How Can I Improve My Score

If you need to get a home loan, you could benefit from boosting your credit score. Here are some tips to improve your credit score that could help you.

-

Pay every bill on time. This will prevent late or missed payments from appearing on your credit file and prevent you from being hit with fees and charges.

-

Register on the electoral roll to confirm your identity and home address.

-

Minimise your credit applications. Each time you apply for loans or credit cards, the lender will record a hard search on your file. This could cause your score to drop as you may appear to be too reliant on getting credit.

-

Stay within your credit limit. Wherever possible, keep the balance of your loans and cards at 25% of the limit or under.

-

Regularly check your Experian credit file to ensure all the details are up to date and accurate. Even small changes such as how your address is recorded could negatively affect your credit rating. If you spot anything which requires correction, contact the lender and ask for an amendment to be made. Alternatively, CRAs like Experian can contact your lenders on your behalf to ask them to do this.

What Happens If I Have A Bad Credit File

It is still technically possible to get a specialist mortgage for bad credit. However, it’s a lot harder to get your mortgage application accepted by a lender. It’ll also probably mean you have a higher interest rate and will be required to pay a bigger deposit on your house.

Many people have had credit issues in their past, which have led to a bad credit profile. For example, they could have defaulted on a loan, failed to pay credit card payments on time, or could have struggled with other financial problems.

Other people are simply in circumstances that look unattractive on their credit profile. For example, they may be self-employed, are not on the electoral register, have a lower income, or have only recently moved to the UK. They may even simply have minimal credit in their history, for example, if they’ve never taken out loans or credit cards before.

Lenders need to get information about your ability to manage your income and finances effectively. They need to be certain when approving mortgages that those they give home loans to aren’t going to miss their monthly mortgage payments and get into excess debt.

It’s therefore important to show them that you’re able to pay your credit card and loans regularly, manage your mobile phone contract responsibly and even handle payments to some utility services to increase your score enough to be approved for a mortgage.

Minimum Credit Score Needed For An Insured Mortgage

On July 1, 2020, Canada Mortgage and Housing Corporation increased the minimum credit score requirement on insured mortgages from 600 to 680. This represented a significant jump, and the response from industry experts was mixed. Many felt that the new benchmark was too restrictive and would result in too many Canadians not entering the housing market.

CMHC’s minimum score applies to at least one borrower on a mortgage. This makes the situation a bit more flexible for couples, as only one borrower needs to exceed the 680 threshold.

Read Also: Is It Worth It To Refinance To 15 Year Mortgage

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

There Should Be No Bankruptcies Consumer Proposals Or Excessive Derogatory Items On Your Credit Report

A derogatory item is a late payment, a missed payment, or a payment that was not enough. While you can still get approved for a mortgage with an old bankruptcy, derogatory item, or consumer proposal on your credit report, you will find it much more difficult and the interest rates you have access to wont be very good.

