Calculating Your Mortgage Overpayment Savings

Start Paying More Early & Save Big

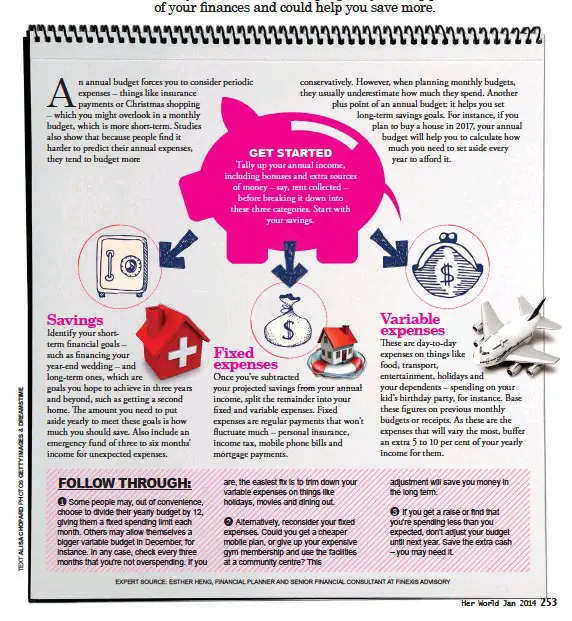

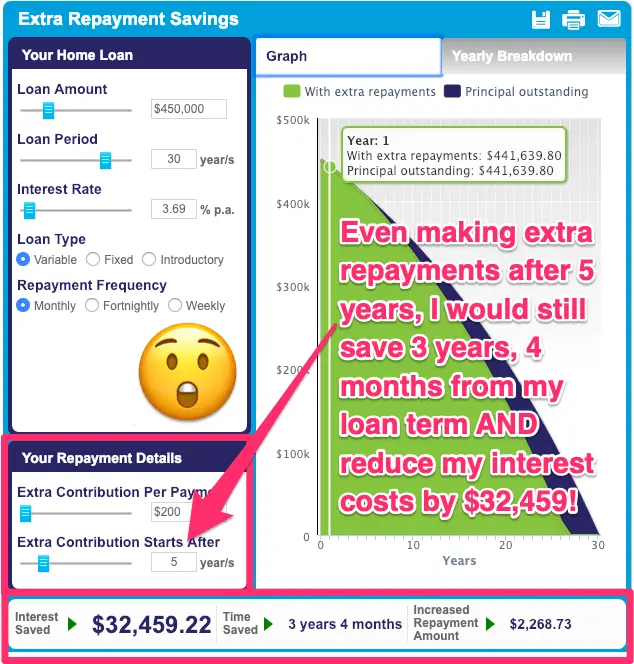

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you’ll save.

Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

How Can I Pay Off My 30 Year Mortgage In 10 Years

How to Pay Your 30-Year Mortgage in 10 Years

Benefits Of Paying Mortgage Off Early

Many people struggle when deciding whether to pay off their mortgage or build up savings, but in the long run, the benefits of getting free from that mortgage really shine through. For one, having one debt paid off means being able to handle any short-term debts such as credit cards. You also end up saving money if you pay off your mortgage earlier, avoiding additional interest that would have otherwise accrued. Your financial stability is bolstered by cutting out these future payments and also by your ability to better endure turbulent housing market conditions.1

Also Check: Can You Get A Mortgage On A Foreclosed Property

How Much Could You Save By Making Extra Payments

Prepaying is not to be confused with making a mortgage payment early simply because youre going to be out of town or indisposed next month, says mortgage banker Todd Huettner, president of Huettner Capital in Denver.

When you prepay, you send your lender additional money and they apply it to your loan balance. This can save a ton of money, especially on a 30-year loan where most of your regular monthly payments go toward paying down your interest during the first several years, Huettner says.

The savings could be huge.

A 30-year fixed-rate mortgage at 4% and $200,000 borrowed would require about $140,000 in interest over the life of the loan.

But if you were to prepay just an additional $100 a month toward principal, you would save about $30,000 in interest, and pay off that loan five years quicker.

Heres another prepayment perk: unlike the capital gains and dividends earned on other types of investments like stocks and bonds, the savings earned from prepayments are not taxable.

The prepayment process is relatively simple. Take the time to write a separate check or send a separate electronic payment to your lender and explicitly state in the memo or on a separate note that this extra payment is to be applied toward the principal on your loan. Otherwise, the bank could possibly apply your extra payment to the next months interest, says Jason van den Brand, CEO of San Francisco-based Lenda.

