When Is A Cash

A cash-out refinance is a great option for homeowners who need on-hand cash, meet the requirements of the refinance loan and generally need no more than 80% of their homes equity. Because of their lower interest rates, cash-out refinances can be a better option than financing with a credit card.

If youre not sure whether a cash-out refinance is right for you, our refinance calculator may be able to help.

Refinancing A Va Loan Into A Conventional Loan

Conversely, refinancing a VA loan into a conventional loan can help you lower your interest rate and pay less in closing costs.

If you have excellent credit, interest rates on a conventional mortgage refinance could be lower than a VA mortgage refinance. You also wont have to pay a VA funding fee, which can be up to 3.6% of the loan value. However, you will have to pay for mortgage insurance if refinancing for more than 80% of the homes value.

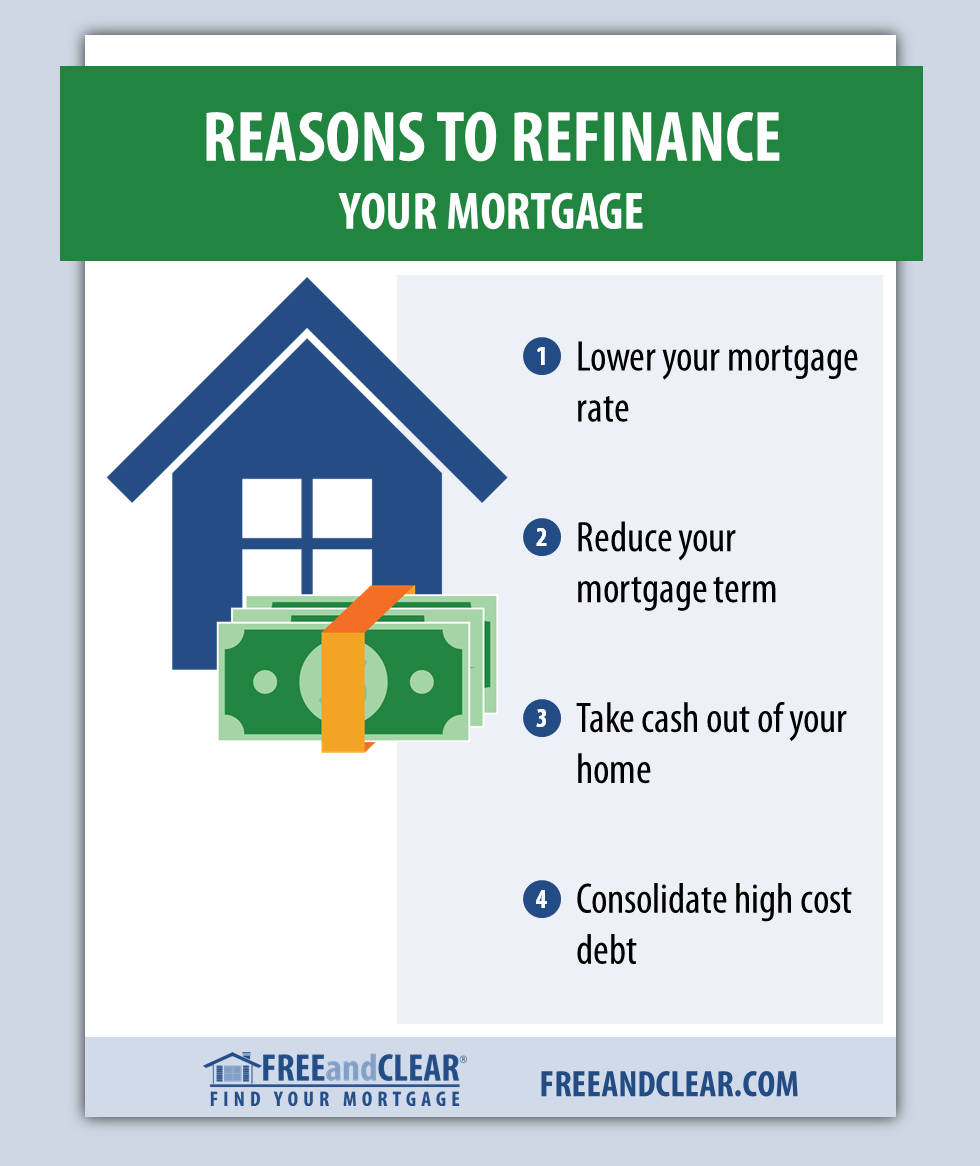

When You Shouldn’t Refinance Your Mortgage

There are also plenty of reasons to hold off on refinancing your mortgage. Everyone’s situation is different. So, before you start filling out any paperwork, make sure you take a look at some top reasons to possibly postpone your refinance.

