Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

What’s The Difference Between A Mortgage Interest Rate And Apr

When searching for rates, you’ll probably see two percentages pop up: interest rate percentage and annual percentage rate .

The interest rate is the rate the lender charges you for taking out a mortgage.

The APR shows you the full cost of borrowing, not just the interest rate. A mortgage’s APR takes into account things like points and fees paid to the lender in addition to your interest rate.

The APR gives you a better idea of how much you’ll actually pay to get a mortgage.

Benefits Of Paying Your Mortgage More Often

If you can get this system to work for you, not only can you save on interest, but you might also see a bit of a tax break if you claim mortgage interest as a deduction. You should talk to a licensed accountant to see what impact more frequent mortgage payments can have on your tax situation.

And, of course, if you choose to pay every two weeks, you can pay your mortgage off earlier by making an extra full payment per year. Over a 30-year mortgage, thats 30 extra payments, totaling 2.5 years off the end of your loan.

Don’t Miss: How Much Faster Can I Pay Off My Mortgage Calculator

What’s The Difference Between Being Prequalified And Preapproved

A quick conversation with your lender about your income, assets and down payment is all it takes to get prequalified. But if you want to get preapproved, your lender will need to verify your financial information and submit your loan for preliminary underwriting. A preapproval takes a little more time and documentation, but it also carries a lot more weight when youre ready to make an offer on a home.

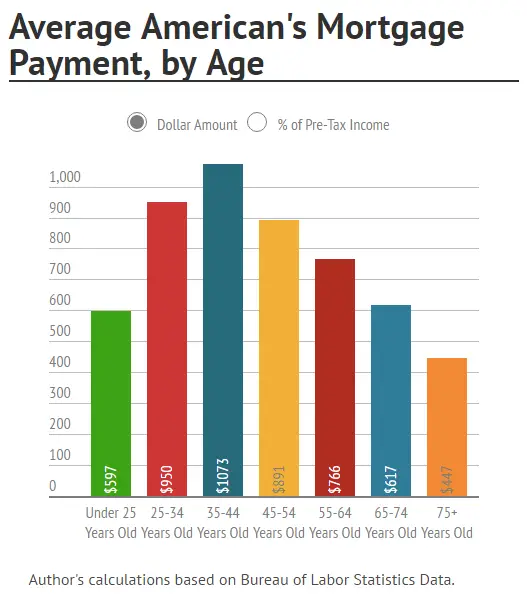

How Much House Can I Afford

Written by David McMillin | Edited by Michele Petry

A house is one of the biggest purchases you can make, so figuring out how much you can afford is a key step in the home-buying process. Youll need to start by weighing how much money you have coming in your monthly earnings from your job, investments and any other streams of income versus how much you have going out to cover costs like student loans, credit card balances and car payments.

Don’t Miss: Is Biweekly Mortgage Payments A Good Idea

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Happens After You Get Preapproved For A Home Mortgage Loan

Getting preapproved for a mortgage is just the beginning. Once the financial pieces are in place, its time to find your perfect home! While its one of the most exciting stages of the process, it can also be the most stressful. Thats why its important to partner with a buyers agent.

A buyers agent can guide you through the process of finding a home, negotiating the contract, and closing on your new place. The best part? Working with a buyers agent doesnt cost you a thing! Thats because, in most cases, the seller pays the agents commission. Through our Endorsed Local Providers program, our team can match you with the top real estate agents we recommend in your area.

