Apply For A Mortgage Broker License

Although each state has a department of banking or finance that regulates the local mortgage industry, they require you to complete the application process through the Nationwide Mortgage Licensing System . When you apply, you will incur the following costs:

- NMLS processing fee

- Criminal background check fee

The total costs incurred will range from several hundred dollars to more than $2,000 depending on where you live. Some states itemize their charges, while others charge a lump sum that includes all costs.

Education And Testing Requirements

You are also required to take 20 to 30 hours of classes through a state- or NMLS-approved course provider. Upon completion of your education requirements, you will have to pass an exam before you can apply for your license. Although you may opt to take the exam before fulfilling your class hours, the test is difficult and it is advisable to do the education beforehand. If you fail, you have to wait 30 days before you can retake the exam. If you fail your third attempt, you will have to wait 180 days. Tests are only administered periodically, and you have to register to take them in advance. You must score a minimum of 75 percent to pass.

Why Start A Career In The Mortgage Industry

A career as a mortgage broker can be a great fit for those who want to help home buyers get through the mortgage loan process from start to finish. If you have a desire to lend a hand to buyers or those refinancing, or you simply have a passion for the real estate industry, being a mortgage broker can be a good career choice. Also, starting a mortgage broker career or business does not require a lot of time or energy. Given the current economic environment, now may also be a good time to pursue this goal.

Over the last decade, the housing market has experienced a steady upward movement, recouping some of the losses incurred during the market downturn of 2008 and 2009. With a more optimistic outlook on the economy as a whole, consumers are more likely to pursue their dreams of owning a home sooner rather than later. Strong jobs reports and relatively low interest rates create an opportunity for mortgage brokers to assist clients ready to make a move.

Read Also: Are Cash Out Mortgage Rates Higher

What Skills Does A Mortgage Broker Need

Not only do mortgage brokers need to know the lending process, lending rates and lending institutions, but they also have to have a variety of hard and soft skills to help them perform their job successfully. Here are some skills a mortgage broker needs:

Attention to detail

Mortgage brokers usually have strong attention to detail. This can help them when reviewing loan options, rates and terms. The better they read the fine print, the easier it can be for them to present their clients with profitable mortgage opportunities.

Interpersonal skills

Most mortgage brokers have friendly and outgoing personalities that allow them to effectively communicate with clients and financial institutions. Having good social skills can make it easier to get along with everyone you work with and might make your job more enjoyable. To develop your interpersonal skills, consider being an active listener and practicing ways to speak positively and professionally to others.

Related: Interpersonal Skills: Definitions, Examples and How To Improve

Patience

Mortgage brokers can also benefit from having enough patience to find lenders who are willing to work with their prospective borrowers. Patience can also help them accommodate their client’s various schedules and be willing to wait for them to make a decision about their loan options. Having patience can also help a mortgage broker remain positive when they receive rejections from lenders.

Negotiation skills

Organizational skills

Nlms Exams And Licensing

Check your state mortgage licensing laws to understand whether or not youll need a mortgage license before becoming a mortgage broker.

The NMLS licensing fee for a mortgage broker in most states is $1,500.

To be approved for an NMLS license, you must complete 20 hours of pre-licensing training through an approved organization. The training includes three hours on federal law and regulations, three hours on ethics, two hours on nontraditional mortgage products, and twelve hours of elective courses. This training must be completed no more than three years before your application submission.

Once training is complete, you must pass a two-part SAFE Mortgage Loan Originator test. You must answer at least 75% of the questions correctly to pass the exams.

You May Like: How Often Are Mortgage Rates Updated

Choose A Physical Location Or Online Mortgage Brokerage

As a mortgage broker, you have the option to select a physical location where you will provide services to clients or an online business where no brick-and-mortar space is needed. However, its important to understand the guidelines of your state to help determine if an online brokerage business is possible.

Some states require you to have a physical location to get licensed and operate legally. When selecting any physical location, think through the ease of accessibility for your customers, price of renting space, and your available hours. If you have the option to work through an online brokerage, plan for a home office space that allows you to effectively work.