You plan to move soon

When you refinance a mortgage, you have to pay closing costs, just like you did when you initially took out the loan. Closing costs range from 3% to 6% of the loan amount. For example, a $200,000 mortgage could have closing costs between $6,000 and $12,000.

In most cases, it can take about five years after refinancing to break even on closing costs. If you plan to move before that time frame, then you should avoid refinancing.

You’ll end up paying more in total costs

When deciding whether or not to refinance, most people start by comparing their current interest rate and overall market rates. But you should also consider what you’ll pay in total over the life of the loan.

For example, let’s say you took out a $200,000 30-year mortgage with a 5.5% interest rate. You took out this loan 10 years ago and now qualify for a 30-year term with a 4.5% interest rate. If you refinance, your monthly payment will be $288 less.

However, by restarting the loan term, you’ll actually end up paying $30,870 more in total interest because you’ve effectively lengthened the loan term by 10 years.

You May Like: How To Fill Out A Pre Approval For Mortgage

Apply Through Your Lender

After you apply for a cash-out refinance, you receive a decision on whether your lender approves the refinance. Your lender might ask you for financial documents like bank statements, W-2s or pay stubs to prove your DTI ratio. After you get an approval, your lender will walk you through the next steps toward closing.

After closing, all thats left to do is wait for your check to arrive.

When Not To Take Equity Out Of Your House

Now that you know the answer to how soon can I take equity out of my house, you need to know when not to tap into your home equity.

- For unnecessary, impractical, frivolous items such as big-ticket purchases. Apply for a home equity loan only if youre planning to pay for a large-scale renovation, medical bills, or your childs education.

- If youre planning to move and sell the house in the next couple of years. You may have to pay off the loan balance with your house sale price.

- If you dont have any emergency savings. Keep your home equity as a backup plan for any financial emergency, medical crisis, or accident. This is really important if you do not have substantial savings.

- Youre struggling financially to make your mortgage payments. Youll not want another loan and its monthly payments on your statement.

- You have a below-average credit score. You may be able to procure a home equity loan with a bad credit score but your interest rates will be high.

If you answer yes to any of the above conditions, its best to consult with a financial advisor before applying for a home equity loan.

Also Check: How To Find Out Which Mortgage Company Owns A Property

Pros And Cons Of A Cash

Savvy investors watching interest rates over time typically will jump at the chance to refinance when lending rates are falling toward new lows. There can be a variety of different types of options for refinancing, but in general, most will come with several added costs and fees that make the timing of a mortgage loan refinancing just as important as the decision to refinance.

In addition to checking rates and fees to make sure that refinancing is a good option, consider your reasons for needing the cash. This refinancing option typically comes with lower interest rates than unsecured debt, like or personal loans, does. However, unlike a credit card or personal loan, you risk losing your homeif you cant pay your mortgage, for example, or if the value of your home goes down and you end up underwater on your mortgage.

Carefully consider if what you need the cash for is worth the risk of losing your home if you cant keep up with payments in the future. If you need the cash to pay off consumer debt, take the steps you need to get your spending under control so you dont get trapped in an endless cycle of debt reloading. The Consumer Financial Protection Bureau has a number of excellent guides to help determine if a refinance is a good choice for you.

Home equity loans and home equity lines of credit are alternatives to cash-out or no cash-out mortgage refinancing.

Can I Refinance My Home Without Taking Cash Out In Order To Lower Payments Or Interest

There are several reasons why you might want to refinance your home without taking the cash out. If you know you can get a better interest rate on your current mortgage, if you have an adjustable rate mortgage, if you want to get rid of your PMI, or if you want to lower your payments, you may want to refinance without the cash-out option.

Recommended Reading: Can You Write Off Points On A Mortgage

Improve Your Credit Score

You may be wondering if a cash-out refinance will improve your credit score. While it does have an impact on your score, you may be better off avoiding it. This type of refinancing triggers a hard inquiry on your credit report, which will temporarily lower your credit score. However, this negative impact should be minimal, and recovery from a minor dip in your score is usually fast.