Also Check: What Is A Jumbo Mortgage In Florida

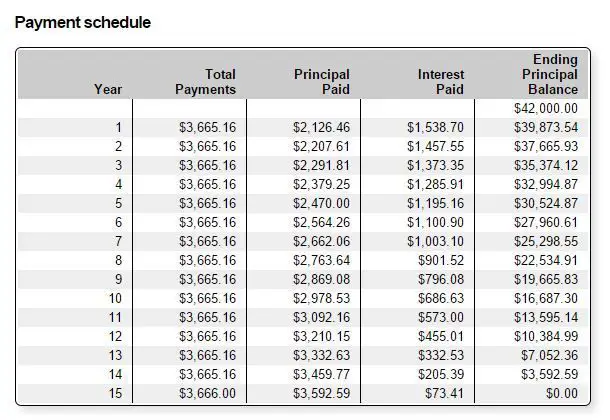

Adding Extra Each Month

Simply paying a little more towards the principal each month will allow the borrower to pay off the mortgage early. Just paying an additional $100 per month towards the principal of the mortgage reduces the number of months of the payments. A 30 year mortgage can be reduced to about 24 years this represents a savings of 6 years! There are several ways to find that extra $100 per month taking on a part time job, cutting back on eating out, giving up that extra cup of coffee each day, or perhaps some other unique plan. Consider the possibilities it may be surprising how easily this can be accomplished.

Paying Off A Mortgage Quicker Without Refinancing

Seeing the outstanding principal balance on a monthly mortgage bill can be defeating. If youre just into a 30-year mortgage or have had one for years, that grand total of principal owed can look like a dim light at the end of a tunnel youll never reach.

Getting rid of that monthly payment can free your money for other things such as investments and can be an emotional lift. For couples nearing retirement, paying off a mortgage early allows them to have fewer bills in retirement. Paying down a mortgage is the best way to build equity in a home.

Don’t Miss: How Do You Apply For A Mortgage

More Mortgage Tools And Resources

You can use CNET’s mortgage calculator to help determine how much you can afford for a house and work out how to manage financially. The tool takes into account your monthly income, expenses and debt payments. In addition to those factors, your mortgage rate will depend on your credit score and the zip code where you are looking to buy a house.

You Might Not Want To Pay Off Your Mortgage Early If

- You need to catch up on retirement savings: If you completed a retirement plan and find you arent contributing enough to your 401, IRA, or other retirement accounts, increasing those contributions should probably be your top priority. Savings in these accounts grow tax-deferred until you withdraw them.

- Your cash reserves are low: You dont want to end up house rich and cash poor by paying off your home loan at the expense of your reserves, says Rob Williams, managing director of financial planning at the Schwab Center for Financial Research. He recommends keeping a cash reserve of three to six months worth of living expenses in case of emergency.

- You carry higher-interest debt: Before you pay off your mortgage, first close out any higher-interest loansespecially nondeductible debt like that from credit cards. Create a habit of paying off credit card debt monthly rather than allowing the balance to build so that youll have fewer expenses when you retire.

- You might miss out on investment returns: If your mortgage rate is lower than what youd earn on a low-risk investment with a similar term, you might consider keeping the mortgage and investing what extra you can.

- You need to diversify: Your house is just as much of an investment as whats in your portfolio. And overconcentration carries its own riskseven when its in something as historically stable as a home. Maintaining your mortgage allows you to fund other asset classes with possibly more growth potential.

Don’t Miss: How To Calculate Principal And Interest For Mortgage

Is It Harder To Qualify For A 15

On paper, its no harder to qualify for a 15-year mortgage loan than a 30-year one. Guidelines vary by loan type , but within each program, requirements for a 15- and 30-year loan are generally the same.

For instance, a 15-year FHA loan will likely require a credit score of at least 580, down payment of 3.5%, and debt-to-income ratio below 50%, just like a 30-year FHA mortgage.

But in reality, its much harder to qualify for a 15-year loan because of the higher monthly payments.

A bigger mortgage payment means your home loan will eat up more of your monthly income. This will have an impact on your debt-to-income ratio.

For most home buyers, a 15-year mortgage payment plus existing debts will take up more than 43% to 50% of their monthly income, which is the maximum DTI range most lenders allow.

If youre set on a 15-year mortgage but have a tighter monthly budget, paying down existing debts before you apply for the home loan could help you qualify.

