Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability and how our calculator works, have a read of the information below.

What Does It Take

If youve seen or heard Bob, you already know income, down payment and credit are the key factors required to obtain a mortgage. But, did you know there are other factors, such as the Stress Test.

Lenders use qualifying rates to ensure borrowers can handle their payments if rates are higher on renewal. This allows a little breathing room so we can continue to enjoy the benefits of home ownership. The current qualifying rate is 4.94%.

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

Read Also: How To Find A Good Mortgage

The Differences Between The Popular Video Formats

Once youve finished creating your video you will then need to export it from the editing software that you have used. Exporting is the process of taking all the video clips, effects, images, color, music and edits, and creating a single video file that you can then upload to another platform.

You will need to select a video format to export the video in. This will depend on what you intend to do with the video. Ultimately, a video file format encompasses two separate components:

- codecs and

- containers .

If a video has already been exported into a different format than needed, you can use a video converter to convert it to the desired video format. Note though, that this can only affect the file size or downgrade the quality. You cant convert a video to have a higher video quality.

Weve rounded up some of the popular video formats and included which formats are best in different situations.

WebM

WebM format was first introduced by Google in 2010 as a royalty-free audiovisual media file format. It is based on Matroska and supports Vorbis audio.

The WebM format was initially designed for web as this format is supported in HTML5. It is supported on Firefox, Opera, Chrome and VLC Media Player. The containers within this format support VP8 and VP9 video.

If a platform doesnt support WebM, you can use a video converter to convert from WebM to MP4 which is a more widely used format.

Size: 2 MB

Dont Forget To Factor In Closing Costs

Alright, dont freak out here. But a down payment isnt the only cash youll need to save up to buy a home. There are also closing costs to consider.

On average, closing costs are about 34% of the purchase price of your home.1 Your lender and real estate agent buddies will let you know exactly how much your closing costs are so you can pay for them on closing day.

These costs cover important parts of the home-buying process, such as:

- Appraisal fees

- Attorneys

- Home insurance

Dont forget to factor your closing costs into your overall home-buying budget. For example, if youre purchasing a $200,000 home, multiply that by 4% and youll get an estimated closing cost of $8,000. Add that amount to your 20% down payment , and the total cash youll need to purchase your home is $48,000.

If you dont have the additional $8,000 for closing costs, youll either need to hold off on your home purchase until youve saved up the extra cash or youll have to shoot a little lower on your home price range.

Whatever you do, dont let the closing costs keep you from making the biggest down payment possible. The bigger the down payment, the less youll owe on your mortgage!

Read Also: How To Apply For A Home Mortgage

Look Closely At All Your Expenses

You’ve got to put food on the table, clothes on your back and gas in your car â and have a little fun now and then. You also need to be ready for emergencies.

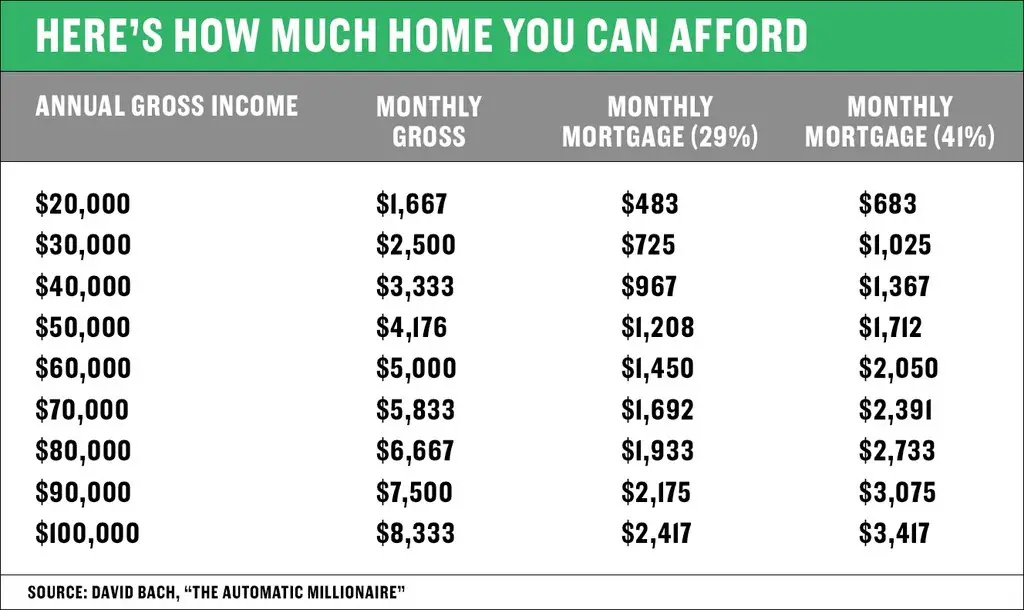

Your mortgage specialist will help you make sure you have money left over to pay for your day-to-day needs, as well as some of your lifestyle choices. Most lenders use the below ratios as guides to figure out the most you should spend on your housing costs and other debts:

If your monthly housing and housing-related costs don’t leave you enough money for your other expenses, you have a few options.

You and your mortgage specialist may also need to think about future expenses. Maybe you’ll need to replace your car within the next year. Or if you’re expecting a baby, child-related costs as well as parental leave may affect your budget.

Online Animated Gif Converter

Sometimes, you dont have the time to get to your own computer. If you still want to turn your video into an animated GIF, Img2Go has your back!

Since this animated GIF converter is an online service, you can access it from anywhere as long as you have an internet connection.

Plus, Img2Go is optimized for mobile usage! Thus, you can even use it from your smartphone, tablet, or someone elses computer.

Rate this tool4.3/ 5

You need to convert and download at least 1 file to provide feedback

Feedback sent

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

You May Like: What Is Aag Reverse Mortgage

Learn About Other Types Of Loans

Most of these guidelines are in relation to conventional loans, but you may qualify for another type of loan. There are a few mortgage programs that allow people with low credit scores or savings to still purchase a home. VA loans and FHA loans have less strict requirements than conventional loans, so its worthwhile to look into them if you dont think you will qualify for a conventional loan.

How Much Of Your Salary Goes To Your Mortgage

Aspiring homebuyers across the country are feeling the squeeze, with home prices in several Canadian markets seemingly out of reach for the average Canadian household. Still, many are scrimping and saving with the hopes of one day securing their place on the property ladder.

Seventy-one per cent of Canadians who donât currently own a home plan to purchase one in the near future, according to a Ratehub.ca survey of 2,000 people.

Young Canadians, in particular, are aspiring homeowners 81% of Millennials and 87% of Gen Z say they would like to buy a home.

Despite this desire, Canadians are having a tough time affording a home in some markets. Of those currently planning on getting onto the property ladder, 44% identify a lack of funds for a down payment as the primary barrier in their way.

According to the Canada Mortgage and Housing Corporation , housing is considered affordable if it costs less than 30% of a householdâs pre-tax income â that includes mortgage payments, utilities, and property taxes. And, according to a recent RBC poll, 39% of Canadians have struggled with affordability by spending 30-40% of their income on homeownership costs.

Recommended Reading: What Mortgage Rate With 650 Credit Score

How Much Of My Income Should Go Towards A Mortgage Payment

Most people dream of owning a home, whether its a small one in the city or a rural one with a huge property. However, affording a home is difficult and saving up enough money can be challenging. Obtaining a mortgage is a big step, and you likely have many questions. One important thing you will need to know is how much of a mortgage you can afford based on your income. You can use a few different guidelines to discover what percent of your net income should go toward mortgage payments each month.

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

You May Like: Does Rocket Mortgage Do Manufactured Homes

Convert Mp4 To Gif On Windows With Easeus Video Editor

All you need is the source video and EaseUS Video Editor, a user-friendly and professional video editing program that enables you to convert MOV to GIF, convert MP4 to MP3, and many more conversion. You can get high-quality GIF animation fast and export the files in 1080P.

Except for format conversion, this YouTube video editor also supports all the basic video editing functions. You can add subtitles to video, add texts/special effects/metadata/filters, crop, rotate, merge videos, and more. It still allows you to extract audio from video and save in MP3 and AAC.

The guide below explains how to convert MP4 to GIF step by step. You can also follow the instructions to transfer other video formats to GIF. Download EaseUS Video Editor for Windows and start creating GIFs right away!

Steps to convert MP4 to GIF on Windows in 1080P with EaseUS Video Editor:

Step 1. Importing Video File

After starting EaseUS Video Editor first thing to do is simply dragging the target file to the media library. You also can right-click on the file and left click import video to do the same thing.

Step 2. Add to Project

The next step is adding video files to the project. After adding source file to media, you can either left-click on Add to Project or you can drag and place it.

Step 3. Exporting the File

After adding a source to Project it will appear on the timeline. Then you can export the video file, it will direct you to another window.

Step 4. Save as GIF

The Annual Salary Rule

The ideal mortgage size should be no more than three times your annual salary, says Reyes.

So if you make $60,000 per year, you should think twice before taking out a mortgage that’s more than $180,000. However, if you have a partner, and your combined income is $120,000, you can comfortably increase your loan amount to $360,000.

That’s not to say you should always opt for the most expensive mortgage you can qualify for. If you settle on something below your max, you’ll have more wiggle room to put money into a savings account or pay for other costs like home renovations.

You May Like: How To Become A Mortgage Specialist

How Much House Can I Afford Based On My Salary

To calculate how much house you can afford, use the 25% rulenever spend more than 25% of your monthly take-home pay on monthly mortgage payments.

That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance and dont forget to consider homeowners association fees. Whoathose are a lot of variables!

But dont worry, our full-version mortgage calculator makes it super easy to calculate those numbers so you can preview what your monthly mortgage payment might be.

How To Qualify For A Bigger Mortgage

If you don’t qualify for the mortgage you need to buy your ideal home, there are ways to increase what you’re eligibility.

To start, work on improving your credit score. If you can qualify for a lower rate, it will allow you to buy in a higher price range.

For example: Say the maximum mortgage payment you can afford is $1,500. At a 5% rate, that’d give you a home buying budget of about $280,000. If you could qualify for a 3% rate instead, you’d get a loan of $356,000 – nearly $70,000 more.

You can also increase your income – either by taking on a side gig or putting in extra hours at work. Reducing your debts will also put you in a better position to get a bigger loan. The more income you’re able to free up each month, the more the lender will be willing to loan you.

Also Check: How Much Do Points Cost On Mortgage

These Rules Might Not Apply Depending On Where You Live

The “three times your salary” rule and the “less than 30% of your monthly income” rule are both helpful guidelines. But the amount you feel comfortable spending on your mortgage payments could differ depending on where you live and your other financial goals.

You should also consider what the market is like where you live, says Reyes. The “three times your salary” rule might not be realistic for people who live in areas with high cost of living.

If it seems like you might need to take out a bigger mortgage to afford to buy a home, Reyes recommends that you make sure you’re in good financial standing in other areas of your life. It’s important to have a significant emergency savings set aside to make up for the fact that your budget will be stretched a little thin. You should also have ample retirement savings and a separate stash of cash to cover your move-in and closing costs.

But bigger mortgages are not always desirable, explains Reyes. If your mortgage represents too big of a chunk of your income, a lender might charge higher interest rates and other fees to compensate for the higher risk you could default.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How To Become A Mortgage Broker In Massachusetts

Create An Mp4 To Gif Gui

PySimpleGUI is a cross-platform GUI framework that runs on Linux, Mac and Windows. It wraps Tkinter, wxPython, PyQt and several other GUI toolkits, giving them all a common interface.

When you installed PySimpleGUI earlier in this article, you installed the default version which wraps Tkinter.

Open up a new Python file and name it mp4_converter_gui.py. Then add this code to your file:

# mp4_converter_gui.pyimport cv2import globimport osimport shutilimport PySimpleGUI as sgfrom PIL import Imagefile_types = def convert_mp4_to_jpgs: video_capture = cv2.VideoCapture still_reading, image = video_capture.read frame_count = 0 if os.path.exists: # remove previous GIF frame files shutil.rmtree try: os.mkdir except IOError: sg.popup return while still_reading: cv2.imwrite # read next image still_reading, image = video_capture.read frame_count += 1def make_gif: images = glob.glob images.sort frames = frame_one = frames frame_one.savedef main: layout = , , , ] window = sg.Window while True: event, values = window.read mp4_path = values gif_path = values if event == "Exit" or event == sg.WIN_CLOSED: break if event in : if mp4_path and gif_path: convert_mp4_to_jpgs make_gif sg.popup window.closeif __name__ == "__main__": main

Pretty neat, eh?