What Are The Key Considerations With Discount Points

One of the most important things to consider with discount points is how long you plan to stay in the home. You need to calculate your breakeven point, which is the amount of time it will take for the money you save on a lower payment to break even with the money you spent buying the points.

If youre planning to be in your home for a significant period of time, buying points might make sense for your situation. However, if you plan to sell your home in a few years, it may not work in your favor.

Your mortgage is a big decision, and its important to work with someone who understands your situation and home financing goals. Get in touch with one of our loan experts today and start a conversation about your next steps!

*Check with one of our mortgage loan experts to learn about the exact costs and benefits of using points to buy down your interest rate.

The Seller Pays The Points

This practice is more common in slower housing markets, and with lower-priced properties.

The sellers may offer to pay some, or all, of your closing costs, including points, to entice you to purchase their home.

But what the seller can pay differs based on the type of loan you have.

- For FHA loans, the seller can pay up to 6% of the sales price, regardless of the down payment made.

You should be aware, however, that while sellers may willingly pay a 1% origination point, they may be highly reluctant to pay discount points. Thats because discount points are more about providing you with a lower interest rate and payment than they are about directly facilitating the sale of the property.

Also, sometimes the property seller is a builder. As the seller, the builder can cover the buyers closing costs within the same limits listed above.

When Will You Break Even After Buying Mortgage Points

To determine if it’s a good idea to pay for points, compare your cost in points with the amount you’ll save with a lower interest rate and see how long it will take you to make your money back. If you can afford to pay for points, then the decision more or less boils down to whether you will keep the mortgage past the time when you break even. After you break even, you’ll start to save money. The break-even point varies, depending on your loan size, interest rate, and term.

Example. As in the example above, let’s say you get a 30-year loan of $300,000 with a 3% fixed interest rate. Your monthly payment will be $1,265. However, if you buy one point by paying $3,000, and your rate goes down to 2.75%, the monthly payment becomes $1,225. So, divide the cost of the point by the difference between the monthly payments. So, $3,000 divided by $40 is 75, which means the break-even point is about 75 monthsmeaning you’d have to stay in the home for 75 months to make it worth buying the point.

As you can see, the longer you live in the property and make payments on the mortgage, the better off you’ll be paying for points upfront to get a lower interest rate. But if you think you’ll want to sell or refinance your home within a couple of years , you’ll probably want to get a loan with few or no points. Check the numbers carefully before you pay points on a loan because you might not recoup the cost if you move or refinance within a few years.

Read Also: How To Mortgage A House That Is Paid Off

Benefits Of Purchasing Mortgage Points

It goes without saying that paying points comes with some benefits. Here are some of them:

Reduced Interest Rate

If your credit score is low, youll almost certainly pay a higher interest rate on your loan. As such, you should strategize to improve your credit before applying for a mortgage.

This helps lower your rate. Nevertheless, if youd like to buy a house immediately, all hope is not lost. You could still lower your rate by paying points.

Reduced Monthly Payments

Because interest is a core component of your monthly payments, getting a lower interest rate means having a smaller monthly mortgage payment. As such, housing expenditures will occupy less space in your budget. Best part? You can save money faster or spend more on other vital aspects of your life!

Overall, Youll Pay Less.

What Do Discount Points Cost

Discount points cost roughly 1% of the loan amount per point.

Purchasing the three discount points would cost you $3,000 in exchange for a savings of $39 per month. You will need to keep the house for 72 months, or six years, to break even on the point purchase. Because a 30-year loan lasts 360 months, purchasing points is a wise move in this instance if you plan to live in your new home for a long time. If, on the other hand, you plan to stay for only a few years, you may wish to purchase fewer points or none at all. There are numerous calculators available on the Internet to assist you in determining the appropriate amount of discount points to purchase based on the length of time you plan to own the home.

The second factor to consider with the purchase of discount points involves whether or not you have enough money to pay for them. Many people are barely able to afford the down payment and closing costs on their home purchases, and there simply isn’t enough money left to purchase points. On a $100,000 home, three discount points are relatively affordable, but on a $500,000 home, three points will cost $15,000. On top of the traditional 20% down payment of $100,000 for that $500,000 home, another $15,000 may be more than the buyer can afford.

