Why Is There Fha Mortgage Insurance

Mortgage Insurance helps you purchase a home even if you don’t have a large down payment or a weak credit score. For example, if you do not have much equity, then based on past loan performance, your loan is a higher level of default risk.

The US government guarantees FHA Mortgage loans. To maintain the FHA mortgage program, the government charges both an Upfront Mortgage Insurance Premium and a Monthly Mortgage Insurance Premium .

Depending on the status of the fund, mortgage insurance premiums change from time to time. For example, in 2013, facing a potential bailout, the FHA increased mortgage insurance premiums. In 2015, the FHA dropped the premiums. In 2017, the Obama administration planned an additional drop in the premiums. However, the Trump administration canceled this.

How To Avoid Fha Mortgage Insurance

If youre using an FHA loan program, you will pay mortgage insurance. All FHA loans involve mortgage insurance, either for the life of the loan or for a set number of years. You can avoid FHA mortgage insurance by:

- Using a different lending program This could mean getting a conventional loan with a 20 percent down payment, but there are other options. One option is accepting an FHA loan and the MIP that it comes with, then refinancing into a non-FHA loan once youve built enough equity in your home.

- Obtaining lender-paid mortgage insurance loan LPMI can be an option if youre not willing or able to make a 20 percent down payment. With this type of loan, the lender covers the PMI in exchange for a higher interest rate.

- Exploring a piggyback loan With this type of loan, you make a 10 percent down payment, then get a second mortgage to add another 10 percent to your down payment. You wind up with a 20 percent down payment overall, avoiding PMI, but youll have to repay two loans.

- Looking into special programs There are also some programs that allow borrowers to make a low down payment without PMI. These range from VA loans to programs directly from major banks and lenders.

Private Mortgage Insurance For Conventional Loans

Unlike FHA loans, not every person who buys a house with a conventional loan is required to pay for mortgage insurance. If you make a down payment of 20% or more, you do not need to pay for PMI. If you make a down payment of less than 20%, you will mostly likely be required to pay for private mortgage insurance by your lender.

The cost of PMI is affected by factors like your credit score and the amount of your down payment. The cost can vary from borrower to borrower and generally runs between 0.5% and 2% of the loan amount of the mortgage.

There are similar requirements when you refinance a conventional loan. You need to have 20% home equity or you will most likely be required to pay for private mortgage insurance.

You May Like: When Do You Pay Pmi On A Mortgage

Fha Loans Have Mip Conventional Loans Have Pmi Learn The Differences

Mortgage insurance premiums and private mortgage insurance help lenders offer home loans to customers who may not otherwise qualify. Mortgage insurance does this by protecting lenders against losses that may occur when a borrower defaults on a loan.

There are two kinds of mortgage insurance which sound the same but they are different. FHA loans have mortgage insurance premiums. Conventional loans have private mortgage insurance. You may be required to pay for mortgage insurance when you get a loan to purchase a house as well as when you refinance. Let’s talk about the differences between MIP and PMI.

Fha Loan Mortgage Insurance Requirements

The first thing to understand is that all FHA loans require mortgage insurance. This is different than the PMI you might need to pay when you get a conventional loan.

When you buy a home with a conventional loan, you need to pay for PMI if you make a down payment of less than 20%. When you refinance with a conventional loan, you need to pay for PMI if your home equity is less than 20%.

FHA loans require you to pay for mortgage insurance when you buy or refinance a home, regardless of the amount of your down payment or home equity. You are also required to pay for two kinds of mortgage insurance. FHA loans have a one-time upfront fee you need to pay at closing as well as monthly insurance payments .

Conventional loans do not have upfront PMI payments. Learn more about the differences between PMI vs MIP.

You May Like: Can You Get A 5 Year Fixed Mortgage

Alternatives To Fhas Mip

When the FHA increased its MIP in the mid-2000s, the FHA loan became a less attractive option. The January 2015 MIP reduction could make FHA-insured loans more competitive, but that still doesnt mean the FHA loan will be the best or cheapest choice for every borrower.

Some low-down payment loans, other than the FHA loan, allow borrowers to cancel their mortgage insurance after theyve built up a certain amount of equity in their home. Homeowners can build equity through mortgage repayment, value appreciation or both.

