What Are The Risks

One of the major risks of refinancing your home comes from possible penalties you may incur as a result of paying down your existing mortgage with your line of home equity credit. In most mortgage agreements there is a provision that allows the mortgage company to charge you a fee for doing this, and these fees can amount to thousands of dollars. Before finalizing the agreement for refinancing, make sure it covers the penalty and is still worthwhile.

Along these same lines, there are additional fees to be aware of before refinancing. These costs include paying for an attorney to ensure you are getting the most beneficial deal possible and handle paperwork you might not feel comfortable filling out, and bank fees. To counteract or avoid entirely these bank fees, it is best to shop around or wait for low fee or free refinancing. Compared to the amount of money you may be getting from your new line of credit, but saving thousands of dollars in the long run is always worth considering.

- Refinancing Risks Have Not Become Smaller There have been reports that risks are diminishing when refinancing. This article argues against that idea.

- Refinancing Won’t Fix the Housing Market How massive amounts of refinancing is affecting the country as a whole.

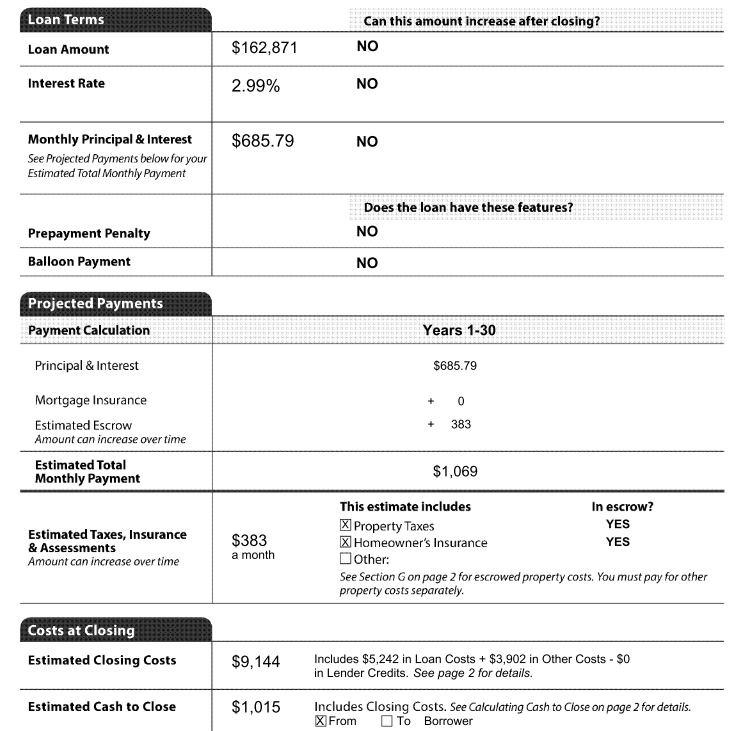

Is There A Prepayment Penalty On My Current Home Loan

There could be a clause in your contract that requires you to pay a penalty should you pay off the mortgage before a certain date. This could be a percentage of the loan amount as a flat fee or a sliding scale.

Your loan might not have a penalty like this, but it doesnt hurt to check first. And if you do have this type of penalty on your loan, youll probably want to wait until it expires before refinancing, as the costs will wipe out many of the benefits.

Consolidate Your Second Mortgageif Its More Than Half Your Yearly Income

Some homeowners want to roll their second mortgages into a refinance of their first mortgage. But not so fast! If the balance on your second mortgage is less than half of your annual income, youd do better to just pay it off with the rest of your debt through your debt snowball.

If the balance is higher than half of your annual income, you should refinance your second mortgage along with your first one. This will put you in a stronger position to tackle the other debts you might have before you pull your resources together to pay off your mortgages once and for all!

Also Check: How To Pay Off Mortgage In 5 Years

Check Your Credit Score

This time has been tough on everyone, and if youve taken a financial hit, your credit score may have lowered. Check your credit score and evaluate if you should take a little more time before you apply to refinance. Borrowers with good credit will get better rates, but dont get too hung up on trying to have a perfect credit score and miss the window of opportunity.

