Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas marketplaces for mortgage rates and mortgage refinance rates as well as our latest state-specific guides.

How Long Does It Take To Get Approved For A Mortgage

Terri Williams is an expert in mortgages, real estate, and home buying. As a journalist she’s covered the “homes” corner of personal finance for more than a decade, with bylines in scores of publications, including Realtor.com, Bob Vila, Yahoo, Time/Next Advisor, The San Francisco Chronicle, Real Homes, and Apartment Therapy.

FG Trade / Getty Images

Buying a home is an exciting and memorable time for most people. However, the actual mortgage approval process can quickly dampen the mood, and it often proves to be quite stressful for anxious buyers. But there are things you can do to actually speed up the timelineor at least not delay it.

Well look at the mortgage approval process to help you better understand the process and how you can work to move it along

How Long Does It Take Between A Mortgage Valuation And An Offer

Normally it will take one to two weeks for the mortgage lender to send a formal offer. You could find the process is completed in only two days, assuming your documentation is well organised, the survey was completed quickly, and your credit score is good. But it can and can take four weeks or longer if the lender needs to chase you for missing information.

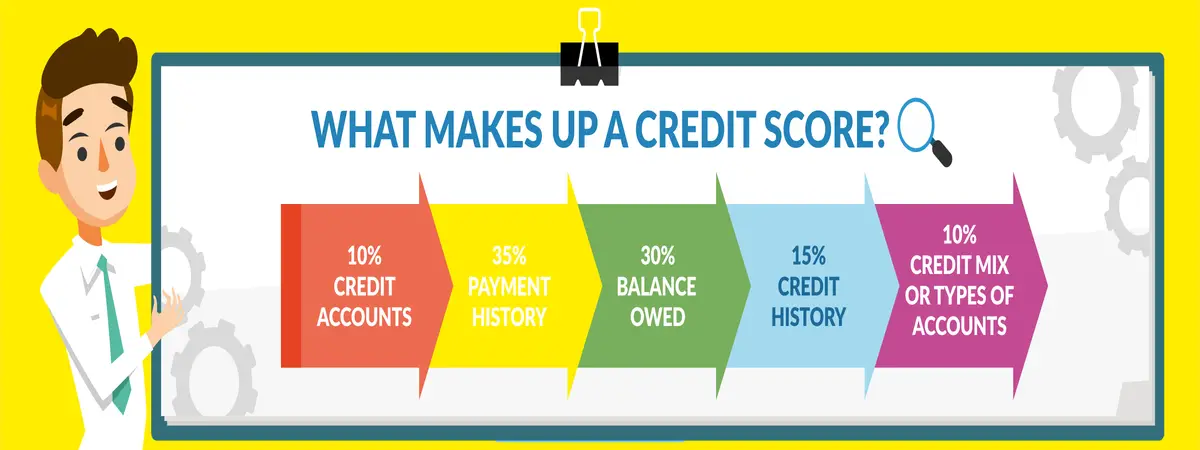

You May Like: Does Shopping For A Mortgage Hurt Your Credit Score

How Long Does A Mortgage Preapproval Take

Some lenders offer same-day mortgage preapprovals that include electronic verification of your employment, credit and assets. Others may take several days, depending on how complicated your financial situation is. Ask lenders upfront what their timelines are. Expect a longer wait if you have credit bumps or are self-employed.

How Far In Advance Should I Get Pre

The best time to get pre-approved for a mortgage is at least one year before you decide to purchase.

As a home buyer, pre-approvals are for your benefit, so its never too early to get one.

Getting pre-approved early is an advantage because one-third of mortgage applications contain an error. These errors can negatively affect your interest rate and ability to buy a home. Pre-approvals uncover those mistakes and give you time to fix them.

Getting pre-approved also sets your price range. Pre-approved buyers are less likely to overspend or underspend! on their residence as compared to buyers who use online mortgage calculators.

Learn more about getting pre-approved before looking for a home.

Recommended Reading: What Is Amortization Schedule Mortgage

Get Some Help How Long Does Mortgage Approval Take Ireland 2022

So you have 6 months of sparkling clean bank statements and you are sick of living on your mates couch, what do you do next?

You have two choices to kick start the application process.

Which lender you apply to can make a huge difference to your approval chances and what you will pay over the course of the mortgage. Thats why we recommend using a broker for your application.

A broker can look at your situation and match you with the best lender to maximise your approval chances and minimise your repayments. Brokers are often free to use and are impartial as they get paid the same commission 1% of the mortgage value by all the lenders.