In some cases, borrowers must request mortgage insurance cancellation. In other cases, the lender is required to cancel the insurance. The cancellation rules can be complicated, but borrowers have an opportunity to get rid of mortgage insurance at some point. With an FHA loan, it is more difficult for borrowers to stop paying for mortgage insurance.

This restriction can make an FHA loan more expensive than the other options, especially if the borrower keeps the loan for many years. If the borrower sells the home or refinances within a few years, the MIP cancellation requirements are not as material.

Borrowers who have an FHA loan may be able to stop paying for mortgage insurance once certain conditions are met.

As of June 2013, borrowers who have less than 10 percent equity must pay MIP for the life of their loan. Borrowers who have 10 percent equity or more must pay MIP for the full term of their loan or 11 years, whichever occurs first.

Private Mortgage Insurance Coverage

First, you should understand how PMI works. For example, suppose you put down 10% and get a loan for the remaining 90% of the propertys value$20,000 down and a $180,000 loan. With mortgage insurance, the lender’s losses are limited if the lender has to foreclose on your mortgage. That could happen if you lose your job and can’t make your payments for several months.

The mortgage insurance company covers a certain percentage of the lenders loss. For our example, lets say that percentage is 25%. So if you still owed 85% of your homes $200,000 purchase price at the time you were foreclosed on, instead of losing the full $170,000, the lender would only lose 75% of $170,000, or $127,500 on the homes principal. PMI would cover the other 25%, or $42,500. It would also cover 25% of the delinquent interest you had accrued and 25% of the lenders foreclosure costs.

If PMI protects the lender, you may be wondering why the borrower has to pay for it. Essentially, the borrower is compensating the lender for taking on the higher risk of lending to youversus lending to someone willing to put down a larger down payment.

Recommended Reading: Can I Get Help Paying My Mortgage

How To Cancel Mortgage Insurance On Fha Loans

FHA loans carry a government guarantee to the lender. Should the loan ever go into foreclosure, the lender is compensated 100 percent of the outstanding balance. Thats quite a benefit to the lender, as long as the lender approved the loan using current FHA guidelines. Yet this guarantee comes at a cost and is funded by an upfront mortgage insurance premium and an annual mortgage insurance premium, or MIP.

The upfront premium, currently 1.75 percent of the loan amount, is rolled into the principal balance and not paid out of pocket. The annual premium is paid in monthly installments. The annual premium amount will vary based upon loan term and down payment. Today, the annual premium is 0.85% of the loan with a 30 year term and a 3.5 percent minimum down payment. The premium for a 15 year loan with 5.00 percent down is 0.70%, for example. But FHA mortgage insurance premiums dont always have to be forever.

Lender Requirements

Current guidelines for all FHA loans with case numbers issued prior to June 3, 2013, the annual MIP will automatically be cancelled on a 30 year note when the balance is naturally amortizes to 78 percent of the original value and the note is at least five years old. The annual premium is also cancelled automatically on 15 year loans when the loan balance falls to 78 percent of the original value. There is no five year waiting period for 15 year FHA loans.

Refinancing Out of an FHA Loan

What Is Mortgage Insurance

Mortgage insurance exists to protect lenders against losses they suffer when borrowers default. If a borrower defaults, the lender can foreclose on the loan and sell the home. The insurance covers all or part of the shortfall between the lenders proceeds from the sale and the borrowers unpaid loan amount.

Small down payment borrowers are perceived as being more likely to default since they have less equity at stake. Thats why lenders typically require mortgage insurance when a borrower makes a down payment thats less than 20 percent of a homes purchase price or appraised value.

Mortgage insurance is different from mortgage life insurance. Mortgage insurance, sometimes called mortgage default insurance, pays all or part of a lenders loss when the borrower defaults. Mortgage life insurance pays off a loan when a borrower dies.

Although mortgage insurance protects the lender, the borrower pays for it. The benefit for the borrower is that mortgage insurance acts as an incentive for lenders to make loans to borrowers whose down payment is smaller than 20 percent sometimes a lot smaller. The minimum down payment for a loan with FHA mortgage insurance is just 3.5 percent.

