Having A High Cibil Score Can Get You A Lower Rate Of Interest

CIBIL score is an important factor that is taken into consideration by lenders at the time of offering you a loan. Having a higher CIBIL score not only makes you eligible to avail a loan but also helps you in getting a lower rate of interest. A CIBIL score is a numerical representation of your ability to repay the credit. It is computed by TransUnion CIBL credit bureau after considering your past payments, credit history, current and old credit accounts, among others. An interest rate is one of the most important factors a borrower considers while availing a loan.

A CIBIL score falls in the range of 300-900. Majority of lenders consider a CIBIL score of 750 and above as ideal. If you want to have easier access to credit, your CIBIL score should be closer to 900. Lenders like banks and non-banking finance companies prefer giving loans to people who have a high credit score as they have a lesser probability of turning a defaulter.

Read Also: How Much Money Should Go To Mortgage

Here Are 10 Ways To Increase Your Credit Score By 100 Points

Ways To Boost Your Credit Score

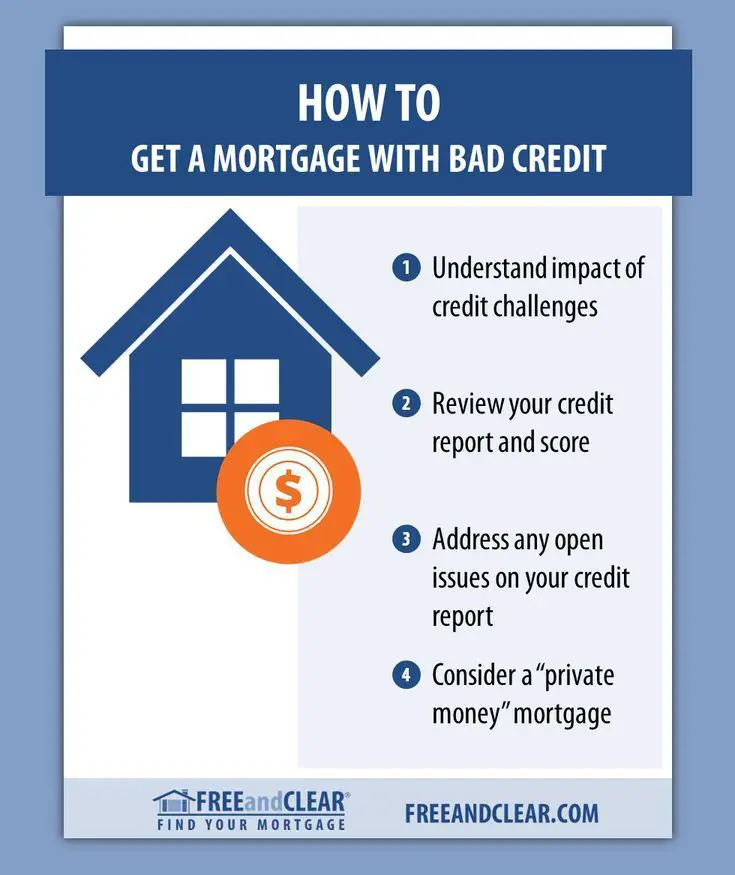

Your credit score can change every month, and even a small increase can help when applying for a mortgage. Here are some steps you can take to improve your score:

Make sure you pay all of your bills on time.

Pay off as much credit card debt as possible. Lenders prefer that balances be less than 30 percent of your available credit.

Check your credit reports and promptly correct any errors. Visit AnnualCreditReport.com to get a free copy of your report.

Avoid closing old credit card accounts or open new ones.

Read Also: How Does A Construction Mortgage Work

How Does Paying Off A Loan Affect My Credit

Paying off a loan can potentially have a positive or negative effect on your credit in the short-term. Whether paying off a loan affects your credit in a positive or negative way depends in large part on the type of credit you have and your current financial situation. Factors such as your credit mix, loan payment history, account balances, and total debt all have an impact on how your credit is affected when you pay off a loan. Well go into more detail on that shortly.

In any case, paying off a loan is generally good for your finances. By getting rid of the loan, you take a financial burden off your shoulders, stop racking up interest charges, and increase your level of financial flexibility. Plus, you will lower your total debt, which can improve your credit score in the long run.

How Does Mortgage Affect Credit Score And Credit Score Affect Mortgages

In Australia, credit reporting agencies collect a variety of information about your borrowing history from banks and other financial institutions.

As part of Australias Comprehensive Credit Reporting, both your positive and negative repayment history information is reported and included in your credit report. Thanks to this more in-depth reporting, your credit score is impacted in more nuanced ways.

To keep track of how your mortgage affects your credit score, get a copy of your credit report from a credit reporting agency, perhaps even for free.

Read Also: What Will My Mortgage Interest Rate Be

Why Did Paying Off My Mortgage Lower My Credit Score

Your score is an indicator for how likely you are to pay back a loan on time. Several factors contribute to the credit score formula, and paying off debt does not positively affect all of them. Paying off debt may lower your credit score if it changes your credit mix, credit utilization or average account age.

Get 90 Day Free Trial Of Lystn*

Your Coupon Code

Offer: Get 90 day free trial of Lystn

- Applicable for only Android users

- This coupon will only work once per user

- Valid in India only

- Existing users on any paid plan are not eligible for this offer. Existing users with No Paid plans are eligible for this offer

- For claiming the offer users need to visit the Android App and click on Profile section and then click on Redeem Coupon

- Incase you are not signed up for the lystn app, you will need to do that prior to redeeming any offer

- Coupon needs to be redeemed within 30 days from being issued

- For any support, please write to

- Coupon once redeemed or issued cannot be refunded, cancelled or transferred

- Coupon issued offer you Unlimited Download access to the service

Recommended Reading: What Is A Good Tip On A Mortgage

Why Do Lenders Care About Credit Scores

From the lenders point of view, a credit score is a mathematical construct that demonstrates a borrowers creditworthiness and the likelihood they will meet future financial obligations. The minimum score needed for FHA loan or a conventional loan typically varies because FHA loans offer financing options with less restrictive credit guidelines than conventional loans. Several scoring algorithms generate consumer credit scores, with the FICO Score the most widely known tool.

Recommended Reading: What Do You Need To Get A Second Mortgage

Where Rates Are Headed

At the start of the pandemic, refinance rates dropped to historic lows, but they have been steadily climbing since the beginning of 2022. The Fed recently raised interest rates by another 0.75 percentage points and is poised to raise rates again to slow the economy. Though it’s unclear exactly what will happen next, if inflation continues to rise, rates are likely to climb. If inflation eases, rates could level off and begin to decline.

We track refinance rate trends using data collected by Bankrate, which is owned by CNET’s parent company. Here’s a table with the average refinance rates reported by lenders across the country:

Read Also: How To Assume A Mortgage With Bad Credit

What Credit Scores Are Required For A Digital Mortgage

Digital mortgages are growing in popularity as they eliminate the need for paperwork and manual processes. Simply put, theyre all about convenience. The benefits of a digital mortgage are faster approval and lower fees compared to the traditional method.

To take advantage of this convenience and the other benefits that come with a digital mortgage, youll need a higher minimum credit score than you would for a conventional mortgage. Ratecloud requires a minimum credit score of 680 when applying for a digital mortgage.

Also Check: Can You Undo A Reverse Mortgage

Request A Credit Freeze From The Credit Bureaus

Contacting each credit bureau to request a credit freeze will flag the account and prevent new lines of credit from being opened by identity thieves. It can be done online or over the phone.

If you decide to do it over the phone, its a good idea to ask any questions you may have about the more formal step of informing the credit bureau of the death.

Heres how to contact each credit bureau online to request the credit freeze:

Heres where you can mail the death certificate to each credit bureau:

- Experians Consumer Assistance Center, P.O. Box 4500, Allen, TX 75013. You can also upload the death certificate online.

- TransUnion, P.O. Box 2000, Chester, PA 19016

- Equifax Information Services LLC, P.O. Box 105139, Atlanta, GA 30348-5139

Read Also: What Is The Current Interest Rate For Interest Only Mortgages

Does Paying Mortgage Increase Credit Score

A mortgage is likely to boost your credit if you make payments as agreed. … Most opt for a mortgage, or a home loan. Like all major lines of credit, a mortgage will appear on your credit report. This is probably a good thing: A mortgage can help build your credit in the long run, provided you pay as agreed.

What Happens To Your Credit If You Pay Off A Loan Early

Paying off installment debt like personal loans and car loans won’t necessarily help your credit scores. If you get rid of these loans early, the impact on credit will be slightly different than if you make a large payment to reduce your credit card balance, for instance. That’s because installment loans will appear as “closed” on your credit report when they’re paid off, and open accounts with positive payment history have a stronger positive impact on your credit score than closed accounts.

You may consider making payments as agreed throughout the loan term if your loan’s interest rates are low or 0%, if you don’t have emergency savings, or if there are only a few months left on the term and you can make use of the resulting positive effect on your credit.

Read Also: What Are Payments On A 250 000 Mortgage

How Refinancing A Mortgage Works

Refinancing a home loan involves paying off your current mortgage and replacing it with a new one.