Mortgage Brokers Vs Loan Officers

So, you’ve decided you want to work in the mortgage industry. You just dont know if youre going to be a mortgage broker vs. a mortgage lender or even a loan processor. Lets take a look at a few key differences.

Loan officers, mortgage consultants, loan originators, or loan processors are all terms for specialists who work for a bank or lending institution. These are the people who can originate loans for borrowers.

Mortgage brokers, on the other hand, are independent parties who do not work for anyone specifically. As a broker, you connect borrowers with lenders. Essentially, you shop around to find the best deal for your clients.

Interested in becoming a mortgage consultant? American Financing is hiring! Check out our careers page to apply for open positions.

Read Also: How Much Mortgage Protection Insurance Cost

Get Your Mortgage Broker Bond

A helps protect your clients should you not follow the rules of operating as a broker in your state. It is not only a protection for your clients, but it also serves as a way to improve your validity among potential customers. Most importantly, though, a mortgage broker bond is a requirement to be licensed.

Each state has different requirements for the amount of a mortgage broker bond you will need. The good news is that you only pay for a percentage of the total bond amount. The percentage you pay is based on your financial history and credit score, as well as your business details and previous claims history. Once you know the amount of the bond you need, you can submit an application online and in some cases, receive instant approval. title=”Get a FREE Mortgage Broker Bond Quote”

What Is The Job Outlook For A Mortgage Broker

The U.S. Bureau of Labor Statistics reports an employment growth of 4% for real estate brokers and sales agents from 2020 to 2030. The BLS notes that demand for this profession can increase due to the number of people needing brokers and sales agents when they look for a home. More positions can also open as current professionals in these roles retire or change careers.

Also Check: What Mortgage Can I Afford On My Salary Calculator

How Do I Get A Mortgage Broker License In California

Are you curious about becoming a Private Money Lender? Here is some information to get you started. First off, you will need a broker license in California.

There are two licensing agencies in California that regulate Mortgage Broker licenses.

California Department of Real Estate

This type of license allows you to act as a real estate broker and/or mortgage broker in California. There are education requirements and a test involved. In addition to taking a test, you must complete 45 hours of continuing education every four years.

If you will be making loans to residential borrowers , you must get a Mortgage Loan Originator endorsement. You can do this through the Nationwide Multistate Licensing System . There is an additional 20-hour education requirement and successfully completing a test.

California Department of Business Oversight .

This agency regulates the California Finance Lender and the California Residential Mortgage Lender licenses.

Finance Broker License: The limitation of this type of license is that such brokers are only allowed to broker loans with those holding a finance lender license. They would not be able to do business with any other type of lenders in the state, such as banks or credit unions.

Residential Mortgage Lender License:

This type of lender license will permit the making and servicing of California Mortgage loans.

What is the difference between these licenses?

California Department of Business Oversight CFLL

California Department of Real Estate

Apply For Your Mortgage Broker License And Get Your Mortgage Broker Bond

After you pass the exam and register your business, apply for your mortgage broker license. Determine your state’s requirements with the NMLS. Typically, states ask candidates to pass an exam, pay a licensing fee, get the right bond and submit an application to get a mortgage broker license.

Getting a mortgage broker license usually also involves securing a bond. Having a mortgage broker bond protects your clients if your brokerage breaks any rules or regulations while operating. It also helps you prove your validity to your potential customers.

The amount of a brokerage bond you might need depends on your state. Mortgage brokers pay for a percentage of the total bond amount, so the amount they pay depends on various factors, including financial history and business details.

Once you determine the amount of bond you need, submit an application online. After you receive your bond certificate, sign it and send both the certificate and your license application to your state. After the state reviews and approves your application, you can receive your license.

You May Like: How Much Mortgage Can You Get

Choose A Mortgage Broker License Types

Chapter 494 of the Florida Statutes sets the different license types and the requirements you need to meet to obtain them.

The license types for mortgage brokers include:

- Mortgage Broker License conducting loan originator activities through one or more licensed loan originators who act as independent contractors or are employed by you

- Mortgage Loan Originator License soliciting a mortgage loan, accepting an application for a mortgage loan, negotiating the terms or conditions of a new or existing mortgage loan, processing a mortgage loan application, or negotiating the sale of an existing mortgage loan to a non-institutional investor

You can find the full list of license types on the NMLS website.

