What Should You Do If Youre Experiencing Mortgage Stress

Just like your other financial obligations, you need to plan monthly mortgage repayments, so you do not fall behind.

However, there are certain life-changing events such as job loss, illness, death of a loved one, divorce, or birth of a child that can affect your ability to manage your home loan payments.

If you are finding it difficult to meet your mortgage repayments without stretching your finances, there are several measures you can take.

These include:

When Should I Start Saving For A House

As soon as you think youre ready to buy a house, start saving for one! For reference: Youre only ready if youre debt-free and have an emergency fund of 36 months of living expenses. Itll probably take some intense saving over a period of timewere talking a year or two just to save for a down paymentso youll want to get started right away.

What If You Just Dont Have Enough For A Down Payment

If you dont have enough savings for a 20 percent down payment, then you need to keep saving, Sethi says. If you are struggling to save, he advises creating a sub-savings account.

A sub-savings account is an automated account that directly deposits small amounts from your paycheck into a savings account, so you dont even have to think about it, he says.

A lot of people say Hey, Im cut to the bone, I cant really save, he says. Well, it turns out when you automate this money you never even see it. It actually adds up pretty quick.

And dont underestimate the power of the side hustle, he says.

Don’t Miss: How Many Rental Property Mortgages Can I Have

How Much Home Can I Afford If I Make $60k A Year

The home affordability calculator will give you a rough estimation of how much home can I afford if I make $60,000 a year. As a general rule, to find out how much house you can afford, multiply your annual gross income by a factor of 2.5 4. If you make $60,000 per year, you can afford a house anywhere from $150,000 to $240,000.

What Is My Mortgage

If you have more debt, you might struggle to keep your DTI low while also paying off a mortgage. In this case, it can be useful to work backward before you decide on a percentage of income for your mortgage payment.

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. Youll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $200

- Homeowners association fees: $100

In this example, your total monthly debt obligation is $1,250.With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Also Check: How Much Per Month Is A 400 000 Mortgage

How Much Can You Spend On A Mortgage

Rather than looking at the total amount of money you can borrow for a house, it’s better to look at how affordable your monthly payment might be. That’s because this is what you’ll be paying each month, so you want to make sure it fits into your budget.

One of the best ways to measure that is the “debt-to-income” or DTI ratio. It’s broadly calculated by dividing your debt payments by your income. More specifically, it can be measured in two ways:

- Front-end DTI ratio: This measures your monthly mortgage payment as a percentage of your total gross monthly income. For example, if your salary is $54,000 per year and your mortgage payment is $1,000, then your front-end DTI ratio is 22% .

- Back-end DTI ratio: This measures your total monthly debt payments, including your mortgage, as a percentage of your total gross monthly income. If you also pay $250 per month for student loans and $200 per month for your credit cards, for example, your back-end DTI ratio would be 33% .

Lenders use these ratios to figure out the maximum monthly mortgage payment you might qualify for. For example, Freddie Mac and Fannie Mae guidelines state that for a conventional mortgage, your back-end DTI ratio shouldn’t exceed 36%. In other words, your debt payments combined shouldn’t be more than 36% of your before-tax income each month.

The Traditional Model: 35% Or 45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time homebuyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

I would hardly call 35% of your pretax income conservative, let alone truly conservative.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. So when you obtain mortgage pre-approval, lenders will likely approve you for a loan amount with payments of up to 35% of your pretax income. That may tempt you to take on more home than you should. But dont just assume that because the bank approved it, you can afford it. They are two very different things.

Remember: The more you spend on your home, the less you have available to save for everything else. You may be able to afford a housing payment that is 35% of your pretax income today, but what about when you have kids, buy a new car, or lose your job?

Don’t Miss: Who Is A Lender In Mortgage

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

Next: See How Much You Can Borrow

Youve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if youre in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: Chase Recast

You May Like: How Much Would A 100k Mortgage Cost Monthly

How Much Of Your Income Should Go Towards A Mortgage Payment

When considering how much you can spend on a mortgage, you will need to calculate your income. Find your monthly gross income and monthly net income, as you will need both these numbers to help with these calculations.

Its important to note that the amount of mortgage you can afford depends on more than just your income, so these are just guidelines to help. Youll notice that the numbers will end up being different depending on which calculation you use.