Not all brokers are created equal though. Check out if your broker has:

- Access to the best lenders for rate Avant Money, ICS, Haven and Finance Ireland

- No fees or low fees for your type of application

- An online application process to make the paperwork easier

- A best rate guarantee

Can You Be Denied A Loan After Pre

In some cases, yes. While pre-approval is an indication youâre a good candidate for a loan at the time of application, that can change. Inevitably, some time will pass between the issuance of your pre-approval letter and when the loan underwriter begins to process your loan application, and there are several events that could result in a denied application, if they happened after pre-approval.

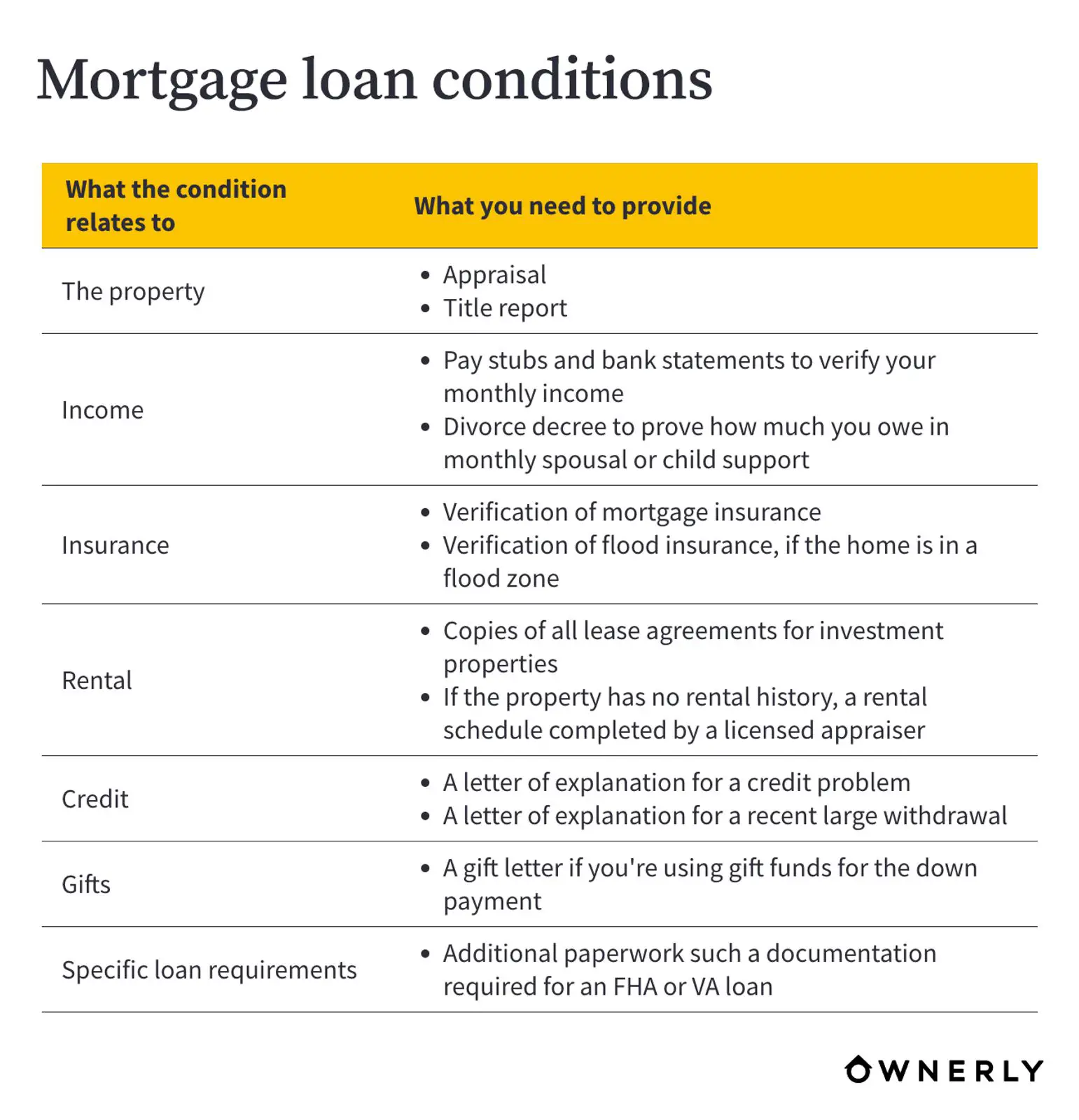

If you changed jobs, youâll likely have to reconfirm your income and employment before a loan is approved. If youâve opened new credit card accounts recently, or stopped servicing your debts, that could result in a lower credit score, which could derail your loan. Similarly, any large cash withdrawals that significantly draw down your cash reserves could adversely affect your application.