What Is A Mortgage Broker License

Mortgage brokers act as an intermediary between lenders and potential homebuyers who wish to access mortgage lending. They often work in tandem with mortgage loan originators and mortgage loan officers, however, mortgage brokers sometimes also fulfil these roles to offer customers a complete service.

The purpose of the licensing procedure is to ensure that mortgage brokers meet federal law and state requirements for operating as a broker. The criteria are rigorous and aim to guarantee the high standards of operation in the industry.

In many states, you need to undergo the process through the website of the Nationwide Multistate Licensing System and Registry . Alternatively, the state body that oversees financial activities would handle the licensing.

In order to launch your mortgage brokering business smoothly, weve prepared a step-by-step guide that will take you through the main tasks that you have to complete to get licensed.

Also Check: Can I Apply For Mortgage With Multiple Lenders

Do Mortgage Brokers Make More Than Realtors

Mortgage brokers are paid slightly more on average than real estate agents, mostly due to the additional education requirements. Mortgage brokers make an average of $95,209 per year , whereas real estate agents make an average of $92,450 per year. Both brokers and agents make their income on commission.

Can mortgage brokers work remotely?

You can work remotely and if youve got your laptop and basic office equipment you can work from home, your clients home even a café. Does a career as a mortgage broker sound appealing to you.

Can you work part-time as a mortgage agent?

Mortgage Brokers and Agents Job Types: Full-time, Part-time. Part-time hours: 20-40 per week. You earn from mortgages, credit cards, insurance, banking, investments and credit reporting products.

Pe Expiration Policy In Ohio

PE Expiration is a policy that was created by the NMLS Policy Committee that addresses situations in which an individual is required to retake 20 hours of pre-licensure education if they fail to acquire a valid mortgage license within three years from the last date of licensure as a mortgage loan originator. Ohio is currently in pending enactment for the PE Expiration policy which means the policy is currently not enforced, but it will be rolled out soon.

Also Check: What Is A Good Fico Score To Get A Mortgage

Department Of Real Estate Mortgage Broker License

To qualify as a real estate broker with the Department of Real Estate you must pass a written exam before applying for a license. You must be 18 years or older, live in California , have no prior convictions, and two years of full-time experience as a licensed salesperson within the last five years. You must complete eight college-level courses that include Real Estate Practice, Finance, Appraisal, Economics, Legal Aspects of Real Estate and three extra courses from a selection of eleven. Members of the California State Bar are exempt from these courses.

Once you acquire the license you can work as a mortgage broker, you can buy and sell real estate and process loans for banks, credit unions and other financial institutions.

Mortgage Brokerage In The United Kingdom

Mortgage brokers in the UK are split between the regulated mortgage market, which lends to private individuals, and the unregulated mortgage market, which lends to businesses and investors. Many UK brokerages mediate both types of business.

The role of a mortgage broker is to mediate business between clients and lending institutions, which include banks, building societies and .

You May Like: How To Create A Rocket Mortgage Account

How To Obtain A Mortgage Broker License: Costs Associated With Opening Your Own Mortgage Brokerage Office

Running a mortgage brokerage company is not cheap. One of the major costs is the cost of licensing. Each state has its own rules and regulations on fees and costs in getting licensed. You cannot originate loans in states you are not licensed. If you are a mortgage broker originating loans in just one or two states, the costs may not be too bad. However, if you intend in getting licensed in dozens of states, you can easily spend tens of thousands of dollars in getting licensed and renewals each year. All states require mortgage broker applicants to complete the mortgage broker application process through the Nationwide Mortgage Licensing System .

Below is the list of the costs associated with applying for a mortgage broker license:

- NMLS processing fee

- Criminal background check fee

- Surety bond fee

Fees and costs in getting your mortgage broker license depends on the individual states. Costs can vary from under $1,000 to over $4,000 per state. This is without the cost of hiring a third-party licensing agency to assist with licensing. Some states allow you to have your new mortgage brokerage company at your home. Other states will require a brick a mortar office for the headquarters and others will require a brick-and-mortar branch office for offices license outside the headquarters home office.