This example illustrates the benefit:

HOME PRICE: $200,000

Minimum 20 percent down payment without mortgage insurance: $40,000 ($200,000 x 0.20

Minimum 3.5 percent down payment with FHA mortgage insurance: $7,000

Recommended Reading: Does Getting Pre Approved For Mortgage Hurt Credit

Fha Monthly Mip Factors

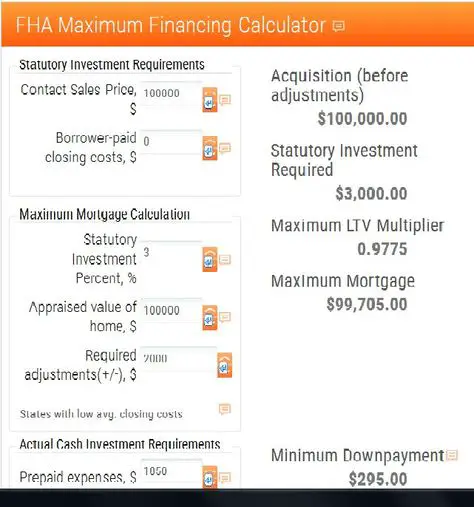

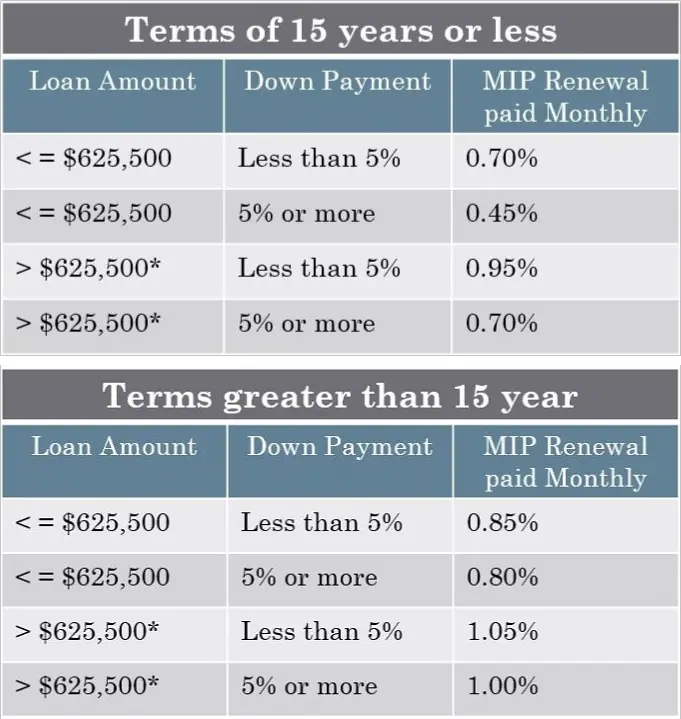

FHAs annual mortgage insurance premium is actually paid monthly which is why its commonly referred to as the monthly MI. The PMI factor is based on the loans duration and the down payment amount.

The FHA monthly MIP factors for purchase loans are as follows:

- For loans greater than 15 years, the PMI is either .85% or .80%.

- The .85% factor applies to loans that have a LTV greater than 95%.

- The .80% factor is for loans with a LTV less than, or equal to, 95%.

Example: a 30-year-fixed-rate FHA home loan with a 3.5% down payment has a PMI factor of .85%. This means on a $196,377 loan amount, the monthly PMI payment would be $139.10 per month. .

Fha Maximum Loan Limits

The FHA home loans have maximum loan amounts that vary by county. FHAs maximum loan amount allowed for most of north Texas counties is $450,800 as of the year 2022.

Note: there is no maximum to the FHA sales price, only the loan amount is limited. For example, FHA financing is available if someone is buying a home in Dallas for $1,000,000 so long as the down payment is $549,200 .

FHAs County Loan Limit Search provides the maximum loan amount for all counties in America. Below is a search result example for Dallas County in Texas. Notice the one-family maximum loan amount is the aforementioned $450,800.

