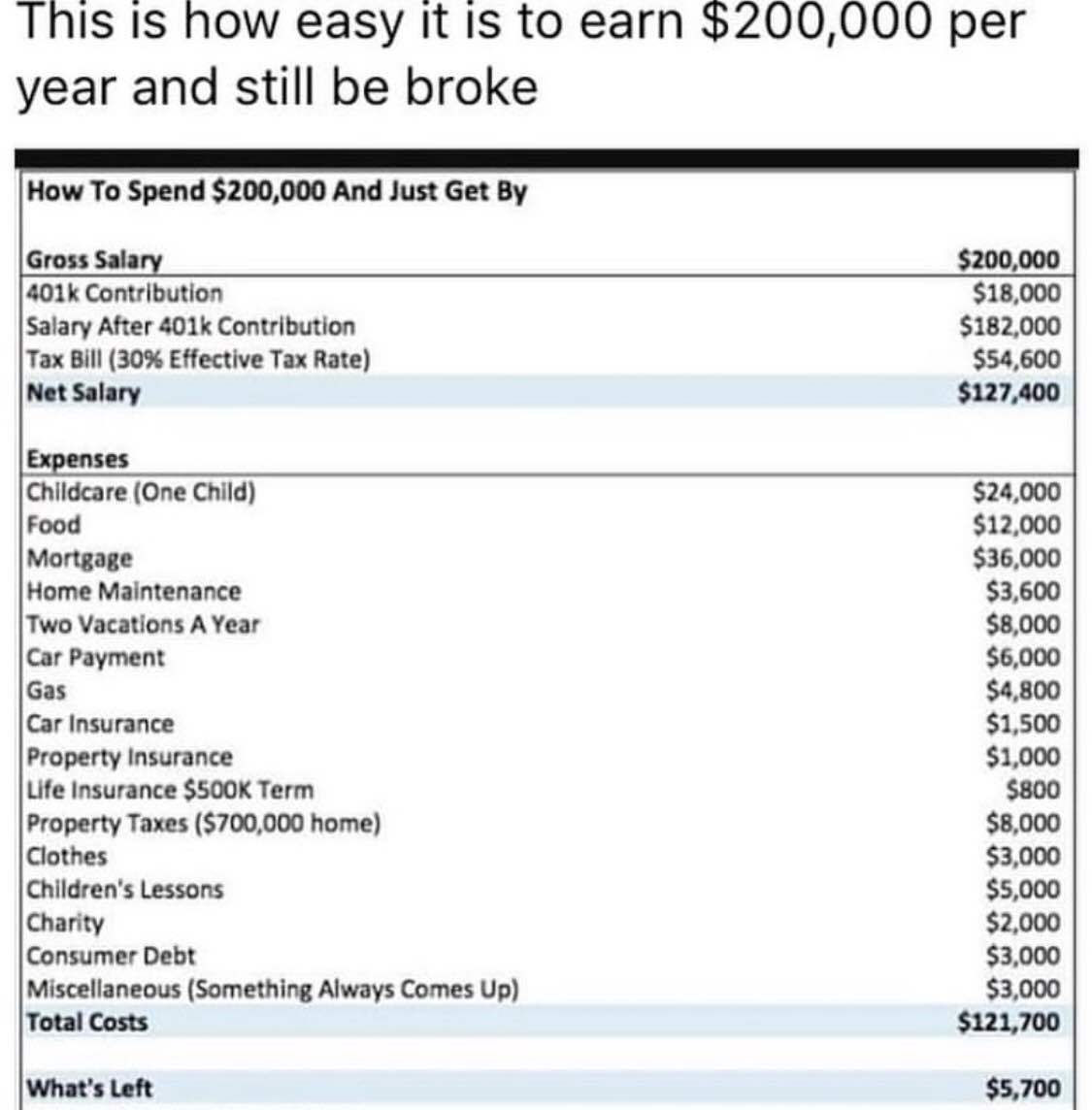

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Also Check: How Much Down Payment For A Mortgage

How Interest Rate Affect 200k Mortgage Repayments

Like other loans, its crucial to consider the interest rate for a 200k mortgage loan as it can affect how much you repay every month. Mortgage lenders in the UK may offer interest rates ranging from 1% to 5%, mainly depending on your risk profile or credit history and the size of your deposit.

Heres an estimate of the monthly repayments you would make for a 200k mortgage based on different interest rates in 30 years.

| Interest Rate |

| £1074 |

Monthly Payments For A $200000 Mortgage

Monthly mortgage payments always contain two things: principal and interest. In some cases, they might include other costs as well.

Heres what typically makes up a mortgage payment:

-

Principal: Principal is money that goes directly toward whittling down your balance.

-

Interest: This is what you pay to actually borrow the money. The amount youll pay is reflected in your interest rate.

-

Escrow costs: If you opt to use an escrow account , youll also have your property taxes, mortgage insurance, and homeowners insurance rolled into your monthly mortgage payment, too.

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance.

But these can vary greatly depending on your insurance policy, loan type, down payment size, and more.