Application Requirements And License Maintenance

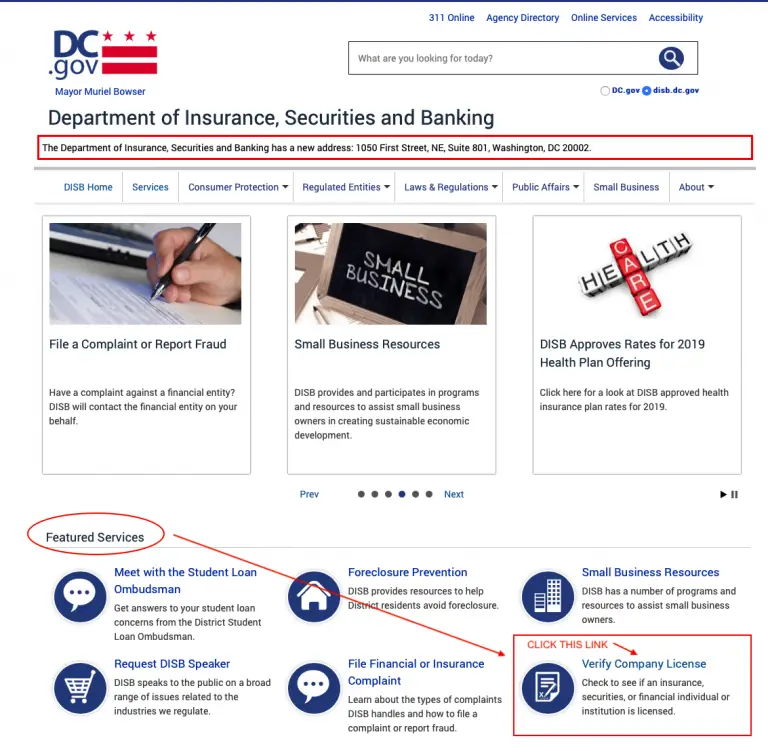

All mortgage license applications, amendments and renewal filings must now be filed through Nationwide Mortgage Licensing System and Registry .

All mortgage license applications, amendments and renewal filings must now be filed through Nationwide Mortgage Licensing System and Registry .

To apply, renew or manage a license, please visit: Nationwide Mortgage Licensing System

Read Also: What Is The Hiro Mortgage Program

Financial Responsibility/credit Report Requirement

The SAFE Act requires that mortgage loan originator applicants have demonstrated financial responsibility, character, and general fitness such as to command the confidence of the community and to warrant a determination that the mortgage loan originator will operate honestly, fairly, and efficiently within the purpose of the article.

The SAFE Act also requires that applicants authorize NMLS to obtain a credit report from a credit reporting agency. This step must be completed as part of the online application process through NMLS.

- When the credit report is obtained, it will be done through a “soft pull” process which has no effect on the applicants credit score.

DRE has adopted Regulations in order to define the requirements of the SAFE Act and SB 36. Regulation 2758.3 – Evidence of Financial Responsibility, specifically addresses how DRE will evaluate the financial responsibility requirement for mortgage loan originator applicants.

How To Become A Mortgage Broker In Ontario

The demand for mortgage brokers, especially in Ontario, has continued to increase over the last several years as the market for real estate remains incredibly hot. There are a ton of people who are looking to buy properties, and they need help getting the money to make their purchase. This is where mortgage brokers come in, and this is where the opportunity is for you.

Dealing with commercial mortgages is a huge opportunity for a variety of reasons, but the biggest factor is the emotions people are dealing with as they try to buy a home and make the right decision for their financial future.

Don’t Miss: Who Qualifies For A Jumbo Mortgage

Register And Establish Your Mortgage Brokerage

After you pass your exam and complete the required coursework, register your mortgage brokerage. The requirements for registering a mortgage brokerage can vary by state. Register your business with various details like your business name and location through your state’s licensing authority.

As you register your brokerage, consider whether you want a physical location to provide your services or if you want to run an online brokerage business. Some states require mortgage brokers to have a physical location. If you opt for a physical location, consider the price of renting a physical space and its accessibility to your customers. If you decide to have an online business, consider creating a home office that allows you to work free from distractions.

Related: How To Register a Business Name