The exact process of refinancing a mortgage depends heavily on state laws and regulations. However, generally, the process of refinancing will likely be similar to the experience you had with your first mortgage. To determine whether you qualify for refinancing, lenders will take into account various factors such as your credit scores, other debts, income, assets and the amount you want to borrow. They’ll also consider how much your home is worth to determine the loan-to-value ratio.

Ideally, you should have a regular income and at least 10 to 20 percent equity in your home to qualify for refinancing. Credit scores of 740 or more will also generally help your chances, although borrowers with scores of 620 and up can get mortgages insured by the Federal Housing Administration from an FHA-approved lender.

Refinancing also comes with some fees and other costs. You might pay 3 to 6 percent of the outstanding principal in fees. Depending on your lender, you might also owe a prepayment penalty for paying off your old mortgage early.

If you’re looking to get rid of , you can apply for “cash-out” refinancing, which allows you to tap into your home equity or the difference between what you owe on your mortgage and the home’s value. In this scenario, you’ll refinance for more than you currently owe and get the difference as a cash payment.

How Is Your Credit Score Calculated

Your credit score could also vary based on which nationwide consumer reporting agency Equifax, TransUnion or Experian provides the data. This is because not all lenders and creditors report to all three agencies. Some report to only one or two, or even none at all. Thanks to all these variables, you have multiple credit reports and credit scores.

Although scoring models vary, they usually consider the following:

You May Like: What Mortgage Companies Use Experian

How To Maintain A Good Credit Score During Covid

Taking steps to protect and maintain your credit score has always been important. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

Set Up Automatic Payments

Its easy to forget to pay a bill before the due date. So eliminate the forgetfulness factor by putting your bills on autopay.

Use technology to pay every bill on time, every time, said Bobbi Rebell, a personal finance expert at debt payoff app Tally. We all know that the number one thing to help your credit score is to pay your bills on time, but life happens and things dont always go as planned. It doesnt help that many Americans feel overwhelmed by their credit card balances. If you have credit card debt, take advantage of automation tools to help streamline your financial life.

Also Check: What Credit Score Is Needed To Get A Mortgage

Also Check: What Are The Current Mortgage Rates In North Carolina

When You Pay It Off

Paying your mortgage off is something to be celebrated, but it can have an impact on your credit since youre no longer managing significant debt and your mix isnt as varied.

If you have a mortgage, credit cards and an auto loan, for example, and youre managing them all, thats a good credit mix, says Mazzara. Eliminating the mortgage will decrease the variety pack the bureaus like to see, but the reduction should be small far smaller than the impact of being 30 days late, for example.

Work On Improving Your Credit

The bottom line is that ceasing to have a mortgage payment will have little effect on your credit score, whether positive or negative. If you want to see your credit score increase, you’ll need to work on the other items in your credit history. For example, continue making timely payments on all auto and students loans. You’ll also benefit from keeping credit card balances low and from not opening too many new accounts at once.

Also Check: Is It Harder To Get A 15 Year Mortgage

Protect Your Personal Information To Avoid Fraud

Your credit can be affected by identity theft if fraudsters access your personal information to open accounts in your name. To help keep your data safe, use a password manager to create and store unique passwords and avoid making financial transactions on public Wi-Fi networks, which could be vulnerable to hackers.

Dont Miss: Do Lending Club Loans Go On Your Credit Report

How Much Can A Collections Account Affect Your Credit Score

Whenever a collection appears on your credit report, it can lower your credit score by approximately 110 points, bringing it from fair to bad. You might lose even more points if your credit score is high to begin with.

Potential lenders will know that you have defaulted on a loan and that you could represent the same risk if they let you borrow money through them.

Read Also: How Do You Get A Second Mortgage On Your House

Keep An Eye On Your Credit When Paying Off A Personal Loan Early

Worried about your credit fluctuating when you pay off a personal loan early? Even if your score drops a few points, you could use other credit-building methods to repair or maintain a good credit score.

Whether you choose to pay off your personal loan early or spend any extra cash elsewhere is up to you. By understanding the pros and cons of an early payment, you can make informed decisions with your money.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

How To Improve Credit Score Despite Having A Mortgage

A borrower can tackle this issue of mortgage repayments versus credit score, through two simple approaches. The first is to prepay the loan. The advantage here is that with prepayment, generally, you pay off the principal amount so that the loan tenure gets reduced and you end up paying less interest over time. Paying off the principal amount is an easy way to reduce loan outstanding and thereby increase the credit score. However, this may not be possible for everyone due to financial commitments. The alternative solution is to avail something called an interest-only mortgage loan.

Read Also: What Will Be My Mortgage