Pay Off Credit Card Debt

If youre having a hard time with like many Americans, its more than likely you dont have enough available cash to commit to paying extra on your mortgage. Your credit card rates are going to be significantly higher than your home loan interest rate so it makes sense to tackle credit card debt first. Credit cards typically carry the highest cost to borrow with an average variable interest rate of about 16%.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

You May Like: Does Spouse Have To Be On Mortgage

How Fast Can I Pay Off My Mortgage With One Extra Payment A Year

Making an extra mortgage payment each year could reduce the term of your loan significantly. The most budget-friendly way to do this is to pay 1/12 extra each month. For example, by paying $975 each month on a $900 mortgage payment, you’ll have paid the equivalent of an extra payment by the end of the year.

Today’s Best Mortgage Rates

Our rate table lists the best current local mortgage rates available from our lender network. Set your search criteria by entering your loan data and selecting the relevant products from the dropdown, click search and we’ll help you compare the market by showing you the most relevant offers for homeowners.

Also Check: When You Refinance Your Mortgage And Take Cash Out You

Bonus Option: An Open Mortgage

Unlike closed mortgages, open mortgages allow you to repay your mortgage in full or in part at any time without paying a penalty. The downside is that open mortgages usually have higher interest rates. So you need to be sure that the higher rate is worth it.

Pro tipThis type of loan can be a good option if you know from the outset that youll be selling your home before the end of the term or that youll be able to make one or more big lump-sum payments.

Related Topics & Resources

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©. Nationwide Mutual Insurance Company.

Also Check: How Much Is A 600000 Mortgage

Mistake #: Not Considering All Of Your Options

It can be very tempting if you come into some extra money to put that toward paying your mortgage off ahead of time. However, getting out of debt a little bit earlier may not be the most remunerative choice to make. To illustrate this, lets look at an example.

Lets say youre considering making a one-time payment of $20,000 toward your mortgage principal. Your original loan amount was $200,000, youre 20 years into a 30-year term, and your interest rate is 4%. Paying down $20,000 of the principal in one go could save you roughly $8,300 in interest and allow you to pay it off completely 2.5 years sooner.

That sounds great, but consider an alternative. If you invested that money in an index fund that represents the S& P 500, which averages a rate of return on 9.8%, you could earn $30,900 in interest over those same 10 years. Even a more conservative projection of your rate of return, say 4%, would net you $12,500 in interest.

Everyones financial situation is unique, and its very possible that the notion of being out of debt is so important to you that its worth a less than optimal use of your money. The important thing is to consider all of your options before concluding that paying off your mortgage earlier is the best path for you.

Losing The Benefits Of Interest Deductions

Before deciding to pay off a mortgage early, it would be a good idea to weigh the pros and cons. The interest charged on up to $750,000 of mortgage debt used to purchase a principal residence can be used as a deduction on taxes in the year that it is paid. Because most of the monthly payments in the early years of a loan are interest, this can really add up. The mortgage interest deduction to homeowners is a very popular subsidy. However, the benefit would be lost if the mortgage is paid off early. In years gone by interest paid on home equity loans or HELOCs was tax deductible, but that is no longer the case in 2018, as equity debt is no longer treated like mortgage debt unless it is obtained to build or substantially improve the homeowner’s dwelling.

Don’t Miss: What Is A Reverse Mortgage For Dummies

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Retiring A Mortgage With Extra Payments

Many homeowners invest in home security systems to protect their property and personal assets. However, a security system will not protect the homeowner against financial disaster or bankruptcy. Making additional mortgage payments will shrink the total amount of interest paid over the life of the loan, and the borrower will pay off the debt more quickly. In addition, the home equity will grow at a faster pace when extra payments are applied to the loan. This provides for a margin of protection by lowering the interest costs. This method gives the property owner a home free and clear of debt. More payments on the principal of the loan equate to assets earning interest at the same rate as the interest rate on the loan.

Also Check: What Is The Lowest Mortgage Amount You Can Borrow

Is Prepaying My Mortgage Right For Me

Prepaying your mortgage can be a good idea in many situations. It can be a big step toward becoming debt-free and greatly reduce your monthly expenses. However, its also important to think about the drawbacks.

For starters, tying up your cash in your home means you have less liquidity and wiggle room in your budget. In other words, youll have less readily available cash to put toward things like increasing your 401 contributions or paying down high-interest debt, for example. These financial goals could offer a higher return on your investment.

Another consideration is the opportunity cost of not having that extra money invested elsewhere. Over the past four decades, the stock market has returned an average of 13 percent a year.

When deciding whether to pay off your mortgage, look at your entire financial picture. Here are some important questions to consider:

- Is your monthly budget tight after meeting necessary expenses?