Using a mortgage calculator is a good resource to budget these costs.

Read Also: What Score Do Mortgage Lenders Use

Consider Making A Larger Down Payment Instead

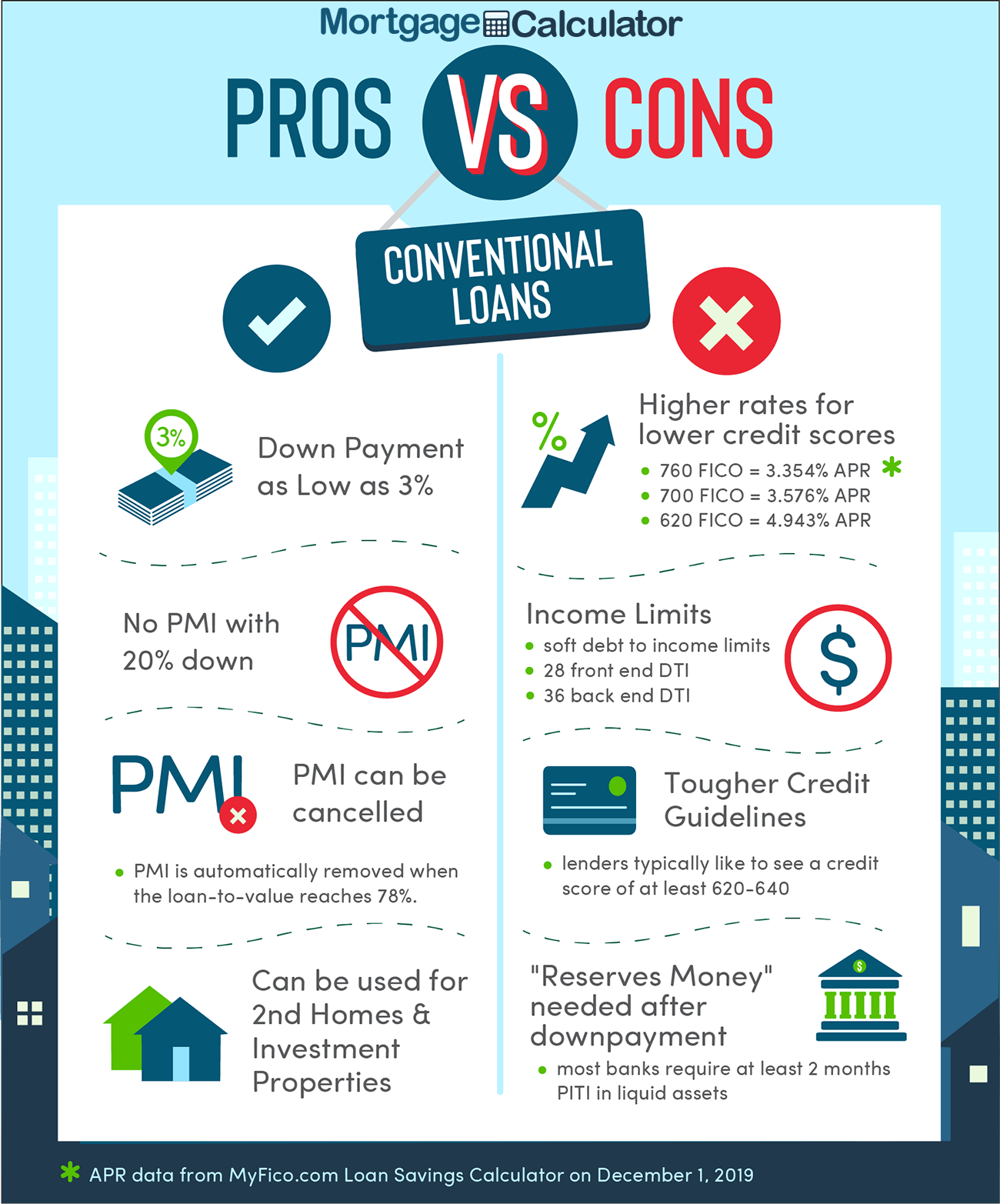

Rather than purchasing points, some borrowers make a larger down payment to reduce their monthly payment amount. Also, if you make a down payment large enough, you can usually avoid paying for private mortgage insurance . The extra money you put towards the down payment might be money better spent than using your money on points.

