How Much Should I Put Down On A $350000 House

| Housing price |

|---|

| 20% |

How much income do you need for a $350 000 mortgage?

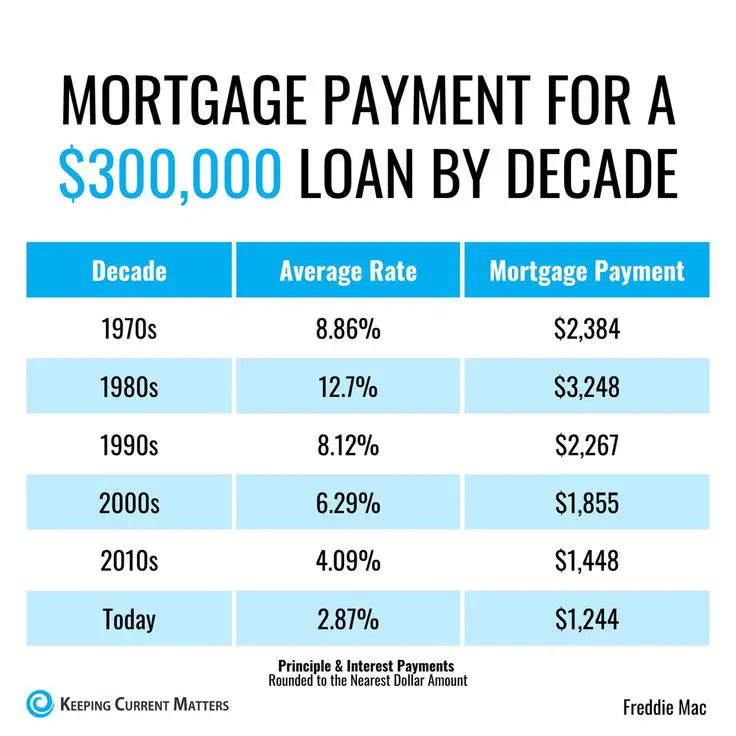

A $ 350,000 mortgage with a 4.5% interest rate over 30 years and a payout of $ 10,000 will require an annual income of $ 86,331 to qualify for the loan. You can calculate even more variations in these parameters with our Mortgage Requirement Calculator.

How much do I need to make to afford a 350k house?

You need to earn $ 107,668 a year to afford a 350k mortgage. We base the income you need on a 350,000 mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be around $ 8,972. The monthly payment on a 350,000 mortgage is $ 2,153.

The Homebuying Process: Step

Buying a house is likely to be the biggest financial commitment that you will make for your entire life, and while the experience can be both exciting and nerve-wracking, its important to get it right in order to avoid excessive extra costs in the future. Dont buy a home without reading this.

When its your first time buying it can be a little overwhelming, with lots of unknowns, legal wranglings, and lists of things to do in order to get the keys to your first home.

A few essentials youll want to do straight off include:

- Check your credit and strengthen your credit score

- Find out how much you might be able to borrow

- Save for down payment, closing costs

- Build a healthy savings account

- Get preapproved for a mortgage

- Start speaking to realtors and finding one you like and is recommended

- Find suitable mortgage lenders

- Buy a house you like

Luckily, when youre ready to make your first move, weve got this extremely thorough home buying guide to walk you through the must-dos of your first purchase.

How Much House Can I Afford On $80 000 A Year

For the couple making $80,000 per year, the Rule of 28 limits their monthly mortgage payments to $1,866. Ideally, you have a down payment of at least 10%, and up to 20%, of your future home’s purchase price. Add that amount to your maximum mortgage amount, and you have a good idea of the most you can spend on a home.

Also Check: Can You Repay A Reverse Mortgage

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Can I Afford A 350k House

How much income do I need for a 350k mortgage? You need to earn $ 107,668 a year to afford a 350k mortgage. In your case, your monthly income should be around $ 8,972. The monthly payment on a 350,000 mortgage is $ 2,153.