Read Also: How Long Until Refinance Mortgage

What Is Mortgage Underwriting

You may have heard the term before, but what does underwriting mean exactly? Mortgage underwriting is what happens behind the scenes once you submit your application. Its the process a lender uses to take an in-depth look at your credit and financial background to determine if youre eligible for a loan.

Here are the steps in the mortgage underwriting process and what you can expect.

Work Out How Much You Can Borrow How Long Does Mortgage Approval Take Ireland 2022

The first step is to work out how much mortgage you can get, you might not need to borrow up to your limit, but it will help you to understand your maximum budget in case you find yourself in a bidding war for your new gaff.

To help avoid a credit bubble like the one that went pop back in 2008 the Central Bank sets some absolute maximum limits that no lender can go beyond.

If you are buying your home to live in, the limit is the lower of either

- Income 4.5 times your joint gross income per year

- Deposit 10 times your deposit

Wait a minute before you rush off and bid on that dream home, the Central Bank only allows 20% of all borrowers in any year borrow up to these limits.

The lenders are therefore very picky about who gets these exceptions only putting forward people with squeaky clean credit histories and very high levels of disposable income.

If you fall outside the top 20% of applications then the limits are

- Income 3.5 times your joint gross income per year

- Deposit 10 times your deposit for first time buyers and 5 time for others

As part of the application process the lenders will also run the rule over your ability to repay the loan. Based on this they may lend you less than the limits above or indeed nothing at all.

Also Check: What Does Mortgage Insurance Do

When Should You Get A Mortgage Preapproval

You should get a mortgage preapproval if youre serious about looking for and making an offer on a home within the next two months. Preapproval letters are good for 30 to 60 days, according to the Consumer Financial Protection Bureau .

If it takes you longer than a month or two to find a home, the lender may need to update your preapproval with more recent pay stubs and bank statements. If your house hunt takes more than 90 days, the lender may also need to pull a new credit report, which may impact your credit score.

Can You Get Pre

Absolutely. When itâs time to get a pre-approval letter, itâs in your best interests to shop around among multiple lenders. Different loans can offer dramatically different terms and rates, so make sure to survey all the possibilities before you commit to one. Working with multiple lenders will also give you an idea of what it feels like to work with each institution, so you can find the right culture fit.

Better yet, if multiple lenders are competing for your business, they may offer you incentives like waived application fees, better rates, or other perks.

