Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, yourannual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

Do I Need Cmhc Insurance

UnderOffice of the Superintendent of Financial Institutions regulations, you are required to purchase CMHC insurance if your down payment is below 20%.

You may beineligible for CMHC insuranceif:

- your purchase price is $1,000,000 or above, or

- your amortization period is longer than 25 years.

In these cases, you must make a down payment of 20% or higher.

How Much Can I Borrow

The amount you can borrow for your mortgage should depend on your annual income, lending terms, interest rate, and monthly debt. By good rule of thumb, you should only be spending 25% to 30% of your monthly income on housing each month.

The Federal Housing Administration and Fannie Mae set loan limits for conventional loans. By law, all mortgage loans have a maximum limit of 115% of median home prices. Currently, the loan limit for a single unit within the United States is $510,400. For high-cost areas, the limit is increased to $765,600 for a single unit.

Government-insured loans such as FHA have similar limits based on current housing prices. At the end of 2019, the FHA limit was increased to $331,760 in most parts of the country. VA loan limits were eliminated in early 2020.

Read Also: Do You Pay Closing Costs To Refinance Mortgage

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

Also Check: Why Use A Mortgage Broker Instead Of A Bank

What Affects Your Mortgage Rate In Canada

There are manydifferent types of mortgages in Canada. Each mortgage typically has the selection of two different rates:

These mortgage rate options will affect how your interest rate changes over time. Fixed rates are historically the most common, followed by variable rates. This changed in late 2021, when variable rate mortgages became more common due to low variable rates and high fixed rates. By the start of 2022, 56.9% of all new mortgages had a variable interest rate, a stark contrast to 24.7% of new mortgages having a variable rate in early 2021.

While less common, there are also hybrid/combination rate mortgages in Canada. With a hybrid/combination rate, youll have a fixed rate for a certain portion of your mortgage balance, and a variable rate for the remaining portion. This allows you to be partially protected from rate hikes, while partially benefiting should rates decrease.

Your mortgage rate will also be affected by certain factors that your mortgage lender will look at. This includes the mortgage term length, whether it is insured/high-ratio or not, and your credit score and credit history. As always, make sure to have theproper documentation for mortgage applications.

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed-upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Recommended Reading: How Many Co Signers Can Be On A Mortgage