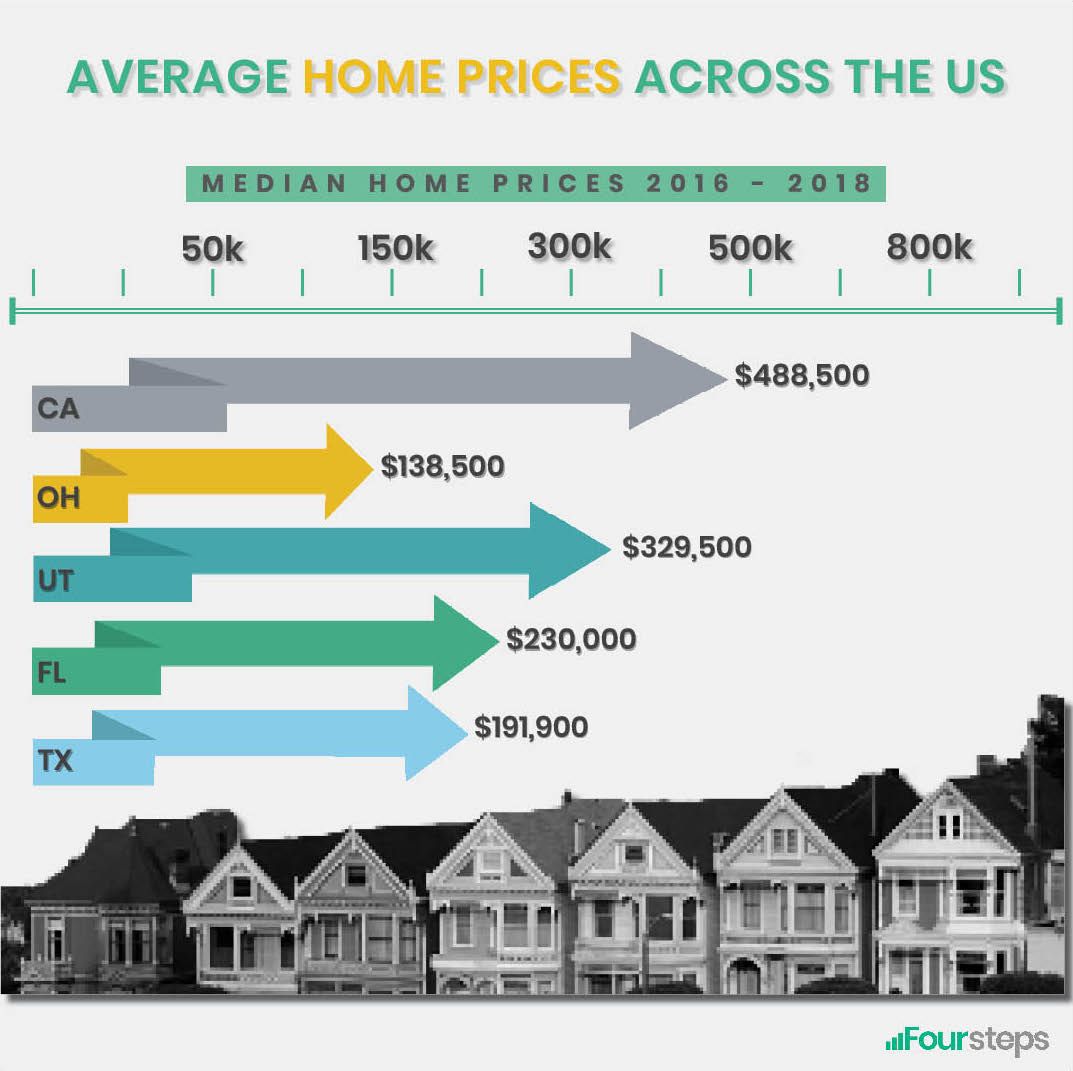

How much do you have to earn to afford a 300,000 house? That means that to afford a $ 300,000 house, you need $ 60,000.

Read Also: How Much Will I Save If I Refinance My Mortgage

How Much Is 3 Down On A House

A down payment is an upfront partial payment toward the purchase of a home. Down payment requirements are typically expressed as a percentage of the sales price of the home. For example, if a mortgage lender requires a 3 percent down payment on a $250,000 home, the homebuyer must pay at least $7,500 at closing.

Do Your Own Research For A $300k Mortgage

Our final piece of advice is simple: do your own research. Were confident that weve put together a solid guide here for a 300k mortgage, but its not the be-all and end-all. We dont tackle your specific financial or personal situation , nor can we provide advice for every single location on the planet. And ultimately, a lot of what weve said is subjective and a matter of opinion.

We recommend taking the resources and advice weve pointed you to and then doing some more leg work. That final call to buy a home is ultimately yours to make.

Don’t Miss: Are Closing Costs On A Reverse Mortgage Deductible

How Much Deposit Do You Need

The deposit required by the mortgage lender will depend on the price of the property youre buying and whether youre classed as high or low risk.

