What Does A Reverse Mortgage Mean To Your Inheritance

From managing your work-home balance, to preparing your children for and enrolling them in college, to even caring for aging parents, your generation has a lot on its plate. It may seem that every time you turn around, youre faced with more responsibilitiesand, consequentially, expenses. And when you factor in todays volatile market and economywith retirement savings depleting, spiking unemployment rates, and general uncertainty surrounding government benefit programsmany adult children are concerned about their parents being able to maintain financial stability through their retirement years.

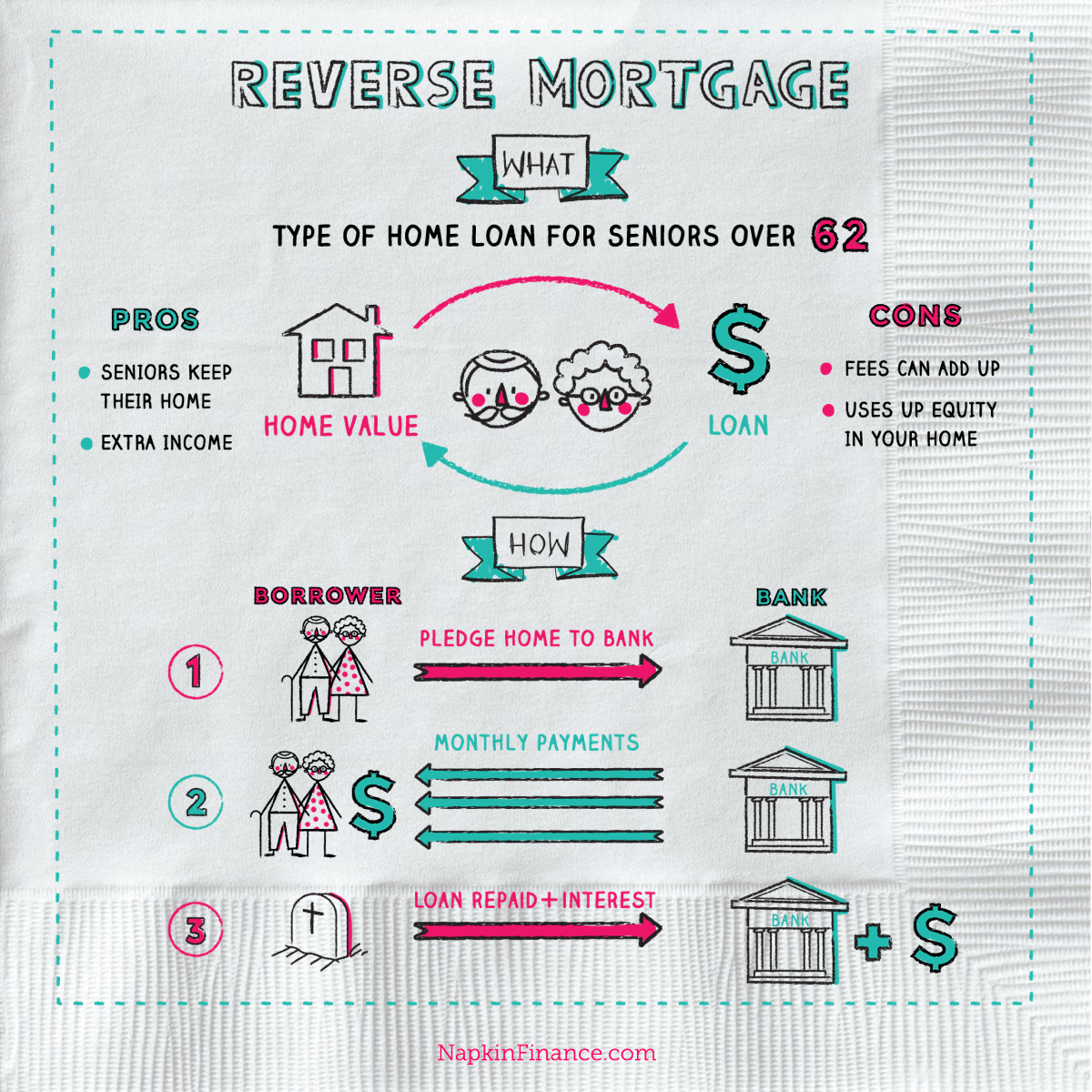

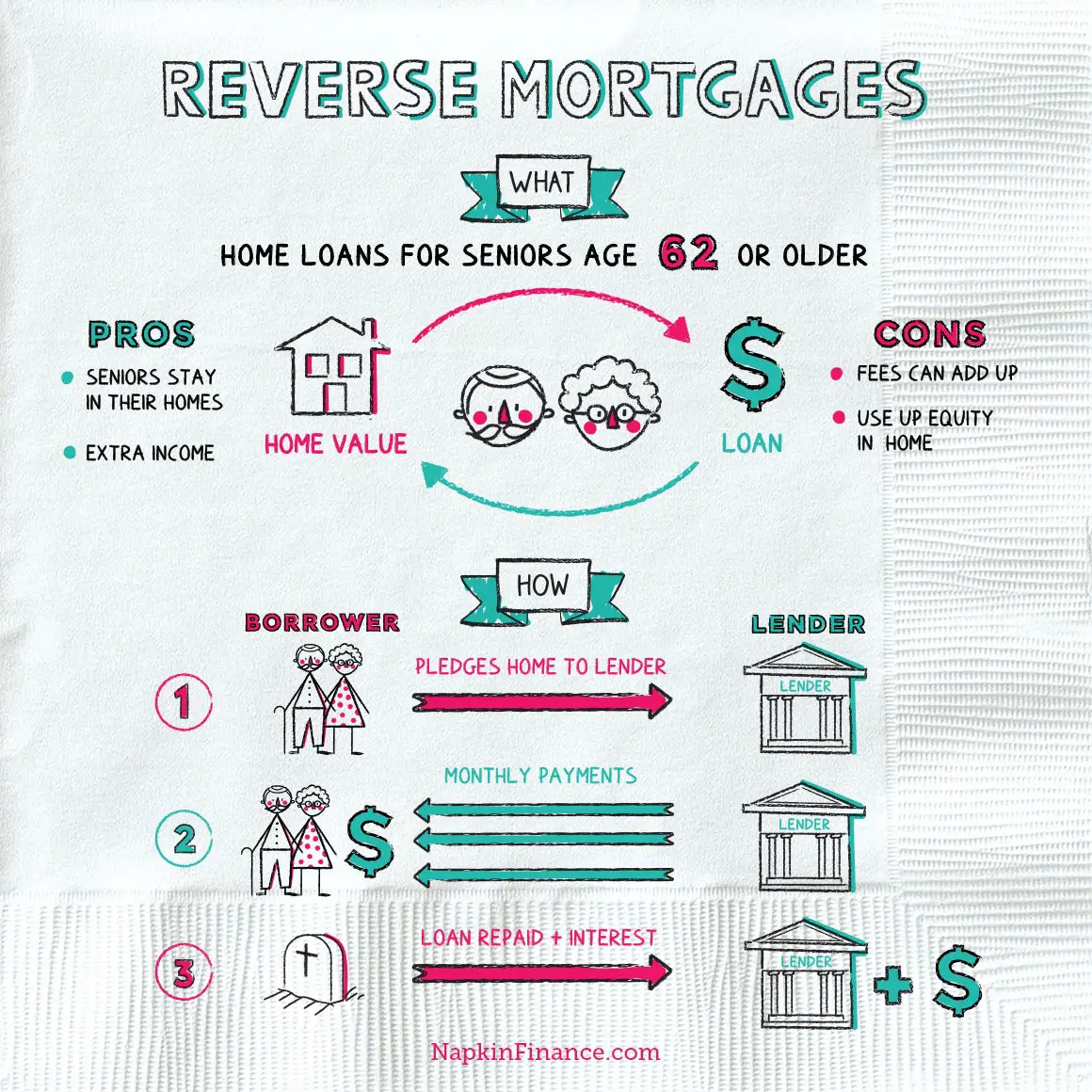

If your parents are 62 or older, and if monthly bills and healthcare costs are becoming a struggle for them, leveraging their home equity with a reverse mortgage could be a smart solution. A Federal Housing Administration Home Equity Conversion Mortgage also known as a reverse mortgageenables your parents to tap into their home equity and get the cash they need to live more comfortably.

