What Happens If I Pay An Extra $1000 A Month On My Mortgage

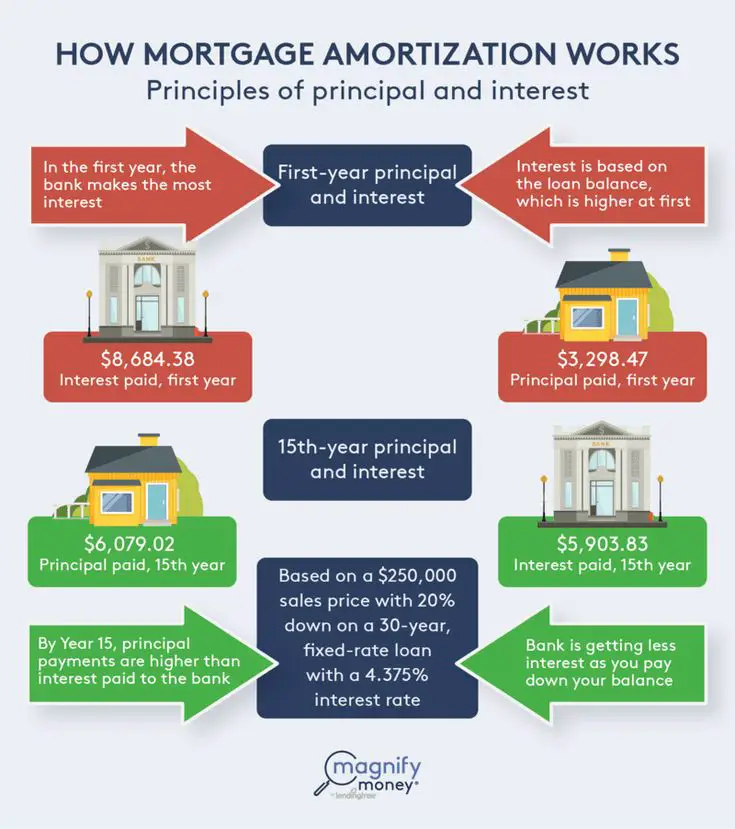

Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, itd shave nearly 12 and a half years off the loan term. The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

Mortgage Interest For Standard Rate And Term Refinances

First, lets talk about mortgage interest on a standard rate-and-term refinance. You can deduct any interest paid on your refinanced loan if all of the following conditions apply:

The loan is for your primary residence or a second home that you dont rent out. For second homes, you can rent out the property and still claim the deduction as long as you stay in the home for more than 14 days or more than 10% of the days when the property would otherwise be available for rent, whichever is longer.

The lender that finances your home has a lien on your property. This means that if you fall behind on your payments, your lender can seize your property or put your loan into foreclosure.

You itemize your tax return well go over more about what that means in a bit.

Do You Have To Deduct Mortgage Points When You Refinance

Mortgage points are also called discount points, a loan discount, a loan origination fee, and a maximum loan charge. If you want to pay your points as a part of a mortgage refinance, you have to deduct those points over the life of a loan. So when you refinance a 15-year mortgage, you divide those points down by 15, and that is what you can deduct.

Don’t Miss: Should I Refinance My Mortgage Or Make Extra Payments Calculator

Types Of Mortgage Debt

There are two different kinds of debt.

1. The money you borrow to buy, build or substantially improve your residence is called âacquisition indebtednessâ or home acquisition debt.

2. The money you borrow against the equity in your home, or money you take out when you refinance your home for any reason except home improvement, is called âequity indebtednessâ or home equity debt.

Get Your Investment Taxes Done Right

For stocks, crypto, ESPPs, rental property income and more, TurboTax Premier has you covered.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Why Is Interest So High On Mortgage

What About Rental Properties

There are rules on what you can deduct when it comes to refinancing a mortgage for a rental property.

Any rent you receive from tenants is fully taxable as income. But, on the other hand, any money you spent to generate that income can be deducted from the rental income you earned for that tax year.

So you can deduct interest, points, and any closing costs and fees. This is a huge advantage residential property owners dont have access to when deciding to refinance. Its bigger than you might think, as closing costs and settlement fees can run into thousands of dollars.

Make sure you dont lose out this tax year by claiming the mortgage interest tax deduction!

How Do You Qualify For A Cash

To get a cash-out refinance loan, youll need to have enough equity in your home. In most cases, a lender will consider you for a cash-out refinance if you have equity of at least 20%.