Earning An Extra $100 A Month:

Okay so everyone wants to pay at least an extra $100 a month of their mortgage, but how do we come up with that extra hundred bucks? From an income perspective heres what I think most people can do, remember $100 a month is about $3.30 a day.

If I didnt have the discipline to actually pay $100 extra on my mortgage every month I would refinance my loan to a shorter term with LendingTree.com. The ability to make a change once and not have to worry about it again is very appealing, and you may be surprised at how low closing costs on a refinance can be. When I refinanced my rental house between the interest saved and the lower monthly payment the refinance paid for itself in under a year. So far I havent had any issues with skipping payments for convenience or cash flow issues. I set up my bank to automatically transfer the money to my loan so I dont have to think about it.

Do you pay any extra on your mortgage each month? If so how do you track how it changes your payoff date and interest saved?

You May Like: What Is Usda Mortgage Insurance

How Much Home Can You Afford

Buying too much house can quickly turn your home into a liability instead of an asset. Thats why its important to know what you can afford before you ever start looking at homes with your real estate agent.

We recommend keeping your mortgage payment to 25% or less of your monthly take-home pay. For example, if you bring home $5,000 a month, your monthly mortgage payment should be no more than $1,250. Using our easy mortgage calculator, youll find that means you can afford a $211,000 home on a 15-year fixed-rate loan at a 4% interest rate with a 20% down payment.

Calculate Your Down Payment

Considering what to offer on a home? Change the home price in the loan calculator to see if going under or above the asking price still fits within your budget.

You can also use our mortgage payment calculator to see the impact of making a higher down payment. A higher down payment will lower your monthly payments not only because it reduces the amount of money you borrow, but also because it can help you qualify for a lower interest rate. In some cases, a down payment of at least 20% of the homes purchase price can help you avoid paying private mortgage insurance .

Ready to take the next step?

Shopping for a house is easier with a vetted professional on your side. Our Endorsed Local Providers are ready to help.

You May Like: Is It Better To Buy Points On Mortgage

Dont Forget About Retirement

Hows your retirement fund? Check on this and see if youre currently contributing enough. Instead of refinancing to a 15-year mortgage, you may be better off putting more money toward a 401 plan or an IRA account.

You also want to make sure youre maximizing your tax benefits in these and other types of programs, like health savings accounts and 529 college savings accounts. Compared to these plans, paying down a low-rate, potentially tax-deductible debt like a mortgage is a low financial priority.

Considerations For Extra Payments

Pay Off Higher Interest Debts First

Paying off your mortgage early isn’t always a no-brainer. Though it can help many people save thousands of dollars, it’s not always the best way for most people to improve their finances.

Compare your potential savings to your other debts. For example, if you have , it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate.

Further, unlike many other debts, mortgage debt can be deducted from income taxes for those who itemize their taxes.

Also consider what other investments you can make with the money that might give you a higher return. If you can make significantly more with an investment and have an emergency savings fund set aside, you can make a bigger financial impact investing than paying off your mortgage. It is worth noting volatilility is the price of admission for higher earning asset classes like equities & profits on equites can be taxed with either short-term or long-term capital gains taxes, so the hurdle rate for investments would be the interest rate on your mortgage plus the rate the investments are taxed at.

You May Like: How Difficult Is It To Get A Mortgage

How Will A Refinance To A 15

The best way to figure out whether a 15-year mortgage refinance is right for you is to run the numbers with our refinance calculator. Compare your current mortgage payment to the calculator results to see if a refinance makes sense and whether you can afford the larger monthly payment.

In the end, the decision comes down to what the monthly mortgage payment is and whether you can comfortably afford it.

When To Consider A 15

The main draws of 15-year fixed-rate loans are their lower interest rates and the fact that they’ll be paid off more quickly. Like any fixed-rate loan, they also offer stability the monthly payment wont change no matter what happens to inflation or market interest rates.

