Should You Refinance A 30

Refinancing is an option for people who have built up equity in their home by making consistent mortgage payments over the years. When you refinance your home loan, youre taking out a new loan to replace your old mortgage at a better interest rate.

If youve only had your mortgage for a few years and have less than 20% equity in your home, the numbers may not work out in your favor. Thats because if your loan-to-value ratio is too high, youll only end up paying more interest over a longer period of time, defeating the purpose of refinancing to begin with.

Benefits Of Selecting A 30

Compare 30 Year Fixed vs Other Loans

Estimate fixed monthly payments with this free calculator, or compare loans side by side.

Selecting a 30-year over other options comes with many benefits. Some of the benefits are:

- Fixed Payment â The first benefit of selecting a 30-year fixed mortgage is that it comes with a fixed payment. Many borrowers in the past few years have been enticed to select an ARM which offers a very low initial interest rate. Once these ARMs adjust, many homeowners have found themselves in trouble because they didnât realize how high their payment would be, and the new adjusted payment was unaffordable. With a 30-year, you know exactly what your required payment will be over the course of the loan.

- Build Equity â Another advantage of selecting a 30-year is it allows a homeowner to build equity. Each month, a portion of the payment goes towards paying down the loan, which in turn builds a homeownerâs household equity. Other products, such as interest only loans, do not allow a homeowner to build equity.

- Increased Cash Flow â Another benefit of selecting a 30-year is that it increases your cash flow. While a 15-year comes with a lower interest rate, the monthly payments can be significantly higher than a 30-year. By selecting a 30-year, a borrower could save hundreds of dollar each month which could be invested in higher yielding investments, or spent elsewhere.

How Do I Know If It Makes Sense To Refinance

So when does it make sense to refinance? The typical should-I-refinance-my-mortgage rule of thumb is that if you can reduce your current interest rate by 1% or more, it might make sense because of the money youll save. Refinancing to a lower interest rate also allows you to build equity in your home more quickly.

You May Like: What Is A Mortgage Modification Agreement

Recommended Reading: How To Pay Down Mortgage Without Refinancing

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

- Rocket Mortgage by Quicken Loans

- AmeriSave Mortgage Corporation Mortgages

Here’s how these three types of mortgage interest rates stack up:

| Mortgage type |

How Are Mortgage Rates Determined

Mortgage rates are set by the lender. The lender will consider a number of factors in determining a borrower’s mortgage rate, such as the borrower’s credit history, down payment amount or the home’s value. Inflation, job growth and other economic factors outside the borrower’s control that can increase risk also play a part in how the lender sets their rates. There is no exact formula, which is why mortgage rates typically vary from lender to lender.

Recommended Reading: Can I Get A Mortgage With A 660 Credit Score

Real Estate Deal Volume & Appreciation

- Fannie Mae anticipates home sales which were at 6 million units in both 2018 and 2019 will end 2020 with 6.2 million transactions and will see 6.1 million transactions in 2021.

- Real estate appreciation in the United States during 2018 and 2019 ran at 5.1% and 4.2%. In 2020 Fannie Mae anticipates home prices to increase 5.5% and increase a further 2.6% in 2022.

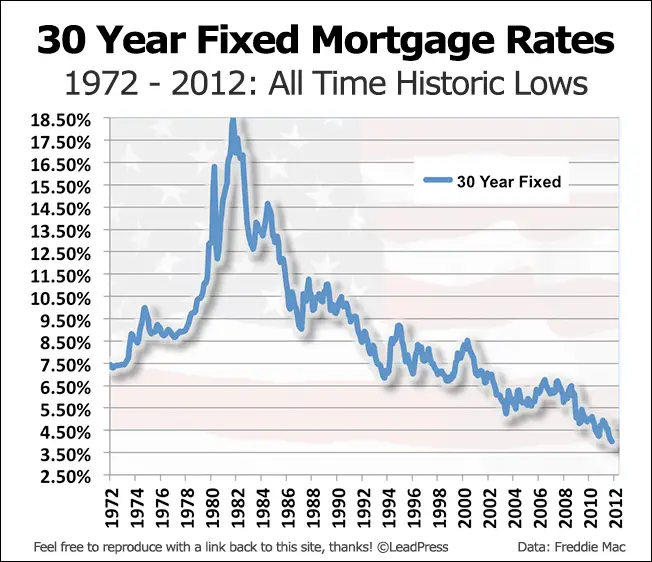

Mortgage Rates From The 1970s To 2019

Since the housing crisis ended around 2008, borrowers have been able to get mortgage rates between 3.5% and 4.98% for a 30-year fixed rate loan. Borrowers who can afford a 15-year payment have enjoyed rates as low as 2.9%.