To figure out whether you qualify, a lender will look at the loan-to-value ratio. This ratio is calculated by dividing the amount you owe on your mortgage by the value of your home. So, if the mortgage balance is $160,000 and the value of your home is $200,000, the loan-to-value ratio is 80%. An 80% ratio translates into 20% equity, which would meet the equity requirements of most cash-out lenders.

Read Also: How To File My Own Taxes For Free

Read Also: What Is Mortgage Payment On 600 000

How To Qualify For Mortgage Interest Tax Deduction On A Cash

If home renovations are on your mind, you might be considering a cash-out refinance loan to pull out some equity. Many homeowners use a cash-out refinance to pay for home remodeling, which may add value to the home when you sell.

However, there were changes to federal tax laws in 2017 with the Tax Cuts and Jobs Act that you should know about that may affect your tax deductions related to pulling out equity.

First, note that when you take the equity out with the refi, the IRS doesnt consider it income they view it as another home loan. So, you dont need to include the equity as part of your income when you file your taxes.

However, in exchange for this benefit, there are new rules on what you can and cant deduct when you pull out the equity. While you can use the money for anything you wish, you will need to use the money for home improvements to deduct the loan interest on your taxes.

The IRS states that you need to make some type of home improvement that boosts the value of the home to deduct the interest. The new tax law states you cannot deduct the loan interest if the money is used for anything else.

In the past, you could still deduct the interest if you used the equity to pay off credit cards or go on vacation.

Keep in mind that you need to make capital improvements to the home that increase the value to qualify for the tax deduction.

Investment Property Refinance And Closing Fees

If you are refinancing a mortgage on a rental or investment property, the rules are different. The IRS will let you deduct just about every closing cost that you incur when you source your new loan, prorated over the life of the loan. For example, if you spent $15,000 to refinance a 10-year loan, you could write off $1,500 per year.

References

Recommended Reading: When Is A Mortgage Payment Considered Late

What Is A Refinance Tax Deduction

A deduction is an expense that can lessen your tax burden. You reduce the overall amount of money that you need to pay taxes on when you take a deduction. For example, if you earn $50,000 a year before taxes and you have $5,000 worth of deductions, youd only pay taxes on $45,000 of your income. Refinance tax deductions are select deductions you can take after you refinance your mortgage loan.

Many of the deductions well discuss also apply to purchasing a home. If you have any doubt as to whether you qualify for a certain deduction, we recommend speaking with a financial planner or tax professional.

How Are The Costs Deducted

If the total refinancing fees are more than $100, they can be claimed over a five year period or the term of the loan, whichever is earlier.

When an investor uses part of their refinanced mortgage for private purposes, all deductions must be apportioned. For example, if 30 per cent of their rentals refinanced mortgage was used to purchase a new private residence, all deductions for the borrowing costs and ongoing interest expenses need to be apportioned.

You May Like: How Can You Pay Your Mortgage With A Credit Card

When The Mortgage Interest Deduction Is Beneficial

For example, consider a married couple in the 24% income tax bracket who paid $20,500 in mortgage interest for the previous year. In tax year 2023, they wonder if itemizing deductions would yield a larger tax break than the $27,700 standard deduction. If the total of their itemized deductions exceeds the standard deduction, they will receive a larger tax break.

After totaling their qualified itemized deductions, including the mortgage interest, they arrive at $32,750 that can be deducted. Since this is larger than the standard deduction, it offers a greater benefit: $7,860 vs. $6,648 .

Additional Requirements To Be Eligible To Deduct Mortgage Points

- The mortgage is for your primary residence

- Points have to be a percentage of your mortgage total

- Points must be normal in your area

- The points must not be excessive in your area

- You have to use the cash accounting method when filing taxes

- The points cannot be used for items that are normally standalone fees

- You cannot be paying for your points with borrowed funds

- You have to itemize your points clearly

In the event that you are unable to deduct points this tax year, you may be able to deduct them over the life of the loan.

Also Check: How To File Ca State Taxes For Free

Read Also: How Much Could We Get Approved For A Mortgage

Limits On Mortgage Indebtedness

You can deduct home mortgage interest on the first $750,000 of the debt. If you’re married but filing separate returns, the limit is $375,000, according to the Internal Revenue Service . A higher limit of $1 million applies if you’re deducting mortgage interest from indebtedness that was incurred before December 15, 2017. If married filing separately, that limit is $500,000 for each spouse.