Repaying the Loan: Rules You Need to KnowShould your parents leave the home to you as an heir, you assume responsibility for the full loan balanceregardless of whether or not you intend to occupy the home. And if youre left with this obligation, its important that you know all your options you can:

Repay the loan and keep the home

Sell the home and keep remaining funds

Do nothing with the home and deed it to the lender

How Does A Reverse Mortgage Work

Despite the reverse mortgage concept in practice, qualified homeowners may not be able to borrow the entire value of their home even if the mortgage is paid off.

The amount a homeowner can borrow, known as the principal limit, varies based on the age of the youngest borrower or eligible non-borrowing spouse, current interest rates, the HECM mortgage limit and the homes value.

Homeowners are likely to receive a higher principal limit the older they are, the more the property is worth and the lower the interest rate. The amount might increase if the borrower has a variable-rate HECM. With a variable rate, options include:

- Equal monthly payments, provided at least one borrower lives in the property as their primary residence

- Equal monthly payments for a fixed period of months agreed on ahead of time

- A line of credit that can be accessed until it runs out

- A combination of a line of credit and fixed monthly payments for as long as you live in the home

- A combination of a line of credit plus fixed monthly payments for a set length of time

If you choose a HECM with a fixed interest rate, on the other hand, youll receive a single-disbursement, lump-sum payment.

The interest on a reverse mortgage accrues every month, and youll still need to have adequate income to continue to pay for property taxes, homeowners insurance and upkeep of the home.

Supplement Social Security Benefits

As the government raises the retirement age in the United States, workers with strenuous or unpleasant jobs may want out early. Retiring at 62 wont get you the maximum Social Security benefit, but with enough home equity, a reverse mortgage can boost that monthly check and get you out of the rat race.

Dont Miss: 70000 Mortgage Over 30 Years

Don’t Miss: How Do You Get A Second Mortgage On Your House

Differences Between Reverse Mortgages And Traditional Mortgages

To get approved for a traditional mortgage, lenders will review your finances, unpacking everything from your debt-to-income ratio to your employment status. If all goes well, youll close on your home and make monthly mortgage payments to your lender. Youll also be responsible for covering property taxes and any relevant insurance premiums.

Reverse mortgages work, well, in reverse. They allow you to liquidate equity in your property and convert it into cash. If the math works out, you may be able to use it to pay off your existing mortgage and create some income during retirement. Again, this money isnt free. Your balance will continue to increase, and interest will accrue while your equity decreases.

Theres one thing reverse and traditional mortgages have in common: origination fees. This is a cost the lender adds to process and manage your application. For traditional mortgages, origination fees usually cost somewhere between 0.5% and 1%. For reverse mortgages, these fees typically range anywhere from $2,500 to $6,000.

This number varies lender by lender, program by program so thats worth shopping, said Flynn.

There are also closing costs, mortgage insurance premiums and servicing fees to contend with when securing a reverse mortgage. Your third-party counselor should be able to outline how this will impact your individual finances.

How Is Hud Involved In Reverse Mortgages

There are two parties involved in every mortgage transaction a lender and a borrower. That is also true with a reverse mortgage. But in addition to a reverse mortgage lender, the government is involved in every transaction because HUD will insure the loan and so there are steps the lender must follow to be certain that the loan meets HUD requirements. To be a lender for a HECM loan, the lender must be approved by HUD.

That does not mean though that the originator is necessarily a HUD-approved entity. Some originators, like mortgage loan brokers, are not HUD-approved but must take the loan to a HUD-approved lender to be underwritten and closed. The loan is the same HUD HECM loan either way, but there may be additional or higher costs with more people in the mix.

Borrowers are encouraged to be good shoppers and compare different lenders. Not all lenders are priced well and not all brokers are priced higher, but it is prudent to compare. After all, if you are getting the same loan with the same parameters and the same insurance no matter where you go, you might as well get the best terms for yourself and your family. HUD is involved in every loan completed no matter who the originator is.

In fact, lenders may not give approvals to borrowers under the terms of the program until after they have received appraisal clearance through the HUD EAD. Then the lender will deliver certain documents to HUD for insuring the loan after the loan closes.