You May Like: How Much Does A 200 000 Mortgage Cost Per Month

What Lenders Like To See

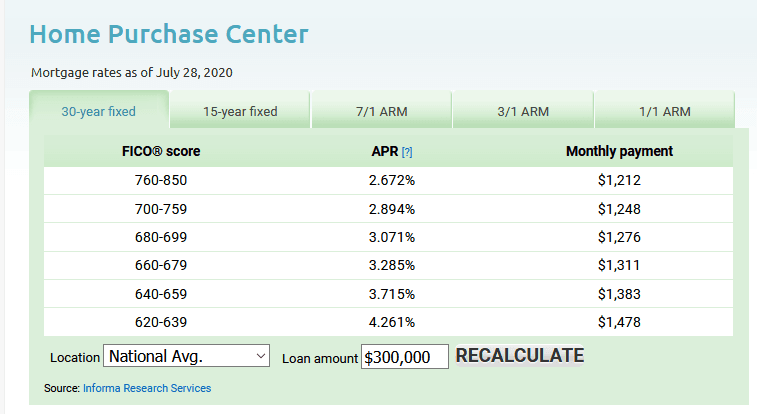

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

Fico Score Vs Credit Score

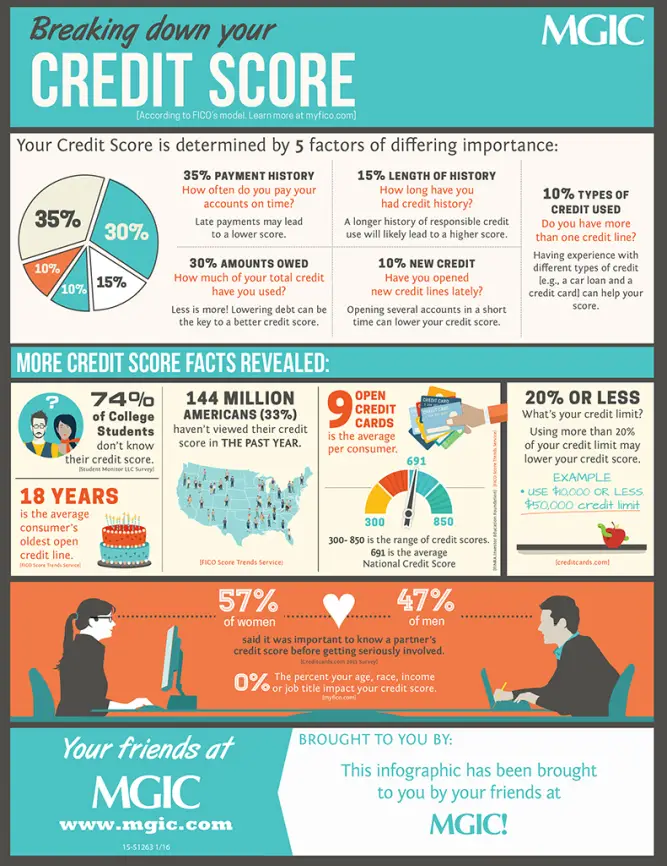

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

Recommended Reading: What Does It Mean To Take Out A Mortgage

What Can Your Experian Credit Score Tell You

The credit score you need to get a mortgage varies, as thereâs no one credit score or universal âmagic numberâ. However, if you have a good credit score from one of the main such as Experian, you are likely to have a good credit score with your lender. Checking your Experian Credit Score before you apply for a mortgage can give you an idea of how lenders may see you, based on information in your Experian Credit Report. It can also help you work out if you need to improve your credit history before making your mortgage application.

What Credit Reference Agencies Do Mortgage Lenders Use

The credit reference agencies that the majority of mortgage lenders use are:

- Experian

- Equifax

- TransUnion

Lenders may just use one or a combination of credit reference agencies to make their assessment. Its important to check each credit report, as they could vary. This is because credit agencies each use different scoring systems.

Don’t Miss: How Big A Mortgage Can I Get

Home Loan For Australians With Below Average Credit Score

In Australia, bad credit home loans are offered by non-conforming Home Loan lenders. In this type of special loan, all circumstances are considered, and applications are evaluated on a case to case basis. These loan providers are generally helping people with a bad credit rating with another chance to gain control of their finances.

In fact, industry statistics indicate borrowers who have successfully applied for bad credit home loans have lower default rates compared to borrowers with clear credit.

Express Mortgage Market is a bad credit expert who can consider most non-conforming loan scenarios, whether for refinancing or purchase.

For inquiries, call Express Mortgage Market on 1300 663 997 or send email to

Even With A High Enough Credit Score For A Mortgage You Might Have To Prove The Source Of Your Down

You should have a record of where your down payment came from if you can’t prove you’ve had the money for more than three months. Lenders will want to ensure that you’re not borrowing your down payment, as that can impede your ability to pay your mortgage back. If youve saved your own down payment, your account records should be proof enough. If you’ve received your down payment as a gift from friends or family, they will need to write and sign a gift letter.

Also Check: How Do You Get A Cosigner Off A Mortgage

What Credit Score Do You Need To Get A Home Loan

Your credit score, also known as Equifax Score, is used by your potential lender to determine the risk of offering a loan to you. This is an automated rating system and based on your credit file as well as the information you have provided in your application.

It is not easy to determine the specific credit score you need to achieve to qualify for a home loan, mainly because most Australian lenders dont publish their credit criteria. Furthermore, most lenders dont depend solely on your credit score to assess your risk. Rather, they also use their own credit evaluation alongside your Equifax Score.

Even though there is no definitive range to surely qualify for a home loan, Equifax has benchmarks that you can use as reference so you have an idea if your score can make the cut.

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

- Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

- Debt-to-income ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

- Down payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think youre less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment makes your loan less risky for lenders.

- Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least 2 monthsof mortgage payments.

- Employment history: Lenders vary, but they usually like to see that youve worked at the same job, or in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

