Lenders Mortgage Insurance Explained

So what is LMI? Basically, it protects lenders in the event of borrowers defaulting on their loans. Think of a $400,000 house. If a bank lends you $360,000, and you repay $40,000 but then fall prey to financial woes and cant make your repayments, the bank is then $320,000 out of pocket. Worst case scenario, a bank may need to seize your house but they may only be able to sell it for $310,000. Theyd still be ten grand out of pocket. And, thats not even accounting for the interest they would have expected on such a loan.

Hence, . You can pay it upfront or include it as part of the loan. So, borrowing $367,000 instead of $360,000 . At this point, its important to remember that borrowing a higher amount not only means repaying that higher amount but also repaying a higher amount of interest. For example, paying interest on $367,000 at 5%, is obviously more than paying interest on $360,000 at 5%.

Now, it is possible to sidestep purchasing mortgage insurance by having someone act as a guarantor for the loan. This is basically where another person puts their property up as additional security for a loan. The most common example of this is a parent putting their property up as security for their son or daughters loan.

How To Deduct Mortgage Interest On State Tax Returns

If your state charges income tax, you may be able to deduct your mortgage interest on your state tax returns. However, how much you can deduct and any other limits depends on your specific state’s rules.

If you want to deduct the interest, you can use the figures from the 1098 form sent by your mortgage company. If you don’t receive a 1098 form, that may mean that you paid less than $600 in interest. However, you should still be able to deduct the mortgage interest. You will just have to manually calculate the amount of interest paid in total.

Some states may have a limit on how many properties you can deduct the mortgage interest for, while others states will let you deduct the interest on all your homes.

Nothing Affects Your Interest Rate Like A Bad Credit Score

The FICO credit score basically measures how well you pay back debt. Wrongly or rightly, it affects many aspects of your daily living. Naturally, its checked when you apply for a loan because the lender wants to confirm your credit worthiness. The higher your score the lower interest rate you are offered. But its also checked when you rent an apartment and sometimes even when an employer considers you for a job opening.

If your credit score is low, its time to ask the question if its really wise to take on more debt. A better option may be to concentrate on making on-time payments and eliminating some of your existing debt. This will help to raise your score. Equifax, TransUnion, and Experian are the three credit reporting agencies. You can check what the credit agencies are reporting about you by visiting annualcreditreport.com and printing out the reports.

You May Like: What Documents Are Needed For Mortgage Pre Approval

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Whats The Impact Of A Base Rate Change On My Mortgage

When the base rate changes, the impact youll see depends on what type of mortgage you have. Tracker rate mortgages are usually linked to the Bank of England base rate – so your mortgage payments will drop in line with the base rate if it reduces. If the base rate rises, youll see a corresponding increase in your mortgage repayments. If you choose this type of mortgage, you should be sure that you have the flexibility in your monthly income to account for fluctuations in your mortgage repayments.

If youre on a discount or standard variable rate mortgage, its likely that when the base rate rises, youll see an increase in your mortgage payments too, but the specific amount is determined by your lender. The same applies if base rate decreases. Our interest only mortgage repayment calculator can give you a good idea of how much additional interest you might have to pay, but you should speak to your lender to confirm this.

For those on fixed rate mortgages, youre only likely to see a change in your payments once you reach the end of your current deal. If rates have gone up whilst youre tied into a mortgage deal, you may find that its more expensive to remortgage to a new rate.

Also Check: What Are Basis Points In Mortgage

What Is A Mortgage Point

Some lenders may use the word points to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Read Also: What Is Federal Interest Rate

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

Also Check: Can You Cosign On A Mortgage Loan

When Should I Lock My Mortgage Rate

Its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

How A 1% Difference In Your Mortgage Rate Affects How Much You Pay

In this example, lets say youre looking to take out a home loan for $200,000. If you get a 30-year mortgage and you make a 20% down payment of $40,000, youll have a $160,000 mortgage.