Read Also: Can I Get A Mortgage To Buy A Foreclosure

How Does Fha Mortgage Insurance Work

FHA loan mortgage insurance is charged at the beginning of your loan and then on an annual basis. But you dont have to pay that annual premium directly. Instead, the amount is divided up and evenly distributed across your 12 monthly payments. Say your loan amount is $300,000 and your MIP rate is 0.80%. Your annual premium would be $2,400. Divided over 12 months, that would add $200 to your monthly payment.

Multiple Fha Home Loans

The purpose of FHA home loans is to provide financing for primary homes. FHA does not want to be a financing vehicle for aspiring real estate investors. For this reason, FHA generally will not insure multiple FHA home loans to one borrower at the same time however, there are exceptions.

At the same time is the key component. FHA will allow someone to buy multiple properties using FHA financing so long as the previous FHA loan is paid off before the new purchase.

For example, Joe Buyer used FHA to buy his current home. Joe is now selling his home and will be purchasing a new home using FHA again. This is permissible so long as the current home is sold and closed before the purchase of the new home.

Don’t Miss: What Is The Best Way To Apply For A Mortgage

What Are Mortgage Insurance Premiums

Mortgage insurance helps offset the lenders risk when a borrower makes a small down payment, as low down payments increase the amount of money your lender loses if you default on your mortgage .

Because FHA mortgages allow for down payments as low as 3.5% for borrowers with a , mortgage insurance is required for all FHA home loans. The mortgage insurance youll pay on an FHA loan is simply referred to as a mortgage insurance premium, or MIP.

Computation Of Annual Average Outstanding Balance

To start, use the original loan amount as the previous balance. Repeat the following steps for the remaining months in the year . The calculation of subsequent years is the same. The second year will begin with the last result of the first year.

Multiply previous balance times annual contract interest rate. Round the result to two decimal places based on value in 3rd decimal place.

Divide result by 1200. Round the result to two decimal places based on the value in3rd decimal place.

Add previous balance.

Subtract P& I payment. Note: For an ARM use original Interest Rate and original P& I through all years. For GEM/GPM compute current P& I based on amortization plan. See table below.

When the final year is computed, total up the 12 results for that year and divide the total by 12.

| AMPLAN |

|---|

Don’t Miss: What Happens If You Pay Your Mortgage Twice A Month

Fha Mortgage Insurance For Buying A Home

Here is an example of FHA mortgage insurance costs for a high LTV loan. If you purchase a home for $268,000 and put down 3.5% and take out a $258,620, 30-year Fixed Rate Mortgage , then your fees would be:

- Upfront MIP: 1.75% * $258,620 = $4525.85 . The UFMIP can be added to the loan and paid off each month. Your monthly payment for this fee would be about $23 .

- Monthly MIP: The FHA annual premium is 0.85% multiplied by the loan amount. Your first-year payments would be approximately $183.19.

- Your monthly payment would vary depending on your initial interest rate. See the chart below for different monthly payment scenarios, depending on mortgage rates.

Refinance To A Conventional Loan

Many homeowners refinance to a conventional loan when they reach 20% equity. When you have a conventional loan, you dont pay MIP. Instead, your lender might require you to pay PMI but only if you have less than 20% down. You can stop paying MIP without switching to PMI by refinancing once youve reached 20% equity.

To refinance to a conventional loan, you must meet your lenders minimum requirements. Conventional loan requirements are stricter than FHA loan requirements, so you might need to take some time to build a better borrower profile before you refinance. To qualify for a conventional loan, youll need at least the following:

- A higher credit score: You must have a median FICO® Score of at least 620. Making your credit card and loan payments on time and limiting your spending can help you increase your credit score while you build equity.

- Debt-to-income ratio: You must have a DTI ratio of 50% or less to qualify for a conventional loan. You can decrease your DTI ratio by increasing your household income or paying down your debts.

- Home equity: You should have at least 20% equity in your home before you refinance. If you refinance before you have 20% equity, youll need to pay for PMI instead of MIP. PMI is more expensive than MIP, so be sure you have the right amount of equity before you refinance. If you arent sure how much equity you currently have, contact your lender.

Apply for a mortgage refinance.

Rocket Mortgage® makes it quick and easy to do online.

Read Also: Can You Pay Off Mortgage Early Without Penalty

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, you’d pay 0.17% because you’d likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because you’d be considered a high-risk borrower at most financial institutions.