How We Make Money

The listings that appear on this page are from companies from which this website and the data provider may receive compensation, which may impact how, where and in what order products appear. Compensation is higher for featured placements. This table does not include all companies or all available products.

How Do Credit Reporting Agencies Work

Every month, banks and other creditors send millions of records to the credit reporting agencies, updating them about their borrowers. These reports include whether the borrowers paid the money they owed that month, if they were late making a payment, or if they defaulted on their balance.

They accumulate all the data given to them by the banks and list it on each individuals credit report.

While most credit report information is updated monthly, they usually have a processing time of several weeks before everything is completely up-to-date.

The Critical Score Is The Middle Score

Each of the three major credit bureaus, Experian, Equifax and TransUnion, keeps a credit file on every person who has ever paid a bill or taken out credit. Lenders use these scores to calculate your risk of defaulting on a mortgage loan. Since each agency may report a slightly different score, lenders take the middle score of the three. For example, if your scores are 680, 710 and 660, lenders will use the middle score of 680 to assess your loan eligibility.

Recommended Reading: What Is Mortgage Interest Deduction

You Can Check Your Own Credit With No Impact On Your Score

When you check your own credit whether you’re getting a or a it’s handled differently by the credit reporting agencies and does not affect your credit score. If you are applying for a mortgage and haven’t already checked your credit report for errors, do so now. You can get a free copy of your credit report at www.annualcreditreport.com. If you find any errors, get them corrected as soon as possible.

How Does The Fcra Regulate Credit Reporting Agencies

In addition to ongoing government oversight, credit reporting agencies must also comply with the FCRA. This federal law helps to protect consumers by requiring the agencies to investigate all disputes within 30 days.

This doesnt guarantee that credit bureaus are making sure your credit reports are accurate. However, it does give you recourse when they unfairly report your credit history.

You May Like: What Are The Typical Closing Costs For A Reverse Mortgage

Will My Credit Score Be The Same Across The Board

In a word, no. Credit scores vary depending on the company providing the score, the data on which the score is based, and the method used to calculate the score.

In an ideal world, all credit bureaus would have the same information. But lenders dont always report information to every bureau, so there will be variations in your credit file usually minor from bureau to bureau.

How Do I Interpret My Credit Report

With each credit report you get, use this checklist to help you review and check for errors.

You can use our printable Credit Report Review Checklist to help you review each section of your credit report. We recommend using this worksheet for each credit report you get throughout the year. Then, keep the completed checklist with your credit reports.

3. Report any errors, fraudulent activity, or outdated information.

If you find errors or fraudulent activity after your review of your credit report, you have the right to dispute inaccurate or incomplete information. Keep in mind that theres a difference between inaccurate or incomplete information and negative but accurate and complete information. Both can lower your credit score, but a credit reporting company will only correct information that is inaccurate or, incomplete, or outdated.

To dispute an error, you should contact both the credit reporting company and the company that provided your information to the credit reporting company. For example, if you review your report and find a listing for a student loan you never took out, you should contact both the credit reporting company that provided the report and the student loan company listed. Be sure to include supporting documentation with your disputes to both companies. The companies must conduct an investigation and fix mistakes as needed.

No matter how you submit your dispute, make sure to include:

Also Check: Can You Get A Mortgage With A Fair Credit Score

What Are Fico Scores And How Do I Get Mine

Your FICO® scores are credit scores. Its a sort of grade based on the information contained in your . Unlike the grades you were given in school A through F base FICO® scores generally range from 300 to 850. And the higher, the better.

Because there are three major consumer credit bureaus , each with its own version of your credit report, you can also have different credit scores. For example, you can have a FICO® score based on your Equifax® credit report, a FICO® score based on your Experian® credit report, and a FICO® score based on your TransUnion® credit report. To further complicate things, you can also have VantageScore® credit scores from each bureau.

Additionally, FICO also creates many different credit-scoring models for lenders in different industries. So your base FICO® scores may not be the same ones a mortgage lender sees if they request your mortgage-specific FICO® scores, for example.