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

Don’t Miss: Can Seniors Get A Mortgage

Formula For Buying A House

Your mortgage payment may consist of a few different factors:

- Principal and interest on your loan

- Private mortgage insurance

Say you’re buying a $250,000 home and are making a 20% down payment. Let’s also assume you’re getting a 30-year fixed mortgage at 3.7% interest. Your total monthly payment in that scenario will be $1,218, broken down as follows:

- Principal and interest – $920

- Property taxes – $210

- Homeowners insurance – $88

- Private mortgage insurance – $0

How To Calculate Your Debt Repayments To Income Ratio

For this calculation, simply add any non-housing debt repayments to your housing cost and divide by your income. The goal is to be under 36%.

Here we continue with the above example:

- Total monthly housing cost = $2,800

- Monthly car loan repayment = $500

- LayBuy repayment = $50

- Mobile phone interest-free purchase repayment = $35

Total monthly debt repayment = $3,485

- Total monthly household income before tax = $10,000

Debt to income ratio = 3,485 divided by 10,000 = 0.3485 = 34.85% or 35% .

Although the 28/36 rule has been around for quite some time, many New Zealand borrowers are now well beyond these limits. This has been a major concern for housing market commentators in recent times.

Recommended Reading: When Was The Lowest Mortgage Rate

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: 10 Year Treasury Vs Mortgage Rates

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in total interest over time, it can free up monthly cash to keep your DTI low.

Read Also: What Is Taking Out A Second Mortgage

The Traditional Model: 35%/45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time home buyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. I wouldnt call 35% of your pretax income on mortgage, property tax, and home insurance payments conservative. Id call it average.

The 30% Rule Doesnt Take Your Personal Situation Into Account

Last but not least, as Bieri pointed out, all renters needs are not alike. Young, city-dwelling professionals with active social lives might not need or want more than a conveniently located small, two- or three-room apartment they can . Contrast their budget to that of a young family looking for space for children and willing to pay a premium to be near good schools.