If you only put down 10%, youll have a $180,000 mortgage. The following table shows you how much youll pay both per month and over the life of the loan in each scenario.

| Mortgage rate | |

|---|---|

| $1,258* | $273,670 |

*Payment amounts shown do not include private mortgage insurance , which may be required on loans with down payments of less than 20%. The actual monthly payment may be higher.

This calculation also does not include property taxes, which could raise the cost substantially if you live in a high-tax area.

In this example, a 1% mortgage rate difference results in a monthly payment thats close to $100 higher. But the real difference is how much more youll pay in interest over 30 yearsmore than $33,000! And just think, if you lived in the 1980s when the highest mortgage rate was 18%, youd be paying thousands a month just in interest!

You can calculate your own mortgage rate using our simple mortgage rate calculator.

Read more:Mortgage Rates Briefly Explained

Recommended Reading: How To Market Yourself As A Mortgage Loan Officer

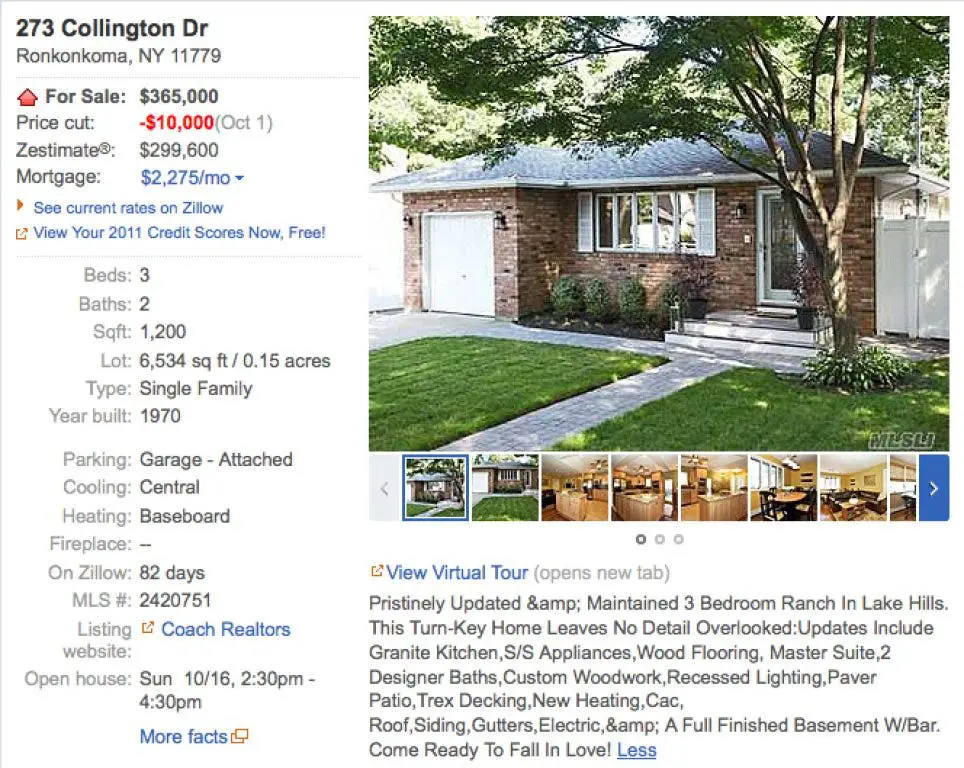

House Prices Vs Interest Rates

Which should drive your decision to buy a new home? There are so many elements that can determine what you will end up paying for your home in the end. When house prices are low, interest rates tend to be higher and vice versa. In either landscape, there are different aspects to consider before you buy a mortgage.

How To Use This Mortgage Payment Calculator

Our mortgage payment calculator computes payments based on your home value, equity, mortgage term and amortization.

