What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

Which Is Right For Me

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow.

Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers. Again, a seller will be more likely to consider you a serious buyer because you have had your finances and creditworthiness verified.

Ready to prequalify, get preapproved or apply? Get started with the Digital Mortgage Experience.

Recommended Reading: What Is The Rate For A 15 Year Mortgage

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

How Much Mortgage Can I Get Approved For

Your loan potential is largely based on two basic financial components. How much you make and how much you already owe.

The industry term for this is debt-to-income ratio, or DTI. Its calculated by taking your total recurring monthly debt load and dividing it by your gross monthly income.

Say you make $5,000 a month in take-home pay and you spend $700 a month on rent $500 a month on an auto loan $200 a month on a student loan and $300 a month on credit cards.

You have $1,700 a month in debt compared to $5,000 in revenue, so your DTI is 34%. That could be troublesome if you replace the rent payment with a $1,000 mortgage payment. That would push your debt-to-income ratio up to 40%.

Most lenders want a clients DTI to not exceed 36%, so you could add only an $800-per-month mortgage and stay below the 36% DTI threshold.

That number is not written in stone, however. Credit scores also weigh heavily in the calculation, so its a good idea to check your credit reports beforehand to make sure they are accurate. Scores range from 300 to 850. The higher your score, the lower the interest rate will be on your loan. Knowing your credit profile and the lenders requirements will help you understand what kind of interest rate you qualify for.

Also Check: What Percent Down Payment To Avoid Mortgage Insurance

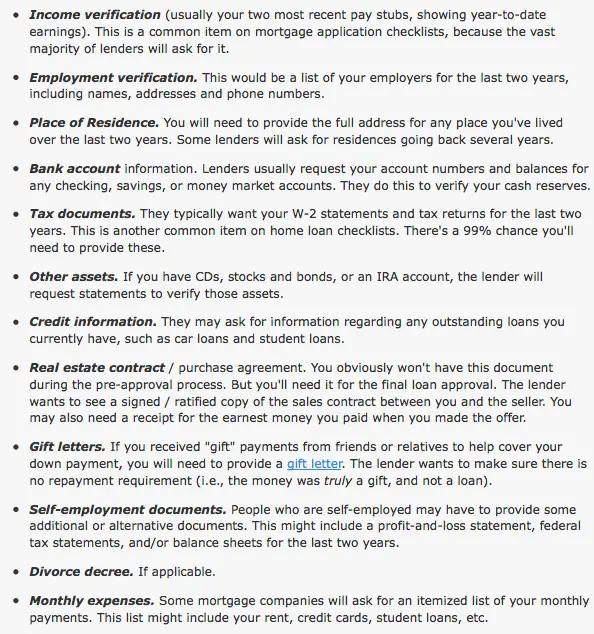

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Recommended Reading: How To Qualify For Zero Down Mortgage Loan

What You Need To Give The Lender For An Fha Loan

FHA loans are one of the most popular types of loan products out there. One of the most significant advantages of an FHA loan is the low 3.5 percent down payment.

Not every property qualifies for an FHA loan, especially when you are buying a condominium. It is essential to check if the complex you are buying at has been FHA approved. As mentioned in the reference, there are also condition requirements for a house to be eligible.

Mortgage documents required for a Federal Housing Administration loan include:

- Identification

- A valid drivers license

- A passport

- An official state or federal ID

Final Thoughts On What A Lender Needs From A Borrower

Hopefully, all the documentation needed to get a pre-approval from a lender has been helpful. Getting a mortgage is a big step in the home buying process. Getting yourself organized well in advance is one of the things I recommend doing before buying a home. Those who are well prepared have less stress and an easier time buying a house.

Once you have your pre-approval, youll want to make sure you dont do anything that will get your mortgage approval taken away, like buying a new car. Many buyers do not realize how much purchasing a car while buying a home can impact their finances.

After being in the real estate business for thirty-plus years, I have seen a few people make this mortgage mistake. Dont be one of them!

Hopefully, you have found this information helpful on what you need to give a lender to get mortgage approval.

Additional Helpful Home Buying and Selling Resources

- Things a buyers agent does for you see an extensive review of why hiring a buyers agent to represent your best interests makes so much sense. A buyers agent is your trusted advisor throughout a real estate transaction.

- First-time buyer tips from numerous real estate pros see a comprehensive guide to buying your first home with twenty-five exceptional tips from real estate pros across the country.

- How to make your garage look awesome get some great tips to organize your garage and make it the envy of the neighborhood.

Don’t Miss: Is It Good To Pay Off Mortgage

Down Payment Gift Letters

Lenders will want to talk about your down payment. Youll need to show the sources of the money you plan to use. If your funds include gifts, youll need to get letters from your donors showing they dont expect to be paid back. Gift letters arent required for pre-approval but we do let borrowers know to be prepared, Kush says.

Whew. Youre done for now. Keep those files handy, though. Youll need these documents again when applying for the loan.