You probably dont need to worry about all these nuances when buying a home, but you should still have an idea of what your scores look like. You can get your VantageScore® 3.0 credit scores from Equifax and TransUnion for free on .

If you want to see your FICO® scores, however, you can easily buy them online from the MyFICO website, and possibly find them for free from your bank or credit card issuer.

What Are Credit Reporting Agencies

A credit reporting agency is also known as a credit bureau or consumer reporting agency. They collect and record the credit information of both individual consumers and businesses.

In the United States, the industry is dominated by the largest three credit reporting agencies: Equifax, Experian, and TransUnion. They are three separate companies in competition with each other and, consequently, dont share information back and forth. So, its not uncommon to see different information from each credit reporting agency.

You May Like: Can You Undo A Reverse Mortgage

How Does A Tri

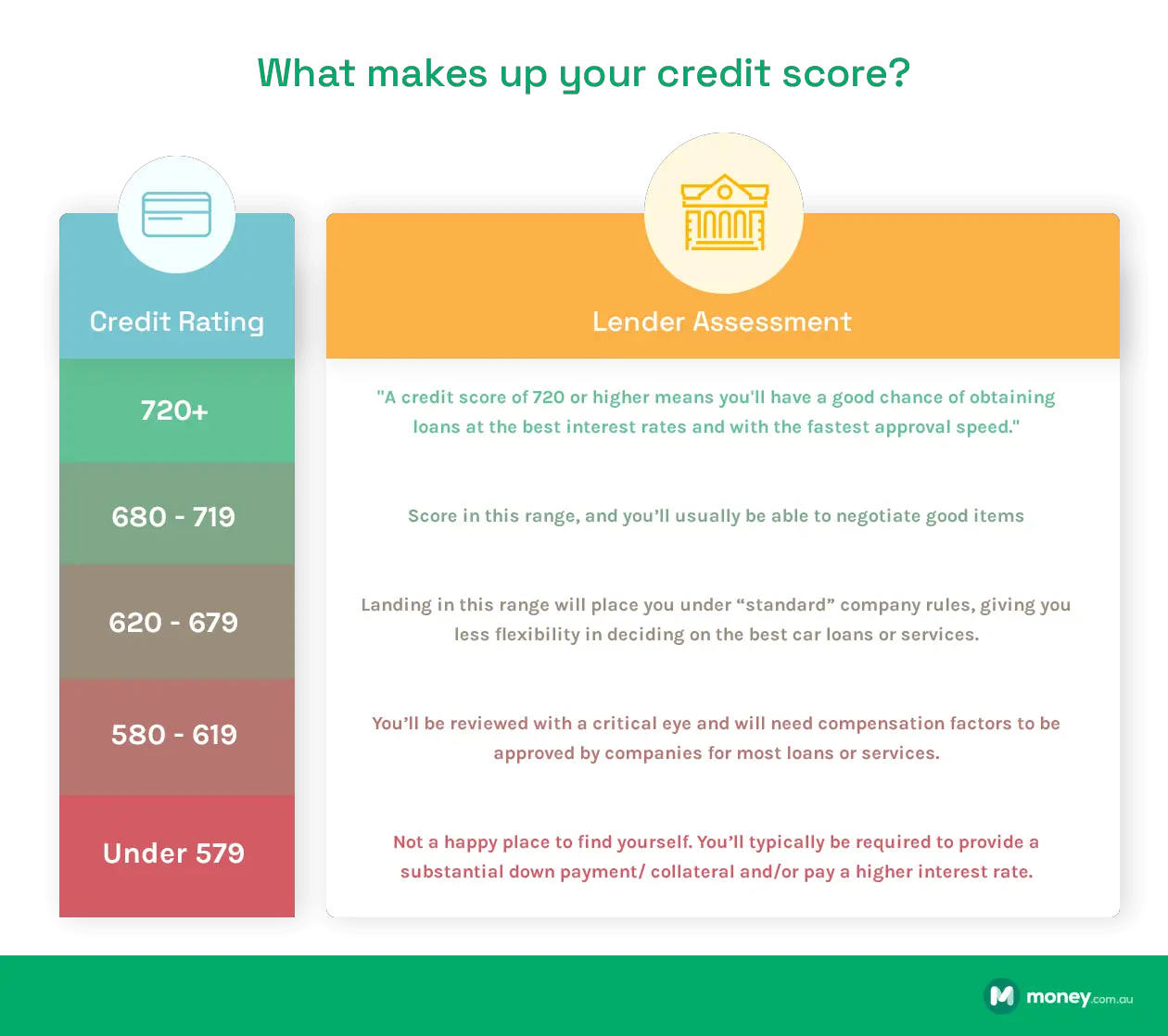

Lenders each have their own . Some have more tolerance for risk than do others. Lenders will use the information contained on your credit reports, along with your FICO® credit score, to determine if they are comfortable lending you mortgage money.

A clean report and a high credit score will qualify you for mortgage loans at lower interest rates. If your report is spotty, with late payments and high credit card balances, you can still qualify for a mortgage loan. But you might have to accept a higher interest rate.

Get your free credit report and score.

Create a Rocket Account to see where your credit stands.

What Is A Credit Report And What’s Included

If you are over 18, your credit report is a profile of your personal credit history or credit file over the last six years. It includes information on mortgages and mortgage payments, loans, overdrafts, credit and store cards, mobile phone contracts and sometimes, utilities. It will show how you have managed the credit, including if you have missed payments or defaulted on loans.

Also Check: What’s The Mortgage Rate Now

What Are The Largest Three Credit Bureaus

The three major credit bureaus are Experian, Equifax, and TransUnion. These bureaus collect and maintain consumer credit information and then resell it to other businesses in the form of a credit report. While the credit bureaus operate outside of the federal government, the Fair Credit Reporting Act allows the government to oversee and regulate the industry.

Its worth noting that not all lenders report to the credit bureaus. You may have seen advertisements for loans with no credit check. Because these loans are riskier for the lender, they can justify high-interest rates and faster repayment schedules. Consumers should beware of predatory lenders, especially risky payday loans and other fast-cash loans.

How Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge. There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

Also Check: Does Fha Offer 40 Year Mortgage

Which Credit Report Is The Most Accurate

All of the credit report agencies should only display accurate information about you. If something isnât right on any of them , it could hurt your chances of being accepted for credit.

Thatâs why itâs worth checking all three to make sure all of the information about you and your finances is totally accurate.

If youâve checked it and all the information is correct, you could have a thin credit history which means youâve never borrowed money before.

* Please note, the lender hasnât officially confirmed this information.

Disclaimer: this information was sourced from a MoneySavingExpert article published in March 2016. For more details on which credit reference agencies your lender uses, please check with them directly.

Disclaimer: All information and links are correct at the time of publishing.

Become a money maestro!

Sign up for tips on how to improve your credit score, offers and deals to help you save money, exclusive competitions and exciting products!

Be Selective About New Accounts

Opening a new credit card or applying for a loan generally involves a hard credit inquiry. Too many hard credit inquiries can have a negative impact on the applicants score. So while having a diverse mix of credit is a good thing in the eyes of lenders, opening a number of new accounts at once may be counter-productive.

Recommended Reading: How To Mortgage Rates Work

What Credit Score Model Do Lenders Use When You Apply For A Mortgage

When you apply for a mortgage, lenders typically pull your credit report from the three main credit bureaus: Experian, Equifax and TransUnion. Each credit bureau uses a different FICO model to determine your credit score. We outline the models used by the credit bureaus below:

Experian: FICO Score 2

Equifax: FICO Score 5

TransUnion: FICO Score 4

The credit score models take into account multiple factors including your current and past credit accounts, payment history, credit capacity and credit events such as a collection, charge off, bankruptcy, short sale, default or foreclosure.