To calculate your mortgage payment:

- Select your mortgage type: purchase, refinance or renewal

- Input the province, home value, down payment / mortgage amount and amortization period

- Choose your desired mortgage term and rate type

The calculator will update the calculations each time you change a number.

Tip: If youre renewing or refinancing your mortgage, select the Renewal/Refinance tab to estimate your potential mortgage payments without having to input a down payment.

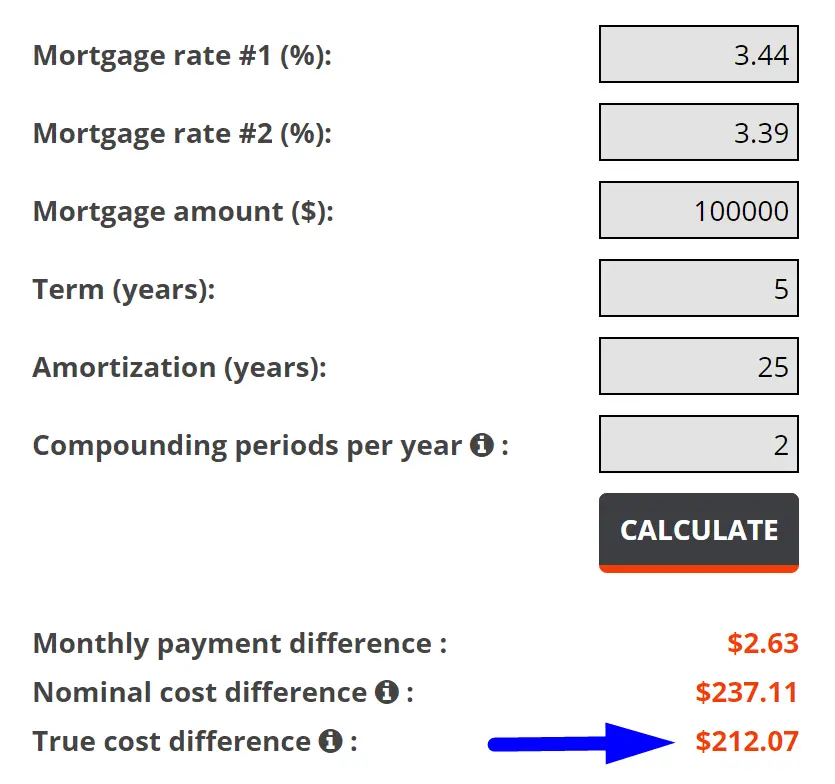

You can even compare two rates side by side to see which saves you more.

You May Like: Which Credit Score Do Banks Use For Mortgages

Meet The Mortgage Payment Calculator

This mortgage payment calculator will estimate exactly that. You can set everything from your amortization and payment frequency to extra payments. The calculator then determines your monthly mortgage payment and provides an amortization schedule showing how fast it will take to whittle down your principal.

How Our Mortgage Rates Are Calculated

To see where mortgage rates are headed, we rely on information collected by Bankrate, which is owned by the same parent company as NextAdvisor. The daily rates survey focuses on mortgages where the borrower has a FICO score of 740 or more, 20% equity or more, and the home is a primary residence.

This table has current average rates based on information provided to Bankrate by lenders from across the nation:

Todays mortgage interest ratesDont Miss:

Read Also: How Much Down Payment For A Mortgage

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short-circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Whats The Fastest Way To Pay Off My Mortgage

The fastest way to hammer down your loan principal is with big lump-sum prepayments.

Barring that, opting for accelerated mortgage payments is the next best thing.

How do lump-sum payments affect my mortgage?

About 900,000 borrowers made a total of $23 billion in lump-sum mortgage prepayments in 2019, according to MPC.

A lump-sum mortgage payment is a one thats applied directly towards your mortgage principal. Depending on your lender, you may be allowed to prepay up to 5%, 10%, 15%, 20%, 25% or 30% of the original principal amount of your mortgage each year.