Article Source: NerdWallet

*The views, articles, postings and other information listed on this website are personal and do not necessarily represent the opinion or the position of Big Valley Mortgage.

Tax Returns From Previous Two Years

To verify the consistency of your income and employment, banks need to see copies of your tax returns from the previous two years. This applies whether youre self-employed or an employee.

Many mortgage programs require at least 24 months of consecutive income.

Ideally:

You should remain with the same employer during this two-year period.

If you switch jobs, a lender might still approve your mortgage, as long as youve worked in the same field for two consecutive years.

Make copies of your returns and forward this information to your mortgage lender.

Getting old tax returns

If you dont have your returns, contact your tax preparer to get a client copy.

If this isnt an option, contact the Internal Revenue Service to get your tax return transcript. This will have most line items from your originally filed tax return. Or if you need an actual copy of your tax return, request one from the IRS for a $50 fee.

It can take up to 30 days to receive a tax transcript, and up to 75 days to receive a copy of your actual tax return.

Recommended Reading: Can You Consolidate Your Debt Into Your Mortgage

How The Mortgage Preapproval Process Works

There are five basic steps in the mortgage preapproval process.

Documents You Need For Mortgage Pre

Getting pre-approved for a mortgage is a smart step before you go out looking for a home. A pre-approval letter shows sellers that you have already proven to a lender that you have the income and down payment to qualify for a mortgage loan. This allows sellers to take you seriously, especially in a hot sellers market. Pre-approval can be quick and painless, if you have the right documents lined up. While each lender may require slightly different paperwork, there are at least 4 documents that almost all lenders will need.

If you have questions about a Mortgage Pre-approval â give us at USA Mortgage Network, Inc. a call today at 413-737-1100.

Recommended Reading: Is Mr Cooper A Legitimate Mortgage Company

The Canadian Mortgage Stress Test And Pre

Since 2018, Canadians have had to undergo a stress-test to qualify for a mortgage. As houses have gotten more expensive, the government was concerned that Canadians were taking on bigger mortgages than they could afford and that if interest rates were to rise, then Canadians would no longer be able to afford their mortgage.

Federally regulated lenders need to make sure that your income will not only support your mortgage payments at the current interest rate, but also if rates rise. If your down payment is 20% or more, your qualification depends on if you can afford your mortgage payments at your mortgage contract rate plus 2%, or at the Bank of Canada’s current five-year benchmark rate, whichever is higher . If your down payment is less than 20% your qualification depends on if you can afford your mortgage payments at your mortgage contract rate or the Bank of Canadas current five-year benchmark rate, whichever is greater. This is a strict standard, but it helps to have this built-in cushion.

Ultimately getting that letter that you’ve been pre-approved for a mortgage is an exciting one. Now you can move on to the next phase of your home-buying journey and start looking seriously at properties, with a clear idea of how much you can afford.

What Factors Lenders Consider When Granting Your Mortgage Preapproval

Lenders scrutinize all of your financial decision-making, from how youve managed credit to how stable your income is. Heres a brief overview of the most important mortgage preapproval factors:

- Your credit score. Your credit score will make or break a mortgage preapproval. Some loan programs permit scores as low as 500, but the road to preapproval will be very bumpy, and youll pay a higher rate. The gold standard is 740 for the lowest rate taking these simple steps can help give you a boost before you apply:

- Pay everything on time. Recent late payments will knock your score down faster than any other credit action.

- Keep your credit balances low. Although its best to pay balances off to zero, try to keep your credit charges at or below 30% of the total amount you can borrow. For example, if you have $10,000 worth of credit, dont charge more than $3,000 in any given time period.

Also Check: How Do I Get A Mortgage Credit Certificate

Review Your Financial Situation

Before you apply for preapproval, it’s a good idea to assess your current financial situation.

Pull your credit report: Under normal circumstances, you’re entitled to one free report from each bureau every 12 months, but you can now get a free credit report every week through April 2021. Review your credit history to make sure everything is accurate you can reach out to lenders and the credit bureaus to make corrections if need be.

Calculate your debt-to-income ratio: A key factor in getting prequalified for a mortgage, your DTI ratio represents your total monthly debt payments as a percentage of your monthly income. Most lenders won’t offer a loan that will put your DTI above 43%. So, if you currently have an auto payment of $300, monthly minimum credit card payments of $65 and a monthly income of $5,000, your lender will only approve you for a mortgage with a monthly payment of $1,785.

For Landlords And Investors

If you rent out an investment property, your tenants rent payments can count toward your income. This can help you qualify for the new mortgage.

For documentation, youll need to provide a current lease that shows the rent amount.

Credibles pre-approval process is quicker than most it takes just a few minutes and can help you compare prequalified rates from all of our partner lenders conveniently online.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Learn More: 10 Ways to Pay Off Debt Fast

Recommended Reading: How To Get A Mortgage With Bad Credit