Also Check: Requirements For Mortgage Approval

Will The Savings Be Enough To Make Refinancing Worthwhile

Youll spend an average of 2% to 5% of the loan amount in closing costs, so you want to figure out how long it will take for monthly savings to recoup those costs. This is often called the break-even point of a mortgage refinance. For instance, it would take 30 months to break even on $3,000 in closing costs if your monthly payment drops by $100. If you move during those 30 months, youll lose money in a refinance.

» MORE:Calculate your refinance savings

Think about whether your current home will fit your lifestyle in the future. If youre close to starting a family or having an empty nest, and you refinance now, theres a chance you wont stay in your home long enough to break even on the costs.

Homeowners who have already paid off a significant amount of principal should also think carefully before jumping into a refinance.

If youre already 10 or more years into your loan, refinancing to a new 30-year or even 20-year loan even if it lowers your rate considerably tacks on interest costs. Thats because interest payments are front-loaded the longer youve been paying your mortgage, the more of each payment goes toward the principal instead of interest.

Ask your lender to run the numbers on a loan term equal to the number of years you have remaining on your current mortgage. You might reduce your mortgage rate, lower your payment and save a great deal of interest by not extending your loan term.

» MORE:When to refinance into a shorter mortgage

Read Also: What Is A Normal Mortgage Rate

You Want A Shorter Loan Term

If youre keen to pay off debt, you may want to refinance your mortgage to a shorter loan term. You could add to your savings if you can secure a lower interest rate and shorten your term. A shorter loan term means youll pay less in total interest.

But one word of warning: Youll probably be increasing your monthly payment in exchange, so make sure it fits into your budget. You dont want to risk defaulting on your loan.

Does It Ever Make Sense To Refinance Your Car Loan Before Applying For A Mortgage

It depends on your financial situation. If you can qualify for a mortgage with your current debt and income, we suggest waiting until after buying a home to refinance your car, said Schandelson.

The one circumstance where car refinancing might actually be beneficial before a home purchase is if you have a high credit score and a high DTI, according to Schandelson. Thats because refinancing for someone who has strong credit could lower the DTI without causing too much of a credit hit.

Also Check: How To Calculate Monthly Mortgage Payment Formula

What You Need To Know

- Theres no perfect time to refinance, but if interest rates drop or your credit score increases, you may be able to get more favorable terms

- Though a small change in interest rates might seem insignificant, it can save you tens of thousands of dollars over the course of a 30-year loan

- Typically, refinancing can cost you anywhere between 3% 6% of the new loan amount

Whats The Difference Between Refinancing Vs Renewing Your Mortgage

Renewing your mortgage means staying with your current lender for another term. Youll have an opportunity to renegotiate your interest rate and term, and you wont need to re-apply.

When you refinance, you are paying out your existing mortgage in order to negotiate a new mortgage loan agreement. This is usually because you want to access the equity in your home or lower other borrowing costs. There may be prepayment charges depending on when you choose to refinance.

Read Also: How Much Is Mortgage On 1 Million

Read Also: What Is My Mortgage Payment Going To Be

What If I Cant Pay My Current Mortgage

If youre out of work right now or youre finding it hard to pay your mortgage due to events you couldnt control, dont lose hope! Depending on your situation, you may be able to get financial assistance through a federal or state program, have your mortgage payments lowered, or even put your payments on hold for a little while.

Doing that can help lift the burden you might be feeling right now if youre worried about when youll see your next paycheck. But its not a perfect solution. The best thing you can do right now is get back into the workforceeven if that means taking a job thats outside your fieldso you can start making ends meet.

Now if you cant pay your mortgage for some other reason , youre probably not going to get much help from your lender. Its up to you to solve the problem.

Youve got to take control of the things you can controlstarting with your money! With a Ramsey+ membership, you can get all the tools and content you need to take control of your money so you can save, build wealth, and get out of debt. And that includes your mortgage!

When Can I Refinance My Home

Most banks and lenders will require borrowers to maintain their original mortgage for at least 12 months before they are able to refinance. Although, each lender and their terms are different. Therefore, it is in the best interest of the borrower to check with the specific lender for all restrictions and details.

In many cases, it makes the most sense to refinance with the original lender, but it is not required. Bear in mind though, It’s easier to keep a customer than to make a new one, so many lenders do not require a new title search, property appraisal, etc. Many will offer a better price to borrowers looking to refinance. So odds are, a better rate can be obtained by staying with the original lender.

Don’t Miss: Can I Get A Mortgage Without My Spouse

Work On Your Credit Score

Borrowers with high and a healthy credit history qualify for the best interest rates. You can bump up your credit score by reducing consumer debt, paying all your bills on time, and removing errors from your credit report.

If youve recently paid off debt, you could opt to include monthly payments like utilities and your cell phone bill on your credit report. As you make these additional payments on time every month, you can get a boost in your credit score.

Mortgage Rates Have Gone Down

Mortgage rates for homeowners can fluctuate since theyre affected by a variety of factors, including U.S. Federal Reserve monetary policy, market movements, inflation, the economy and global factors.

If mortgage rates fall, you may be able to save by securing a lower interest rate than you have on your existing loan.

So how much should mortgage rates fall before you consider whether refinancing is worth it? The traditional rule of thumb says to refinance if your rate is 1% to 2% below your current rate.

Make sure to factor in your current loan term when considering refinance though. For instance, if youre four years into a 30-year mortgage and refinance to a new 30-year term, it will have taken you 34 years total to pay off your home in the end. Plus, youll likely pay more interest over the extended term than if you had chosen a shorter term.

No matter what rates are doing, youll want to check that the math works out in your favor. Make sure to calculate your break-even point and how the overall costs including total interest of your current mortgage and your new mortgage would compare, says Andy Taylor, general manager for Home/Mortgage at Credit Karma.

Don’t Miss: What Is The Federal Interest Rate For Mortgage

What Are My Refinancing Options

As stated above, you have options when it comes to refinancing loans. You could refinance your mortgage in order to secure a lower interest fee and a change in the terms of your loan or you might opt for a cash-out refinance that lets you turn your homes equity into extra income that you can use to pay for home improvement, tuition costs, high-interest debt payments, and more.

If The Monthly Payment Will Go Down But You’ll Pay More Interest

When you refinance a mortgage and start over at the beginning of a new 30-year loan, you’re likely to get a lower monthly payment. But all those years of interest payments will add up.

This refinance might meet your needs if you’ll sell the home within a few years, or if you need rock-bottom monthly payments for a while to meet other needs .

Much of the slider and the bars below it may be red in this scenario, indicating that you’ll pay more total interest and closing fees during that period.

Or, the slider’s color might change from red to green and then to orange in this scenario, indicating that you’ll save money for a while before the total payments pile up.

You May Like: How Many Months Can You Go Without Paying Mortgage

Q: Ive Heard That Refinancing My Mortgage Can Help Me Access Better Interest Rates Or Allow Me To Change The Terms Of My Mortgage Since I First Took Out My Mortgage My Financial Health Has Improved And Rates Have Decreased Does That Mean Now Is A Good Time To Refinance When Should I Refinance My Mortgage

A: Its common for homeowners to wonder, When should I refinance my mortgage? The short answer is that refinancing is generally a good idea when you stand to get better terms on the mortgage, can save money through better interest rates, need to access your homes equity, or want a different type of mortgage. Since there are many variables to consider, a good place to start the research process is to search how does refinancing a mortgage work? Refinancing a mortgage is basically trading in the existing mortgage for a new one, which can lead to better interest rates and terms. If youre considering a refinance, its important to understand the full picture, including the benefits of refinancing and when it makes the most sense to do so this will allow you to get an idea of when the right time is to consider a refinance.

So Should I Refinance My Mortgage

The first thing to decide when considering a refinance mortgage is: Should I refinance my mortgage. What are the pros and cons?If you were to reduce your monthly payments this would most likely be offset by an increase in the length of the time taken to pay off the loan.

You will need to check that the cost of a mortgage refinance will not outweigh the financial benefits.

The types of charges you will likely incur for refinancing amongst others are: a processing fee, an application fee, brokerage fees, legal costs and credit checks.

The magnitude of refinancing a mortgage is so great that it is something to be very carefully considered before committing to any undertaking. Thorough research is recommended of the interest rates and refinancing costs of multiple financial institutions. The internet takes the legwork out of shopping around for the rates and charges of the various financial services providers.

When disclosing your financial details online, check that the providers site is secure.

Before taking up with any one provider, it is a good idea to ring their customer services number and see how long it takes them to answer to get a taste of things to come were you to refinance with them and have any need of assistance.

While a home mortgage refinance could potentially improve your financial situation, it is not right for everyone. Each individual should carefully consider their own circumstances

Don’t Miss: Is 4.75 A Good Interest Rate For Mortgage

Can I Cover The Refinance Closing Costs

While lenders might offer to add the closing costs to the loan amount or increase the interest payments to cover the cost, it isnt ideal. These sorts of deals could end up costing you more money than if you had covered the closing costs for yourself.

Please consider spreading the word and sharing Should I Refinance My Mortgage? 12 Important Considerations

About the Author

Top Wellington Realtor, Michelle Gibson, wrote: Should I Refinance My Mortgage? 12 Important Considerations

Michelle has been specializing in residential real estate since 2001 throughout Wellington Florida and the surrounding area. Whether youre looking to buy, sell, or rent she will guide you through the entire real estate transaction. If youre ready to put Michelles knowledge and expertise to work for you call or e-mail her today.

Areas of service include Wellington, Lake Worth, Royal Palm Beach, Boynton Beach, West Palm Beach, Loxahatchee, Greenacres, and more.

Should I Refinance My Mortgage? 12 Important Considerations

What Else Do I Need To Be Aware Of

Closing costs: There are costs associated with refinancing a loan, and they are typically lower than when you purchase a home. When you purchase a home, closing costs can range from 2 percent to 6 percent of the loan amount, according to lender estimates.

For a refinance, average closing costs accounted for less than 1 percent of the loan amount, excluding taxes, according to a report from ClosingCorp, a San Diego company that provides residential real estate closing cost data for the mortgage and real estate services industries. With taxes included, the average cost of refinancing was 1.29 percent of the loan amount. Estimates for closing costs vary depending on the state and municipality of the home. Yet because the cost of closing a loan can include state and local taxes, ask what is included in the term closing costs.

According to ClosingCorp, the average closing costs for a single-family home in 2020 were $3,398 including taxes, and $2,287 excluding taxes. ClosingCorp refinance calculations include lenders title policy, appraisal, settlement and recording fees, as well as various state and local taxes.

Some states require an attorney to review the closing documents. If required in your state, that would add an attorney fee to your closing costs.

Read Also: What Are Bank Mortgage Rates

How To Negotiate A Refinance Offer

Negotiating refinance offers works much like any other negotiation. Take the following steps to work your way toward the best possible deal.

Gather your loan estimates and review the numbers Focus on the estimated interest rate, annual percentage rate and loan term, as well as upfront and ongoing loan costs.

Ask each lender if theyll lower or waive some of the refi costs Request an appraisal waiver and lower origination fees. It may also be worth buying mortgage points to get a lower rate.

Make lenders aware that youre shopping around If you share this info, theyre more likely to compete for your business.

Pay attention to the services you can choose Page 2 of your loan estimate includes third-party services you can shop for, including the title search and insurance, pest inspection and property survey.

Ask about a custom loan term Do you want to have your house paid off by the time youre ready to retire? Or how about the same year your kid will graduate from high school? Many lenders now allow you to choose your own loan term and put things on a timeline that makes sense for your life.

Refinancing your mortgage is more about the financial benefit youll get from the new loan than the lender you choose. Pick one that provides the most favorable terms and pricing even if that means ditching your current lender.