Heres a more detailed look at what the total monthly payment would look like for that same $200,000 mortgage:

Recommended Reading: How To Negotiate Best Mortgage Rate

How Much A $200000 Mortgage Will Cost You

The monthly payment on a 200k mortgage is $1,348. You can buy a $220k house with a $20k down payment and a $200k mortgage.

Some of the links on our website are sponsored, and we may earn money when you make a purchase or sign-up after clicking. Learn more about how we make money.

What house can I afford? What is a $200,000 mortgage monthly payment? What would the mortgage be for a 200k house?

The monthly payment on a $200,000 mortgage is $1,348 for a 30 year-loan and $1,879 for a 15 year one.

You can buy a home worth $220,000 with a $20,000 down payment and a $200,000 mortgage.

Your monthly payment on a 200k mortgage would be $1,348.09 :

- Principal and interest: $898.39

- Taxes and insurance: $283.33

For a $220,000 home, your mortgage payment will be $1,348.09. This is calculated at 3.5 percent interest and a 10 percent down payment .

This includes estimated property taxes, insurance premiums for risks such as fire and theft, and mortgage insurance payments.

To edit your assumptions, you can click below to use the mortgage calculator.

What Are The Repayments For A 200k Buy

Rules for buy-to-let mortgages are usually stricter and slightly different from residential mortgages. Lenders will have higher minimum income requirements and require more significant deposits.

Some may consider rental income forecasts and require that the projected rental payments cover 125% to 130% of the 200k mortgage monthly repayments.

You can make most buy-to-let mortgage repayments on an interest-only basis, and this will be more tax-efficient and flexible for you as a landlord. Youll have the option to quickly sell the property when you wish to clear the loan balance.

You May Like: What Questions Do Mortgage Lenders Ask Employers

Monthly Payments On A $200000 Mortgage

What is each mortgage payment made up of?

- Principal payment. This goes towards the amount you borrowed from the lender . As you gradually pay off the amount you borrowed, you will be paying interest on a smaller loan amount, so your interest payments will slowly reduce.

- Interest payment. This is the cost to borrow from the lender. The higher your principal and the higher your interest rate, the more interest youll need to repay.

$1,111.66$2,072.77

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

Dont Miss: Recasting Mortgage Chase

Recommended Reading: How To Pay Off Your Mortgage Quickly

How To Use Our Mortgage Calculator

You want to determine your $200,000 mortgage monthly payment at 5% interest and intend on repaying it over 30 years. Enter:

- “200,000” as the Mortgage Amount

- “30” as the Term, and

- “5” as the Annual Interest Rate.

Thinking about a fixed-rate mortgage? Use this calculator to see the total principal and interest you’ll owe each month.

Amortization Schedule For A $200k Mortgage

Amortization for a mortgage shows the process of paying both the interest and principal off on a mortgage. Initially, you will pay mostly interest on your $200k mortgage and eventually pay mostly principal.

An amortization schedule shows each payment towards a mortgage until the predetermined term ends.

Recommended Reading: Does Applying For Mortgage Hurt Credit

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Read Also: Can You Refinance A Mortgage Without A Job

How A Broker Can Help You Reduce Your Repayments

All mortgage applicants want to minimise their monthly repayments, particularly ones that want to borrow at a relatively high level such as £200k. To do so, you need to apply to a lender that will give you the lowest interest rate possible.

This is why using a broker can be such a good idea. The brokers we work with have in-depth knowledge and experience of the market which means their help can quickly pinpoint the right lender for you. Theyll know which provider will offer a mortgage with the cheapest repayment plan you can secure.

If you get in touch well arrange for a mortgage specialist to contact you straight away.

Repayments on mortgages can be impacted by the following factors, both directly and indirectly:

You May Like: Can A Mortgage Loan Be Used For Renovations

Apply For A 200000 Mortgage

To find out more about our range of £200,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

How Much Income Do I Need To Qualify For A 200k Mortgage

As weve already touched on, it can come down to more than just the numbers on your wage slip. However, to give you a rough idea, some lenders cap the amount you can borrow based on x4.5 your salary, others go up to x5 and a minority to x6, under the right circumstances.

So, to give a ballpark figure, assuming two applicants, each would need a combined salary of between £33,000 and £50,000, although this does not include other varies lenders take into account when assessing affordability, such as how much deposit you have and your credit rating.

You can read more about affordability assessments here.

Read Also: What Is A Bad Mortgage Rate

How Loan Terms Affect 200k Mortgage Repayments

Generally, you can get a 5 to 30 years loan term to repay a 200k mortgage. The amount it will take you to pay off a 200k mortgage will depend on how much you can realistically afford to pay each month.

The length of the mortgage has a significant effect on repayments and how much you ultimately pay. Extended periods will have cheaper monthly repayments but a higher overall cost, while lesser periods will have higher monthly repayments but a lower total amount.

For example, a 200k mortgage over 30 years will cost you more than a mortgage for 25 years or less but will have cheaper monthly repayments that may be worth the extra cost.

Its advisable to base your decision on how much you can realistically afford to repay each month without financial strain. The table below can give you an idea of how the term affects the total amount and repayments for a 200k mortgage based on an interest rate of 3%.

| Term |