Also Check: Which Mortgage Lenders Use Fico Score 2

How Much Of A Mortgage Can I Afford Based On My Salary

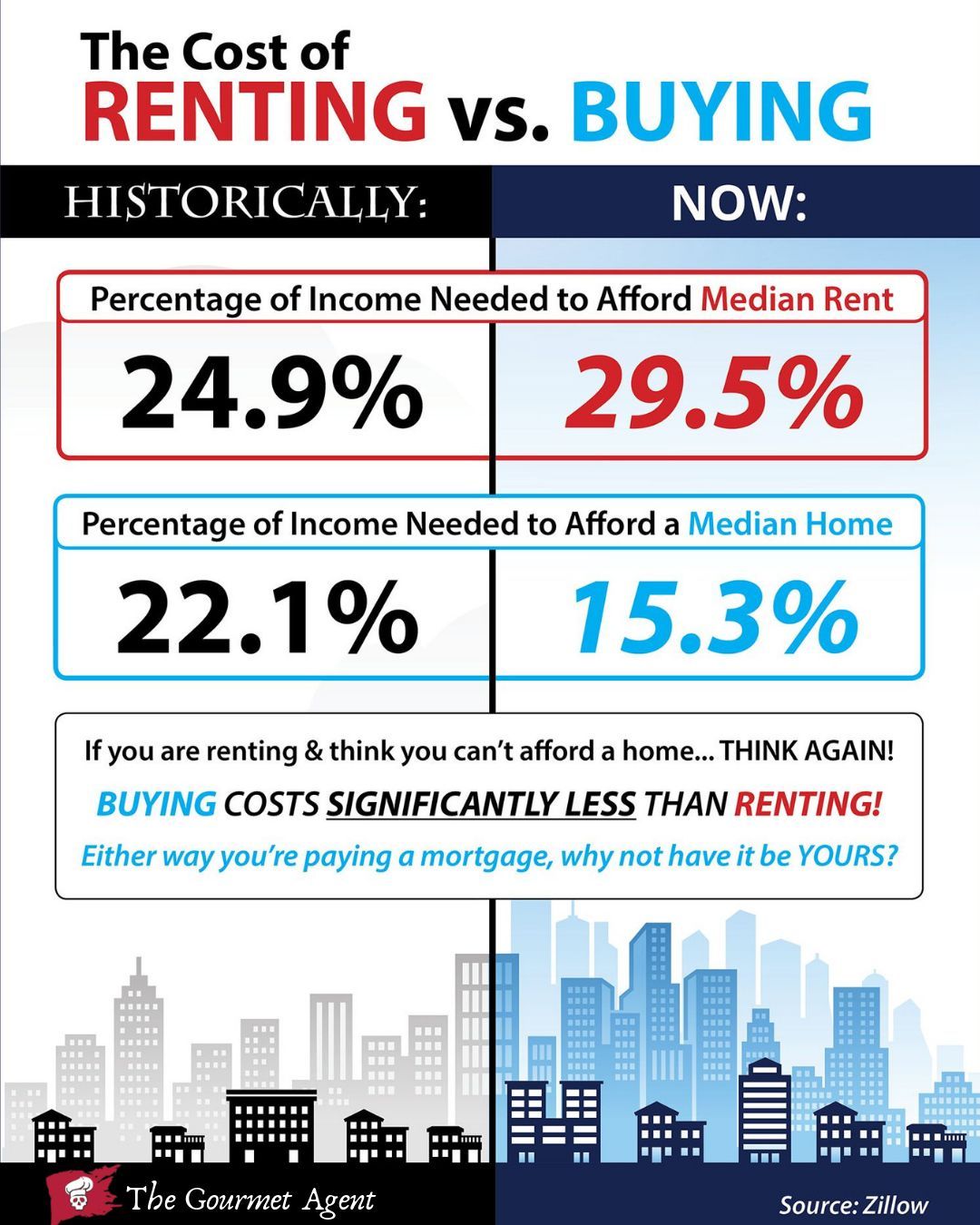

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

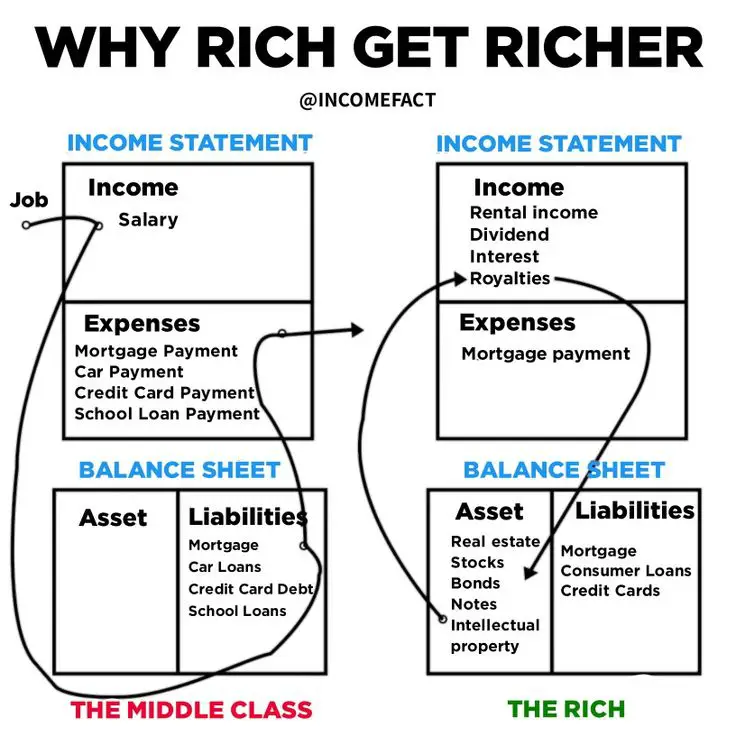

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Read Also: Which Credit Report Do Mortgage Companies Use

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Why Should I Follow The 28/36% Rule

The 28%/36% rule states that you shouldn’t spend more than 28% of your gross monthly income on housing. It also says you shouldn’t spend more than 36% of your gross monthly income on all of the debt payments you have, including credit card payments and other loans. It’s a good rule to follow when figuring out how much house you can afford.

Read Also: What’s The Mortgage Rate

How To Determine How Much House You Can Afford

Most people use a mortgage to buy a home, but everyoneâs income and expenses are different. Because of this, youâll want to calculate your potential monthly payment based on your current financial situation. Youâll need to calculate some figures like:

- Income: This is how much you earn on a monthly basis from your regular day job and any side hustles you have. Make sure you have gross and net numbers at the ready. You can find these on your most recent pay stub. If you have a fluctuating income, use your most recent tax returns for guidance.

- Debt: Debt consists of what you currently owe money on. This would include things like credit cards, student loans, car loans, personal loans and other types of debt. Debt isnât the same as expenses, which might fluctuate month-to-month .

- Down payment: This is how much cash youâll pay up-front for the cost of a home. A 20% down payment might remove private mortgage insurance charges from your monthly costs, but itâs not always required to buy a home. The higher your down payment, however, the lower your monthly mortgage payment will be.

- : Having good or excellent credit means you can get the lowest interest rate available offered by lenders. A high interest rate typically means a higher monthly payment.

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Don’t Miss: How Much To Earn For 200k Mortgage