Next: See How Much You Can Borrow

Youve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if youre in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Read Also: Chase Recast Calculator

Your Down Payment Affects How Much You Can Borrow For A Mortgage

While having fun with our mortgage calculator, we thought wed show you how big a difference your down payment makes to the value of the home you can afford.

Were going back to the assumptions we used in our first example, and changing only the monthly inescapable expenses and the size of the down payment.

The salary and mortgage rate remain the same.

How Much Of My Income Should Go Towards Paying A Mortgage

There are no set rules regarding how much of your income should cover a mortgage payment. However, lenders will look at how much of your income is going to other outstanding debts before approving another loan. Check out this guide for the different methods for determining how much of your income should go to your mortgage.

Also Check: Does Having A Mortgage Help Your Credit

A Home Affordability Calculator Doesnt Tell You:

- Whether the lender will approve you for financing at the sales price shown

- What your final mortgage interest rate or closing costs will be

- How much your payment might vary based on your actual credit score

The bottom line: While the home affordability calculator gives you an idea of what you might qualify for, youre better off getting a mortgage preapproval if youre looking for a dollar amount based on your unique financial circumstances.

MORTGAGE CALCULATOR TIP

Our calculator is pre-set to a conservative 28% DTI ratio. You can slide the bar up to an aggressive 50% DTI ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

Recommended Reading: How To Calculate Mortgage Loan

How Much Mortgage Can I Get If I Earn 30000 A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Can you buy a house making 40k a year?

What kind of house can I afford making 50k a year?

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

The House You Can Afford Versus The House You’re Approved To Buy

You may run the numbers and determine you can afford a certain home and mortgage based on what your monthly payments will look like. But that doesn’t mean you’re guaranteed to get approved for the full mortgage amount you’re after.

Going back to our example, say you want to buy a $250,000 home and have $50,000 on hand for a down payment. Your lender, based on your income and other factors, may only approve you to borrow $180,000.

If you don’t have another $20,000 to put toward that home, it may not be an option. In that case, you’d either have to look for a less expensive home or postpone your plans to buy until you’re able to save up more money to put down at closing.

It’s a good idea to get pre-approved for a mortgage before you start looking at homes. You might run the numbers and determine you can afford a home of a certain amount, only to then not get approved to borrow what you need. If you start with a pre-approval letter, you’ll see what loan amount you’re eligible to take out and can work around that number when searching for homes.

Also Check: How Much Money Should Go To Mortgage

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

How Do Buyers Pay For A House

Some buyers take money out of their retirement savings. Others liquidate other investment accounts and various assets like other property or use cash savings. Buyers also turn to relatives to help gather the amount needed to cover the purchase price. Once you have enough cash, you purchase the home .

Don’t Miss: What Is A Fixed Mortgage Rate For 30 Years

Your Maximum Monthly Debt Payments

Finally, your total debt payments, including your housing, auto, or student loan, and credit cards, should not exceed 40% of your gross monthly income.

In the above example, the couple with an $80k income could not have total monthly debt payments exceeding $2,667. If, say, they paid $500 per month in other debt , their monthly mortgage payment would be capped at $2,167.

This rule means that if you have a big car payment or a lot of credit card debt, you wont be able to afford as much in mortgage payments. In many cases, banks wont approve a mortgage until you reduce or eliminate some or all other debt.

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

Also Check: What Are Mortgage Rates Going To Do Tomorrow

Can You Refinance A House You Paid Cash For

If you want to take out a mortgage on a paid-off home, you can do so with a cash-out refinance. This option allows you to refinance the same way you would if you had a mortgage. When refinancing a paid-off home, youll decide how much you want to borrow, up to the loan limit your lender allows.

Do I need a solicitor to buy a house cash?

As a cash buyer, you will still have to instruct a conveyancer to handle the legal aspects of the sale and you will still have to liaise with the sellers solicitor. However, you wont have to apply for a mortgage in principle or be put through a variety of checks by a lender.

Commercial Property Loan Rates

Commercial property loan rates are typically higher than residential loan rates, but vary depending on the type of commercial property and the lender. Factors that affect commercial loan rates include the loan amount, the loan-to-value ratio, the type of property, the occupancy rate, the location of the property, the creditworthiness of the borrower, and the lenders policies.

Interest rates below should be considered indicative of properties in primary markets with excellent LTVs and DSCRs, as well as a strong and experienced sponsor. Interest rates listed below may not always be the same as the actual interest rates. Borrowers must meet certain requirements in order to participate in the Private Banking relationship program. Principals must have at least $3 million in liquid assets and at least $10 million in net worth. Commercial Insurance Rates: The majority of insurance companies prefer newer, high-quality properties with low leverage in major markets and highly experienced investors, according to the Life Company/LifeCo. A bridge loan is a type of loan that is used for light renovation and/or stabilization of investment properties. The interest rate is typically determined by a lender, property type, market, and loan product.

Also Check: What Is Considered A High Balance Mortgage Loan

Read Also: Can You Get A Mortgage With No Job

Interest And Partial Principal

In the U.S. a partial amortization or balloon loan is one where the amount of monthly payments due are calculated over a certain term, but the outstanding balance on the principal is due at some point short of that term. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed.

How To Use Our Borrowing Power Calculator

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity, or how much you would be eligible to take out on a home loan. If youre not sure, just put an estimate.

There are three parts to this calculator: Annual income, monthly expenses and loan details.

-

Annual income. The calculator will ask you to provide all your income streams including your net salary before tax, rental income, and any other regular sources of income.

-

Monthly expenses. Youll need to enter your overall day-to-day expenses, existing loan repayments and any other financial commitments such as insurance, additional superannuation contributions, and the combined limit of your credit cards and overdrafts.