Even if you pay small amounts, the effect is magnified over time, reducing your interest expense every month until the mortgage is paid off.

Lump-sum prepayments also help increase your home equity faster. If necessary, that allows you to use your equity for further borrowing someday, such as adding a HELOC.

The average lump-sum prepayment in 2019 was $19,100, reports MPC.

You May Like: What Are Current Residential Mortgage Rates

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

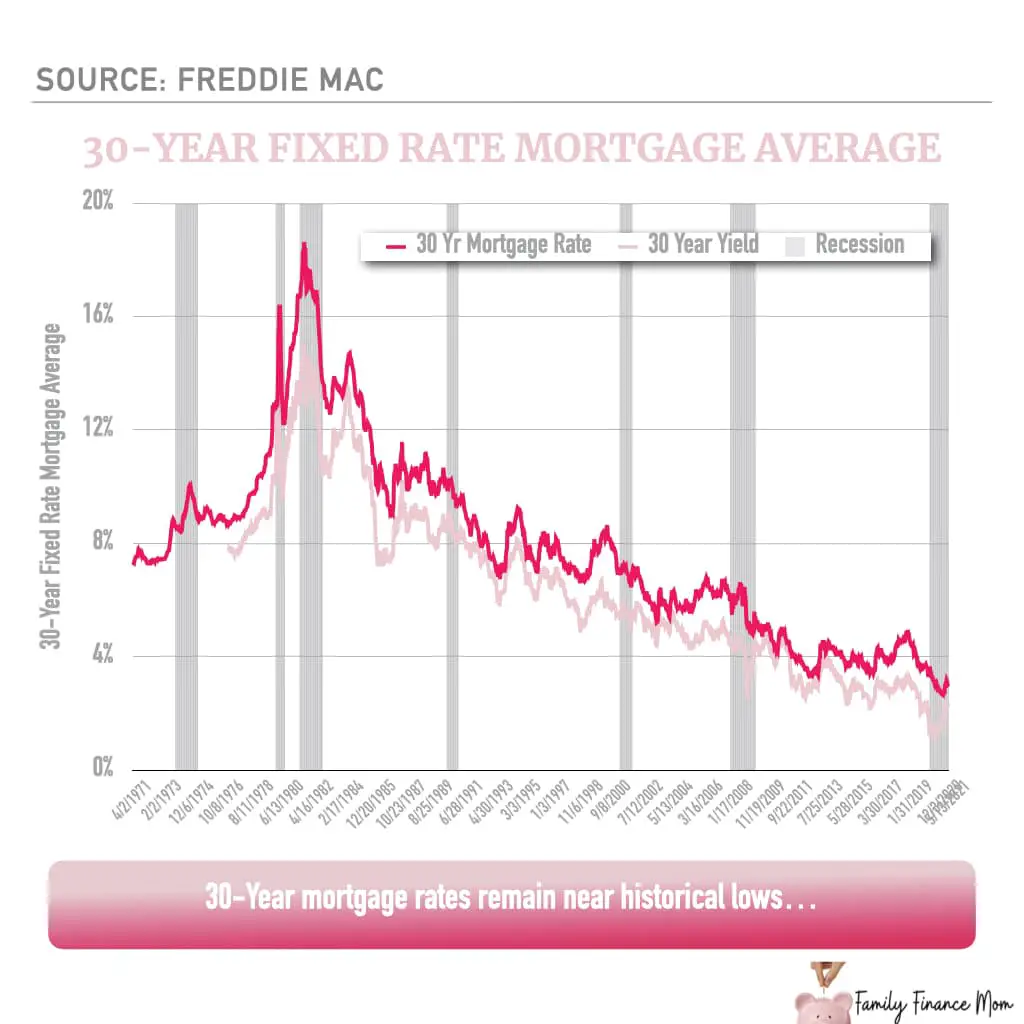

Some Interesting Takeaways From The Mortgage Rate Charts

- Monthly payment differences grow larger when interest rates are higher

- Higher mortgage rates may be worse than larger loan amounts in some cases

- Small loan amounts are less affected by interest rate movement

- Those with smaller loan amounts have a higher likelihood of affording 15-year payments

The lower the interest rate, the smaller the difference in monthly payment. As rates move higher, the difference in payment becomes more substantial.