You May Like: What Determines The Interest Rate On A Mortgage

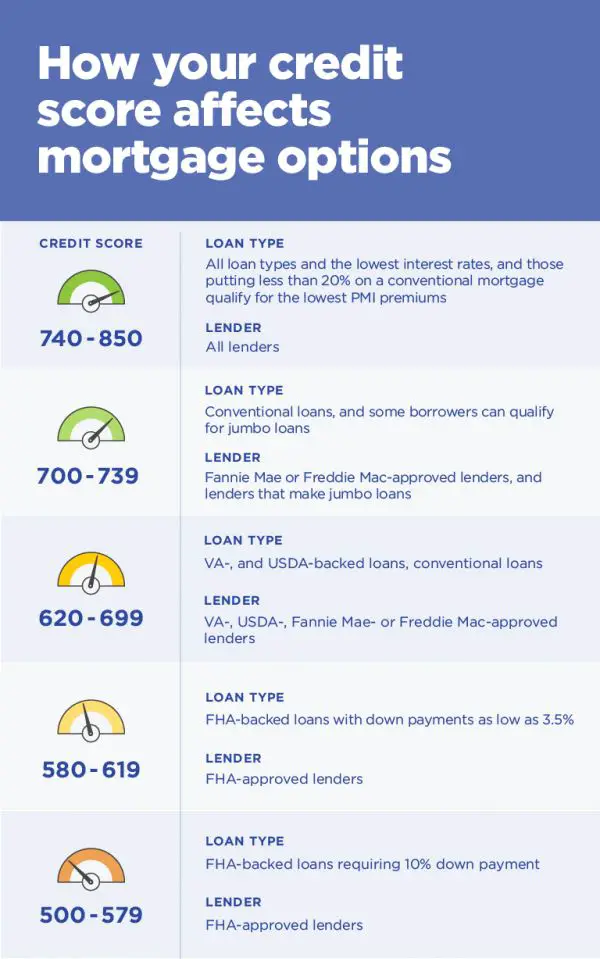

What Credit Score Do I Need For A Conventional Loan

Lenders issuing conventional mortgages have considerable leeway in determining credit score requirements for their applicants. Lenders may set credit score cutoffs differently according to local or regional market conditions, and they may also set credit score requirements in accordance with their business strategies. For example, some mortgage lenders may prefer to deal only with applicants with credit scores above 740considered very good or exceptional on the FICO® Score scale range of 300 to 850, while others may specialize in subprime mortgages aimed at applicants who have lower credit scores. Many lenders offer a catalog of mortgage products designed for applicants with a range of credit.

All that considered, the minimum FICO® Score required to qualify for a conventional mortgage is typically about 620.

What Is The Best Credit Score To Get A Home Loan

If youre asking yourself what should my credit score be to get a mortgage, then youre probably thinking about meeting the bare minimum requirements. However, the truth is that theres no real benchmark for how high of a credit score to get a mortgage.

You can get a mortgage even if your credit score isnt excellent. However, youll most likely pay higher interest rates or have to come up with a larger downpayment.

To give you an understanding of the best credit score for getting a mortgage in Canada, lets take a look at a few different credit scores and what they mean to lenders.

Recommended Reading: What Is Needed For A Mortgage Loan

What Credit Score Do I Need For A Loan With Better Mortgage

-

To qualify for a conventional loan with Better Mortgage, you need a credit score of 620 or above. The minimum credit score required to be eligible for a jumbo loan is 700. To see what types of loans you qualify for, complete a pre-approval from Better Mortgage. It takes as little as 3 minutes and wont impact your credit score.

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Better Real Estate, LLC dba BRE, Better Home Services, BRE Services, LLC and Better Real Estate is a licensed real estate brokerage and maintains its corporate headquarters at 3 World Trade Center, 175 Greenwich Street, 59th Floor, New York, NY 10007. A full listing of Better Real Estate, LLCs license numbers may be foundhere. Equal Housing Opportunity. All rights reserved.

Better Real Estate employs real estate agents and also maintains a nationwide network of partner brokerages and real estate agents . Better Real Estate Partner Agents work with Better Real Estate to provide high quality service outside the service area covered by Better Real Estate Agents or when Better Real Estate Agents experience excessive demand.

Better Cover is Registered in the U.S. Patent and Trademark Office

Make A Larger Down Payment

If you need another way to demonstrate your financial stability to lenders, consider making a larger down payment of 20% or more to show that you have a sizeable income and budgeting prowess. This will also help you reduce your monthly mortgage payments which will make them more manageable in the long-run and make you a more attractive borrower in the eyes of the lender.

You May Like: How To Pay 15 Year Mortgage Off Early

Can You Get A Mortgage With Low Credit

The minimum credit scores required to get approved for a mortgage mentioned above usually apply to conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

Thankfully, there are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

Bad Credit Mortgage Lender Risks

It should be noted that if you do plan to apply for a mortgage with one of these lenders with bad credit scores, you will likely pay a higher interest rate than you would if you had higher credit scores and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

How Can I Improve My Credit Score For A Mortgage

You can take certain steps to improve your credit score, such as:

- Ensure youre on the electoral roll

- Check your credit reports for inaccuracies or fraudulent activity

- Pay your bills on time, preferably on a monthly direct debit

- Check that your address history is correct, especially if youve moved recently

- If you have CCJs, make sure theyre satisfied

- Try not to depend on loans and overdrafts

- Dont apply with multiple mortgage lenders

Don’t Miss: Is Quicken Loans A Mortgage Broker

What Is A Credit Score

Your credit score or rating is essentially a picture of how reliable you are at borrowing money, in the eyes of a particular agency or lender. Your score is improved by positive actions, such as regularly paying off loans on time or using a credit card sensibly. Meanwhile its adversely affected by negative actions like missing payments and going over your agreed credit limit. So far, so obvious. However, none of us has a universal credit score, as each lender interprets our history slightly differently. Most use similar criteria to assess how good your credit history is, but what is considered a major negative by some might not be so harshly treated by others .

Can A Friend Cosign A Mortgage

To be eligible, a cosigner must have a family relationship with the primary borrower. This includes a parent, grandparent, sibling, aunt or uncle. But it can also be a family type relationship. This can include someone with whom you have a close, long-term relationship very similar to that of a family member.

You May Like: How To Sell A Private Mortgage Loan