What was the highest mortgage rate in history?October of 1981 saw the highest 30-year fixed mortgage rate in history. The rate was around 18.63%. That’s 14.13% higher than the average 30-year fixed mortgage rate today.

What was the lowest mortgage payment in history?November of 2012 saw the lowest 30-year fixed mortgage rate in history. The rate dropped all the way down to 3.31%. Interest rates remained in that range until June 2013, when interest rates increased to 4.3% to 4.5%.

What was the highest 15-year fixed rate mortgage in history?December of 1994 saw the highest 15-year fixed mortgage rate in history. The rate was around 8.89%. That’s 5% higher than interest rates are today on the average 15-year fixed loan.

What was the lowest 15-year fixed rate mortgage in history?The lowest 15-year fixed mortgage rates in history occurred during May 2013. At that time, 15-year rates were just 2.56%. A $100,000 mortgage would cost just $670 per month.

Don’t Miss: How Do Mortgage Interest Rates Work

Are Mortgage Rates Going Up

Mortgage rates started ticking up from historic lows in the second half of 2021 and have increased significantly so far in 2022.

In the last 12 months, the Consumer Price Index rose by 7.7%. The Federal Reserve has been working to get inflation under control, and is expected to increase the federal funds target rate two more times this year, following increases at its last five meetings.

Though not directly tied to the federal funds rate, mortgage rates are sometimes pushed up as a result of Fed rate hikes and investor expectations of how those hikes will impact the economy.

Inflation remains elevated, but has started to slow, which is a good sign for mortgage rates and the broader economy.

What Is A Good Mortgage Interest Rate

The best mortgage rate for you will depend on your financial situation. A home loan with a shorter term may have a lower interest rate but a higher monthly payment, while a home loan with an adjustable interest rate may have a lower interest rate at first but then change annually after a set period of time. For example, a 7-year ARM has a set rate for the initial 7 years then adjusts annually for the remaining life of the loan , while a 30-year fixed-rate mortgage has a rate that stays the same over the loan term.

You May Like: How Much Does Mortgage Insurance Cost Per Month

How To Compare 30

If you compare loan offers from mortgage lenders, youll have a better chance of securing a competitive rate. Heres how to compare:

How To Compare Mortgage Rates

While online tools, , allow you to compare current average mortgage rates by answering a few questions, you’ll still want to compare official Loan Estimates from at least three different lenders to ensure you are getting the best mortgage rate with the lowest monthly payment.

After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges.

You May Like: How Much Is A Mortgage On A 650k House

See Other Mortgage Types

| Avg. Days on Market | Home Costs as % of Income |

|---|

Methodology A healthy housing market is both stable and affordable. Homeowners in a healthy market should be able to easily sell their homes, with a relatively low risk of losing money. In order to find the big cities with the healthiest housing markets, we considered the following factors: stability, affordability, fluidity and risk of loss. For the purpose of this study, we only considered U.S. cities with a population greater than 200,000.

We measured stability with two equally weighted indicators: the average number of years people own their homes and the percentage of homeowners with negative equity. To measure risk, we used the percentage of homes that decreased in value. To determine housing market fluidity, we looked at data on the average time a for-sale home in each area spent on the market – the longer homes take to sell, the less fluid the market. Finally, we calculated affordability by determining the monthly cost of owning a home as a percentage of household income in each city.

Affordability accounted for 40% of the healthiest markets index, while each of the other three factors accounted for 20%. When data on any of the above four factors was unavailable for cities, we excluded these from our final rankings of healthiest markets.