There are variations between the different FICO models but the underlying inputs and scoring factors are relatively similar. Making your loan payments on time, maintaining low credit utilization and limiting the number of credit accounts you have open leads to higher credit scores for all FICO scoring models.

Although the FICO models utilize a consistent methodology, there may be differences in your credit scores across the three main credit bureaus. Score differences may be attributable to inconsistent account information or subtle differences in how accounts or credit events are weighted by the models.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Read Also: What Are The Current 30 Year Mortgage Interest Rates

How Do My Fico Scores Affect My Ability To Get A Mortgage

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.

How To Check Your Credit Reports

Now that you know more about the three credit bureaus, you might be wondering: How do I check my credit reports?

You can get a free copy of your credit report from each of the three major credit bureaus. Visit AnnualCreditReport.com to learn how. There may be a limit on how often you can get your report. You can check the site or call 877-322-8228 for more details.

Another way to monitor your credit is by using . With CreditWise, you can access your TransUnion credit report and weekly VantageScore 3.0 credit scoreâwithout hurting your score. And is free for everyone. You donât even have to be a Capital One cardholder to enroll.

Checking your credit reports and your credit scores regularly can help you:

- See where you stand before making major financial decisions.

- Catch identity theft if you find inaccurate information.

- Keep track of your financial habits.

- Monitor your progress as you work to improve your credit scores.

- Understand how negative information affects your credit scores.

Read Also: Can You Sell House Before Paying Off Mortgage

Equifax Experian And Transunion Create The Credit Reports That Inform Your Credit Scores

If youâve ever applied for credit, you probably know a little bit about credit reports already. But did you know that there are several different versions of your credit report?

Key Takeaways

- The three major credit bureaus are Equifax®, Experian® and TransUnion®.

- The information credit bureaus collect includes things like payment history and public records.

- Information in each bureauâs credit reports might come from different sources, which can result in a subtle difference in credit scores.

Lenders Use A Different Credit Scoring Model

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Mortgage lenders, on the other hand, pull FICO scores from the three main credit bureaus Equifax, TransUnion, and Experian and use the mid score.

Mortgage lenders use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts. So theres a good chance your lenders scoring model will turn up a different sometimes lower score than the one you get from a free site.

Also Check: Where Do You Get A Mortgage

What Does My Credit Score Need To Be For A Mortgage

The minimum credit score required to get a mortgage varies by loan type:

| Type of Loan | |

| 700-740 | 10-20% |

1With a credit score between 500-579 you may still qualify for an FHA loan if you can put at least 10% down.

2No minimum credit score established by either the USDA or VA, but lenders are allowed to set their own requirements.

If youre a first-time home buyer, you may be surprised you could get approved for a mortgage loan with a credit score below 600.

But the score you see in a credit monitoring app, or in your credit card statement, wont necessarily be the score your lender sees when it pulls your credit.

The score your lender sees will likely be lower. So if your credit is borderline, youll want to understand how lenders evaluate your credit score and credit history before moving forward with a loan application.

How Your Credit Scores Are Made And Why They Matter

Since there are few numbers that matter as much to your financial well-being as your credit score, it helps to know what your scores mean and how they work.

First, know that theres a big difference between a credit report and a credit score.

- Your credit report is a record of your borrowing history. Each loan or line of credit youve opened, dates on those accounts, payment history , and so on. Overall, it shows how reliably you manage and pay back your debts

- Your credit score sums up your credit report in a single number. It weighs every item on your credit report to come up with an overall score that sums up how responsible of a borrower you are

The big three credit bureaus operate in the realm of credit reporting. Each one keeps a separate record of your borrowing history, based on the information your creditors send them.

The other players in the game FICO and VantageScore are responsible for credit scoring. They determine your score based on whats included in those credit reports.

For example, keeping your credit utilization ratio low can help your credit scores, while repeatedly neglecting to pay your credit card bills on time can hurt them.

Also Check: What Is The Best Refinance Mortgage Company