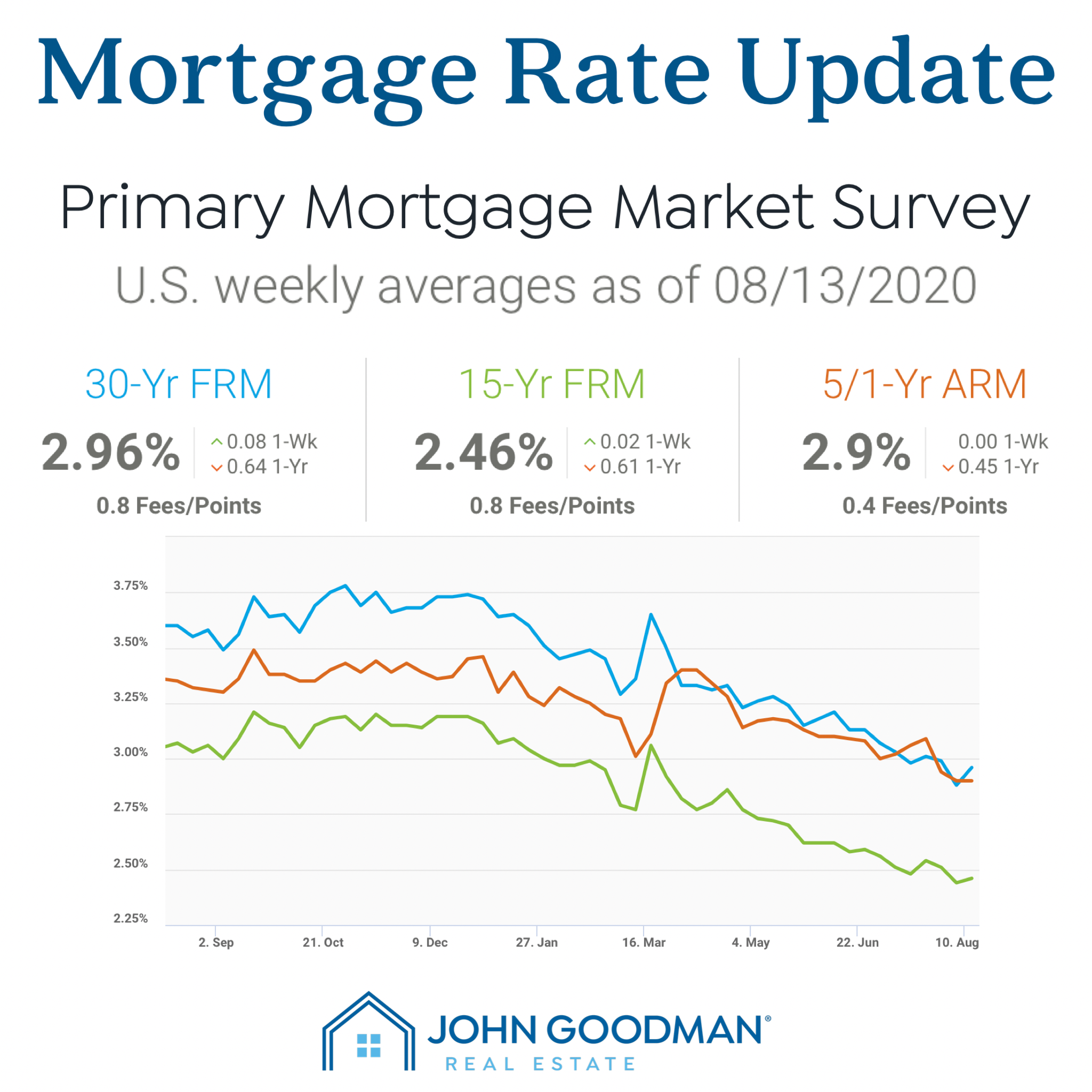

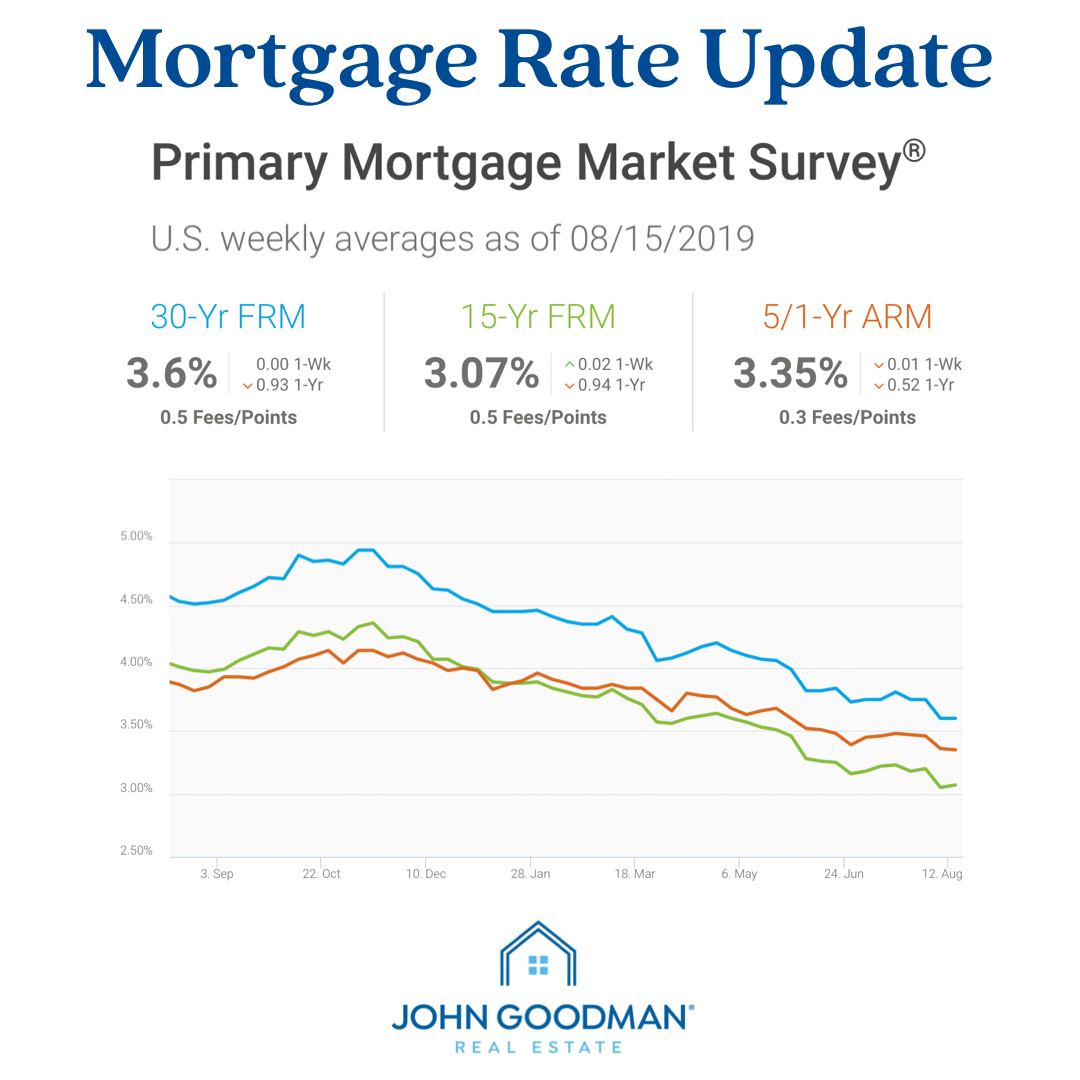

Mortgage Interest Rates For Today: Get The Latest Rates

The best mortgage interest rates today are 3.6% for a 30-year fixed rate and 4% for a 15-year fixed rate. According to Freddie Macs Primary Mortgage Market Survey® . This is not the lowest rates have been in the past 20 years in fact, the 30-year fixed rate has never been lower than 3.5%, even during the depths of the Great Recession in 2009 and 2010.

How Do I Choose The Right Mortgage Interest Rate For Me

Buying a property is usually the most expensive purchase a person will make in their life.

Given the price of a Kiwi property these days, its likely you dont have $1 million sitting in the bank gathering dust.

So, in order to buy your first home, or your next investment property, youll need to ask the bank to lend you the money. You need to get a mortgage.

All mortgages come with an interest rate, the price you pay for the bank to lend you the money.

Once you get a mortgage youll develop a keen obsession with interest rates. What are they? How are they behaving? Can I predict what rates will be in 3 years time? What bank offers the best interest rates?

In this article well take you through 8 essential things to consider when you are deciding on your interest rate.

Do you have a question or comment about the the current interest rates? Feel free to leave your thoughts in the comment section at the end of the page.

Please remember: Heres the thing with interest rates they change all the time. So, the interest rates mentioned today may be out of date in 6 months.

Well do our best with current figures and market trends in this article. But, to check out the latest interest rates, look at the table above .

Fixed Or Floating Rate?

Also Check: Does A Bigger Down Payment Lower Mortgage

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

What Is A Good 30

A 30-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over the 30-year loan period. With a rate that lasts the length of the loan, youll want the best rate you can get. Since your rate is most directly impacted by your credit score and down payment, youll want to make sure your credit file is accurate and make a down payment thats as much as you can easily afford.