In addition, putting more money down helps you build equity in the property faster. You could also decide to use the money to make extra payments on your loan and gain equity in your home quicker that way.

Donât Miss: How To Negotiate The Best Mortgage Rate

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan and reduce its monthly payment. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

Of course, if you dont plan to stay in a home for a long time, paying points is likely to lose you money overall.

Another consideration is whether you should put money toward points or a larger down payment. A larger down payment can often help you secure a lower interest rate anyway. Additionally, hitting the 20% down payment mark can also let you avoid the additional cost of PMI.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Read Also: Can You Cancel A Reverse Mortgage

Basis Points And Fixed

First, let’s consider basis points for a fixed-rate mortgage.

A mortgage lender tells you they can offer a 30-year, fixed-rate mortgage for $300,000 at an interest rate of 4%. But your lender then finds out they can lower the interest rate by 50 basis points to 3.5%.

In this example, the monthly payment for the mortgage with the 4% rate would be $1,432.25. Over the life of the loan, you’d pay a total of $515,608, including $215,608 in interest.

But if you’re able to get the same loan at 3.5%, the monthly payment would be $1,347.13. That’s $85.12 less per month than the 4% loan. More importantly, the total amount paid over the life of the loan would be $484,968 roughly $30,000 less than the 4% loan. That reflects a drop in interest paid from $215,608 for the 4% loan to $184,968 for the 3.5% loan.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: How To Make Mortgage Lenders Compete

How Much Difference Does 1% Make On A Mortgage Rate

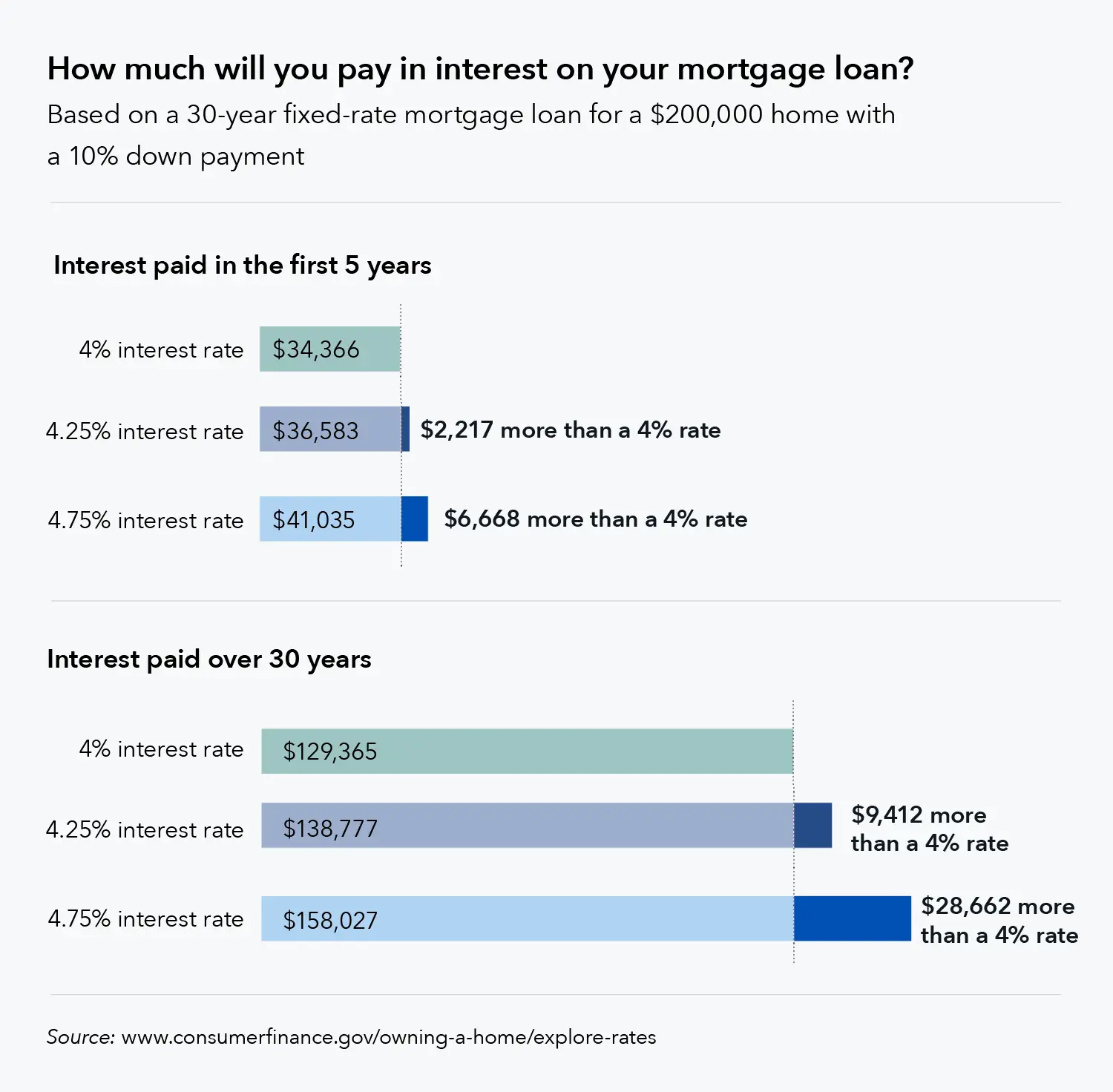

The short answer: It can produce thousands or even potentially tens of thousands in savings in any given year, depending on the purchase price of your property, your overall mortgage rate, and the total amount of the mortgage being financed.

By way of example, say that Taylor, a 30-year-old who is a first-time home buyer, wishes to obtain a 30-year fixed FHA loan on a new home with a 20% down payment. Below, you can get a sense of just how much that they stand to save given a 1% difference in interest savings on their 30-year mortgage.

How Points Work On A Loan

Witthaya Prasongsin/Getty Images

A point is an optional fee you pay when you get a home loan. Sometimes called a “discount point,” this fee helps you secure a lower interest rate on your loan. If you would benefit from a lower interest rate, it might be worth making this type of upfront payment. However, it may take several years to recoup the benefits of paying points.

Recommended Reading: What Is Rocket Mortgage Fieldhouse

Drawbacks Of Buying Mortgage Points

Purchasing mortgage points has its drawbacks as well. The following are some disadvantages of paying points.

Larger Initial Payment.

Buying points means paying extra in advance, which means your closing expenses will be higher. Typically, the closing expenses range from 2% to 5% of the homes buying price. As such, people who cannot comfortably afford such a large sum would find it financially incapacitating.

You Might Not Be Able To Recoup the Cost of Points if You Move.

Mortgage points can run into thousands of dollars if paid all at once. With each monthly payment, the savings from your lower interest rate will add up over time. However, if you relocate too soon, the savings wont be worth it. This is also true if you opt to refinance your mortgage, which would incur additional closing expenses.

Should I Pay Discount Points To Get A Lower Rate

That depends. Paying for discount points to get a lower interest rate could be a good financial strategy if you plan to live in the home long enough to cover the breakeven period. The upfront costs need to bake out before the savings can kick in. If you move or refinance before that period is up, they are worthless.

This article was updated on Sept. 4, 2020, to remove comments made by a source whose credentials do not meet NextAdvisor editorial standards.

Recommended Reading: What If I Pay Extra On My Mortgage

How Much Does One Point Lower Your Interest Rate

One discount point usually equals 1% of your total loan amount and lowers the interest rate of your mortgage around one-eighth to one-quarter of a percent. But heads up: the actual percentage change will depend on your mortgage lender.

Is your head spinning yet? Well hang on, were about to do some math.

To help this all make sense, lets break it down. Suppose youre buying a $300,000 house. You have a 20% down payment and are taking out a 30-year fixed-rate conventional loan of $240,000 at a 4.5% interest rate.

To lower the interest rate, you pay your lender for one mortgage point at closing, and assuming that point equals 1% of your loan amount, it will cost $2,400.