- Is your income variable or unpredictable?

- How long do you plan to stay in your home?

- Do you have an adequate emergency savings fund of three to six months of household living expenses?

- Do you have a lot of high-interest credit cards or loans?

Assessing your financial goals, income and budget can help you decide whether it makes more sense to address other pressing financial concerns before paying ahead on your mortgage.

Overview: Paying Off Your Mortgage Early

Every time you make a mortgage payment, its split between your principal and your interest. Most of your payment goes toward interest during the first few years of your loan. You owe less in interest as you pay down your principal, which is the amount of money you originally borrowed. At the end of your loan, a much larger percentage of your payment goes toward principal.

You can apply extra payments directly to the principal balance of your mortgage. Making additional principal payments reduces the amount of money youll pay interest on before it can accrue. This can knock years off your mortgage term and save you thousands of dollars.

Lets say you borrow $150,000 to buy a home at 4% interest with a 30-year term. By the time you pay off your loan, youll have paid a whopping $107,804.26 in interest. This is in addition to the $150,000 you initially borrowed.

Now, lets say that you pay an extra $100 every month toward a loan with the exact same term, principal and interest rate. At the end of the term, youll have paid $82,598.49 total in interest. Thats $25,205.77 less than you would have paid if you didnt make any extra payments. Youll also pay your loan off 74 months earlier than you would if you only paid your premium each month.

The decision to pay off your mortgage early is a personal one that depends heavily upon your individual circumstances.

Read Also: How Much Are Mortgage Interest Rates Now

Two Benefits Of Making Extra Mortgage Payments

As you may know, making extra payments on your mortgage does NOT lower your monthly payment. Additional payments to the principal just help to shorten the length of the loan . Of course, paying additional principal does, in fact, save money since youd effectively shorten the loan term and stop making payments sooner than if you were to make the minimum payment. However, that only happens after a certain period of time.

If you have an extra mortgage payment plan that will end your mortgage within a timeframe that lets you enjoy five years or longer of mortgage-free living, that makes more sense, says Sullivan.

So what is the effect of paying extra principal on a mortgage?

Make More Frequent Payments

It could be one extra mortgage payment a year, two extra mortgage payments a year, or an extra payment every few months. Whatever the frequency, your future self will thank you. Maintain these additional payments over an extended period of time and you’ll likely eliminate several years from your term.

A quick note here: there is no best day of the month to pay your mortgage. Both the principal and interest amounts decrease over time, whether you make payments on the 1st, 15th, or a date in between.

Don’t Miss: Is It Cheaper To Pay Mortgage Or Rent

Is It Better To Pay Extra On Mortgage Or Save

Its typically smarter to pay down your mortgage as much as possible at the very beginning of the loan to save yourself from paying more interest later. If youre somewhere near the later years of your mortgage, it may be more valuable to put your money into retirement accounts or other investments.

Paying Extra On Your Mortgage

Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments. For example, if you pay $1,300 per month normally, you may pay an extra $200 to the principal for a total payment of $1,500. Or if you get a bit of money, say a $5,000 tax refund, you could apply it to your principal loan balance. The faster you pay off your mortgage, the less you will pay in interest, reducing your overall loan cost. However, this option should be considered in the context of your larger financial situation.

Recommended Reading: How Soon You Can Refinance Your Mortgage

Refinancing Vs Making Extra Mortgage Payments

Refinancing could shorten your mortgage, save you money on interest, and help you cash in on home equity.

When you refinance your mortgage, you substitute your current mortgage with a new one. Your new mortgage will typically have new terms, such as a different interest rate, term length, loan amount, and even loan type.

How To Pay Off A Mortgage Early

Paying off a mortgage early requires you to make extra payments, but there’s more than one way to approach it.

Here are some specific ideas:

-

Use the 1/12 rule. Divide your monthly principal payment by 12, then add that amount to each monthly payment. You end up making the equivalent of 13 payments, instead of the required 12 payments, every year.

-

Use a savings account. Deposit one-twelfth of the monthly principal payment into a savings account each month, then use that money to make a 13th payment.

-

Make biweekly payments. Pay half a mortgage payment every two weeks. You make 26 half-payments, equivalent to 13 full payments a year. If you want to try this, first make sure your mortgage servicer is set up to receive biweekly payments.

Before you make an extra payment, ask your mortgage servicer for instructions. You might have to specify that the extra payment should go toward paying down the principal balance, not toward interest or future payments. Each servicer has its own process.

Read Also: Why Are Mortgage Rates Going Down

How Does Mortgage Recasting Work

Follow these steps to recast your mortgage: