What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

What Is The Difference Between Interest Rate And Apr

While interest rates show the percentage a lender may charge for a loan, it gives an incomplete look at total costs.

An annual percentage rate includes the interest rate as well as other fees, including origination fees, mortgage insurance, closing costs, mortgage points and more.

The APR gives borrowers greater insight into what theyre actually paying for their mortgage. For more on what you need to know, visit our Interest Rates vs Annual Percentage Rate page.

What Else Do I Need To Know

Mortgage deals offering the cheapest rates usually come with fees attached. You can opt to pay these upfront or add them to the loan. To factor in the cost of the fee, order your the results by initial period cost .

Alternatively, you can order results by initial rate, lowest fee or monthly repayment even by the lenders follow on rate that the deal will revert to at the end of the term.

The very cheapest are reserved for bigger deposit amounts, usually of 60% of the property value or more. And, in all cases, you will need a sufficient income and clean credit history to be accepted for a mortgage.

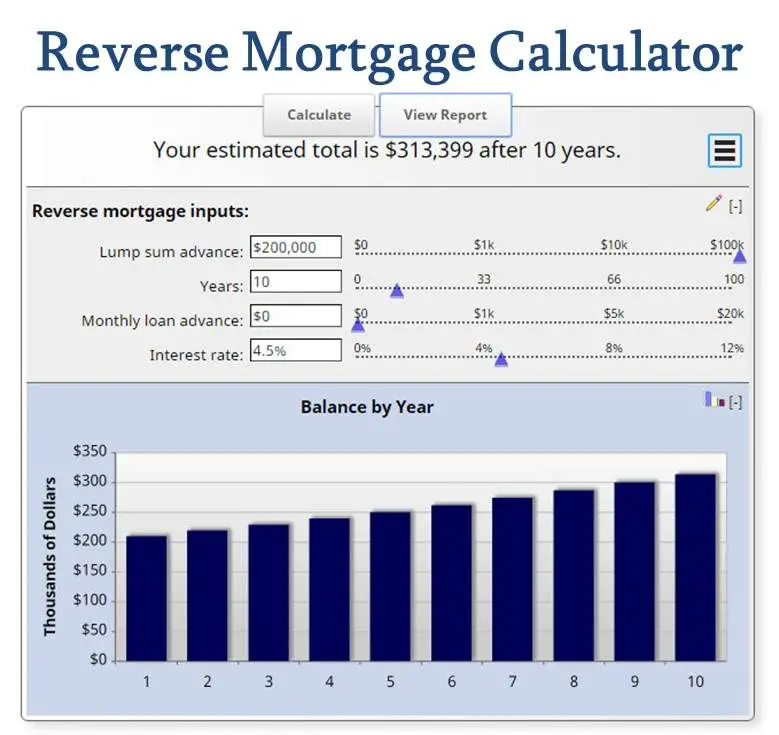

If you want to see what your monthly mortgage payments might look like in different scenarios while overlaid with household bills, our Mortgage Calculator will crunch the numbers.

You May Like: How Much Is A Mortgage On A 400k House

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

You May Like: How To Find Out Who My Mortgage Was With

How Credible Mortgage Rates Are Calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage rates reported here will only give you an idea of current average rates. The rate you actually receive can vary based on a number of factors.

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

Recommended Reading: What Credit Score Do You Need For A Conventional Mortgage

Home Loan Interest Rate Latest News: Emis Go Up As Banks Hike Rate Check Calculator Impact On Your Monthly Budget

Home Loan Interest Rate, EMI Calculator 2022-2023: The Reserve Bank of India has recently hiked its repo rate by 35 basis points. If this is taken along with all the previous rate hikes in this year, the total hike stands at 2.25%. The RBI had gone for a 40 bps hike in May this year, then 50 bps each in June, August and September and now 35 bps in December. The current repo rate now stood at 6.25%. The home loan rates used to be around 6.9% to 7% around April. However, with the central bank raising the repo rate, the public sector and private sector lenders have also hiked the home loan interest rate which is affecting the middle class the most.

Mortgage Interest Rates Forecast 2022

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserveâs monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

âThe pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year,â says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . âAdditionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.â

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : âMortgage rates are expected to end 2022 at 4.8%âand to decline gradually to 4.6%âby 2024 as spreads narrow.â

- NARâs Yun: âAll in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.â

- Matthew Speakman, senior economist at Zillow: âCompeting dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.â

Also Check: What Is Considered Income For Mortgage

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youâll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loanâs interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

The Type Of Mortgage Loan

There are different types of mortgages, including conventional loans, government-insured loans and jumbo loans. Interest rates can vary significantly depending on the loan type, but there are other factors that could impact your decision as well. For instance, an FHA loan may come with a higher interest rate but require a lower credit score or down payment than a conventional loan.

Also Check: What Is Mortgage Payment On 350 000

How Much House Can I Afford

Income is the most obvious factor in how much house you can buy: The more you make, the more house you can afford.