Also Check: How Does Refinancing Mortgage Affect Credit Score

A Few Questions To Ask Yourself

1. Is there anyone who lives in the home that will be mortgaged besides the borrower or borrowers?

YES: When the borrower dies or moves out of the home, the reverse mortgage becomes due. This could affect those living with you, such as a younger spouse, children, or other family members. Discuss the situation with them beforehand and then proceed if it makes sense for you.

NO: There is no need to worry about your family or loved ones needing to move out when the reverse mortgage becomes due.

2. Do you plan to keep living in your home for an extended period of time?

YES: Reverse mortgages are expensive over a short time horizon and get progressively less expensive as more time passes. Thus, a reverse mortgage is more likely to be right for you if you will remain in your home for a long time.

NO: If youre not planning to stay in your home, there are other short term options that are likely cheaper. A reverse mortgage is less likely to be right for you, especially after the FHA discontinued the HECM Saver program.

3. Is it important for you to leave your home to your family without debt attached to it?

YES: A reverse mortgage is probably not right for you. If you are comfortable leaving some debt on your home, there are reverse mortgage options that will limit the amount of equity that you withdraw, leaving your heirs with a more valuable inheritance.

NO: A reverse mortgage is more likely to be right for you.

Helocs As A Barometer Of Interest In Equity Lending Education

Both Lunde and Sless agree that the newfound fuel in HELOC volume could be an indicator of broader acceptance of home equity lending, which could encompass reverse mortgages particularly as people get older.

Homeowners understanding the concept of incorporating their home equity into a comprehensive financial plan is a good thing for the reverse industry, Sless says. Now, its on us to educate them about why and how a reverse mortgage is the best route to put that equity to good use.

For Lunde, the indications of interest in home equity could serve as a signpost for industry participants to potentially bring new partners into the fold.

I do think were in a position where HELOC lending can be a good broad indicator for interest in reverse as well, and potentially lender interest in offering reverse for companies that arent already in the space, he says.

When it comes to product education, a new kind of acceptance for home equity lending could indicate a need for the industry to pivot to some new priorities especially considering the sizable investments that industry companies and organizations have made in that effort, Sless says.

While the industry has some of its own secondary and capital markets concerns at the moment, the viability of the reverse product is something to be accentuated, Sless says.

Recommended Reading: How Do I Know If I Have Mortgage Insurance

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Heres how reverse mortgages work, and what homeowners considering one need to know.

How Is Reverse Mortgage Paid

Eventually, the reverse mortgage must also be repaid. The loan will be due when the borrower gets to sell the property or when he or she passes away. Nevertheless, the borrower may opt to pay back the loan sooner than that.

But for many cases of reverse mortgages, the loan is paid when the property is sold. If youre planning to get a reverse mortgage, you first have to understand that it is designed in such a way that whatever amount you owe will not exceed your propertys value.

Reverse mortgages are from the HECM which is the Federal Housing Administrations program. This means that the federal government guarantees these loans. Borrowers dont have to worry about the lender not being able to make the payment.

Don’t Miss: Does Rocket Mortgage Affect Your Credit Score

How Can I Find A Trustworthy Reverse Mortgage Lender How Do I Know Its Not A Scam

The unfortunate truth is that scammers exist and they often target senior homeowners. But just because there are some bad actors doesnât mean reverse mortgages are predatory.

Quite the opposite â a reverse mortgage from a reputable, trusted lender can provide substantial benefit to older homeowners.

Hereâs how to take advantage of the reverse mortgage opportunity while protecting yourself from scams:

- Choose an FHA-approved lender with reverse mortgage knowledge. Ask your lender how many reverse home loans they do each year and how often they work with retirement-age borrowers

- Donât sign a contract if youâre not 100% clear on the terms

- Never sign a contract or send or accept money until youâve reviewed it with your financial advisor

- Never respond to unsolicited reverse mortgage offers only pursue a loan you applied for with a lender you chose

How Much Can You Get From A Reverse Mortgage

The amount of money you can receive from a reverse mortgage loan is based on the youngest borrowers age, current interest rates, and your homes appraised value. The Loan to Value on a reverse mortgage are known as Principal Limit Factors and those percentages will vary with age and rate and are based on actuarial tables. The older you are the higher the loan to value will be. Similarly, the lower the interest rates the higher the loan to value as well.

You May Like: Does Pre Approval Mean You Get The Mortgage

Who Can Get A Reverse Mortgage

They are only available to homeowners who are at least 62 years old. Borrowers have to meet other requirements, according to the Consumer Finance Protection Bureau. They must:

-

live in the home they’re borrowing against

-

either own the home outright or have a low balance on the mortgage, which they will need to pay off when they close on the reverse mortgage

-

not owe any federal debt

-

keep their home in good condition

-

get counseling from a reverse mortgage counseling agency that’s approved by the United States Department of Housing and Urban Development

There’s also an application process. The bank will want to make sure you have enough equity in your house and that you have sufficient funds to keep paying costs like property taxes, homeowner’s insurance, homeowner association fees, and general upkeep of the property.

How To Avoid Reverse Mortgage Foreclosure

Another danger associated with a reverse mortgage is the possibility of foreclosure. Even though the borrower isnt responsible for making any mortgage paymentsand therefore cant become delinquent on thema reverse mortgage requires the borrower to meet certain conditions. Failing to meet these conditions allows the lender to foreclose.

As a reverse mortgage borrower, you are required to live in the home and maintain it. If the home falls into disrepair, it wont be worth fair market value when its time to sell, and the lender wont be able to recoup the full amount that it has extended to the borrower.

Reverse mortgage borrowers are also required to stay current on property taxes and homeowners insurance. Again, the lender imposes these requirements to protect its interest in the home. If you dont pay your property taxes, then your local tax authority can seize the house. If you dont have homeowners insurance and theres a house fire, the lenders collateral is damaged.

In the case of a HUD-backed HECM, you’ll need to be able to show proof of financial assets or resources to pay these costs in order to qualify.

Read Also: Is Mortgage Interest On A Second Home Deductible

Who Is A Reverse Mortgage Right For

A reverse mortgage might sound a lot like a home equity loan or a home equity line of credit . Indeed, similar to one of these loans, a reverse mortgage can provide a lump sum or a line of credit that you can access as needed, based on how much of your home youve paid off and your homes market value. But unlike a home equity loan or a HELOC, you dont need to have an income or good credit to qualify, and you wont make any loan payments while you occupy the home as your primary residence.

A reverse mortgage is the only way to access home equity without selling the home for seniors who:

- Dont want the responsibility of making a monthly loan payment

- Can’t afford a monthly loan payment

- Cant qualify for a home equity loan or cash-out refinance because of limited cash flow or poor credit

Of course, those seniors could still tap into other types of loans. Unsecured personal loans, for instance, can provide a lump sum of cash without using the home as collateral. However, that type of loan would require monthly repayment.

Do I Have To Complete In

The answer depends on the type of reverse mortgage loan for which you are applying. In New York, in order to get a proprietary reverse mortgage loan , the borrower must either complete in-person counseling or waive such requirement in writing. In order to get a HECM reverse mortgage loan , a borrower may not waive the counseling requirements but he or she may opt to complete the required counseling either in person or over the telephone. You can find a list of non-profit housing counselors on the Departments website.

Recommended Reading: How To Find Mortgage History On A Property

Reverse Mortgage Vs Refinance: Which Is Better

While a reverse mortgage can supplement your income as you age, this type of financial tool might not be your best choice. There are times when you might consider alternatives to a reverse mortgage, especially if you want to leave your home to your children after you die or if you plan on selling the property.

You might instead consider refinancing options for seniors and the different types of mortgage refinancing that could be a better alternative to a reverse mortgage.

A cash-out refinance is one such option. Most people refinance to lower their interest rate or shorten or lengthen the term of their existing mortgage loan. A cash-out refinance, though, can also provide you with a lump sum of cash that you can spend on anything.

In a cash-out refinance, youll refinance for an amount higher than what you owe on your mortgage. Say you owe $100,000 on your mortgage and your home is worth $200,000. You might refinance for $170,000. You then receive that extra $70,000 as a lump sum payment. Youll have to repay the full $170,000 that youve borrowed in regular monthly payments with interest. But if you pay off your new mortgage loan before you die, you can leave your home to your heirs without worrying about forcing them to pay off a reverse mortgage to gain the property.

Remember: If you pass away before repaying your new mortgage, your heirs would have to pay off that loan before taking over possession of your home.

Need extra cash?