Most lenders set the maximum loan to value ratio at 90%, meaning youll need a deposit of 10%.

The LTV shows how much of the property you own outright. Some can accept as little as a 5% deposit, while others will need you to put down more if youre considered higher risk because of issues like bad credit.

Size matters when it comes to residential mortgage deposits, and it can affect the interest rates you get, which affects your monthly repayments.

A larger deposit means a lower LTV, and it increases your chances of getting favourable rates from more lenders as they consider the mortgage a lower risk.

If the total amount of the property youre buying costs £300,000 in the market and lenders need a 10% deposit, youll need to make a £30,000 down payment.

You would then borrow £270,000 from the mortgage lender.

The Mortgage Payment Calculator In Action

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

If you switch from monthly to accelerated weekly payments, for example, you’ll increase your repayment frequency from 12 monthly payments to 52 weekly payments. That can shave two years and 10 months off your mortgage, versus monthly payments .

Similarly, if you switch from monthly to an accelerated bi-weekly payment schedule, youll increase your repayment frequency from 12 monthly payments to 26 bi-weekly payments. This means youll make a payment every two weeks. That too adds up to one extra monthly payment over the course of a year. As with accelerated weekly, accelerated bi-weekly payments shave about two years and 10 months off your mortgage, versus monthly repayment.

Recommended Reading: What Documents Do I Need For A Mortgage

New Mortgages Interest Only Mortgages And Interest Rate Rises

Itll give you a simple, ballpark figure to show you the monthly payments youd pay on:

- intertest only mortgages

- your mortgage if there was an interest rate rise.

You can also adjust the mortgage term, interest rate and deposit to get an idea of how those affect your monthly payments.

To get started all you need is the price of your property, or the amount left on your mortgage.

MoneyHelper is the new, easy way to get clear, free, impartial help for all your money and pension choices. Whatever your circumstances or plans, move forward with MoneyHelper.

Benefits Of Cmhc Insurance

Benefits of CMHC Insurance CMHC insurance allows you to make a down payment as low as 5% of the value of the home for homes less than $500,000, or 5% on the first $500,000 and 10% on the remainder for homes over $500,000 and less than $1 million. Since the mortgage is insured, mortgage lenders will often offer lower mortgage rates for insured mortgages.

You May Like: How To Invest In Mortgages

How Accelerated Mortgage Payments Work

Accelerated mortgage payments are the payment frequency options that will allow you to pay off your mortgage faster and save you potentially thousands in mortgage interest costs.

With accelerated bi-weekly payments, you’ll still make a payment every 14 days , which adds up to 26 bi-weekly payments in a year. The part that makes it accelerated is that instead of calculating how much an equivalent monthly mortgage payment would add up to in a year, and then simply dividing it by 26 bi-weekly payments, accelerated bi-weekly payments does the opposite.

To find your accelerated bi-weekly payment amount, you’ll divide the monthly mortgage payment by two. Note that there are 12 monthly payments in a year, but bi-weekly payments are equivalent to 13 monthly payments. By not adjusting for the extra monthly payment by taking the total annual amount of a monthly payment frequency, an accelerated bi-weekly frequency gives you an extra monthly payment every year. This pays off your mortgage faster, and shortens your amortization period.

The same calculation is used for accelerated weekly payments. To find your accelerated weekly payment amount, you’ll divide a monthly mortgage payment by four.

Canadian Mortgage Regulations Taxes And Fees

Canada-wide mortgage regulations are set by the Ministry of Finance to help protect home buyers and lenders alike. These regulations include guidelines on minimum down payments, maximum amortization periods, as well as mortgage default insurance.

Here are the key regulations you need to be aware of, and that are included in the Ontario mortgage calculator above:

- The minimum down payment in Canada is between 5% and 10%, depending on the purchase price of the home.

- The maximum amortization is 25 years for down payments under 20% and 35 years for higher down payments.

- Mortgage default insurance also called CMHC insurance must be purchased for down payments between 5% and 20%. Visit our CMHC insurance page to learn more.

Don’t Miss: What To Look For When Applying For A Mortgage

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

You May Like: How To Take A Mortgage Loan

Total Interest Paid On A $300000 Mortgage

Youll always pay more interest on longer-term loans. So, for example, a 30-year loan would cost more in the long haul than a 15-year one would .