$240,000 loan amount x 1% = $2,400 mortgage point payment

After you buy the mortgage point, your lender reduces the interest rate of your mortgage by, say, a quarter of a percent. That takes your interest rate from 4.5% to 4.25%.

This slightly lowers your monthly payment from $1,562 to $1,526which is $36 less a month on a fixed-rate conventional mortgage.

You can use our mortgage calculator to figure the difference between the interest amount with the original rate and the interest amount with the reduced rate over the full lifespan of the loan.

Are you still with us? Okay, good.

Without any mortgage points, youll pay a total of $197,778 in interest. With one mortgage point, youll drop that amount to $185,035which saves you $12,743 in total interest.

| 30-year loan amount: $240,000 |

| $172,486 |

How Much Do Discount Points Cost

The price for discount points is always the same, regardless of lender: 1 percent of the loan amount for each point. That’s where the name comes from in financial terminology, 1 percent is commonly referred to as a “point.” So if you have a $300,000 loan, one point will cost $3,000.

How much a discount point will reduce your rate varies from lender to lender, but is often between one-eighth to one-quarter of a percent. So buying one point might reduce a 5 percent rate to 4.875 percent or 4.75 percent, for example.

You can buy multiple points, fractions of a point and even negative points . How many you can buy depends on the lender and your loan. Some lenders may let you buy 3-4 points others may limit you to only one or two. That’s something you want to check into when shopping for a mortgage and comparing offers.

You can pay for discount points up front if you wish, but they’re often rolled into the loan. So you start with a somewhat higher balance but the lower rate means your monthly payments are less.

You May Like: What Is The Current Home Mortgage Interest Rate

The Bottom Line: Mortgage Points Can Save You Money

Though mortgage points and prepaid interest are right for some borrowers, they dont make financial sense for everyone. To determine whether you can save with discount points, you have to crunch the numbers.

Sit down and assess your budget, down payment, loan terms and future plans before you close. Determine your breakeven point and your likelihood of staying in the home to understand if discount points will save you money in the long run when refinancing or buying a home.

If youre ready to buy a new home or need to refinance your existing home loan, dont wait. Apply online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

How Soon Youll Break Even After Buying Mortgage Discount Points

To figure out when youâll break even if you buy mortgage discount points, take the cost of the points and compare it to how much youâll save each month if you have a lower interest rate. After you break even, youâll start saving money.

Example: Mortgage Points Break-Even

Using the example above, letâs say you get a 30-year loan of $200,000 with a 5% fixed interest rate. Your monthly payment will be $1,073.64. But if you buy two points by paying $4,000, and your rate goes down to 4.5%, the monthly payment falls to $1,013.37. Divide the cost of the point by the difference between the monthly payments. So, $4,000 divided by $60.27 is about 66, which means the break-even point is about 66 monthsâmeaning youâd have to stay in the home for 66 months to make it worth buying the points.

The break-even point varies, depending on the size of the loan, the interest rate, and the term . Once you do the calculation, assuming you can afford the upfront cost of the points, think about whether youâll remain in the house and not refinance beyond the time when you break even. The longer you live in the property and make payments on the mortgage, the better off youâll be paying for points upfront to get a lower interest rate. But if you plan to sell or refinance your home within a couple of years , you should probably opt for a loan with few or no points.

Recommended Reading: What Is A Good Fixed Mortgage Rate

Are Points Tax Deductible

Home mortgage points are tax-deductible in full in the year you pay them, or throughout the duration of your loan.

The IRS guidelines list the following requirements:

- Your main home secures your loan .

- Paying points is an established business practice in the area where the loan was made.

- The points paid werenât more than the amount generally charged in that area.

- You use the cash method of accounting. This means you report income in the year you receive it and deduct expenses in the year you pay them.

- The points paid werenât for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes.

- The funds you provided at or before closing, including any points the seller paid, were at least as much as the points charged. You canât have borrowed the funds from your lender or mortgage broker in order to pay the points.

- You use your loan to buy or build your main home.

- The points were computed as a percentage of the principal amount of the mortgage, and

- The amount shows clearly as points on your settlement statement.

Also Check: How To Recruit Mortgage Loan Officers