But the monthly payment will be much higher than that of a 30-year loan for the same property due to the shorter term, and that will make it harder to qualify for the loan.

» MORE:Pros and cons of 15-year mortgages

Recommended Reading: What Is The Difference Between Hazard Insurance And Mortgage Insurance

Why Should I Get A 15

If you can afford the larger monthly payment that comes with a 15-year fixed mortgage, it can help you pay off your home, freeing up funds for retirement. You will spend less in interest over the life of the loan compared to a 30-year mortgage, and usually, a 15-year fixed mortgage means a better interest rate.

How Is A 15

There are just four required steps to calculate your 15-year mortgage payment, but the more information you provide, the more accurate the result. Here are the steps to take with the NerdWallet 15-year mortgage calculator:

Provide the home’s purchase price.

Enter your expected down payment.

Since you’re considering a 15-year loan, put “15” as the loan term. You can play around with any number of loan terms to get an idea of how each would affect your monthly payment.

Enter your estimated interest rate.

The results will instantly appear below the calculator inputs, in the “summary results,” showing a monthly payment breakdown as well as even more payment and interest details.

One important note: If you are making a down payment of less than 20%, it’s likely you’ll be paying mortgage insurance. That’s one variable that the 15-year calculator doesn’t account for. Check out our mortgage calculator with PMI to see how private mortgage insurance might affect your payment.

To get an even better view of what mortgage interest rate you’ll qualify for, click on the “Get personalized mortgage rates” green box just above the summary results. Once you nail down a custom rate, you can use it to refine the interest rate used to determine your monthly payment in the 15-year mortgage calculator.