-

Loan details. Lastly youll need to fill in the details of your loan including the interest rate and the loan term. Take note the calculator will estimate your borrowing power based on a fixed interest rate over a loan term.

Don’t Miss: Does Usaa Do Mortgage Loans

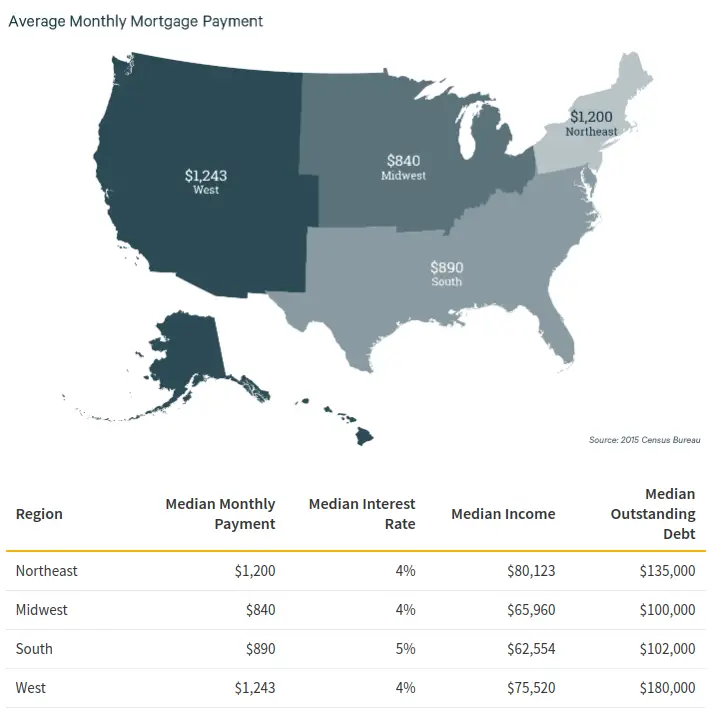

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

How Much House Can I Afford Based On My Salary

To find out if a house might be affordable for you, estimate your total housing expenses. Housing expenses include the principal and interest you pay on your mortgage. They also include mortgage insurance, property taxes, homeowners insurance and homeowners association fees, if you pay them.

Next, divide that number by your gross monthly income. For example, if youre thinking of a total monthly housing payment of $1,500 and your income before taxes and other deductions is $6,000, then $1,500 ÷ $6,000 = 0.25. We can convert that to a percentage: 0.25 x 100% = 25%. Since the result is less than 28%, the house in this example may be affordable.

In addition to deciding how much of your income will go toward housing, you should also consider how much a mortgage would add to your existing debts. You can then decide if youd be able to keep up with all of your debt payments, and if youd have enough room left over in your budget for food, healthcare and other spending categories.

You May Like: Why Does My Mortgage Loan Keep Getting Transferred

Tips For Buying A Home

In order to help ensure that you can afford your home and maintain it over time, there are some smart measures you can take. First, save up a cash reserve in excess of your down payment and keep it in reserve in case you lose your job or are unable to earn income. Having several months of mortgage payments in emergency savings lets you keep the house while looking for new work.

You should also look for ways to save on your mortgage payments. While a 15-year mortgage will cost you less over the loan’s life, a 30-year mortgage will feature lower monthly payments, which may make it easier to afford month-to-month. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

Finally, don’t buy a bigger house than you can afford. Do you really need that extra room or finished basement? Does it need to be in this particular neighborhood? If you are willing to compromise a bit on things like this, you can often score lower home prices.

The Rules Of Home Affordability

Mortgage lenders use something called qualification ratios to determine how much they will lend to a borrower. Although each lender uses slightly different ratios, most are within the same range. Some lenders will lend a bit more, some a bit less. We have taken average qualification ratios to come up with our three rules of home affordability.

You May Like: How Much Is The Average American Mortgage Payment

What Are My Options If The Result Is Less Than I Need

In this case, you may find that adjusting the loan term enables you to meet your requirements. Although it will mean repaying more in total over the course of your loan, the lower monthly repayments could help you to afford more than your initial result suggests.

Alternatively, you can experiment with different interest rates â to get the best options delivered directly to you, click the Get the FREE Quote button to get in touch with lenders who will be able to assist you.

Also Check: What Is Reverse Mortgage Meaning

Loan Term And Adjustable Vs Fixed Rate Mortgage

Loans with short terms usually have lower interest rates than loans that are paid off over a longer period of time.

An adjustable-rate mortgage might have a lower rate than a fixed-rate mortgage at first. But over time, the rate on an adjustable-rate mortgage could go up by a lot, while the rate on a fixed-rate mortgage would remain the same.

Recommended Reading: What Is A Mortgage Deposit

Personal Loan Calculator: See Your Payments On A Loan

Before you take out a personal loan, its important to consider how much it will cost you. You can use our personal loan calculator to estimate your future costs.

Taylor MedineUpdated March 28, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

If youre wondering how much you can borrow, use our personal loan calculator below to estimate how much youll pay for a loan. This will help you prepare to cover any unexpected expenses, tackle home improvements, or consolidate debt.

Enter your loan information to calculate how much you could pay

With a$ loan, you will pay$ monthly and a total of$ in interest over the life of your loan. You will pay a total of$ over the life of the loan.

Need a personal loan?

Also Check: Can You Do A 20 Year Mortgage

How To Use The Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be.

As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income.

So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

Also Check: How Much Per 1000 On Mortgage

Recommended Reading: How To Become Mortgage Loan Underwriter