However, it also depends on how much of your income is already spoken for through debt payments as well as your credit score and history. The more debt you have, the less likely you will be approved for a mortgage or one at a lower interest rate. Your credit score also plays a role in that the higher your score, the better loan rate and terms you will receive.

And of course, if you have a larger down payment, it will help you in all these factors for affording a home.

Fed Sees Through November Hike Mortgage Rates At 7 Percent

The benchmark fixed rate on 30-year mortgages now sits at 7 percent, its highest level in 20 years, according to Bankrates national survey of large lenders. This, as the Federal Reserve made good on its promise to raise rates yet again at its .

The interest rate mantra for 2023 is shaping up as higher for longer, says Greg McBride, CFA, Bankrate chief financial analyst. Unfortunately, were likely to feel the pain of a slower economy before we see the gain of lower inflation.

Federal policy doesnt directly impact rates on fixed mortgages, but the central bank has some sway with 10-year Treasury yields, which do drive fixed mortgage movement. The Feds actions affect adjustable-rate mortgages and home equity products, however. Each time the central bank raises its key rate, variable home loan rates move in tandem.

Some analysts believe fixed mortgage rates might hover in the 7 percent range, while others arent ruling out the possibility of the 30-year rate approaching 8 percent. Learn what the experts predict in Bankrates forecast.

Whatever type of mortgage youre looking for, in this environment, its more important than ever to compare rates before selecting a lender.

Conducting an online search can save thousands of dollars by finding lenders offering a lower rate and more competitive fees, says McBride.

Recommended Reading: Does Charles Schwab Offer Mortgages

What Mortgage Deals Are Available

With upwardly-mobile Bank and inflation rates, keeping track of mortgage costs is increasingly challenging especially when rates change, and deals can be pulled, on a daily basis.

One simple way is use our mortgage tables, powered by online mortgage broker, Trussle.

To find out what deals are available at todays rates for the kind of mortgage youre after, youll need to enter your personal criteria into the table below. Heres what to do:

- Select whether the mortgage is to fund a house purchase or if its a remortgage for an existing property

- Enter the property value and the mortgage amount you require. This will automatically generate a percentage which is known as your loan to value. The lower your loan to value, the cheaper the mortgage rates available

- Tick the relevant box if its a buy-to-let or interest-only mortgage , or if youre looking for a mortgage to fund a property

- Finally, filter your search by the type of mortgage you want, for example a two- or five-year fix or tracker. The filter is set to a complete mortgage term of 25 years but you can change this if required.

Heres a live table of the mortgage deals available today.

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnât process the loan before the rate lock expires, youâll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Thereâs income on your application that canât be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but itâs wise to get it in writing as well.

Read Also: How To Take Money Out Of Mortgage

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

Should I Choose A Mortgage Based On The Apr

The APR is a great tool for comparing two mortgages with different terms, but it’s ultimately important to consider all aspects of your loan when making a decision. For example, if your savings account is well-stocked, you may be willing to pay some higher closing costs for a loan with a lower monthly payment that is more in line with your regular income.

And there are other, non-financial factors as well. Every mortgage lender does business its own way. Some use a personal touch with each customer and others offer the most cutting-edge technology to make your borrowing experience easy. Do you prefer a small, local institution? An online lender? A national bank with a 100-year history and an established reputation? Theres no right answer to any of these questions, but they are important to think about nonetheless. You could be making payments on your mortgage for 30 years, so you should find a lender that suits your needs.

Before you sign your papers, its a good idea to research your lender. Read reviews, the company website and any homebuying material the lender publishes. It can help you get an idea of the company before you do business.

Recommended Reading: How To Take A Mortgage Out On Your Home

Does Everyone Get The Same Rates

Because there are so many different factors involved in coming up with mortgage interest rate offers for individual applicants, not everyone gets the same offer. For this reason, its important as a consumer to shop around with multiple lenders to ensure that youre accessing the most competitive rate possibleas well as improving your own financial health if need be.

As a consumer, you have the right to choose the best loan for you. Shopping around is essential to making a well-informed decision on which lender, loan type, and rate is best for you, says Valerie Saunders, board member with the National Association of Mortgage Brokers. Dont just look at one option.

House Prices And Stamp Duty

While still beyond the realms of affordability for many, UK house prices are starting to fall. The average asking price of a property listed on Rightmove in December stands at a heady £359,137, according to figures published today by the portal.

While this is 5.6% higher than last December, its a marked slowdown from the annual growth rate in November which was recorded at 7.2%.

On a monthly basis, asking prices have dropped by 2.1%.

Tim Bannister at Rightmove, said: The price drop is an understandable short-term reaction to the economic turmoil we saw in late September and October, before things began to settle down.

Rightmove expects average property prices to drop by a further 2% during the course of next year.

Stamp Duty cuts announced in the mini-Budget raised the nil-rate band on the purchase of a property from £125,000 to £250,000. While u-turns were made on the other tax breaks announced under former Prime Minister Liz Truss, this one has remained in place.

Recommended Reading: What’s Needed To Apply For A Mortgage

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.