A cash-out refinance can be a great way to pay off high-interest debt. It can also be a great way to pay for home improvements. You can also use the money for education or emergency expenses. You can even pay off high-interest credit card debt with the money you receive from cash-out refinancing.

Cash-out refinances are not right for everyone, so its important to discuss this option with a mortgage expert before applying. Your credit score is a crucial factor, as it will determine how much money you can borrow and how much you will be charged in interest. You should also review your debt-to-income ratio to ensure you can afford the monthly payments.

Youre Paying Off Debt

Cash borrowed from your homes equity can be used to pay off high-interest credit card debt. Debt consolidation* can simplify your finances and reduce how much you pay in credit card interest. But you should only tap your equity for debt consolidation if youre committed to using credit cards responsibly moving forward. You dont want to fall into a circumstance where you pay off your credit cards with your home equity but then max out these cards again, essentially doubling your debt.

You May Like: Can Student Loans Affect Getting A Mortgage

How To Refinance Your Mortgage

When it comes time to refinance your mortgage, you may be unsure which option is best for you. The best option is to shop around and get two or three quotes before choosing one. You should also ask about fees or waivers from the mortgage lender. You should read the loan estimate carefully and negotiate any costs you dont understand.

Whether It’s For Home Improvements Or Debt Consolidation Refinancing Your Mortgage May Help Ease The Burden Of Cumbersome Expenses Excessive Debt Or A High

But there’s more than one way to refinance a mortgage: Depending on your situation, you may want to consider a mortgage cash out. The answers to these frequently asked questions could help determine whether a cash out is the right refinancing option for you.

What is a mortgage cash out?

“The term ‘cash out’ is generally used to describe intent,” says Keith Smith, a Regional Sales Manager at Regions Mortgage in Little Rock, Arkansas. A mortgage cash out is a refinancing option whereby your existing mortgage balance is ultimately replaced with a higher loan balance in order to provide cash that can be used for other purposes.

For example, let’s say your home is valued at $200,000. You can typically refinance 80 percent of the home’s value, which would be $160,000. From there, subtract your existing balance mortgage and/or home equity loans to determine how much money you may receive with a mortgage cash out. So, using the above example, if your existing balance is $75,000, you may be able to receive $85,000 in a mortgage cash out.

Just remember that the amount you refinance, current interest rates, and the length of the loan may affect what you owe each month. If you’re seeking the lowest monthly payment, Smith suggests looking for a 30-year term for refinancing. However, you will also pay more interest with a longer term loan.

What are the benefits of a mortgage cash out?

What are the challenges associated with a mortgage cash out?

Content Type: Article

Don’t Miss: What Is The Current Trend In Mortgage Rates

Beginner’s Guide To Cash

Cash-out refinances allow you to use the equity in your home to get the cash you need for things like home improvements, medical bills, paying for college and other large expenses. Your home is probably the biggest investment you’ve made in your life, and it may be a source of financing when you need it.

When To Consider A Cash

As with any mortgage refinance, a cash-out refi makes sense if it can save you money. But a cash-out refinance wont get you the lowest interest rate or smallest monthly payment. When youre doing a cash-out refinance versus a normal refinance, the rate is likely going to be a bit higher, Beeston says. Its considered a riskier loan because youre taking cash out.

But a cash-out refinance can still make sense even if your monthly mortgage payments increase, as long as youre saving somewhere else as a result.

You May Like: How To Become Mortgage Agent

What About A Reverse Mortgage

If you need extra cash but don’t feel like you would benefit from a mortgage refinance, you can also look into a reverse mortgage.

A reverse mortgage allows homeowners who have paid all or most of their existing mortgage, to withdraw a portion of their home’s equity. This is considered tax-free income. It needs to be repaid, however, if the homeowner dies or elects to sell the home. The advantages of this alternative are multiple:

- It can help eliminate the existing mortgage payment .

- It can provide a reliable source of cash.

- The money can be disbursed in a variety of ways .

- The balance of the loan won’t exceed your home’s value, so there’s no need to worry about putting yourself into debt.

This option is only available to older Americans but those who qualify may find it more advantageous than the traditional mortgage refinance. If this is something you would like to explore further, reach out to an expert who can answer any questions you may have.

When To Use A Cash

The right time to use a cash-out refinance depends on your personal situation, current mortgage and goals for the extra money.

A cash-out refinance might be smart if:

- You have the funds to comfortably cover a higher monthly payment.