Don’t Miss: How To Determine My Mortgage Payment

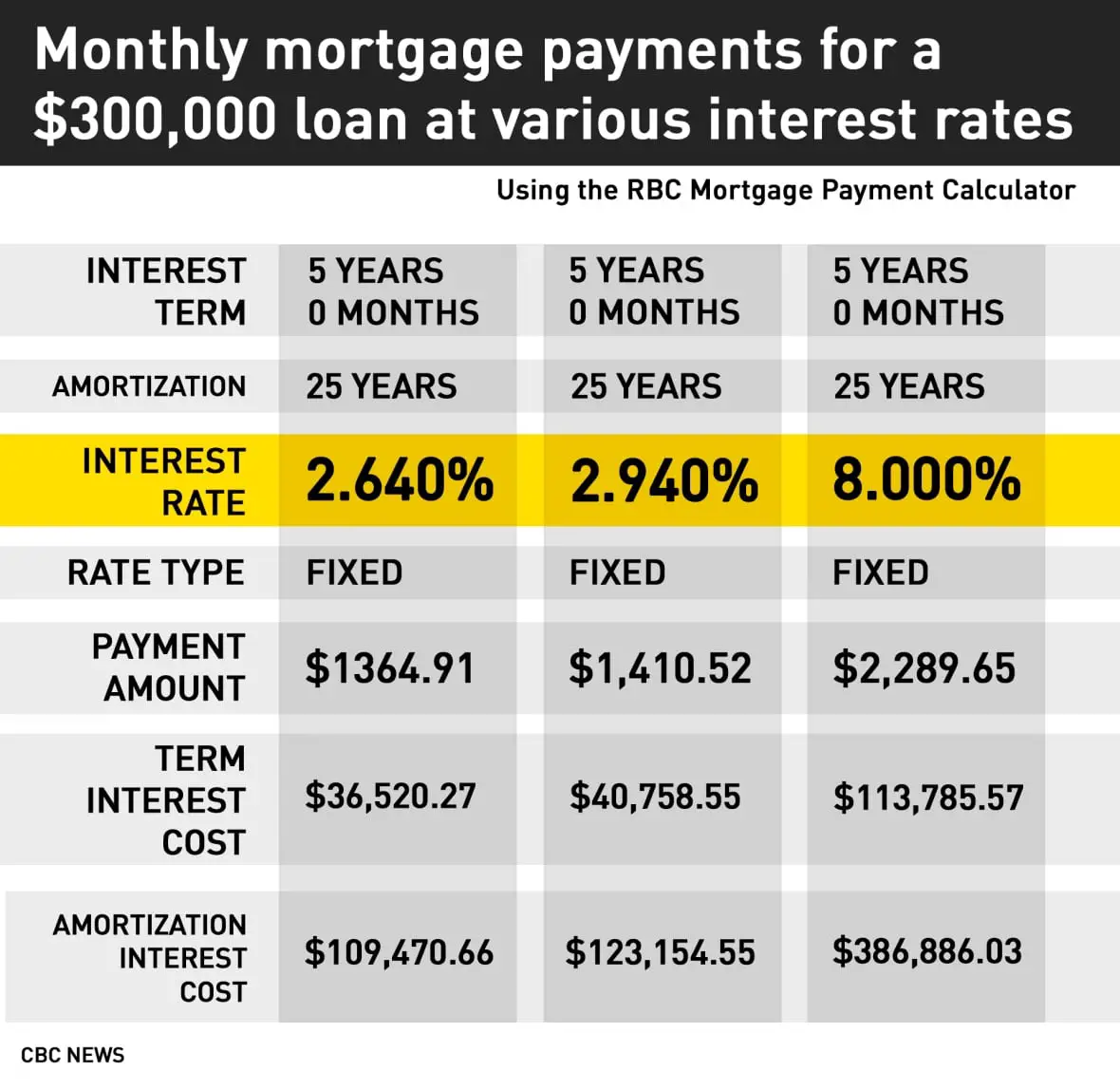

Pro: Youll Save Thousands Of Dollars

One advantage of a 15-year mortgage is all the money youll save on interest. Lenders charge a lower interest rate for 15-year loans because its easier to make predictions about repayment over a 15-year horizon than it is over a 30-year horizon.

Another reason for the savings? Home buyers are borrowing the money for half the time, which dramatically reduces the cost of borrowing.

Calculate What Will Happen If I Pay $100 Extra On My Mortgage:

I started paying $100 extra on my mortgage about 3 years into my mortgage, which causes the numbers to be different from starting right at the beginning. After a few months I increased it from $100 a month to $200 per month and now I currently pay $300 per month extra on my mortgage plus a large payment at the end of each year. To calculate changes like these you need to use my mortgage planning spreadsheet to find out exactly what paying $100 extra on your mortgage will do to shorten your term and save you on interest expense. I track mine every month and I am able to see in real time how many months I have taken off of my mortgage and how much interest I have saved. My mortgage planning spreadsheet is available for download by clicking this button.

You May Like: How To Get Out Of Mortgage Without Ruining Credit

How To Get A Low 15

If you want to lower the cost of homeownership, you can start by finding a way to lower your mortgage rate. The higher your mortgage rate, the more interest youll pay over the life of your home loan. Thats why its important to compare mortgage rates before committing to working with a specific lender.

The homebuyers who qualify for the lowest mortgage rates tend to have good credit scores. According to the FICO scoring model, youll likely need to have a credit score of at least 740 if you want access to the best rates. Of course, the exact credit score youll need to qualify for a 15-year fixed-rate mortgage will depend on the mortgage lender you choose to work with.

If your credit score isnt as high as it could be, it might be a good idea to work on improving your credit before you apply for a mortgage. Eliminating debt, paying bills every month on time and in full and keeping your below 30% are all things you can do to boost your credit score and put you in the best position to get a favorable mortgage rate.

While its possible to qualify for a mortgage with a low credit score , itll be more challenging and could result in a high interest rate. If this is your situation, your best bet might be to go for an FHA loan or a USDA loan. The former is designed for first-time homebuyers, while the latter is built for those buying a home in a rural area.