Getting a good deal on a mortgage is like getting a good deal on a car. You do online research, you talk with friends and family, and then you comparison-shop. That last step, which involves applying with multiple lenders, is the most important step.

When you compare loan offers using the Loan Estimates, youll feel confident when you identify the offer that has the best combination of rate and fees.

A Freddie Mac report concluded that a typical borrower can expect to save $400 in interest in just the first year by comparison-shopping five lenders instead of applying with just one lender. Over several years, comparison-shopping for a mortgage can save thousands of dollars. Thatll give you something you can brag about.

The 30-year fixed isnt your only option. The 15-year fixed loan is common among refinancers. Adjustable-rate mortgages have low monthly payments during the first few years of the loan, making them popular for high-dollar loans.

Read Also: How To Calculate Percentage Of Mortgage

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Read Also: What Is A Mortgage Payment On 300k

Open Vs Closed Mortgages

You may often notice a significant difference in mortgage rates betweenopen and closed mortgages. Open mortgages allow you to make principal prepayments at any time without any charges or penalties, which makes it very flexible. This flexibility is counterbalanced by open mortgage rates being higher than closed mortgage rates.

Choosing a closed mortgage can let you access much lower mortgage rates at the risk of prepayment penalties if you go over your lenders annual prepayment limit. Things like selling your home or a mortgage refinance can cause you to have to pay significant prepayment penalties. This could be avoided with an open mortgage, but youll have to pay a higher mortgage rate.

Renting Vs Buying A Home

Deciding whether it makes sense to rent or buy is about more than just comparing your monthly rent to a potential mortgage payment. How long you plan on staying in that area should also factor into the decision. Buying a home requires you to pay thousands of dollars in upfront fees. If you sell the house in the next two or three years, then you may not have enough equity built up in the home to offset the fees you wouldnt have paid if you were renting. You also need to factor in maintenance and upkeep costs with owning a home.

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Recommended Reading: How Much Is A Normal Mortgage

How Much Does 1 Point Lower Your Interest Rate

The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether you’re paying points or not. When comparing offers from different lenders, ask for the same amount of points or credits from each lender to see the difference in mortgage rates.

What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt-free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the loans life. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes.

Regardless of what loan type you go with, remember, its not the loan you have to keep forever. Even if you stay in the same home for the rest of your life, you can refinance your mortgage to take advantage of better terms or rates.

Also Check: What Are The Different Types Of Mortgage Loans

How To Apply For A Mortgage

Whenever a lender provides a mortgage loan to a borrower, they take on a certain amount of risk because there is never a 100% guarantee that the borrower will have the ability to pay back the entire loan. The best protection for the lender is the property itself, which the lender can seize or foreclose if the borrower defaults on payments. The other way lenders protect themselves is by running a background check on the borrower.

When assessing a borrower, the lender is likely to take into account credit score, income, expenses, and the size of the down payment. In order to run an assessment, your lender is likely to ask for the following:

- Social security number

- W-2s or I-9 from the past two years

- Proof of other sources of income

- Federal tax returns

Scoring A Low Interest Rate

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

Read Also: What Experian Credit Score Do I Need For A Mortgage

Where To Find The Best Rates

Mortgage rates can differ largely based on overall market forces, the loan amount, your location, your financial situation and how motivated lenders are to get your business. Remember that the rates we quote are market averages — some people will be quoted higher or lower or that exact rate, and the rate may change daily even at the same lender.

Its crucial when youre searching for a loan to shop around and compare and contrast all the terms of your offers, not just the interest rate youre being quoted. Your best rate and terms may be from an online lender, the bank down the street or perhaps through a mortgage broker. You wont know unless you shop multiple lenders through multiple channels.

Bankrate is a great place to start, because you can take advantage of our mortgage rate comparison tool and remain up to date on current rates. If youre not happy with the results there, you should check with the institution where you do your banking, and other small lenders like credit unions or local banks.