- You need to pay off high-interest debts like credit cards.

- You’re facing expenses you’d otherwise need to put on a credit card or other high-interest product.

- You need to repair your home or make improvements.

A cash-out refinance might not be smart if:

- You’re tight on funds.

- Refinancing your loan would mean losing a super-low interest rate.

- Home values are falling in your area, as this could leave you upside down on your mortgage .

Also Check: Who Qualifies For A Jumbo Mortgage

You Can Afford A Higher Monthly Payment

Because youre borrowing from your equity and increasing your mortgage balance, a cash-out refinance can create a more expensive mortgage payment. For this reason, only touch your equity when youre confident in your ability to afford a higher payment.

When you apply for mortgage refinancing, our underwriters will review your income, assets, and existing debt to determine affordability. Depending on the type of mortgage loan, your house payment should not exceed 28% to 31% of your gross monthly income.

But even if your new house payment will fall within this range, you need to be realistic about your financial situation and know what you can afford. Otherwise, you could experience cash flow problems after closing on the new mortgage.

Can You Deduct Your Mortgage Points

Your mortgage lender might allow you to buy discount points. Discount points allow you to pay money upfront to buy down your interest rate. Though these points are deductible, you cannot deduct the full amount you pay the year you refinance. Instead, you must spread the cost over the total course of your loan.

For example, lets say that your lender allows you to purchase $1,500 worth of discount points on a 15-year refinance. You would be able to deduct $100 worth of discount points from your taxes for each year that you hold your loan.

You May Like: How Do Interest Rates Affect Reverse Mortgage

What Is A Limited Cash

A limited cash-out refinance allows homeowners to refinance at a more favorable rate and/or term, while receiving a limited amount of cash, no greater than 2% of the new loan balance or $2,000 . Closing costs are rolled into the loan, making it slightly larger than your existing loan amount. With a limited cash-out refinance, you do not access your home equity. This can be advantageous for those looking to put a little cash in their pockets while refinancing but not a great fit for those with larger funding needs.

Drawbacks Of Cash Out Refinance

Risk of Foreclosure

If you miss enough payments, you risk losing the house. A cash out refinance should not be approached with the same nonchalance as opening a Macys credit card. Its a serious investment, with serious, long-term implications should things go south. Every three months, 250,000 new families enter into foreclosure, according to the Federal Deposit Insurance Corporation .

Keep this in mind if you plan to use the cash out refinance loan to consolidate unsecured debt like credit cards. Without the proper budgeting and foresight, you could end up making a bad situation even worse.

New Loan Terms and Costs

A cash out refinance, like any other refinance, will come with a host of fees and closing costs to consider. Make sure the numbers add up in your favor before you pull the trigger.

Closing costs will run you 2-5% of the new loan amount. A loan of $180,000 would cost you between $3,600-$9,000.

Shop around and dont settle for the first offer. Remember, If the new loan exceeds 80% of the homes value, you will need to pay for private mortgage insurance, which will run you between 0.55%-2.25% of the loan. Thats as much as $4,050 a year.

Short Term Solution

Your home is your most precious asset it should not be the first thing you look to leverage when youre in a financial pickle. It should only be used with a clear, thought out goal in mind.

Also Check: What Is The Recommended Percentage Of Income For Mortgage

You Are Now Leaving The Cherry Creek Mortgage Website

Please be advised that you are leaving the Cherry Creek Mortgage, LLC NMLS #3001 website. This link is provided as a courtesy. Cherry Creek Mortgage, LLC NMLS #3001 does not manage or control the content of third party websites.

If you are planning to use a credit card to make your payment, please check with your credit card company to find out if any fees will apply to your transaction.

Do I Have To Pay Taxes On A Cash

Because the IRS considers a cash-out refinance an additional loan, you dont need to list the cash you receive from your cash-out refinance as income on your taxes. However, the IRS does limit refinancing deductions you can take on your cash-out refinance with your taxes.

Cash-out refinance borrowers have the opportunity to deduct the interest on their original loan balance only if they use the equity to make improvements to the propertys value.

Don’t Miss: Can You Refinance A Second Home Mortgage

When Is The Right Time To Refinance

When you refinance, you are applying for a new mortgage to replace your current one, which will result in a new rate, term and monthly payment. A refinance can help you improve your financial situation if you refinance at the right time.

There are several factors you should consider when deciding whether refinancing is right for you right now.