Something to consider if youre looking to pay mortgage discount points to determine if its actually worth the cost.

If you look at the 30-year mortgage rate chart, the monthly payment difference on a $500,000 loan amount between a rate of 3.5% and 3.75% is $70.36, compared to a difference of $77.93 for a rate of 5.25% vs. 5.5%.

Additionally, higher mortgage rates can be more damaging than larger loan amounts.

Again, using the 30-year mortgage rates chart, the payment on a $400,000 loan amount at 3.50% is actually cheaper than the payment on a $300,000 loan at 6%.

So you can see where an individual who purchases a home while mortgage rates are super low can actually enjoy a lower mortgage payment than someone who buys when home prices are lower.

However, for someone purchasing a really expensive home, upward interest rate movement will hurt them more than someone purchasing a cheaper home.

Sure, its somewhat relative, but it can be a one-two punch for the individual already stretched buying the luxury home.

Don’t Miss: What Is The Best Refinance Mortgage Company

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Dont Miss: Does Rocket Mortgage Sell Their Loans

How Much Difference Does 1% Make On A Mortgage Rate

The short answer: It can produce thousands or even potentially tens of thousands in savings in any given year, depending on the purchase price of your property, your overall mortgage rate, and the total amount of the mortgage being financed.

By way of example, say that Taylor, a 30-year-old who is a first-time home buyer, wishes to obtain a 30-year fixed FHA loan on a new home with a 20% down payment. Below, you can get a sense of just how much that they stand to save given a 1% difference in interest savings on their 30-year mortgage.

Also Check: What Income Is Needed For A 300k Mortgage

Special Considerations For Interest

Some interest-only mortgages may include special provisions that allow for just paying interest under certain circumstances. For example, a borrower may be able to pay only the interest portion on their loan if damage occurs to the home, and they are required to make a high maintenance payment. In some cases, the borrower may have to pay only interest for the entire term of the loan, which requires them to manage accordingly for a one-time lump sum payment.

If I Can Afford My Payment Can I Get A Mortgage

It depends. If you use an actual rate to calculate your payments, that payment may be lower than the theoretical payment a lender requires you to afford. Were referring here to the mortgage stress test. The governments stress test requires that you prove you can afford a payment based on a rate that is typically 2+ percentage points higher than actual rates.

Don’t Miss: How Much Can You Get A Mortgage Loan For

Some Factors Are Part Of The Cost Of All Mortgages

Think of a mortgage as a product you buy. Any business that sells you something tries to make a profit. To do that, the price they charge for the product has to be higher than the cost to make it. A lender profits on your mortgage because you pay more in interest than what they paid to borrow the money themselves .

This funding cost makes up most of the interest rate on your mortgage. Other factors include your lenders operating costs and how much the lender needs to cover the risk that you wont repay the loan. But funding cost is the most important factor.

So, what determines funding cost?

Pay Attention To The Fine Print

If you are considering a consumer loan, first ask yourself if its something you really need now, or can you wait and save for it? Make sure a consumer loan is paid off before the product loses its usefulness. Furniture loans fall into this category. Over the years, furniture companies have extended the loan payments for up to five years. No one can deny the pleasure of new furniture, but do you really want to continue making payments five years later on furniture that is old and worn? Many of these loans are advertised as interest free if paid off by a stated amount of time. But read the fine print carefully. If you dont follow their requirements exactly, they can charge interest from the beginning of the loan some up to 29.9%

Also Check: How Do You Shop Around For The Best Mortgage