The old rules allowed you to deduct interest on an added $100,000 of the loan, or $50,000 each for married couples filing separate returns.

There is an overall limit of $750,000, or $375,000 each for a married couple filing separately when refinanced loans are partly home acquisition loans and partly home equity loans.

What If Your Tax Refund Is Lower Than Usual

One of the biggest stresses associated with tax season is getting a lower-than-expected tax refund. If your refund is lower than you were anticipating, consider adjusting the deductions that come out of your paycheck next year.

By allowing your employer to withhold more tax from your paycheck now, you could receive a higher tax refund later, and vice versa.

You May Like: Can You Include New Appliances In A Mortgage

Closing Costs And Other Fees

If youre refinancing your home and are prepared to accept that closing costs arent an allowable deduction, you have a silver lining to your situation: The IRS allows homebuyers to include acquisition and settlement costs in their homes basis when they calculate any capital gains taxes from the sale of the home. The homes basis represents all costs needed to carry it, from purchase price and finance fees to costs of new construction. The higher your homes basis is, the less gains taxes youll have to pay if you qualify for gains taxes.

What Do Mortgage Lenders Look For On Your Tax Returns

When you apply for a mortgage, your lender is likely to ask you to provide financial documentation, which may include 1 to 2 years worth of tax returns. Youre probably wondering exactly how those tax returns can affect your mortgage application. Well break it down for you.

Why do mortgage lenders request tax returns?

Your tax returns, along with the other financial documents. in your mortgage application, are used to determine how much you can afford to spend on your home loan every month. Because a mortgage commits you to years of payments, lenders want to make sure your loan is affordable to you both now and years down the road.

To help calculate your income, mortgage lenders typically need:

- 1 to 2 years of personal tax returns

- 1 to 2 years of business tax returns

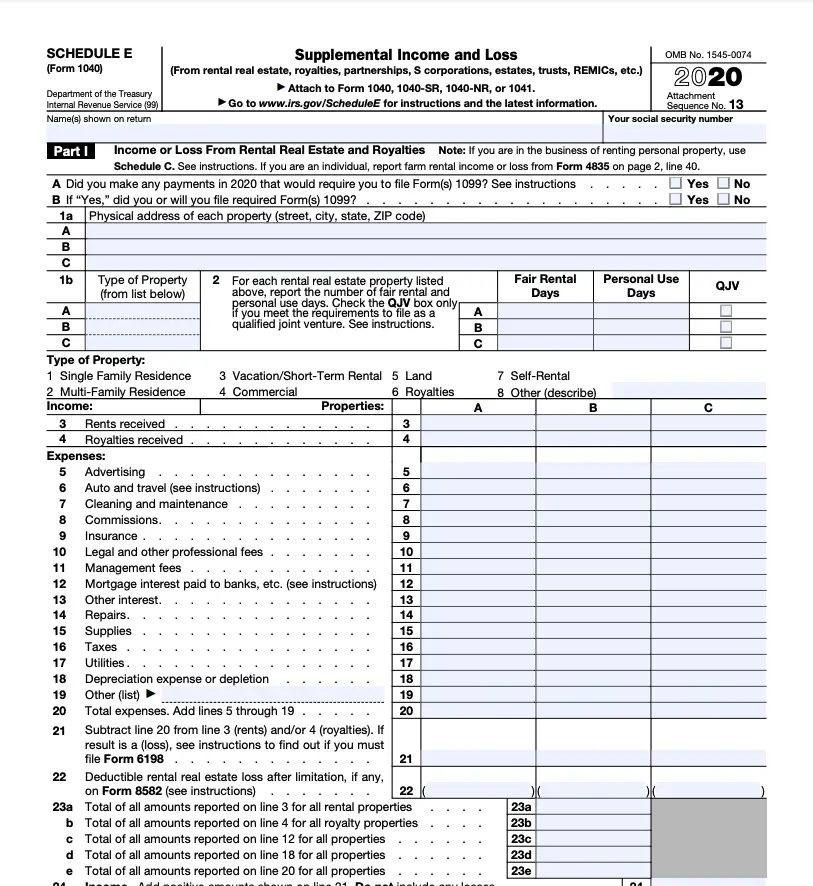

Depending on your unique financial picture, we might ask for additional paperwork. For example, if you have any real estate investments, you may need to submit your Schedule E paperwork for the past 2 years. If youre self-employed, you may have to provide copies of your Profit and Loss statements. On the other hand, if youre not required to submit tax returns, lenders may be able to use your tax transcripts instead. If you are self-employed, a business owner, or earn income through other sources , youre more likely to be asked for your tax returns along with additional paperwork. Heres a guide to what documents lenders might need for your specific situation.