When Should You Refinance A 30

If you want to pay off a 30-year fixed-rate mortgage faster or lower your interest rate, you may consider refinancing to a shorter term loan or a new 30-year mortgage with a lower rate. Thebest time to refinancewill vary based on your circumstances. Keep in mind that closing costs when refinancing can range from 2% to 6% of the loans principal amount, so you want to make sure that you qualify for a low enough interest rate to cover your closing costs. Learn more abouthow to refinance and compare todays refinance rates to your current mortgage rate to see if refinancing is financially worthwhile.

The rate and monthly payments displayed in this section are for informational purposes only. Payment information does not include applicable taxes and insurance. Zillow Group Marketplace, Inc. does not make loans and this is not a commitment to lend.

Recommended Reading: How Much Per 1000 On Mortgage

How Much Does 1 Point Lower Your Interest Rate

The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether you’re paying points or not. When comparing offers from different lenders, ask for the same amount of points or credits from each lender to see the difference in mortgage rates.

Home Buyers With A Lot Of Monthly Income

If you have plenty of cash left over every month, you may be able to afford the higher payments that come with a shorter-term mortgage.

Opting for a shorter term could save you a bundle, because it means you pay less interest.

Instead of borrowing over 30 years, youd be borrowing for 20, 15, 10 or even fewer. And the less time you pay interest, the more you save.

The same benefits apply when refinancing to a 15-year term instead of a new 30-year term.

Intrigued? Run your figures through The Mortgage Reports mortgage calculator.

Youll notice the payments for a 15-year loan are much higher. But you may be shocked by how much interest youd save.

Don’t Miss: Can A Discharged Bankrupt Get A Mortgage

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether its the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds todays mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesnt make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money youd save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which wont hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and youd pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . Youll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Read Also: How Does A Reverse Mortgage Work When The Owner Dies

How Do I Refinance A 30

Refinancing is when you replace your existing mortgage with a new home loan. When 30-year refinance rates are significantly lower than your existing mortgage rate, you may be able to save money with a refinance. Keep in mind that the potential savings will need to outweigh the upfront closing costs youll pay to refinance, which are typically 3% to 6% of the loan balance.

Another factor to consider when you refinance is, how many years have you been paying off your current mortgage? If youre 10 years into a 30-year loan, taking out a new 30-year mortgage adds those 10 years back onto your repayment term. Even though you may be lowering your monthly payment and rate in that scenario, you could end up paying more interest over the long term even if you have a lower rate.

For more information on how to refinance a mortgage, see NextAdvisors refinance page.

Comparison To Other Mortgage Rates

When selecting a mortgage, there are many different mortgage products and terms to choose from, each of which has different interest rates. While 30-year fixed rates are near an all-time low, and were recently below 4%, they are still higher than other loan options with a shorter duration. 30-year rates can be compared to the following popular products:

15-year Fixed Rates

15-year fixed rates are normally lower than a 30-year and, depending on the lender, the interest rate variance ranges from 0.50% to 0.75%. These rates are often lower because having a shorter term provides significantly less risk to the lender. Although interest rates are lower, 15-year payments are higher than 30-year payments because the loan has to be paid off in half the time.

Adjustable Rate Mortgages

Interest Only Mortgages

While they are not as frequently offered today as in years past, many borrowers still opt for interest only mortgages. Since interest only loans do not require principal payment and do not amortize, the balance due never decreases. Because of this, lenders assume a lot more risk and often require a sizable down payment and charge higher interest rates. Interest only mortgage rates are commonly 1% higher than 30-year rates.

The following graph shows historical data from the Freddie Mac Primary Mortgage Market Survey. It shows historical rate data back to 1971 for the 30-year, along with 15-year data back to 1991 and 5/1 ARM data from 2005 onward.

Also Check: How To Pay Off 30 Year Mortgage Early

How Historical Mortgage Rates Affect Buying

When mortgage rates are lower, buying a home is more affordable. A lower payment may also help you qualify for a more expensive home. The Consumer Financial Protection Bureau recommends keeping your total debt, including your mortgage, at or below 43% of what you earn before taxes .

When rates are higher, an ARM may give you temporary payment relief if you plan to sell or refinance before the rate adjusts. Ask your lender about convertible ARM options that allow you to convert your loan to a fixed-rate mortgage without having to refinance before the fixed-rate period expires.