With a 30-year, $300,000 loan at a 3% interest rate, youd pay $155,332.34 in total interest, and on a 15-year loan with the same rate, itd be $72,914.08 a whopping $82,418 less.

You can use Credibles mortgage calculator to see how much interest youll pay, as well as what your home will cost you every month.

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

Recommended Reading: When Do You Get Preapproved For A Mortgage

How Much Do You Need As A Down Payment For A $300000 House

The minimum down payment required depends on the value of the home youre looking to purchase. Houses under $500,000 require a down payment of at least 5%, while houses valued between $500,000 and $1,000,000 require 5% on the first $500,000 and 10% on the remainder.

To avoid paying mortgage default insurance, youll need to offer your lender a down payment of at least 20% .

Minimum Down Payment Amounts

Below, weve demonstrated how much youll need as a down payment based on varying house prices .

| $300,000 | |

| $70,000 | $75,000 |

What Deposit Do I Need For A 300k Mortgage

One of the most important factors when determining how much youre able to borrow and what your mortgage will end up costing is the size of your deposit.

The higher the deposit you have, the better your chances of getting a £300,000 mortgage and accessing the cheapest or most competitive mortgage rates available on the market.

That being said, the number of higher loan to value mortgages has increased considerably over the last few years with some lenders have started to provide mortgage products with 90% LTVs and a small number willing go up to 95% .

Read Also: What Does Rocket Mortgage Do

You May Like: What Would My Mortgage Payment Be On 150 000

How Much Is A 300k Mortgage

Veterans: You May Be Missing Out On $42K In Mortgage Benefits VA loan payments on a $250k mortgage average about $3,100 less than a conventional loan. Prequalification: Getting prequalified is the best way to start testing the home buying market. It costs.

Mortgage Calculator Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule of a mortgage with options for taxes, insurance, PMI, HOA, early payoff. Learn about mortgages, experiment with other real estate calculators, or explore many other calculators addressing math, fitness, health, and many more.

Viewers brand Channel 4s Ugly House to Lovely House unrelatable One wrote: Sometimes I think people just go on this programme to show how much wealth they have why pay 655k on a house that isnt suitable in the first place, then throw another 300k at it..

Making mortgage payments For example, on a 300k mortgage with an amortization of 25 years your. The interest on these accounts can be much higher than your mortgage, making it the obvious choice to payout first. Even those.

How Much House Can I Afford? | Home Affordability Calculator How Much House Can I Afford? Location. Annual Household Income. Additional options. monthly spending. loan type.. monthly Mortgage Payment. When calculating how much home you can afford, we estimate how much you will pay each month toward your mortgage. Your monthly mortgage payment will.

How The Repayment Type Affects Monthly Repayments

You can choose between repayment and interest only mortgages, which will affect how much you pay each month.

With repayment mortgages, you make one payment per month, part of which goes towards repaying the capital, and the rest covers the interest.

With interest only mortgages, youll only pay off the interest each month and repay the whole loan amount at the end of the term.

Your monthly payments will be higher in a repayment mortgage than in an interest-only mortgage.

Interest only mortgages are suitable if you want to keep monthly costs down.

However, the amount due at the end of the term can reach significant amounts, and lenders will need proof of a repayment strategy to pay off the capital in one lump sum.

Lenders will require you to put down more significant 25% to 30% deposits to qualify for an interest-only mortgage.

You May Like: How Much Would Mortgage Payment Be On 250 000

Should I Choose A Fixed Or Variable Rate

A variable rate lets you benefit from decreases in market interest rates, but it will cost you more if interest rates rise. Fixed rates are a better option if interest rates will rise in the future, but it can lock you in at a higher rate if rates fall in the future.

Of course, its not possible to exactly predict future interest rates, but a2001 studyfound that variable interest rates outperform fixed interest rates up to 90% of the time between 1950 and 2000. If youre comfortable with taking on risk, a variable mortgage rate can result in a lower lifetime mortgage cost.

Other Ontario Closing Costs

There are a number of other Ontario closing costs to consider when purchasing a home.

Legal fees: There are many legal aspects to consider when purchasing a home. With that in mind, its important to hire an experienced real estate lawyer to review all of your paperwork and help you finalize your transaction.

Home Inspections: Its wise to use an home inspector before purchasing a home, to make sure the home youre about to buy is in good condition.

Recommended Reading: How Much Interest Do I Pay On A Mortgage

You May Like: Can You Pay Back A Reverse Mortgage Early