- More

Recommended Reading: What Is A 7 Year Arm Mortgage

Points Are Normally Tax Deductible

While you are usually out of luck to tax deduct your closing costs, you can usually tax deduct any points that you paid on your mortgage refinance. Points are paid in most cases so that you can get a lower interest rate. In some cases, you may pay several thousand dollars in points, so this is a significant deduction on your taxes. To itemize the point deductions, you need to use Schedule A on your 1040 return. In many cases, the IRS will require you to tax deduct the points over the loans life, whether it is 15 or 30 years.

If you are using the money from a refinance mortgage program to pay for some improvements to your house, some of the points that you paid may be fully deductible in whatever year you took them. However, the improvements need to add some value to the home. IRS guidelines also state that you need to use your home as collateral for the refinance loan. Also, the paying of points must be a customary practice where you live, and you are not allowed to pay more in points than what the lender normally charges.

Further, you have to use the cash method of accounting to tell the IRS what your income is, as well as what you are deducting. A lender also may not charge you any points to waive any other mortgage loan fees and points that you might pay. Talk with a trusted tax adviser and consider the pros and cons of a refinance with no closing costs or fees.

Recommended Reading: Www.1040paytax.com

Mortgage Interest Deduction For Prepaid Interest Points

There are also special rules regarding when you can apply your deduction for prepaid interest points. You may be able to deduct more of your points in the year you bought them. But, generally speaking, you cant deduct the full cost of prepaid points in the year you paid them. Instead, you can deduct a portion of the points each year over the life of the loan.

To determine the amount you can deduct each year, use the following equation:

x Number of mortgage payments made each year

As an example, lets say you bought a house with a 30-year mortgage term and paid $3,400 in points upfront. Here are the steps you would need to complete:

1. Multiple the full term of the loan by 12 to determine what the loan term is in months:

30 x 12 = 360

2. Divide the cost of the points paid by the full term of the loan :

$3,400 ÷ 360 = $9.44

3. Multiply the result by the number of mortgage payments made in the tax year:

$9.44 x 12 = $113.33 deduction each year.

Also Check: How Long Is A Normal Mortgage

Simple Question: Are Closing Costs Tax

Simple answer: it depends. Homeowner tax deductions can be very difficult to calculate, given all the varying factors that go into the equation. So to find out whether the closing costs on your particular home purchase make the cut, check out what the IRS says in its tax deduction breakdown in Form 1040 and on its website.

As with all possible tax deductions, beyond just home-related ones, it is the responsibility of the taxpayer to report each of the taxes and fees related to the purchase as itemized deductions. Also with all possible tax deductions, your first priority is most likely to save money and earn tax advantages. For this purpose, do the groundwork: research whether taking a standard deduction versus deducting your closing costs would save you the most. The standard deduction for tax year 2021 is $12,550 for single filers an d $25,100 for married couples filing jointly. It will increase in tax year 2022 to $12,950 for single filers and $25,900 for married couples filing jointly.

How To Calculate Refinancing Closing Costs

The average closing costs on a home are between 3% to 6% of your mortgages principal amount. Closing costs on refinancing can include appraisal fees, attorney fees, title insurance, and credit report fees. To lower your interest rate, you may also have to deal with additional expenses to lower your interest rate, such as discount points.

A discount point, also known as a mortgage point, is a fee paid before purchasing the property to lower the loans interest rate. One discount point is equal to 1% of the mortgage amount.

Refinancing costs can be impacted by your location, the property value, and the terms of your new or old lender. Though it typically makes sense to refinance when your new interest rate is low enough to justify paying for these closing costs, you can also aim to recoup some of these expenses on your taxes if youre refinancing a rental property.

Also Check: How To Become A Mortgage Loan Officer In Arizona

Should You Take The Standard Deduction Or Itemize

Many taxpayers automatically opt for the standard deduction and in many cases, the standard deduction is the best choice. However, you might want to use part of December to do the math on whether to itemize your deductions.

Bankrate has a guide to help you through the process of , as well as a tax calculator that can help you run the numbers. Getting this particular item off your tax to-do list before the end of the year can save you a lot of stress next spring.