Also Check: Which Credit Score Is Used For Mortgage Loans

How Can I Get Preapproved Faster

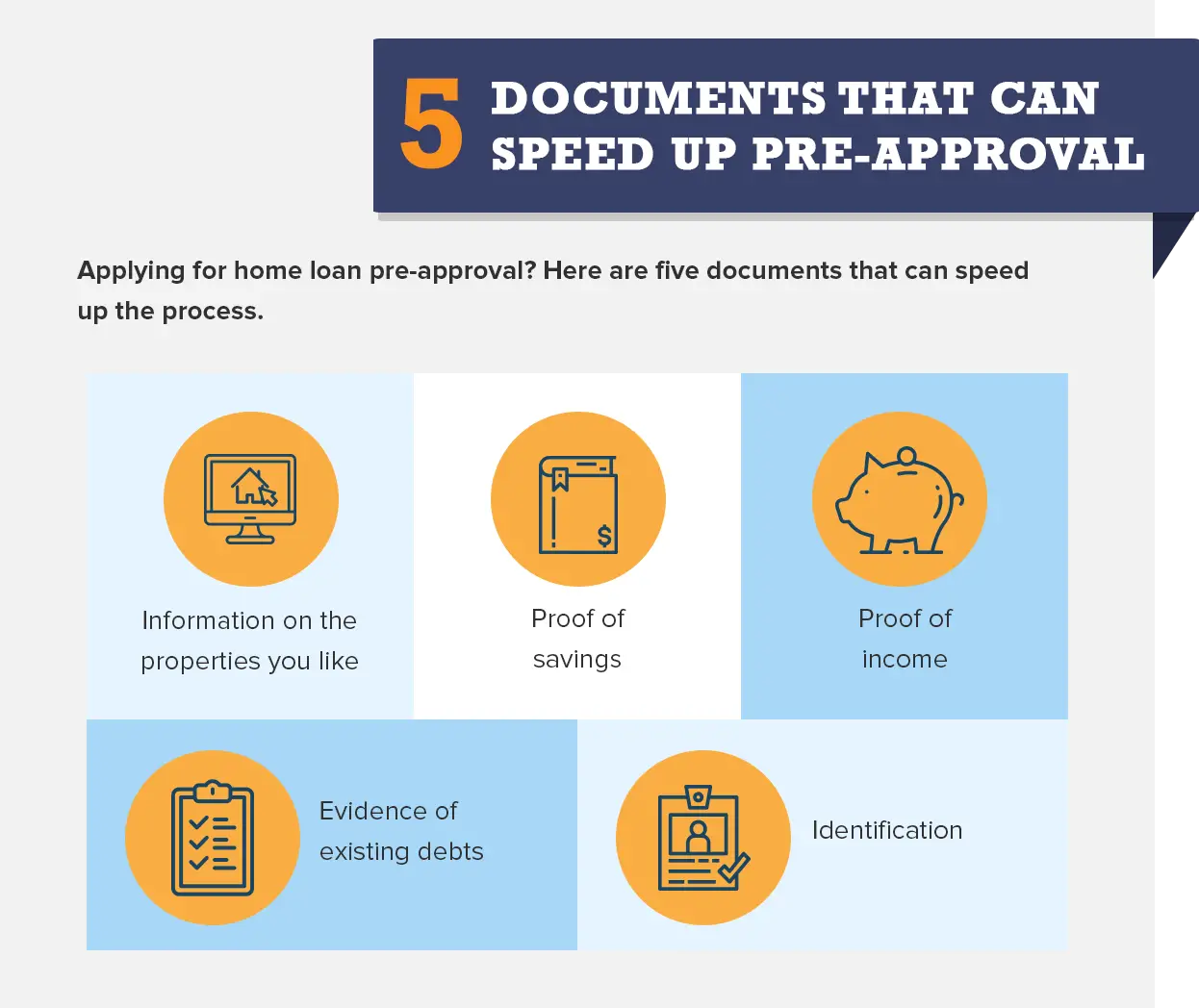

The best way to get preapproved faster is to gather your documents and keep them together in a physical folder or a folder on your computer . This will help when it is time to submit your documents to your lender and you are not left scrambling to find your tax returns. Its equally important to keep your documentation updated. For example, make sure you are saving your latest two months of pay stubs and bank statements as they become available to you. If you have to submit tax returns, make sure you have them uploaded and ready to go.

While it may seem like a hassle, especially if youre looking at homes but arent necessarily in a hurry to buy, getting underwritten preapproval can help the actual approval move a little faster once you make an offer and the seller accepts.

What Is Mortgage Preapproval

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check. If youre preapproved, youll receive a preapproval letter, which is an offer to lend you a specific amount, good for 90 days.

Read Also: Can You Wrap Closing Costs Into Mortgage

Get Preapproved And Start House Shopping

If youve been gearing up to start your home search, preapproval is a necessary step. It not only gives you the best idea of how much you can afford, but it also could improve your chances of acceptance when you do find the right place and make an offer.

Well leave you with a few final tips to make the preapproval process move faster:

- Know what documents youll need depending on your unique situation

- Gather all of the documents you need and keep them together in a file folder or saved on your computer

- Check with multiple lenders to compare rates and terms

- When applying with multiple lenders, do so in a short time frame to avoid negative impacts to your credit score

And when youre ready to start looking for your new home, partnering with a top agent can make the process go more smoothly.

Header Image Source:

What To Do If Your Pre

If your pre-approval is about to expire, that doesnt mean you have to apply from scratch all over again. Just prepare to provide updated financial statements to your lender to prove theres been no change to your income, debts, or credit scores.

Since pre-approvals do have a shelf life, its generally best to not get it until youre seriously looking for a home. If youre just window shopping, it may not be worth the trouble unless you want to know what price house you can afford.

Read Also: Should I Have A Mortgage In Retirement

What Are Todays Mortgage Rates

The faster you can close on a mortgage, the lower your mortgage interest rate can be. Know the steps in the home buying process, and where you cut time and corners to get to closing quicker.

Get started on your mortgage application as soon as possible to have better chances of a fast home loan closing.

How Long Does It Take To Exchange Contracts

Once your solicitor has received the offer from your lender, you should be able to exchange contracts with them in around 2 months.

During the mortgage application period, your solicitor will have been executing the conveyancing process. This involves tasks such as applying to your local authority, for a market search, which takes around 1 month on average, although can take longer depending on how busy your local authorities property and the land department is.

Other tasks your solicitor will have been doing include communicating with the sellers solicitors and asking relevant and important questions.

Once all of the above tasks have been taken care of, your solicitor will book a meeting with you for a pre-exchange meeting, where you can ask questions and raise any issues. If you are happy, they will then arrange a convenient time for a final competition date.

Read Also: Can You Buy Two Properties With One Mortgage

How Long Does It Take To Get Pre

Getting pre-approved for a mortgage can be a stressful, complicated process involving stacks of personal documents and unforgiving loan underwriters. However, there are ways to make this process faster, easier, and less stressful.

If youâre looking to buy in a hot market, you can bet that youâll face plenty of competition. In dense, popular cities like Washington, D.C. or San Francisco, where supply is low, demand is high, and prices rise seemingly by the hour, bidding wars are common. So how do you maximize your chances of getting your dream home?

Pre-approval for a mortgage is one of the best ways to show sellers youâre a serious, qualified buyer, and that you could quickly and smoothly close on a sale. Thatâs because pre-approval is the product of a careful, exhaustive investigation into your finances by your lender, and represents a firm promise on the lenderâs part to issue you a mortgage. A pre-approval letter is essentially a guarantee.

Pre-qualification is simply an estimate of how much of a loan you might qualify for, based on self-reported financial information. For that reason, sellers take pre-approval much more seriously than pre-qualification.

But because itâs the product of a long process, pre-approval isnât an instant, snap-of-a-finger process. In this post, weâll go into detail on how long pre-approval can take, and why.

How Long Does It Take To Complete

Once you have exchanged contracts, your solicitor will organise the completion date with the sellers solicitor, which will be between seven and 28 days later although it is typically set two weeks after the exchange date. As this needs to be coordinated with the other people in the chain, it can be hard to speed up this part of the process. Still, it gives you time to pack, book a removal company and prepare for the move.

While Friday is a popular completion day, financial hold-ups can leave you stuck for a whole weekend while you wait for the banks to reopen on Monday. For this reason, it is worth choosing to complete the sale on a Monday or Tuesday so that you can tackle any problems straight away.

Also Check: How Much Mortgage Can I Qualify For

The Bottom Line: When It Comes To Mortgage Underwriting No News Is Good News

Once youve submitted your mortgage application, your part isnt finished. Although its the underwriters job to look at all the documentation youve provided and come to a decision about your loan eligibility, you can help ensure the process moves along as quickly as possible by being prepared to answer questions and provide additional information as soon as your lender asks for it.

Buying a house and the process of underwriting take time. The best way to get to the closing table sooner is to get preapproved before you start the home buying journey.

Ready to take the first step? Apply online today and start looking for your next home.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

What Is A Verified Approval Letter

At Rocket Mortgage®, we take your approval application very seriously. During our Verified Approval process1, well pull your credit and ask for documentation verifying your income and assets, including your W-2s, income tax returns, pay stubs and statements for any accounts you want to use as assets.

Because we take the time to verify the information you provide, our Verified Approval Letter is a strong indication that a borrower who has been approved will close on the mortgage. This Verified Approval Letter will separate you from the rest of the mortgage-seeking pack. In fact, if your application doesnt lead to a closing, well pay you $1,000.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Also Check: Are Mortgage Rates Higher For Townhomes

How Long Does Underwriting Take For A Conventional Loan

A conventional loan is a mortgage that isnt backed by a government agency. When you apply for a conventional loan, the underwriter will ensure that the loan meets the lenders standards for their loans as well as the standards of the investors they sell their mortgages to, such as Fannie Mae or Freddie Mac.

According to Ellie Maes most recent data, conventional loans take an average of 51 days to close 49 days on average for a purchase transaction and 51 days for a refinance. As weve mentioned, the underwriting part of this could take anywhere from a few days to a few weeks.

Closing Timeline If You Havent Found A House Yet

Closing on a house takes time. Exactly how much time depends on your starting point.

- If you havent yet found your dream home, you could spend a month or two just visiting houses with a real estate agent

- Once you find the house, it could take one to five days to make an offer, have the seller look at your offer, negotiate, and come to an agreement on price and other aspects of the real estate transaction

- At this point, you can make a full application for your home loan and get final approval for the specific home youre buying

You can speed up this process by getting a mortgage preapproval as soon as you start looking at homes. Dont let that 30 to 60 days go to waste.

Getting preapproval means the lender gives a thumbs-up to all aspects of your home loan besides the property. Once you have an accepted offer, your lender already has a serious head start on your final approval.

Recommended Reading: Can You Add Debt To Your Mortgage